Bitwise exec says a bet on Solana gives ‘two ways to win’

Bitwise CIO Matt Hougan says Solana presents “two ways to win.” The first is through the broader growth of stablecoins and tokenized assets, which he expects to expand sharply in the coming years. The second is Solana’s potential to capture a growing share of that market as adoption accelerates and its ecosystem matures.

Hougan noted that these are “good bets,” adding that it’s easy to imagine the market multiplying tenfold or more. He framed this view in an X post earlier this week, calling Solana one of the standout blockchain opportunities. However, he emphasized that his optimism on Solana doesn’t diminish his bullish outlook on Ethereum and other select networks that continue to drive innovation in decentralized finance and digital infrastructure.

Stablecoins, tokenization and Solana’s adoption curve

Western Union on Oct. 28 announced plans for USDPT, a dollar-backed stablecoin to be issued by Anchorage Digital on Solana, integrated into the firm’s digital asset network for settlements. The move underscores a broader institutional shift toward stablecoin-based rails for cross-border payments.

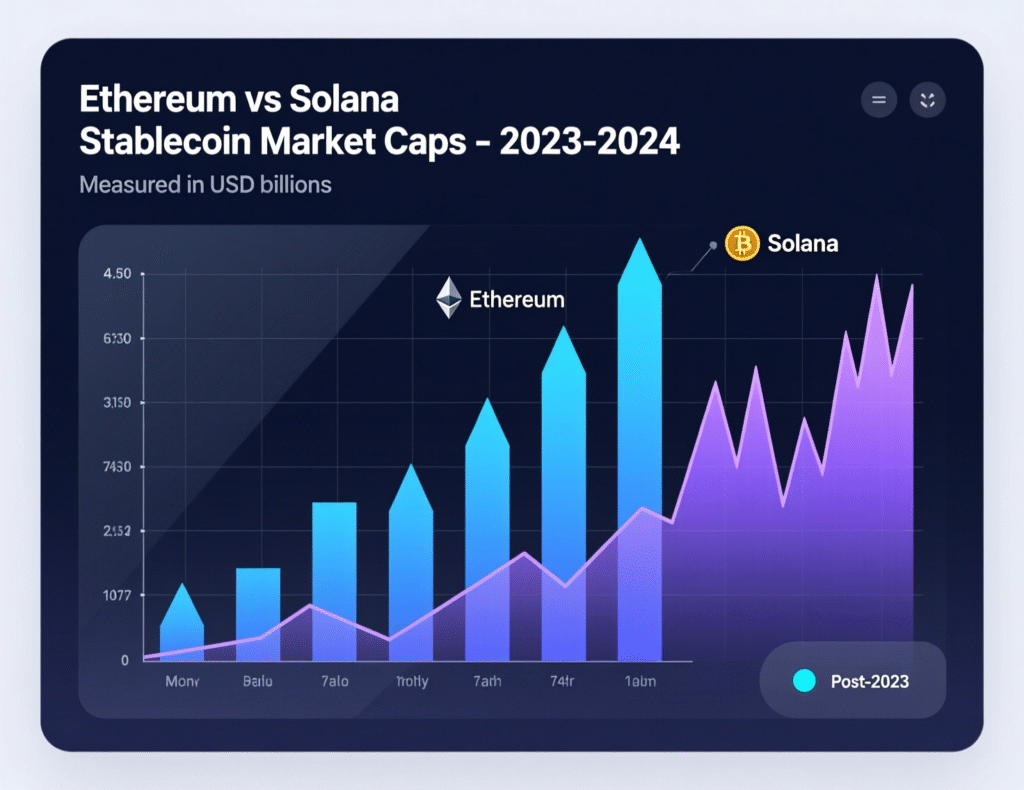

Ethereum’s lead remains wide

By most metrics, Ethereum is still dominant: roughly $163B in stablecoins circulate on Ethereum, and its TVL leads the sector. Solana, meanwhile, hosts about $14.9B in stablecoins—growing but far smaller in absolute terms. Hougan lists Solana among the top challengers alongside Tron and BNB Smart Chain. DeFi Llama+1

Institutional interest: new onramps for SOL

On Oct. 28, Bitwise launched BSOL, a spot Solana ETF that stakes holdings and reinvests rewards an approach designed to appeal to yield-seeking institutions accustomed to ETF wrappers. Early coverage emphasized the product’s staking-forward design and its potential to broaden access to SOL.

Why Solana two ways to win is resonating with investors

Hougan’s framing mirrors the way many investors evaluate secular themes: (1) growing total addressable market, and (2) rising platform share. If both occur, returns can compound; if either occurs, the thesis can still work. Recent enterprise pilots and ETF channels give investors clearer exposure paths.

Risks to the Solana two ways to win thesis

Execution and reliability risks (e.g., network incidents), regulatory changes affecting stablecoins, and Ethereum’s entrenched network effects could slow share gains. Data still shows Ethereum’s commanding lead in stablecoins and TVL.

Context & Analysis

Hougan’s framing is not a prediction that Solana will overtake Ethereum; rather, it emphasizes probabilistic upside from secular growth (stablecoins/tokenization) plus potential share gains. The Western Union announcement adds credibility to the “real-world settlements” narrative, while BSOL offers a compliant vehicle for institutions to express that view.

Conclusion

Matt Hougan believes Solana’s upside could be “explosive” if stablecoins and tokenized assets keep expanding and Solana captures a larger share of that growth. He sees the network’s speed and low costs positioning it well to serve as core infrastructure for on-chain payments and tokenized finance.

In the short term, Hougan points to enterprise pilots like Western Union’s USDPT and inflows into products such as BSOL as key signals of adoption. Still, he cautions investors to watch Ethereum’s continued dominance and potential regulatory challenges that could shape how institutional capital flows into Solana and other blockchain ecosystems.

FAQs

Q : What does “Solana two ways to win” mean?

A : It’s Hougan’s view that investors can benefit if the stablecoin/tokenization market grows and/or if Solana increases its share of that market.

Q : Is Ethereum still ahead?

A : Yes. Ethereum leads in stablecoin capitalization (~$163B) and TVL by a wide margin.

Q : Why is Western Union’s USDPT notable?

A : It’s a major money-transfer firm planning a Solana-based stablecoin for settlements, signaling mainstream adoption.

Q : What is BSOL?

A : Bitwise’s spot Solana ETF that stakes holdings and reinvests rewards to target yield within an ETF wrapper.

Q : How big is Solana’s stablecoin market today?

A : Around $14.9B across Solana, per DefiLlama.

Q : Does Hougan dismiss Ethereum?

A : No. He says he’s “very bullish on Ethereum and select other blockchains”; Solana is one of his favored challengers.

Q : What could derail the thesis?

A : Regulatory shifts on stablecoins, technical outages, or Ethereum retaining share could limit Solana’s upside.

Facts

Event

Bitwise CIO outlines two ways to win thesis for Solana; enterprise and ETF catalysts emergeDate/Time

2025-10-31T00:00:00+05:00Entities

Bitwise Asset Management; Matt Hougan; Solana (SOL); Western Union; Anchorage Digital; Ethereum (ETH)Figures

ETH stablecoin cap ≈ $163B; SOL stablecoin cap ≈ $14.9B (DefiLlama)Quotes

“I love investments that give me two ways to win.” Matt Hougan, CIO, Bitwise theblock.coSources

The Block report; Western Union press release; DefiLlama metrics; ETF.com coverage. etf.com+4theblock.co+4ir.westernunion.com+4