Bitcoin’s Slump Widens Safe Haven Divergence for Gold

Gold recently touched a fresh peak near \$3,791 per ounce, while Bitcoin slipped toward \$112,000, underscoring a widening contrast between the two assets as safe-haven choices. Analysts attribute gold’s strength to ongoing macroeconomic uncertainty and sustained demand from central banks, which continue to add to reserves in a bid to shield against global financial risks.

In contrast, Bitcoin’s muted performance has fueled debate about its role in turbulent markets. Several crypto-focused fund managers suggest the digital asset often lags behind bullion, only catching momentum once overall liquidity conditions improve. This perspective keeps alive the narrative that Bitcoin may still benefit later, but for now, gold firmly holds the spotlight as the primary refuge during times of market stress.

What’s driving the Bitcoin vs gold safe haven divergence?

Spot gold notched a fresh record high around $3,790–$3,791/oz this week, supported by rate-cut expectations and persistent geopolitical risk. By contrast, Bitcoin is stuck near $112k, extending weakness after a sizeable derivatives liquidation earlier this week. Reuters and Investing.com data show bullion near records while BTC trades at two-week lows.

Farzam Ehsani, CEO of VALR, told Decrypt: “Part of gold’s newly found strength in recent weeks lies in strong sovereign and central bank demand.” He added that countries such as China and Russia have been accumulating gold as a “geopolitical buffer and a hedge against U.S. dollar dominance.” World Gold Council data corroborate sustained central-bank demand through 2025.

Recent performance and flows

Price action: From Thu, Sept. 18 to Wed, Sept. 24, Bitcoin slipped from roughly $116.5k–$117.1k to about $112.0k (≈ 4–5%). Gold, meanwhile, advanced to new highs near $3,791.

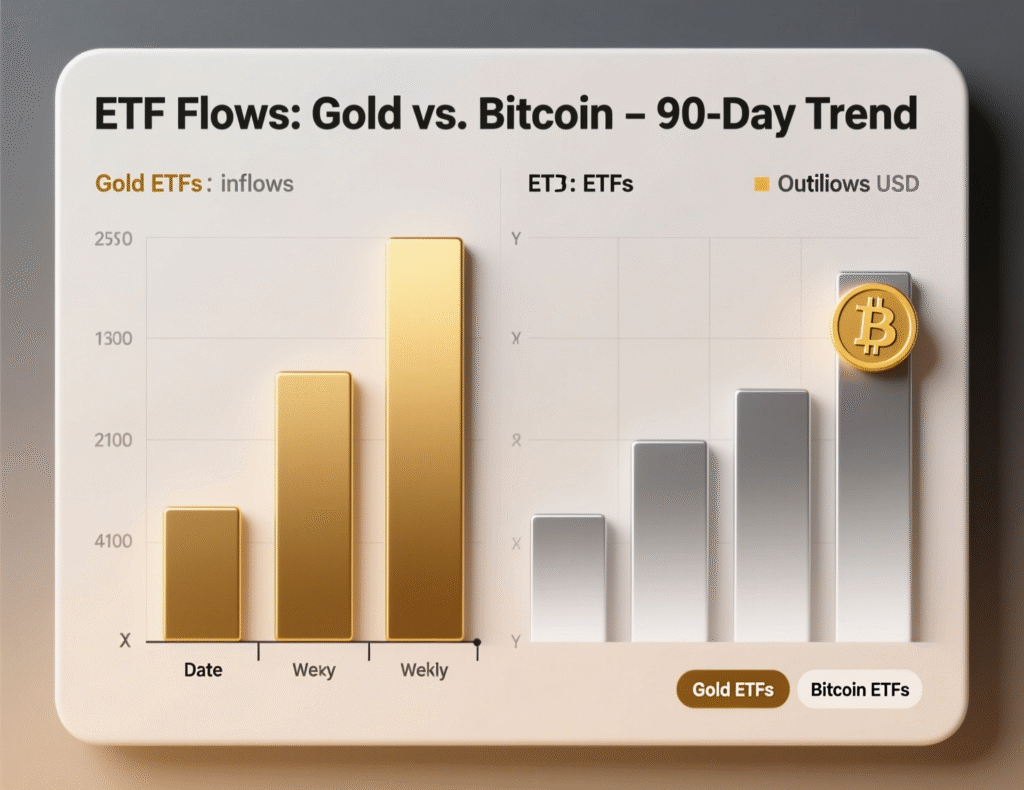

ETF trends: ByteTree’s BOLD Report dashboard shows 90-day ETF flows favoring gold over Bitcoin in recent weeks; Decrypt reports an estimated $18.5bn 90-day inflow to gold ETFs versus just under $10bn for Bitcoin ETFs.

Will the Bitcoin vs gold safe haven divergence persist?

Some crypto managers expect the gap to narrow if monetary policy eases. “Gold moves first, Bitcoin follows 1–2 months later,” said Ryan McMillin, CIO at Merkle Tree Capital, in comments to Decrypt. Historically, BTC has outperformed later in easing cycles as private risk capital returns and liquidity improves especially given Bitcoin’s much smaller market capitalization relative to gold.

<section id=”howto”> <h3>How to read the gold–Bitcoin split for your portfolio</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Track spot gold and BTC daily closes and their 30–90 day correlation.</li> <li id=”step2″><strong>Step 2:</strong> Watch ETF flow dashboards (e.g., BOLD Report/WGC) for direction of institutional money.</li> <li id=”step3″><strong>Step 3:</strong> Monitor rate-cut odds and liquidity gauges (e.g., Fed expectations, funding rates).</li> <li id=”step4″><strong>Step 4:</strong> Set allocation bands; rebalance gradually when divergence hits pre-set thresholds.</li> <li id=”step5″><strong>Step 5:</strong> Use risk controls (position sizing, stop-loss ranges) to manage volatility.</li> </ol> <p><em>Note: Process may vary by jurisdiction/provider. Confirm requirements before acting.</em></p> </section>

Context & Analysis

Central-bank buying has been a durable tailwind for gold, cushioning dips and propelling new highs. Bitcoin’s institutional story buoyed by U.S. spot ETF adoption remains earlier-stage and more sensitive to funding conditions and risk appetite. If the Fed’s eventual cuts ease financial conditions, a rotation of private capital into BTC could compress the divergence, echoing prior mini-cycles. Still, near-term BTC path-dependency on derivatives positioning and macro prints (e.g., PCE) keeps risks two-sided.

Conclusion

The present divergence highlights shifting risk preferences. Gold is benefiting from strong official-sector demand and investor caution around global uncertainties, reinforcing its position as the leading safe-haven asset. Central banks continue to accumulate reserves, adding further strength to bullion’s appeal.

Meanwhile, Bitcoin remains in a phase of consolidation, waiting for improved liquidity and market stability. If monetary easing gains momentum and volatility settles, history indicates the gap between the two could shrink. In such conditions, Bitcoin has the potential to outpace gold later in the cycle, offering investors a different kind of refuge with higher growth prospects.

FAQs

Q : What is the Bitcoin vs gold safe haven divergence?

A : It’s the widening performance gap when gold rallies as a haven while Bitcoin lags during risk-off periods.

Q : Why is gold outperforming now?

A : Strong central-bank purchases and rate-cut expectations have lifted bullion to records.

Q : Has Bitcoin historically followed gold?

A : Some managers note gold often moves first, with Bitcoin catching up 1–2 months later as risk appetite improves.

Q : Do ETF flows support the divergence?

A : Recent dashboards show stronger 90-day gold ETF inflows versus Bitcoin.

Q : Could Bitcoin outperform later?

A : Yes if cuts materialize and liquidity improves, BTC’s smaller market cap can amplify upside.

Q : How should investors respond to the split?

A : Define allocation bands, monitor flows and policy odds, and rebalance gradually with risk controls.

Q : What risks could reverse the pattern?

A : Hot inflation, slower cuts, or renewed deleveraging could keep BTC subdued and sustain gold’s premium.