Blockchain Use Cases in MENA for US, UK and EU Firms

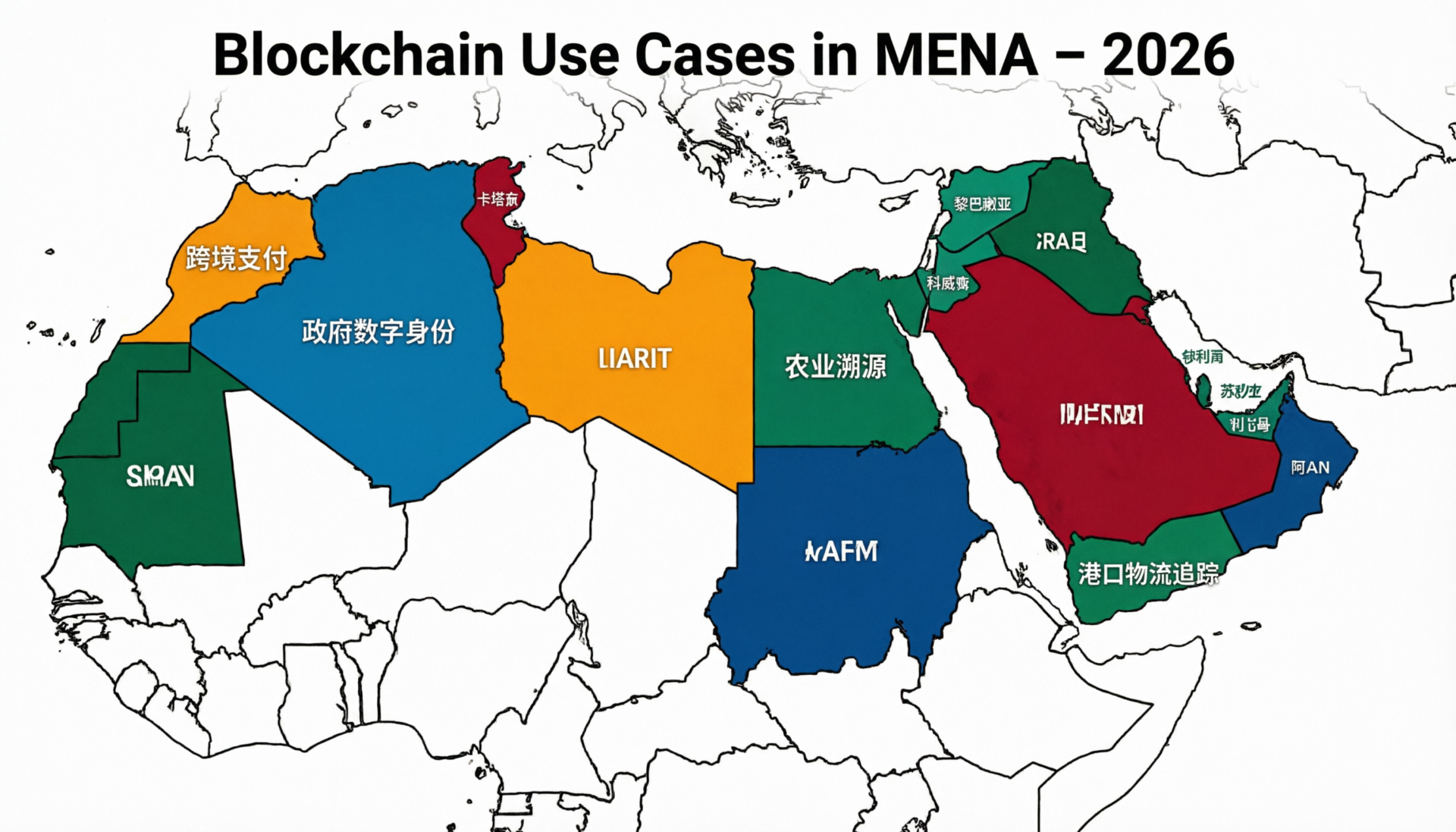

Blockchain use cases in MENA today centre on cross-border payments, trade finance, government services, supply-chain tracking, energy and tokenization of real assets. For US, UK and EU firms, the most attractive opportunities are in GCC hubs like Dubai and Riyadh, Levant logistics corridors and North African trade gateways as long as you align with local regulation and plug into the right partner ecosystems.

Introduction

The MENA region is using blockchain to modernize finance, trade and public services, creating early-mover opportunities for US, UK and European firms. In practical terms, blockchain use cases in MENA are emerging fastest where cross-border money, goods and data already flow at scale remittances, trade corridors and government platforms.

The UAE and Saudi Arabia, in particular, sit at the intersection of Asia–Europe–Africa value chains, while North African ports and free zones plug directly into EU supply networks. For a bank in London, a fintech in New York or an industrial group in Berlin, this is no longer a distant innovation story it’s a set of concrete B2B projects and RFPs on the ground.

Who is this guide for?

This guide is written for institutional investors, banks, payment providers, fintechs and large enterprises in the US, UK and EU that are:

Evaluating distributed ledger technology in MENA as part of a wider digital-transformation roadmap.

Considering direct investments into GCC and North African blockchain startups.

Shortlisting consulting, cloud and implementation partners with real case studies in the region.

GCC, Levant and North Africa on the global blockchain map

The Gulf Cooperation Council (GCC) including the United Arab Emirates, Saudi Arabia, Qatar, Bahrain, Kuwait and Oman is positioning itself as a global testbed for digital assets, CBDCs and permissioned enterprise chains tied to trade and finance. North African economies like Egypt and Morocco focus more on logistics, customs and development-backed projects, while Levant markets such as Amman explore digital identity and e-government.

In parallel, capital and expertise still flow from traditional hubs London, New York, Berlin into these projects, often via regional centres such as Dubai International Financial Centre and Abu Dhabi Global Market.

How this article is structured

Here’s what we’ll cover.

The most important blockchain use cases in MENA today.

Why adoption is accelerating now.

Sector-specific examples in finance, government, energy, logistics and healthcare.

Country and city-level case studies (UAE, Saudi Arabia, Egypt, Morocco)

Regulatory and compliance considerations for US, UK and EU firms.

Practical market-entry and roadmap models you can adapt immediately.

What are the most important blockchain use cases in the MENA region today?

The leading blockchain use cases in MENA today are cross-border payments, trade finance, government services, supply-chain tracking, energy and tokenization of real assets. For institutional buyers, this means focusing on real-economy workflows not speculative crypto and aligning with national digital strategies and banking rails.

Finance, government, trade, energy and healthcare

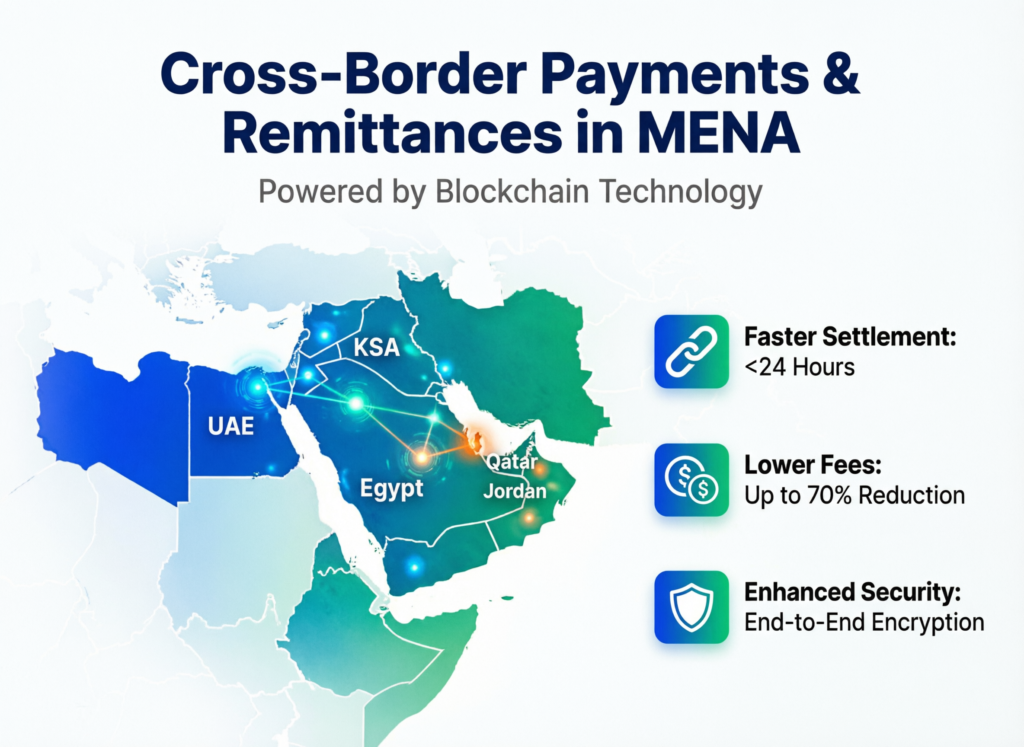

In finance, cross-border payments and remittances dominate. The UAE and KSA alone accounted for roughly US$77 billion in remittance outflows in 2023, making the region one of the world’s largest send markets a natural fit for blockchain rails that cut cost and settlement time.

Trade-finance pilots digitise letters of credit (LCs), bills of lading and supply-chain finance workflows, often using permissioned DLT platforms linked to ports in Dubai, Jeddah or Alexandria. In energy, national oil companies explore tokenization of real assets in the Middle East from pipeline capacity to carbon credits improving transparency for global investors. Healthcare and pharma projects focus on medical-record integrity and anti-counterfeiting in drug supply chains.

Public vs private blockchains and distributed-ledger models in MENA

Most production-grade use cases rely on private or consortium distributed-ledger technology, with strong identity/KYC and permissioning. Public blockchains and stablecoins appear more in innovation sandboxes or cross-border pilots with carefully ring-fenced risk.

GCC regulators typically distinguish between volatile, retail-facing crypto trading (tightly controlled) and enterprise blockchain infrastructure used for payments, trade and records (more actively enabled). For US, UK and European firms, this often means.

Permissioned EVM chains or platforms like Hyperledger / Corda for B2B flows.

Interoperability with public networks only where compliance and risk are clearly managed.

Governments, central banks, large enterprises and startups

Three groups drive most serious projects today.

Governments and regulators launching national blockchain strategies, digital identity, land registries and customs platforms.

Central banks and financial institutions piloting CBDCs and wholesale settlement platforms that connect to global corridors.

Enterprises and startups logistics providers, energy majors, healthcare groups and fintechs building specialized solutions, often in partnership with global vendors from the US, UK and EU.

Why is blockchain adoption accelerating in Middle East and North Africa markets?

Blockchain adoption is rising in MENA because governments link it to national digital strategies, cross-border trade and remittances, while regulators provide more clarity. At the same time, cloud infrastructure and fintech ecosystems in GCC and key North African hubs have reached the scale required for production deployments.

National digital strategies.

The UAE Central Bank, federal government and emirate-level authorities align blockchain with the UAE Blockchain Strategy 2021 and broader smart-city programs in Dubai and Abu Dhabi. Saudi Arabia embeds blockchain and digital assets within Saudi Vision 2030 to diversify the economy beyond oil and modernise financial services.

Across the region, “Middle East digital transformation” agendas increasingly mention blockchain alongside AI and cloud not as a novelty, but as plumbing for identity, registries and payments.

Pressures from cross-border trade, remittances and financial inclusion in MENA

Global cross-border payments exceeded an estimated $40 trillion in 2024, with emerging-market corridors seeing some of the fastest growth. (Thunes) A significant share of that flows through GCC settlement hubs, where even small basis-point savings in FX and fees are material.

MENA also remains one of the largest remittance corridors globally, and unbanked/underbanked segments in North Africa and the Levant push policymakers toward GCC fintech innovation that expands access without breaking compliance. Stablecoin and tokenized-deposit pilots for remittances and B2B payments are now a core part of this conversation.

Infrastructure, cloud, talent and startup ecosystems in GCC, Levant and North Africa

Hyperscale cloud providers now operate data centres in the UAE and Saudi Arabia, giving banks and governments local options for compliant hosting. Startup ecosystems in Dubai, Riyadh, Cairo and Casablanca combine regional founders with talent from London, Berlin and beyond.

Market-research estimates suggest the Middle East and Africa blockchain technology market is growing fastest in payments, driven by remittances, trade and tourism. Meanwhile, the FinTech blockchain segment globally was valued at roughly $7.2 billion in 2023, with forecasts above $300 billion by 2033, underscoring the scale of the opportunity.

How are banks and fintechs in MENA using blockchain for payments and trade finance?

Banks and fintechs in MENA use blockchain mainly for cross-border payments, remittance corridors, trade finance and CBDC-style interbank settlement. For US, UK and EU institutions, these are the most mature and regulator-driven entry points into the region’s blockchain ecosystem.

Cross-border payments and remittances between MENA, US, UK and Europe

In the UAE, major banks partner with global payment infrastructure providers to offer real-time international transfers to corridors like the UK, EU and US, using blockchain to reduce friction and cost. (The Paypers) For migrant workers sending money from Dubai to Cairo or Manila, even a 1–2% fee reduction is meaningful.

For a London-based fintech, plugging into a GCC bank’s blockchain-enabled rails can open corridors to South Asia and Africa that would otherwise take years to build bilaterally. US-headquartered firms often use regional hubs in Dubai or Doha to connect to these networks while keeping core compliance functions in New York or San Francisco.

Trade finance, letters of credit and supply-chain finance pilots across GCC

Trade-finance consortia in Dubai, Abu Dhabi, Riyadh and Manama digitise LCs, invoices and warehouse receipts on shared ledgers, cutting fraud and manual reconciliation. For German exporters shipping machinery to Saudi Arabia or the UAE, this can mean faster confirmation that documents and payments are in sync, improving working-capital cycles.

Here, cross-border payments and remittances in MENA intersect with tokenized trade assets: invoices, receivables and inventory can all be represented on ledgers accessible to banks in Europe and buyers in GCC.

Central bank digital currency (CBDC) and interbank settlement experiments in the region

Central banks in the UAE and Saudi Arabia have already piloted cross-border wholesale CBDCs, and KSA has joined Project mBridge, a BIS-coordinated multi-CBDC experiment focused on cross-border payments. (Reuters) In late 2025, the UAE executed its first cross-border CBDC payment with China over a new platform, underlining how quickly these trials are moving from lab to live.

For banks in London, New York or Germany, this matters because future interbank settlement in the region may partially shift from traditional correspondent networks to CBDC- or tokenized-deposit rails. Early participation in pilots can shape standards and technical choices.

Government, energy, logistics and healthcare.

Beyond banks, MENA governments, energy majors, and logistics and healthcare providers use blockchain for identity, records, asset tracking and anti-counterfeiting. These “real-economy” use cases often offer the clearest ROI and the least regulatory controversy for foreign investors.

Government-led blockchain initiatives in MENA and how they impact foreign investors

E-government platforms in Dubai, Abu Dhabi, Riyadh and Doha increasingly use DLT to secure business-license registries, land and property records, and notarisation services. For a UK or US company, this can translate into faster incorporation, clearer ownership records and easier KYC when onboarding local partners.

Some free zones and financial centres such as the Dubai International Financial Centre and Abu Dhabi Global Market encourage pilots around digital identity, notarisation and corporate registries, in collaboration with law firms and global consulting houses.

Oil & gas, utilities and tokenization of real assets in the Middle East

National oil companies and utilities explore tokenization of pipeline capacity, renewable-energy certificates and carbon credits. These tokens may never touch public crypto markets, but they can improve transparency for institutional investors in Europe and North America, and enable secondary markets among regional energy buyers.

For example, a German utility entering a long-term renewables offtake agreement with a GCC counterpart might receive blockchain-secured certificates aligned with EU sustainability reporting standards, simplifying audits.

Ports, logistics, healthcare and pharma supply-chain traceability across MENA

Ports in Dubai, Jeddah, Tangier and Alexandria are testing blockchain for container tracking, customs documentation and origin verification. This directly benefits exporters and importers in the EU and UK dealing with complex rules-of-origin and sanctions regimes.

In healthcare, hospitals and regulators in the Gulf and North Africa evaluate blockchain to secure medical records, share data between providers and combat counterfeit medicines. For US and European pharma companies, this creates opportunities to integrate serialization and track-and-trace systems with local DLT platforms.

Country and city-level case studies.

UAE and Saudi Arabia lead in large-scale blockchain programs, with Egypt, Morocco and other markets piloting projects tied to EU–MENA trade and development finance. For foreign firms, understanding these differences is essential for prioritising markets.

UAE, Dubai and Abu Dhabi: free zones, smart-city platforms and financial centres (DIFC, ADGM)

The UAE combines ambitious national strategies with hyper-active city initiatives in Dubai and Abu Dhabi. Smart-city platforms use blockchain for identity, land registries and trusted document issuance; financial centres such as DIFC and ADGM provide tailored regimes for fintechs and digital-asset firms, often including regulatory sandboxes.

For a London or New York fintech, launching from a UAE free zone can provide access to MENA clients while retaining familiar common-law frameworks and high-quality courts.

Saudi Arabia, Riyadh and Jeddah.

Saudi Arabia’s Vision 2030 has turned Riyadh into a major fintech and digital-government hub, while mega-projects like NEOM experiment with smart-city and digital-identity architectures that may incorporate blockchain. The Saudi Central Bank (SAMA) supports payment modernisation, CBDC participation and partnerships with global providers to expand digital wallets and cross-border options.

For US, UK and German firms, Saudi projects tend to be large, strategically important and long-term but also require careful navigation of local procurement, data-residency and talent-localisation policies.

Egypt, Morocco and wider North Africa.

In Egypt, blockchain projects often sit at the intersection of port logistics (e.g., Alexandria, Port Said), customs and trade-facilitation programs supported by multilateral development banks. Morocco and neighbouring states explore DLT for customs, land registries and SME finance, with an eye on smoother trade into the EU under various association and partnership agreements.

For an industrial company in Germany or the UK, these projects can reduce friction in shipping components to North African assembly plants, while providing more reliable data for ESG and supply-chain reporting back home.

What regulatory and compliance challenges affect blockchain projects in MENA?

The main challenges are fragmented national rules, strict KYC/AML for cross-border flows and complex data-residency and GDPR/DSGVO requirements for US, UK and EU firms. Understanding these early in your roadmap can prevent costly redesigns later.

Fragmented regulations across GCC, Levant and North Africa for crypto and enterprise blockchain

Each jurisdiction treats crypto assets, tokens and enterprise DLT differently. Some offer explicit licensing frameworks for virtual-asset service providers; others rely on existing securities and payments laws. Enterprise blockchain projects that avoid speculative tokens often have an easier path, but still need clarity around data, liability and contractual enforceability of on-chain records.

For German readers, regulators such as BaFin provide a familiar baseline for token classifications; mapping local regimes back to EU practice is a key early step.

KYC/AML, FATF guidance and cross-border payments for US, UK and European institutions

MENA regulators generally follow FATF virtual-asset guidelines and expect strong KYC/AML processes, especially for cross-border flows touching high-risk jurisdictions. For banks and fintechs in London, New York or Frankfurt, this means blockchain rails must integrate sanctions screening, transaction monitoring and travel-rule compliance just as tightly as legacy payment systems.

When designing remittance or B2B platforms, assume that regulators will want not only cryptographic assurances from the ledger, but also clear operational playbooks for investigations and reporting.

Data residency, cloud hosting and GDPR/DSGVO/UK-GDPR when EU and UK data touches MENA

US and European firms must balance local data-residency requirements in GCC and North Africa with GDPR/DSGVO and UK-GDPR when EU/UK personal data is involved. Architectures often blend.

Regional cloud regions in the UAE or Saudi Arabia for operational data.

EU/UK data hubs for analytics and long-term storage.

Careful segregation or pseudonymisation of personal data written to ledgers.

Working with cloud providers that support multiple regions and with advisors fluent in both GDPR and local data-protection laws is critical.

How can US, UK and European companies enter MENA markets with blockchain solutions?

Successful entry combines clear use-case focus, local partners, compliant hosting and a phased enterprise-blockchain roadmap tailored to each MENA jurisdiction. Rather than “launching everywhere”, most US, UK and EU firms do best by starting with one or two high-value corridors or sectors.

Selecting enterprise blockchain platforms and MENA-focused consulting and implementation partners

Most MENA enterprise use cases favour permissioned ledgers with strong identity, such as enterprise EVM stacks, Hyperledger-based networks or Corda-like platforms. When choosing technology, look at.

Existing adoption by regional banks or government entities.

Availability of local talent in Dubai, Riyadh, Cairo or Casablanca.

Interoperability with your existing systems and target corridors (e.g., UK–UAE trade)

Implementation typically involves a mix of

Local systems integrators who know ministries, regulators and large incumbents.

Specialist blockchain consultancies (often from London, Berlin or New York) who bring architecture, security and token-design expertise.

Market-entry models for US, UK and German/EU companies (JV, reseller, onshore vs free-zone)

Common models include:

Free-zone entity in Dubai or Abu Dhabi to serve regional clients under business-friendly rules.

Joint ventures with local banks, telecoms or infrastructure players for large, regulated projects.

Channel/reseller agreements with regional SaaS or IT providers for mid-market clients.

For a UK fintech, starting in a UAE free zone and then adding onshore licences in Saudi Arabia or Egypt as volumes grow is a typical path. German industrial firms might instead partner with logistics or energy companies in Morocco or the Gulf, embedding blockchain into specific supply-chain or sustainability programs.

Estimating cost, ROI and building a phased roadmap for blockchain projects in MENA

As a rough guide, many first enterprise pilots in the region fall in the US$150k–$500k budget range for 3–6 months, depending on complexity and integrations. Full production rollouts can run into low single-digit millions when spanning multiple countries, regulators and entities.

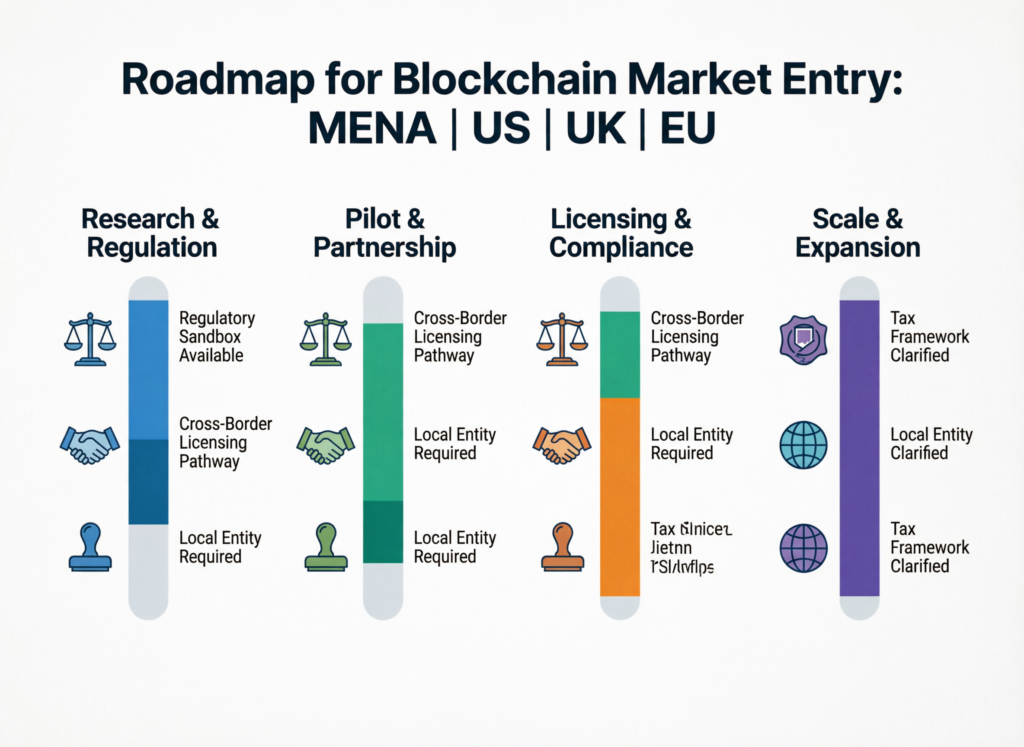

A pragmatic roadmap often follows four phases.

Discovery and prioritisation

Map where blockchain genuinely adds value versus conventional databases.

Design and regulatory alignment

Engage early with regulators, legal and compliance teams in both home and target markets.

Pilot in one corridor or sector

For example, a UK–UAE trade-finance lane or a US–Saudi remittance corridor.

Scale and integrate

Extend to new corridors, automate more processes and integrate with ERP, core-banking and analytics platforms.

Final Thoughts

Blockchain use cases in MENA are moving from pilots to production, particularly in payments, trade and government services, and specialist guidance helps US, UK and EU stakeholders de-risk entry and capture early-mover advantage. The winners will be those who treat blockchain as part of a broader Middle East digital-transformation strategy, not a standalone experiment.

Where the biggest opportunities are by sector and country

Finance: cross-border payments, remittances and trade finance, especially in UAE and Saudi Arabia.

Government: identity, registries and e-government services in GCC and select Levant/North African states.

Energy and logistics: tokenization and traceability tied to global ESG and supply-chain compliance.

When to engage a MENA-focused blockchain consulting firm

You should seek specialist help when.

Navigating multi-jurisdictional regulation (e.g., GDPR + GCC data-residency + FATF)

Designing token models for real-world assets or cross-border settlement.

Scaling from a successful pilot to multi-country operations.

Discovery call, opportunity assessment or tailored market study

A sensible starting point is a structured discovery workshop to prioritise 2–3 concrete use cases across GCC, Levant and North Africa. From there, you can commission a focused opportunity assessment or a detailed market-entry study for one or two target jurisdictions (e.g., UAE + Saudi, or Egypt + Morocco) and build a 12–24 month roadmap.

Key takeaways

Focus on real-economy use cases: payments, trade, government, energy and logistics.

Align with national strategies like UAE Blockchain Strategy and Vision 2030.

Use permissioned DLT and strong KYC/AML to stay within regulatory comfort zones.

Start with one or two corridors or sectors, then scale.

Combine local partners with US/UK/EU-grade architecture, security and governance.

If you’re a US, UK or European bank, fintech or enterprise exploring blockchain use cases in MENA, this is the moment to move from desk research to concrete pilots. Mak It Solutions has hands-on experience with cloud, mobile, data and integration projects across GCC and Europe, and can help you frame a realistic, regulator-ready roadmap.

Share a short brief on your target markets and use cases, and we’ll help you shape a phased plan from discovery to pilot to regional scale-up tailored to your risk appetite and budget. You can start the conversation via our contact page.

FAQs

Q : Which MENA country is currently the most advanced for enterprise blockchain projects?

A : Today, the UAE and Saudi Arabia are generally seen as the most advanced MENA markets for enterprise blockchain. The UAE combines smart-city initiatives, active free zones (DIFC, ADGM) and a strong fintech ecosystem, while Saudi Arabia’s Vision 2030 and CBDC participation make it a heavyweight in payments and trade-finance pilots. Other markets, such as Qatar, Bahrain, Egypt and Morocco, are catching up, particularly in logistics, e-government and SME finance.

Q : How do blockchain regulations in UAE and Saudi Arabia differ from those in the EU or UK?

A : In the UAE and Saudi Arabia, regulators focus heavily on licensing, sandbox regimes and distinguishing between speculative retail crypto and enterprise DLT used for payments or records. In the EU and UK, frameworks like MiCA, GDPR/DSGVO and UK-GDPR provide detailed treatment of tokens, data and consumer protection, often with more prescriptive requirements. For US, UK and European firms, the key is to map each GCC jurisdiction’s rules back to home-market standards and design governance that satisfies both.

Q : What risks should US or European investors evaluate before funding blockchain startups in MENA?

A : Investors should assess regulatory risk (licence stability, crypto rules), technology risk (platform choice, security, scalability), and go-to-market risk (dependence on a single regulator, bank or ministry). Team quality, local relationships and the ability to pass strict KYC/AML and data-protection audits are critical. It’s also wise to consider currency and geopolitical risk, plus exit options for example, whether the startup’s technology and contracts are portable to other regions if regulations change.

Q : How can German industrial companies use blockchain to improve MENA supply chains?

A : German industrial firms can use blockchain for end-to-end traceability of parts and materials shipped to GCC and North African plants, improving quality control and ESG reporting. By recording origin, customs and inspection data on a shared ledger, they can reduce disputes, accelerate payments and respond faster to recalls or compliance checks from EU and German regulators such as BaFin and customs authorities. Integrating blockchain with existing ERP and MES systems is key to making this seamless rather than a parallel silo.

Q : What are realistic timelines and budgets for a first blockchain pilot in the Middle East or North Africa?

A : Most serious enterprise pilots take around 3–6 months from design to initial go-live, assuming requirements are clear and partners aligned. Budgets commonly range between US$150k and US$500k for a focused pilot, with higher costs for complex integrations or multi-country deployments. Timelines can stretch if regulatory approvals are needed, especially in financial services, so it’s smart to build in extra time for sandboxes, security reviews and legal sign-off across both MENA and home-market jurisdictions.