Blockchain Remittances MENA: Safe Crypto Routes for 2025

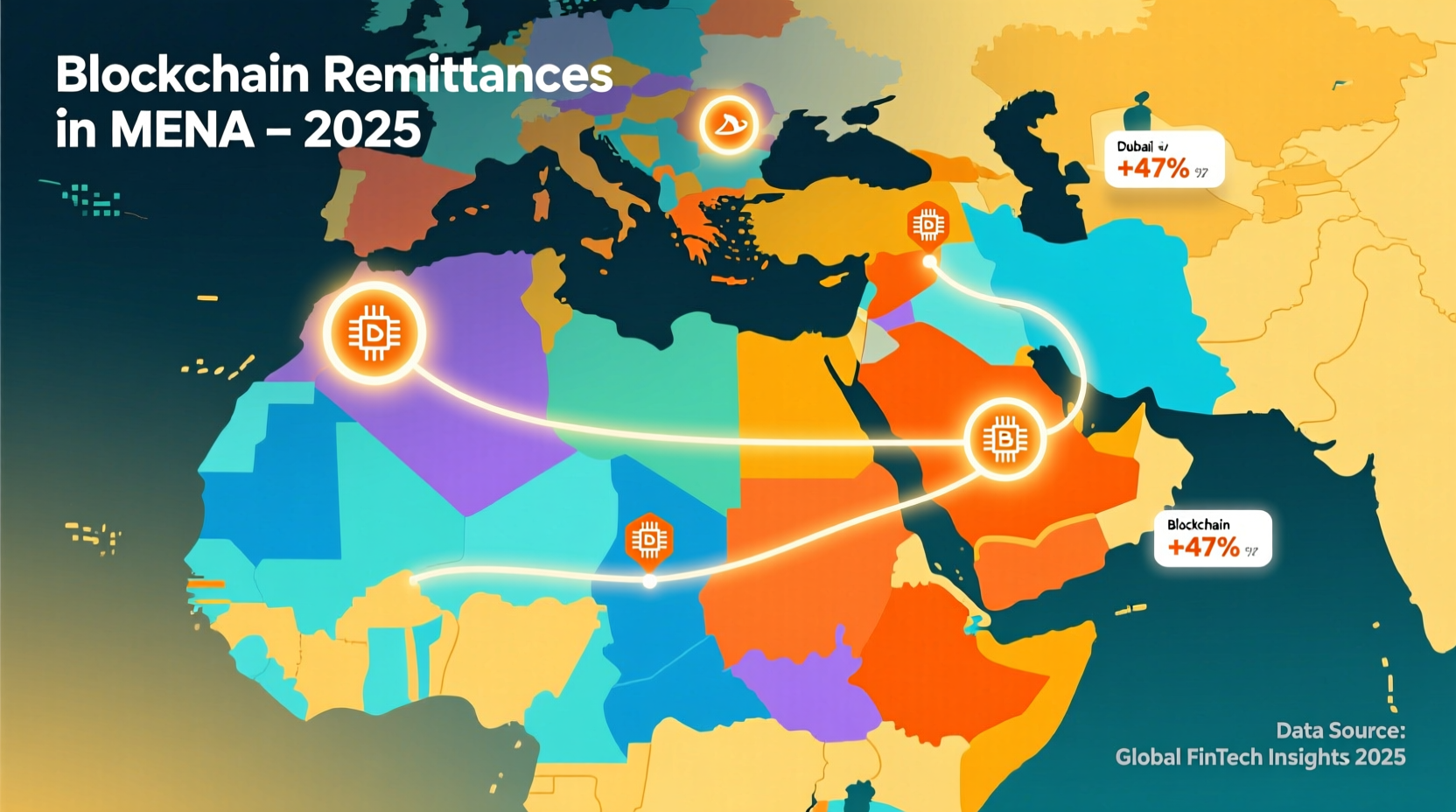

Blockchain remittances in MENA use public or permissioned blockchains often via stablecoins like USDT or USDC to move money from senders in the USA, UK and Europe to recipients across the Middle East and North Africa through licensed fintechs and exchanges. When you use regulated providers, blockchain remittances MENA can cut fees, improve speed and transparency, and still respect regulations in the US, UK, EU and key MENA markets.

Introduction

“Blockchain remittances MENA” sounds complex, but the core idea is simple: use blockchain rails instead of old-school bank pipes to move money from the USA, UK and Europe into the Middle East & North Africa.

Instead of paying 6–7% in fees and waiting days, senders use regulated apps that convert dollars, pounds or euros into stablecoins, push them on-chain, then cash out locally in dirhams, riyals or Egyptian pounds. Global remittances to home countries reached roughly $650+ billion in 2023 and continue to grow, so even a small shift onto blockchain rails can have a big impact for migrant workers and SMEs.

Mak It Solutions regularly works with fintech, cloud and analytics teams across the US, UK, Germany and the wider EU, helping them design compliant, data-driven products for payments and remittances. That means we look at blockchain remittances into MENA not as hype, but as a stack of rails, apps, data and regulations you can actually build on.

Blockchain Remittances vs Traditional Transfers

At a high level, remittances are cross-border transfers from workers and businesses back to families or partners in another country think a nurse in London sending pounds home to Cairo, or a freelancer in Berlin paying a contractor in Casablanca.

MENA (Middle East & North Africa) usually includes GCC countries (UAE, Saudi Arabia, Qatar, Bahrain, Kuwait), plus Egypt, Morocco, Jordan, Lebanon, Tunisia, Turkey and neighbours like Pakistan that send workers into GCC labour markets.

Traditional flows use SWIFT messages, correspondent banks and money transfer operators (MTOs). Each intermediary adds delays, FX markups and compliance steps, which is why the average global cost to send $200 is still around 6–6.5%.

Blockchain-based cross-border payments instead send tokens over networks like Bitcoin, Ethereum or low-fee chains carrying stablecoins such as USDT and USDC. On-chain money transfer fees can be a flat $0.50–$2 in many cases, even for large amounts, versus percentage-based fees in bank and MTO channels.

How Blockchain Money Transfer Works for MENA Recipients

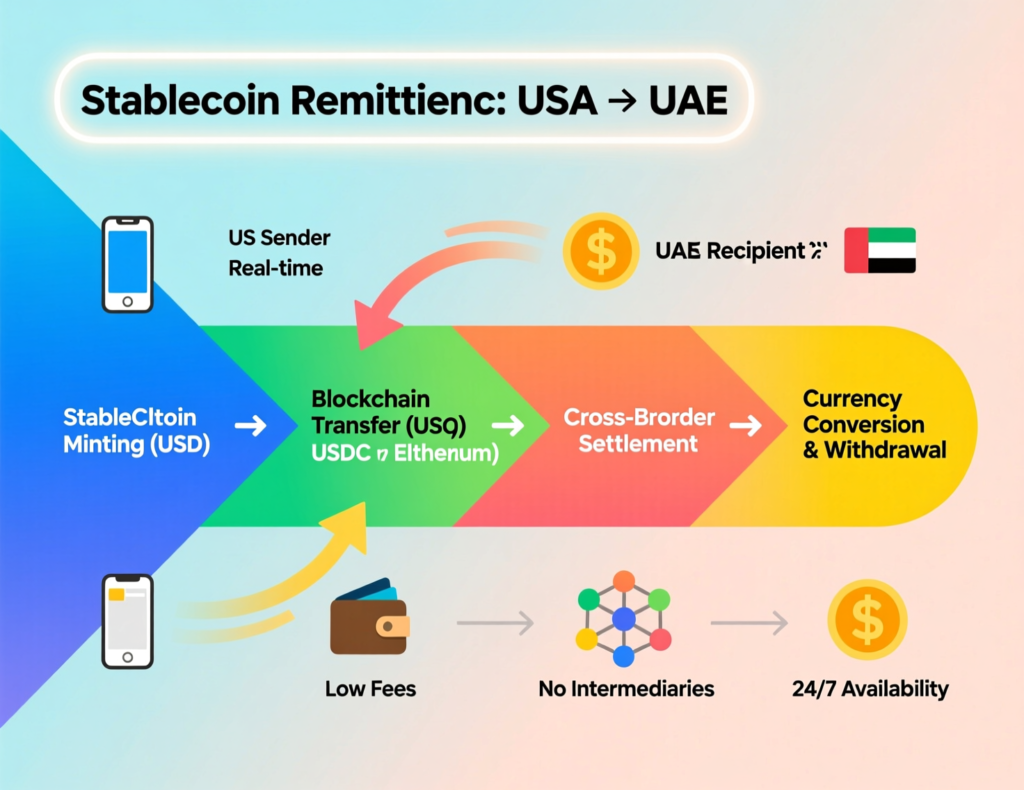

A typical blockchain remittance into MENA looks like this.

Sender in New York, London or Berlin opens a regulated remittance or exchange app.

Provider performs KYC, accepts dollars, pounds or euros, and converts to a suitable coin (often a USD stablecoin).

Blockchain: the provider (or sometimes the user) sends tokens to a wallet or to a local partner’s address over a chosen network.

Local payout: a partner in Dubai, Riyadh, Cairo, Casablanca, Amman, Beirut or Istanbul converts into local currency and pays out via bank deposit, mobile wallet or cash pickup.

In practice, most migrant workers will interface with a mobile app or a trusted local agent, not a raw blockchain address. Crypto exchanges, remittance fintechs, mobile wallets and OTC cash-out agents in MENA do the heavy lifting FX conversion, liquidity management and KYC/AML checks on the receiving side.

Common payout methods include.

Local bank deposits (e.g., into UAE or Saudi accounts)

Top-up to regional mobile wallets in Egypt, Morocco or Turkey

Over-the-counter cash collection at partner branches or agents

Who Uses Crypto Remittances into MENA Today?

Right now, blockchain remittances into MENA are used by a mix of.

Migrant workers in the USA, UK, Germany and across the EU who want lower fees and faster access for families in UAE, Saudi Arabia, Egypt, Morocco, Jordan or Lebanon.

SMEs paying suppliers and contractors in Dubai, Riyadh, Cairo or Istanbul, often looking for cheaper, predictable cross-border payments than standard bank wires.

Early adopters: freelancers, Web3 workers and marketplace sellers who already hold stablecoins or get paid in crypto and want to cash out safely in the region.

Industry estimates suggest that crypto and stablecoin remittances still represent a mid-single-digit percentage (roughly 3–5%) of global remittance flows, but adoption is rising fast in regions like North Africa.

Benefits & Risks of Crypto Remittances for MENA

The biggest benefits of blockchain remittances to MENA are lower average fees, near-real-time settlement and better transparency, especially when flows are stablecoin-based and handled by regulated providers. The flipside: users still face volatility risk if they use non-stable assets, plus scams, sanctions issues and last-mile cash-out challenges in cash-heavy markets.

Cost, Speed & Transparency vs Banks and MTOs

Traditional corridors from New York to Cairo or London to Dubai commonly see all-in costs (fees plus FX spread) between 5–8%, especially for smaller ticket sizes. Global data shows the average cost of sending $200 at around 6.4%, with digital routes somewhat cheaper but still above the UN’s 3% target..

By contrast, many blockchain-based cross-border payments that use stablecoins on efficient networks can land in the 0.5–2% range all-in when done via regulated providers combining low on-chain money transfer fees with more competitive FX margins.

Speed is another differentiator.

Banks & MTOs: usually 1–5 business days, limited by cut-off times and intermediaries

Crypto & stablecoins: often minutes to an hour, 24/7, with confirmations visible on-chain

Transparency also improves: senders and providers can see transaction status on-chain and reconcile it with internal ledgers, instead of relying on opaque correspondent banking chains.

Financial Inclusion & Digital Wallets for Migrant Workers

For many families in Egypt, Morocco, Lebanon or Jordan, maintaining a full-service bank account is still difficult. Digital wallets for migrant workers often linked to phone numbers rather than IBANs help bridge that gap.

When remittance fintech solutions for blockchain remittances MENA pair stablecoin rails with local mobile wallets, you get:

Faster access: instant or same-day credit instead of waiting for a branch to open

Smaller-ticket viability: micro-payments and frequent transfers become economical

Better UX: users interact with a simple app in Arabic, English or French, not crypto jargon

This is where Mak It Solutions’ strengths in mobile app development and business intelligence matter: a robust wallet or remittance app needs high-quality UX, real-time analytics and segmentation to manage risk and personalise offers. Platforms like our Mobile App Development Services and Business Intelligence Services can underpin these experiences.

Key Risks: Volatility, Scams, Sanctions & Last-Mile Challenges

Even with benefits, risks are real.

Volatility.

Sending Bitcoin or Ether from Frankfurt to Beirut can expose both sides to price swings; stablecoin remittances reduce but don’t eliminate this risk.

Fraud & scams.

Unregulated P2P channels, fake trading platforms and phishing attacks remain a major cause of loss, especially where people misinterpret speculative trading as remittances.

Sanctions & high-risk corridors.

OFAC and EU sanctions touch some MENA countries and actors, so providers must screen transactions and may block certain routes entirely.

Last-mile issues.

Cash-heavy markets can face FX liquidity shortages, agent cash-out limits, and strict ID requirements for large receipts.

The safest path is to use regulated providers, not informal P2P swaps in Telegram groups, and to treat “too good to be true” FX rates with suspicion.

Nothing here is legal, tax or investment advice; always check local rules and, if needed, speak with a qualified professional.

Core Corridors: From USA, UK & Europe into MENA

The cheapest and safest blockchain remittances MENA typically use regulated exchanges or remittance fintechs that move stablecoins from the USA, UK or EU into local payout partners. They avoid speculative on-chain trading and instead optimise on-chain fees plus FX spread in specific corridors.

From USA to MENA with Crypto

Common corridors include.

US → Egypt (Cairo, Alexandria)

US → UAE (Dubai, Abu Dhabi)

US → Jordan (Amman)

US → Morocco (Casablanca, Rabat)

In the US, crypto remittance providers are generally treated as money services businesses (MSBs) and must register with FinCEN, implement AML programs and comply with sanctions rules.

For a typical US sender funding via ACH or card.

Blockchain routes often win on fees, especially for amounts above $200–$300.

Traditional methods may still win when both sides are fully banked and can use low-cost local ACH-style systems, but this is rare for US → MENA family remittances.

From UK to Middle East & North Africa

Key UK → MENA routes include:

London → Dubai / Abu Dhabi (UAE)

London → Riyadh / Jeddah (Saudi Arabia)

UK → Egypt or Morocco

UK-facing fintech apps often hide the blockchain complexity: users see a pound balance and a “same-day payout” to Dubai, while the app quietly uses stablecoins or other rails behind the scenes.

These providers usually need FCA registration for cryptoasset activity and must comply with UK-GDPR for customer data.

Compared with bank wires and MTOs, UK-to-MENA stablecoin flows can offer:

Faster settlement minutes to hours instead of days

Lower headline fees and tighter FX spreads

Better transparency on where a transfer is in the pipeline

From Germany & Europe to Turkey and Wider MENA

From Germany and the wider EU, typical routes are:

Germany/Netherlands/France → Turkey (Istanbul, Ankara)

Germany → Egypt, Morocco, Lebanon

SEPA payments are extremely efficient within the eurozone, but they don’t solve FX spreads or access issues when money leaves the EU. That’s where MiCA-ready EU crypto service providers can help: licensed crypto-asset service providers (CASPs) that route euro deposits into compliant stablecoin remittances.

For Berlin → Istanbul, SEPA to a Turkish bank may still be competitive for large, well-banked businesses. But for migrant workers with smaller tickets and unbanked relatives, stablecoin remittances plus local wallet or agent payout often win on speed and convenience.

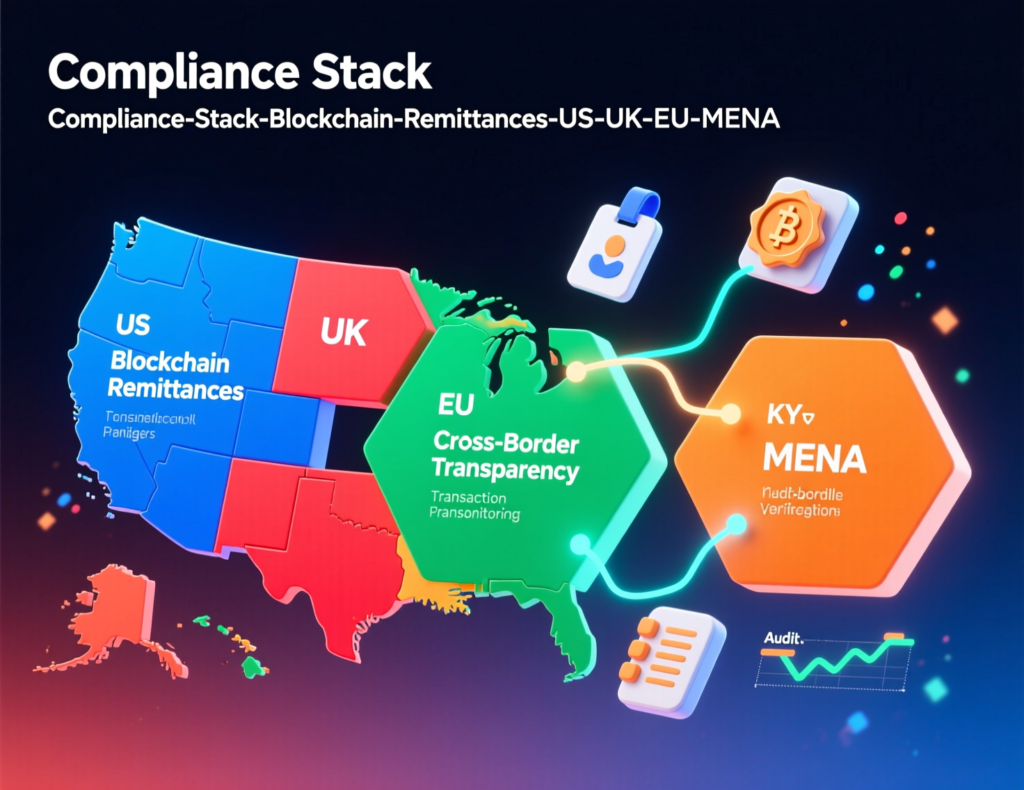

Regulation, Compliance & Licensing for Blockchain Remittances to MENA

In most cases, it is legal to use crypto for remittances from the USA, UK and EU to MENA if you go through regulated providers that follow KYC/AML rules, sanctions screening and travel rule requirements. Direct P2P transfers are technically possible, but they can trigger tax, reporting or licensing exposure if you’re operating “as a business” or touching high-risk jurisdictions.

US Rules: FinCEN, OFAC, MSB Licensing & Tax

In the USA.

Crypto remittance providers usually qualify as money transmitters, a type of MSB, and must register with FinCEN and comply with AML recordkeeping and reporting.

OFAC sanctions apply regardless of rail USD wires, stablecoins or other virtual assets so US-facing providers must screen sends to or through sanctioned countries and persons.

Disposing of volatile crypto (e.g., selling BTC for USDT) can create taxable events for US senders under IRS rules, which should be discussed with a tax professional.

If cards fund the transaction, PCI DSS and SOC 2 become key trust signals and requirements for payments infrastructure.

For corporate programs, Mak It Solutions often helps teams map compliance requirements into architecture using analytics, logging and business intelligence pipelines that make audits easier.

UK & EU/Germany

For UK and EU senders.

UK cryptoasset businesses must register with the FCA under AML regulations and comply with UK-GDPR.

In Germany, BaFin licences crypto custody and related services; under MiCA, many crypto-asset services require authorisation as CASPs.

EU-wide, MiCA and updated AML directives formalise rules for stablecoins and crypto-asset service providers, including capital, reserve and disclosure requirements.

GDPR/DSGVO applies to all personal data in the stack, from KYC details to device identifiers in mobile apps.

MENA Central Banks, Local Rules & Sanctioned Corridors

On the receiving side, rules vary.

The UAE has a relatively advanced crypto and digital payments ecosystem, with the Central Bank and specialised regulators supervising exchanges, wallets and instant payment systems like Aani, an instant payments platform operated by Al Etihad Payments.

Saudi Arabia’s SAMA, the Central Bank of Egypt, and other regulators in Morocco, Jordan, Lebanon and Turkey take a mix of “sandbox, cautious, or restrictive” approaches to crypto.

Many MENA central banks insist that on/off-ramps partner with licensed banks or payment institutions, and may fully ban retail crypto trading while still allowing regulated remittance pilots.

High-risk and sanctioned corridors (for example, certain routes touching Syria or Iran) are often blocked outright by compliant fintechs. For a provider, risking licence loss for a marginal corridor simply isn’t worth it.

How a Typical Crypto Remittance to MENA Works Step by Step

A typical crypto remittance from the USA, UK or EU to MENA starts with picking a regulated app, then passing KYC, funding in fiat, converting to a stablecoin, sending it on-chain and finally cashing out local currency via a partner bank, wallet or agent.

Choose a Provider, Verify Identity (KYC/AML)

First, choose a provider that is.

Licensed as an MSB (US), registered with the FCA (UK) or authorised under BaFin/MiCA (EU)

Transparent about fees and FX

Clear about which MENA countries it supports

You’ll typically submit

Government ID (passport, national ID, driving licence)

Proof of address (utility bill, bank statement)

Sometimes proof of income/source of funds for higher limits

These KYC checks are required not only by FinCEN, FCA and BaFin, but also by MENA regulators and FATF standards on virtual assets and travel rule data.

Fund the Transfer and Move Value On-Chain

Next steps

Fund the transfer via bank transfer, card payment or open banking in the UK/EU.

Convert to a coin & send your provider converts fiat into a stablecoin or other crypto and sends it on-chain to a local partner or directly to the recipient’s wallet.

Network choice (e.g., Tron, Stellar, Polygon, Lightning) affects both speed and on-chain fees. Users can usually see confirmations through a blockchain explorer, so they can track the transfer’s progress without needing to understand the protocol.

FX Conversion and Cash-Out in MENA

Finally.

FX conversion a partner in Dubai, Riyadh, Cairo, Casablanca, Amman, Beirut or Istanbul converts the stablecoin into AED, SAR, EGP, MAD, JOD, LBP or TRY.

Cash-out payout can be

Local bank deposit

Mobile wallet top-up

Over-the-counter cash collection

Senders should check

All-in fees (platform + FX + on-chain)

Payout times (instant vs T+1)

Daily/annual limits and supporting documentation needed for large transfers

For fintech builders, Mak It Solutions can help design this end-to-end flow integrating web, mobile and data layers so it’s both compliant and user-friendly. Our experience with shadow IT management and IT cost optimisation also helps enterprise teams avoid fragmented, high-cost payment stacks.

Choosing a Blockchain Remittance Provider for MENA

The best apps and platforms for blockchain remittances to MENA combine strong licensing, robust security and transparent pricing with reliable payout partners in UAE, Saudi Arabia, Egypt, Turkey and North Africa. Avoid any service that cannot show a clear regulatory home or detailed fee structure.

Non-Negotiable Features.

Key checks

Licensing

FinCEN MSB, FCA registration, BaFin/MiCA authorisation, plus local MENA licences where applicable.

Security

SOC 2 reports, PCI DSS compliance where cards are involved, secure key management and insurance where offered.

Transparency

Published fee tables, FX margins, supported corridors and clear dispute support.

Comparing Total Cost: Stablecoin vs Bank vs Traditional MTO

To compare options for, say, USA → Egypt, UK → UAE or Germany → Turkey, calculate:

Platform fee

FX markup

On-chain fee (if passed through)

Banks sometimes look cheap on headline fees but hide cost in FX spreads; blockchain providers may charge a small platform fee but offer mid-market FX plus negligible on-chain costs, especially for stablecoin remittances.

For intra-EU flows (e.g., Paris → Berlin), SEPA is still incredibly efficient, so blockchain doesn’t always win. But once you move into MENA currencies, stablecoin rails often compete very well.

Questions for Enterprises, Marketplaces and Fintech Partners

If you’re a marketplace, exchange or neobank serving routes like New York, London, Berlin or Paris into Dubai, Riyadh, Cairo, Istanbul or Casablanca, ask potential partners:

Do you provide APIs and webhooks for programmatic stablecoin remittances and payout reconciliation?

How do you handle travel rule compliance and transaction monitoring?

What coverage do you offer by country and city, and what are your per-corridor SLAs?

This is where Mak It Solutions can support: designing and integrating API-based payment flows, analytics dashboards and monitoring as part of a broader digital transformation roadmap.

The Future of Blockchain Remittances in MENA

Stablecoins, CBDCs and the Next Generation of Corridors

Stablecoin remittances already account for a meaningful share of on-chain payments volume, with daily transfers measured in tens of billions of dollars, though still a small slice of global money movement.

At the same time, MENA states like the UAE and Saudi Arabia are piloting central bank digital currencies (CBDCs), with cross-border experiments linking Gulf CBDCs to Asian partners. Over time, corridors might blend: CBDC-on-CBDC for wholesale settlement, stablecoins for retail access, and instant payment schemes like Aani for domestic last-mile payouts.

Open Banking, Instant Payments & Regional Wallets

Open banking in the UK and EU is steadily improving funding UX for remittance apps—users can approve a bank transfer in seconds with strong customer authentication, then see it converted to stablecoins and routed to MENA.

On the recipient side, instant schemes (Aani in the UAE) and advanced mobile wallets in Egypt, Morocco and Turkey are creating a more interoperable environment between bank-led rails and blockchain-based cross-border payments.

Strategic Next Steps for Senders and Fintech Builders

For individual senders in the USA, UK, Germany or wider EU:

Start with a small, low-risk test using a regulated app.

Compare all-in costs vs your existing bank or MTO route.

Educate your recipient on wallet, bank or cash-out options.

For fintech builders and exchanges, the strategic play is to treat MENA corridors as a product, not a single integration: mix and match rails, analytics and compliance workflows. Mak It Solutions can help you design those stacks, integrate with your existing web and mobile platforms, and extend them with Islamic fintech-friendly UX for GCC markets.

Key Takeaways

Blockchain remittances MENA use stablecoins and other crypto rails to move money from the USA, UK and Europe into UAE, Saudi Arabia, Egypt, Turkey and North Africa faster and often cheaper than traditional channels.

The best results come from regulated providers that combine on-chain efficiency with strong KYC/AML, FATF travel rule compliance and clear sanctions controls.

Stablecoin remittances can significantly reduce on-chain money transfer fees, but last-mile banking, FX spreads and agent liquidity still matter for real-world pricing.

Open banking, instant payment schemes like Aani and emerging CBDCs will likely converge with blockchain rails, reshaping corridors between hubs like New York, London, Berlin and Dubai, Riyadh or Cairo.

For enterprises, marketplaces and fintechs, partnering with experienced development and analytics teams like Mak It Solutions helps translate regulatory and payments complexity into robust, scalable products.

If you’re exploring blockchain remittances into MENA whether as an individual sender, a fintech founder in London or a payments lead in Berlin this is the right moment to move from theory to architecture. Mak It Solutions can help you design compliant flows, build mobile and web apps, and plug in analytics for real-time visibility on cross-border payments.

Book a conversation with our team, share your key corridors (USA, UK or EU into MENA), and we’ll help you scope a pilot that balances cost, speed, user experience and regulatory comfort. (Click Here’s )

FAQs

Q : Is it legal to use crypto for remittances from the USA, UK or EU to MENA countries?

A : In most cases, yes if you use regulated providers. In the USA, many crypto remittance platforms must register with FinCEN as MSBs and comply with AML and sanctions rules. In the UK and EU, providers typically need FCA, BaFin or MiCA-related authorisations, plus GDPR/UK-GDPR compliance for personal data. Direct P2P transfers aren’t automatically illegal, but they can raise tax, sanctions or licensing risks if you’re acting like an unlicensed money transmitter or dealing with restricted jurisdictions.

Q : Do recipients in MENA need a crypto wallet, or can they receive cash or local bank transfers?

A : Recipients don’t always need a crypto wallet. Many providers convert stablecoins to local currency and pay out via local bank deposits, mobile wallets or over-the-counter cash collection. In cities like Dubai, Riyadh, Cairo and Casablanca, regulated partners provide last-mile banking and agent networks so families can receive funds just like a normal remittance. A few advanced users still prefer direct crypto wallets, but most mainstream customers interact with fiat accounts and mobile apps in their local currency.

Q : How are taxes handled when I use cryptocurrency for international remittances to family in MENA?

A : Tax treatment depends on your home country. In the USA, selling or converting volatile crypto (like BTC or ETH) is typically a taxable event, even if the purpose is a family remittance; using stablecoins funded directly from fiat can simplify reporting but doesn’t remove other obligations. EU and UK rules vary but often treat crypto-to-fiat conversions as disposals for capital gains. Recipients in MENA usually aren’t taxed on inbound family remittances, but high-value flows can trigger reporting or AML reviews. Always check local tax guidance or consult a professional.

Q : Are stablecoin remittances safer than sending volatile cryptocurrencies like Bitcoin or Ether to MENA?

A : For most senders and families, yes. Stablecoins are designed to track fiat currencies, so the amount you send is more likely to match what your recipient receives in value terms, reducing price volatility risk. They also integrate more naturally into compliant corridors because regulators can apply MiCA, AML and travel rule requirements directly to stablecoin issuers and service providers. However, stablecoins carry issuer and regulatory risk, so choose well-known, fully-backed tokens via regulated platforms rather than unknown or algorithmic assets.

Q : What limits, caps or documentation should I expect when sending larger blockchain remittances into MENA?

A : Most providers apply tiered limits based on KYC level. Low tiers might allow a few hundred dollars per day with basic ID, while higher tiers for several thousand dollars or more require proof of address, income and source of funds. For very large payments (e.g., SME supplier settlements), expect enhanced due diligence, detailed invoices and possibly questions about counterparties in MENA. Regulators in the USA, UK, EU and MENA all encourage risk-based limits, so “unlimited” transfers with no questions are often a red flag rather than a feature.