Bittensor, Zcash Lead Altcoin Rebound as BNB Rally Cools

After a volatile weekend, Bitcoin rebounded toward the $110,000 mark, restoring some confidence across the crypto market. The recovery encouraged traders to re-enter riskier positions, sparking renewed interest in select altcoins. Market sentiment improved slightly as investors viewed Bitcoin’s stability as a sign of potential short-term upside.

Among altcoins, Bittensor (TAO) and Zcash (ZEC) stood out as key gainers, leading the rebound narrative with sharp intraday moves. Traders rotated into these higher-beta assets, seeking stronger returns amid improving momentum. However, Binance Coin (BNB) lost steam after a strong run, as profit-taking set in and volumes normalized. Overall, the market showed signs of selective strength, with traders focusing on projects offering clear catalysts while remaining cautious about broader volatility.

Market Overview: Bitcoin bounce sparks selective altcoin strength

Bitcoin reclaimed the $110k area intraday, helping lift risk appetite across parts of the market. Analysts noted that capital rotated into high-beta tokens rather than the entire altcoin complex—consistent with early-stage recoveries. CoinGecko+1

TAO and ZEC extend gains

Bittensor (TAO) and Zcash (ZEC) posted standout 24-hour gains, building on pockets of momentum from last week. Live trackers showed TAO and ZEC up on the day as liquidity chased higher-volatility names.

“Rotation into high beta”

“Bitcoin’s rally has renewed market confidence… Traders are now rotating capital into high beta assets to seek short-term outperformance,” said Shawn Young, chief analyst at MEXC Research, in comments to Decrypt. Other researchers suggested the next major move could skew upward if macro headwinds continue to ease.

BNB rally cools as weekly performance slips

Despite an intraday uptick, BNB underperformed on a 7-day lookback as traders booked profits after a strong prior run. CoinGecko’s price tables show BNB up on the day but down over the week.

Risk rotation, not regime change (yet)

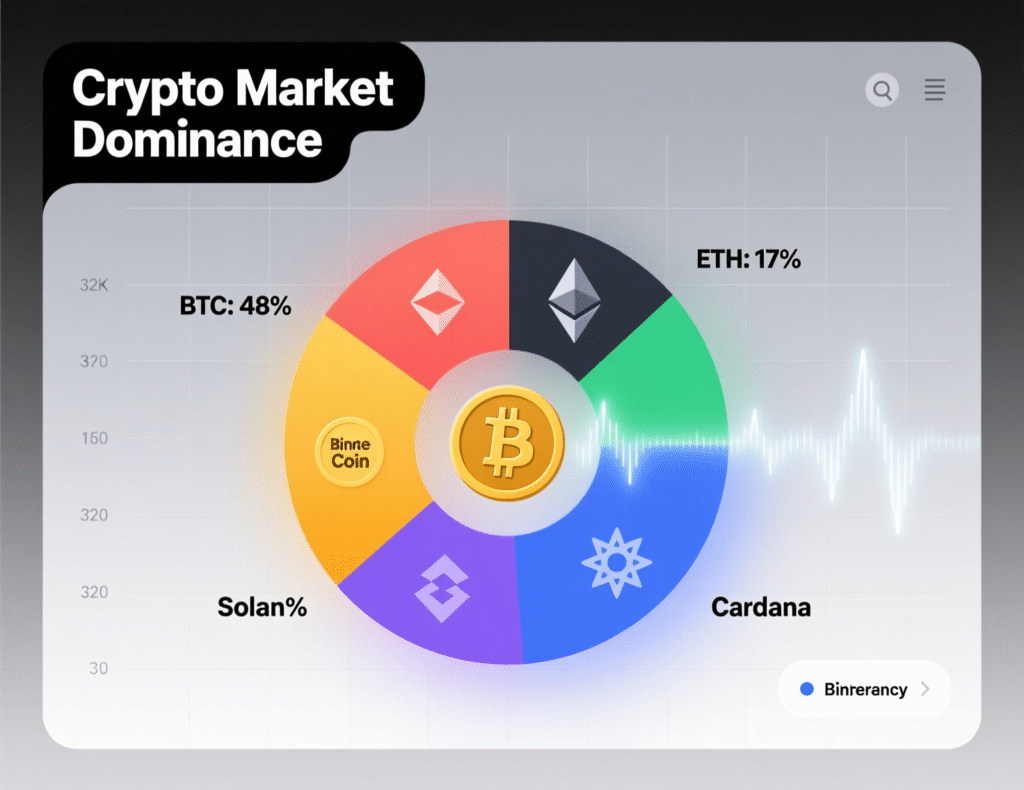

Bitcoin’s market share hovered in the high-50s to ~60%, signaling that while risk is returning at the edges, most capital remains anchored in BTC pending clearer macro signals.

what’s next?

Experts remain cautiously optimistic, arguing a sustained altseason likely needs macro/geopolitical fears to cool further. Narratives around AI, restaking and tokenized assets could benefit if BTC holds key support.

Context & Analysis

Today’s pattern BTC stabilization, leadership from high-beta alts, and a soft BNB week is typical of early recovery phases. Key watchpoints: U.S. rates path, geopolitical headlines, and whether flows expand from majors to DeFi/AI-linked tokens over coming weeks.

Conclusion

If Bitcoin manages to hold key support levels and broader market sentiment stabilizes, the recent pockets of altcoin strength could expand. A calmer macro backdrop may encourage traders to diversify into more risk-sensitive assets, fueling wider participation across the crypto market.

At present, leadership remains concentrated among a few standout performers. Bittensor (TAO) and Zcash (ZEC) continue to lead the altcoin rebound narrative with notable momentum, reflecting selective investor confidence. Meanwhile, Binance Coin (BNB) is consolidating after its recent rally, as traders pause to assess the next directional move amid shifting market conditions.

FAQs

Q : Why did Bittensor and Zcash lead altcoin rebound today?

A : Selective rotation into higher-beta assets followed Bitcoin’s recovery toward $110k, pushing TAO and ZEC higher.

Q : Is BNB still in an uptrend?

A : BNB rose intraday but lagged on a 7-day basis as profit-taking set in.

Q : What does Bitcoin dominance near 60% imply?

A : It suggests investors are cautious about a full rotation into altcoins; BTC still anchors market risk.

Q : Could this turn into a broad altseason?

A : Possibly, if macro and geopolitical risks cool and BTC holds support, allowing flows into DeFi and AI-linked themes.

Q : How can traders evaluate momentum safely?

A : Track BTC trend and dominance, confirm 24h vs 7d data, and size positions prudently (see steps above).

Q : Did Bitcoin set the move in motion?

A : Yes, its rebound toward $110k preceded the high-beta outperformance.

Q : Are these gains sustainable?

A : Analysts are cautiously optimistic but point to macro conditions as the key swing factor.

Facts

Event

Traders rotate into high-beta altcoins; TAO & ZEC lead while BNB coolsDate/Time

2025-10-20T16:00:00+05:00Entities

Bittensor (TAO), Zcash (ZEC), Binance Coin (BNB), Bitcoin (BTC), MEXC Research (Shawn Young), Presto Research (Peter Chung), BuyUcoin (Shivam Thakral)Figures

BTC > $110k intraday; TAO & ZEC up on 24h; BNB down on 7-day; BTC dominance high-50s/≈60% (varies by source)Quotes

“Traders are now rotating capital into high beta assets…” Shawn Young, MEXC Research (to Decrypt)Sources

Decrypt article; CoinGecko market pages (BTC, TAO, ZEC, Dominance)