BlackRock Takes First Step Toward a Staked Ether ETF

BlackRock has moved a step closer to launching a yield-bearing ether investment option by registering the iShares Staked Ethereum Trust ETF in Delaware. This early filing signals the firm’s intention to explore a staked-ETH product that could provide investors with exposure to Ethereum along with potential staking rewards. The development highlights growing institutional interest in bringing more advanced crypto-based income products into regulated investment structures.

However, this registration does not yet qualify as a formal application under the Securities Act of 1933, meaning the product is still far from regulatory approval. U.S. authorities have not fully endorsed staking activities within exchange-traded funds, and several policy questions remain unresolved. Until clearer guidelines emerge, market participants will continue watching how regulators approach staking and whether such products can eventually reach mainstream investors.

Market Context and What’s New

What happened

A Delaware statutory trust named iShares Staked Ethereum Trust was registered on Nov. 19, 2025, a typical precursor to ETF filings. Independent reporting flagged the registration, citing state records and commentary from ETF analysts.

Why it matters

If approved, a staked-ETH ETF could add a yield component to spot ETH exposure, differentiating it from 2024’s non-staking ETH ETFs those launched only after issuers removed staking under SEC pressure. Investopedia

Competitive backdrop

VanEck formed a Delaware trust tied to Lido’s staked ETH in October 2025 and later filed an S-1, setting up a likely first-mover race pending SEC clarity.

Regulatory Picture: Staking Still Under Review

The SEC approved spot ETH ETFs in 2024 without staking, and issuers stripped the feature to gain approval. Subsequent 2025 staff statements addressed liquid staking considerations, but product-level allowances and conditions for ETFs remain the key hurdle.

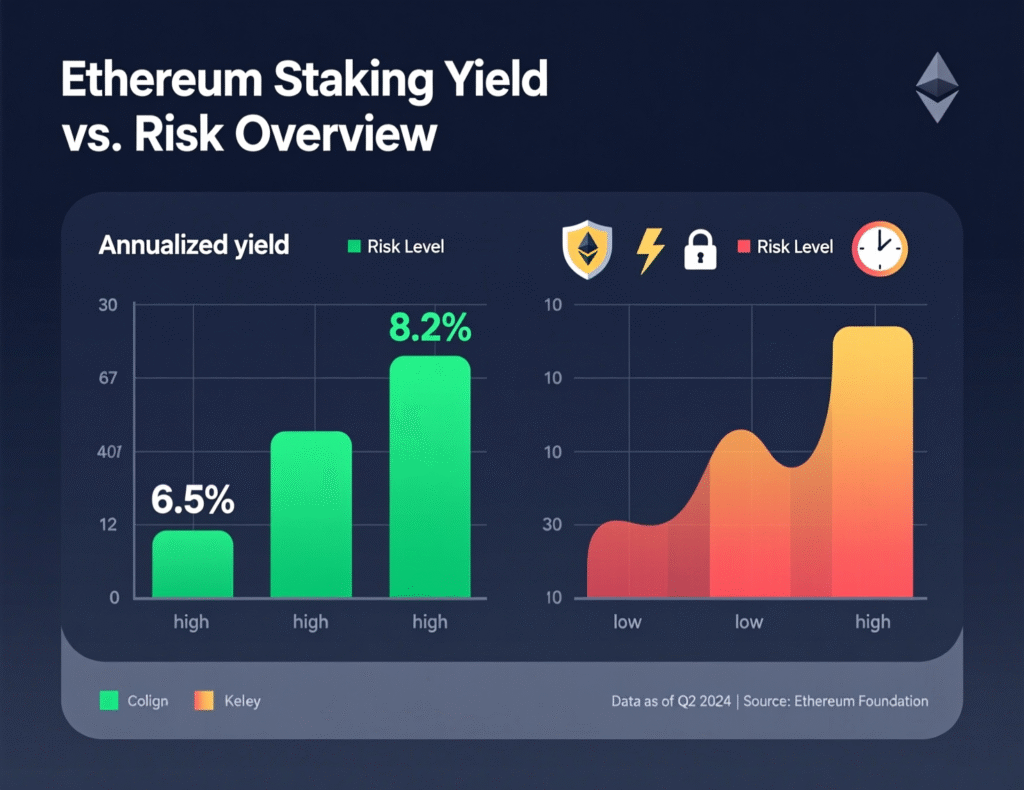

Any ETF using staking will likely face scrutiny over custody, validator selection, slashing risk, reward accounting, tax treatment, and potential securities-law implications of liquid staking tokens (e.g., stETH).

What the Delaware Registration Means (and Doesn’t)

Means

Sponsor readiness, name reservation, and a structure to hold assets if/when federal filings proceed.

Doesn’t mean

SEC approval, listing approval, or confirmation of staking mechanics within the ETF. Further filings (prospectus/S-1 and exchange rule changes) are required, with SEC review to follow.

Outlook for Investors and Issuers

Expect iterative disclosures on how staking would operate (e.g., direct validator vs. liquid staking integration), fee impacts, yield reporting, and risk controls.

VanEck’s Lido-linked approach underscores one possible path; BlackRock’s trust suggests a competing design may be forthcoming. Timelines depend on SEC feedback and market plumbing.

iShares Staked Ethereum Trust ETF: Key Questions Ahead

Reward accrual & NAV

How will staking rewards be accrued, distributed, and reflected in NAV?

Counterparty/Protocol risk

Will any third-party staking provider or liquid staking protocol be used, and under what controls?

Tax/accounting

Treatment of staking rewards and any rebase/derivative mechanics.

Liquidity & creation/redemption

How staking affects primary market flows and secondary liquidity.

Disclosure Must-Haves for the iShares Staked Ethereum Trust ETF

Validator selection criteria, slashing protections, insurance/coverage

Reward timing, dilution, and compounding policy

Protocol governance and any “stETH-like” token mechanics

Clear risk factors on regulatory changes and protocol upgrades (e.g., Ethereum hard forks)

Context & Analysis

The filing cadence echoes the 2024 spot ETH rollout: name reservation → trust formation → federal filings → iterative SEC dialogue. The wild card is staking: 2025 staff statements on liquid staking narrowed uncertainty, but ETF-specific implementations still need bespoke controls and disclosures. VanEck’s Lido path and BlackRock’s trust creation point to parallel strategies converging on the same regulatory checkpoint.

Conclusion

BlackRock’s Delaware registration marks an initial move rather than a completed milestone, signaling early intent but leaving major steps ahead. Progress now depends on submitting detailed federal filings and gauging how receptive the SEC will be to incorporating staking features within an ETF structure. Until that evaluation moves forward, the product remains at a preliminary stage.

At the same time, competing efforts such as VanEck’s trust tied to Lido staking show that the market is entering a more advanced phase. These proposals reflect a growing race among issuers that could redefine how investors access ETH once regulatory clarity finally arrives.

FAQs

Q : What is the iShares Staked Ethereum Trust ETF?

A : A Delaware-formed trust by BlackRock signaling intent to pursue a staked-ETH ETF, pending federal filings and SEC review.

Q : Does the filing mean the ETF is approved?

A : No. It’s an early corporate step, not an indication of SEC approval.

Q : Why didn’t 2024 ETH ETFs include staking?

A : Issuers removed staking to obtain SEC approval for spot ETH ETFs.

Q : What risks come with staking inside an ETF?

A : Slashing, counterparty/protocol risk, reward accounting complexity, tax considerations, and liquidity impacts.

Q: How does VanEck’s product compare?

A : VanEck registered a Lido-linked trust and later filed an S-1; specifics vary depending on structure and service providers.

Q : When could the iShares fund launch?

A : Launch timing depends on SEC feedback on any 1933 Act filing and exchange-listing proposals.

Q : Will staking definitely be allowed in U.S. ETFs?

A : Not guaranteed. Although 2025 statements discussed liquid staking, ETF design and regulatory details will determine approval outcomes.

Facts

Event

BlackRock registers Delaware trust for a potential staked-ETH ETF.Date/Time

2025-11-19T00:00:00+05:00 (formation reported); coverage verified 2025-11-20. CoinDesk+1Entities

BlackRock, Inc.; iShares; Ethereum (ETH); U.S. SEC; VanEck; Lido DAO.Figures

N/A (no fees, AUM, or yield terms disclosed yet).Quotes

“Delaware name registration…‘33 Act. Filing coming soon.” Eric Balchunas (analyst commentary). X (formerly Twitter)Sources

CoinDesk report; The Block; Yahoo Finance summary of analyst commentary; SEC statements on liquid staking. SEC+3CoinDesk+3The Block+