Bitcoin’s Legal Status in Saudi Arabia: Banks, Bans and Grey Areas

Bitcoin is not legal tender in Saudi Arabia, and a 2018 government committee warned that virtual currencies, including Bitcoin, are illegal and unlicensed for trading and investment offers. At the same time, there is still no clear criminal-code article that expressly bans private holding or low-profile peer-to-peer trades, so residents and expats operate in a high-risk legal grey zone where policy can tighten quickly

Before anything else, this guide is general information, not legal or investment advice.

So, is Bitcoin legal in Saudi Arabia in 2026? The short version is.

Bitcoin is not legal tender.

Banks and licensed financial institutions are effectively banned from dealing in it.

A high-level committee has called virtual currencies “illegal and unlicensed”, especially when offered as investments to the public.

Yet there is still no dedicated crypto statute that clearly criminalises every individual who quietly holds or trades Bitcoin. That leaves residents and expats in a grey area, where enforcement risk depends heavily on behaviour, volume and visibility.

Global context helps. By 2024, around 6.8–7% of the world’s population roughly 560 million people owned some form of cryptocurrency, with Bitcoin holding the largest share. Over the same period, the global crypto market cap swung around the multi-trillion-dollar mark, pushing regulators in the US, UK, EU and Gulf to tighten rules and enforcement.

If you are a US, UK or EU national working in Riyadh or another Saudi city, or a business leader in New York, London or Frankfurt with Saudi clients, you need to think about both Saudi rules and home-country obligations.

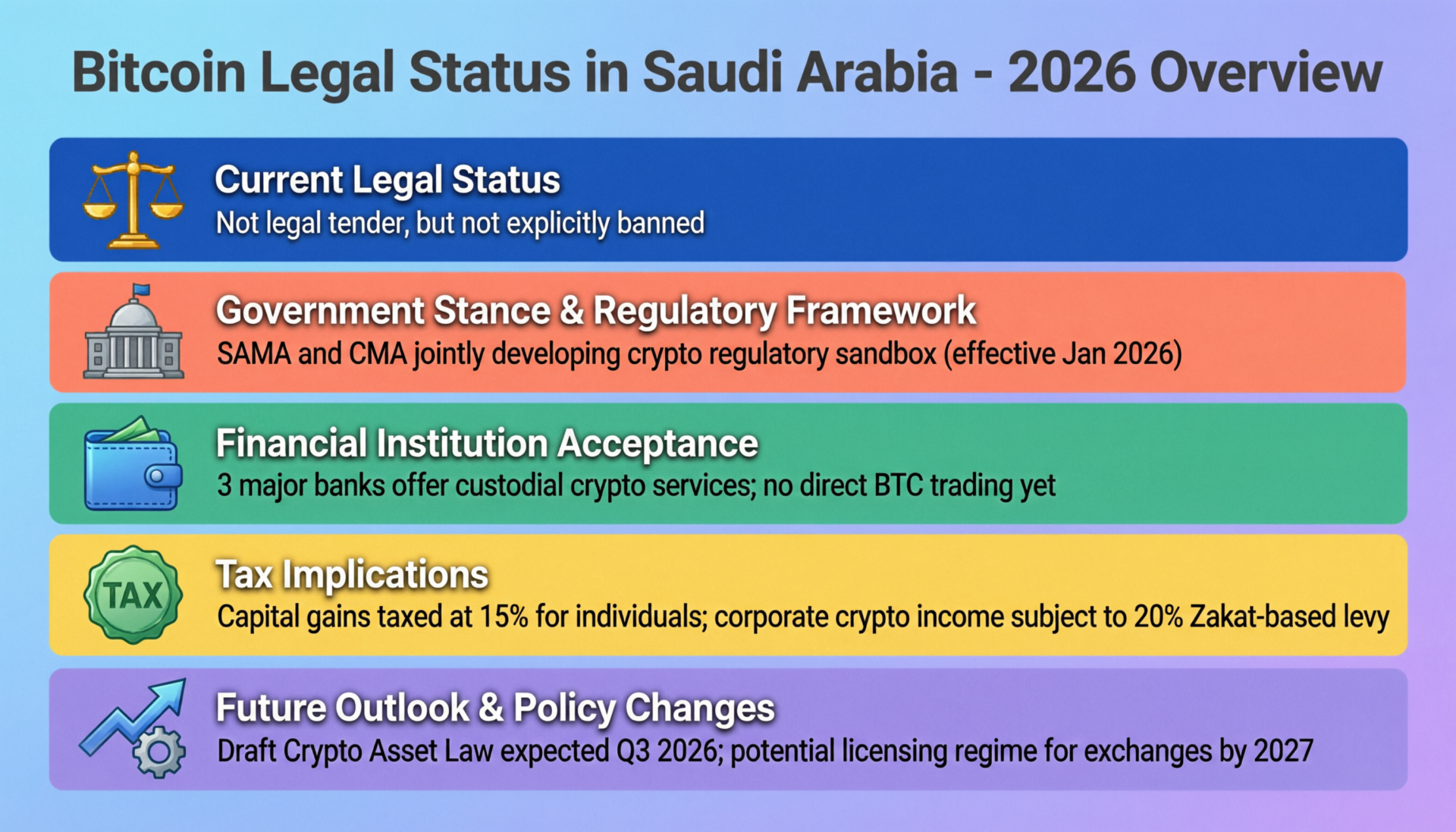

Is Bitcoin Legal in Saudi Arabia in 2026?

The current position is that Bitcoin is not recognised as legal tender in the Kingdom. A 2018 statement from a Standing Committee of regulators, led by the central bank, warned that virtual currencies explicitly including Bitcoin are not approved as official currencies, fall outside government supervision, and that no parties or individuals are licensed to offer such products.

In practice, that means

You cannot use Bitcoin like the Saudi riyal for official payments, salaries or government obligations.

Offering Bitcoin-based investments or forex-style schemes to the public is considered unauthorised and illegal activity.

Legal Tender vs. “Illegal and Unlicensed”

“Legal tender” simply means the money the state recognises for settling debts and obligations. In Saudi Arabia, that is the Saudi riyal, issued by Saudi Central Bank (SAMA) Bitcoin does not have this status, which aligns with commentary from the Law Library of Congress on Gulf crypto regimes.

The 2018 Standing Committee statement went further than many countries’ generic “risk warnings”. It said that virtual currency including Bitcoin is illegal in the Kingdom and emphasised that no party is licensed to trade or offer these products domestically. This is why many international summaries, including compliance guides and fintech blogs, describe crypto as “illegal” in Saudi Arabia.

Are Individuals Themselves Breaking the Law?

Here is where nuance matters. Saudi Arabia has no standalone “crypto law” or dedicated Bitcoin statute as of early 2026. Instead, authorities rely on existing frameworks for.

Fraud and financial crimes

Unlicensed securities or FX activity

Anti–money laundering and counter-terrorist financing (AML/CTF)

Consumer protection and marketing rules

In day-to-day life, the legal risk often turns on how Bitcoin is used.

High-risk: running an investment scheme, pooling funds from colleagues in Riyadh, or advertising guaranteed-return Bitcoin products on social media.

Lower but uncertain risk: quietly holding a small amount of Bitcoin on a foreign exchange account, funded from already taxed savings, with no public marketing or brokerage behaviour.

Because there is no bright-line statute, anyone with serious exposure should take advice from qualified Saudi counsel rather than relying on internet summaries or hearsay in expat groups.

Banking Ban and Institutional Restrictions

Saudi banks and licensed financial institutions are effectively prohibited from dealing in cryptocurrencies or offering crypto trading, brokerage or custody services.Regulatory guidance to banks focuses on blocking suspicious flows linked to unlicensed forex, scams and virtual currency schemes.

International commentators therefore label Saudi Arabia a “banking ban” jurisdiction institutions can’t touch crypto, even though the criminal law position for private individuals remains patchy.

Who Regulates Crypto in Saudi Arabia?

Saudi policy on virtual currencies is shaped by a small group of powerful regulators rather than a single crypto law. Understanding who they are helps explain why the rules feel both strict and vague at the same time.

Role of Saudi Central Bank (SAMA)

Saudi Central Bank (SAMA) oversees monetary policy, payments, banks and much of the fintech ecosystem. Since 2018 it has repeatedly warned the public against trading in virtual currencies, stressing that these markets are unregulated, high-risk and potential vehicles for fraud.

At the same time, SAMA has been actively experimenting with central bank digital currencies (CBDCs) and digital payments as part of Vision 2030. Projects like Project Aber, a joint wholesale CBDC pilot with the UAE central bank, and participation in multi-country initiatives such as mBridge, show that policymakers are keen on state-controlled digital money, not on liberalising open crypto.

Capital Market Authority (CMA) and the Standing Committee

The Capital Market Authority (CMA) and SAMA both sit on the Standing Committee for Awareness on Dealing in Unauthorized Securities in the Foreign Exchange Market. That committee produced the 2018 statement declaring virtual currencies illegal and unlicensed in the Kingdom.

Because of the CMA’s role, many crypto-linked investment schemes can be treated as unlicensed securities or FX activity, even if the underlying tokens are not yet fully defined in statute.

How Enforcement Works in Practice

So far, enforcement appears to focus on visible, systemic risk, not on every small retail holder:

Shutting down unlicensed forex / crypto “brokers” and multi-level marketing schemes.

Warning banks, payment companies and fintechs about processing flows linked to virtual currencies.

Public reports suggest limited day-to-day enforcement against low-profile individuals, but that position can change quickly especially if someone acts as an informal exchange, runs a public Telegram group, or handles large inbound/outbound transfers.

Can You Buy or Trade Bitcoin From Inside Saudi Arabia?

Residents and expats do find ways to get exposure to Bitcoin from inside the Kingdom, but every path carries legal, banking and tax risks. If your goal is legitimate long-term exposure, every route should be tested against both Saudi rules and your home-country obligations.

Using Foreign Exchanges From KSA

Many users simply log into global exchanges such as Binance or other large platforms via mobile apps, web browsers or VPNs. These exchanges are not locally licensed in the Kingdom and operate entirely outside Saudi regulatory supervision.

For US citizens in the Kingdom, platforms also have to fit within rules set by the Internal Revenue Service (IRS), FinCEN and the SEC. British expats need to consider the Financial Conduct Authority (FCA) and UK tax rules, while German expats fall under BaFin and evolving EU regulations such as MiCA.

If you access a US, UK or EU exchange from a Saudi IP, you can end up under two overlapping regimes: Saudi restrictions plus your home regulator’s expectations for KYC/AML, disclosures and tax.

P2P Trading, OTC Deals and Informal Channels

Because banks are conservative, some residents rely on

Peer-to-peer (P2P) deals

OTC brokers

WhatsApp or Telegram groups advertising “cash for crypto”

These sit squarely in a regulatory grey zone. They raise obvious questions around fraud, money-laundering and unlicensed FX business exactly the behaviours Saudi authorities have been trying to stamp out.

Practical risks include

Bank account freezes if compliance teams see patterns that resemble unlicensed brokerage.

Blocked international wires or card transactions flagged as crypto-related.

Being treated as an unregistered “money service business” by home-country regulators if you regularly convert crypto for others for a fee.

What Saudi Banks and Payment Providers Will Block

Local banks and payment providers are expected to block or scrutinise

Card payments and transfers to well-known crypto exchanges and ramps.

Large or repetitive transfers where the narrative suggests forex or investment activity outside licensed channels.

Safer behaviours (though never risk-free) include

Avoid mis-describing transfers don’t call something “consulting” or “family support” if it’s actually a crypto trade.

Avoid acting as an informal exchange for friends or co-workers.

Check your bank’s latest crypto policy and, where possible, get written guidance before making large transfers.

If your business needs compliant cross-border flows, partnering with a specialist provider and building transparent data pipelines for example with BI and data integration platforms like those delivered by Mak It Solutions can help you evidence source-of-funds and transaction logic to compliance teams.

Tax, Compliance and Sharia Considerations for Residents and Expats

Even if Saudi law treats Bitcoin as a grey-area asset, foreign tax authorities usually do not. At the same time, many Muslims also weigh Sharia principles when deciding whether to hold or trade Bitcoin.

Foreign Tax Reporting (US, UK, Germany/EU)

US citizens and green card holders in the Kingdom remain fully taxable on worldwide income. IRS guidance treats most Bitcoin disposals as taxable events and expects accurate reporting of gains and losses, regardless of where you live.

British expats may need to report Bitcoin gains and income to HM Revenue & Customs (HMRC), depending on residence status and remittance rules.

German and wider EU citizens are increasingly governed by BaFin-supervised rules and the EU’s Markets in Crypto-Assets (MiCA) framework, which expects robust reporting and KYC/AML controls from service providers.

For professionals in London, Frankfurt or New York who run fintech or SaaS platforms serving Saudi clients, this often means dual compliance: one set of rules for the platform, another for Saudi users.

Is Bitcoin Halal or Haram in the Saudi Context?

Sharia discussions centre on whether Bitcoin counts as valid “mal” (property) and a legitimate medium of exchange, or whether it is closer to speculation (maysir) and unacceptable uncertainty (gharar).

Analysts note that.

Some scholars are cautiously positive when Bitcoin is used as a payment tool or long-term store of value.

Others emphasise the volatility and speculative trading culture as reasons for concern.

There is no single, binding Sharia ruling in the Saudi context; investors usually consult Sharia boards associated with local banks or fintechs rather than relying solely on generic fatwas.

KYC/AML and Data Protection

Foreign exchanges serving EU or UK users in the Kingdom must comply with robust KYC/AML rules and data protection frameworks like GDPR/DSGVO and UK-GDPR. If a German expat in Riyadh uses an EU-regulated exchange, their data may still fall under EU privacy rules and BaFin-supervised oversight, even though they are physically outside the European Union.

Saudi Arabia is also tightening its own data and cybersecurity requirements for financial and fintech players. Corporates that combine Saudi user data with EU or UK datasets for example in cloud data lake houses or BI platforms need careful data-mapping, role-based access and audit-ready logging.

How Saudi Policy Compares With the US, UK and EU in 2026

Saudi Arabia has chosen a cautious, statement-driven model rather than a detailed licensing regime for retail crypto. By contrast, the US, UK and EU are moving towards explicit, often complex frameworks that allow licensed exchanges and custodians to operate under strict rules.

Banking Ban vs. Licensing Regimes

Saudi Arabia: banking ban, high-level prohibition on unauthorised virtual currency trading, and case-by-case enforcement using existing laws.

US: patchwork of state and federal rules (FinCEN, SEC, CFTC, state money-transmitter licences)

UK: FCA registration and marketing rules for crypto-asset businesses, with strict financial promotion standards.

EU: MiCA introduces passported licences, reserves and disclosure obligations for exchanges and stablecoin issuers.

Think-tank work from organisations like the Virtual Assets Regulatory Authority (VARA) and Carnegie centres highlights how Gulf states are experimenting with more open licensing inside free zones a deliberate contrast to Saudi’s conservative stance.

GCC Neighbours.

The UAE and Bahrain have embraced crypto licensing frameworks in places like Dubai’s VARA regime and the Abu Dhabi Global Market (ADGM), positioning Dubai as a regional hub for regulated exchanges and crypto businesses.

Saudi’s slower, risk-averse path is not about ignoring digital finance; it is about prioritising state-backed digital currency projects and tightly supervised fintech over open-ended crypto markets.

What This Means for US/UK/EU Businesses Working With Saudi Clients

Fintechs, exchanges and SaaS companies in New York, London or Frankfurt that serve Saudi users need to:

Implement geofencing and IP controls where regulatory risk is high.

Strengthen onboarding, KYC and sanctions screening for Saudi-linked accounts.

Align cross-border data flows with both Saudi and EU/UK data rules.

This is a classic multi-jurisdiction compliance problem, where working with a mix of local counsel, Big-4-style advisors such as Grant Thornton, and specialist legal content services like Lexology is often the safest option.

Digital Riyal, CBDC Projects and Possible Legal Reforms

Saudi Arabia is unlikely to become a “crypto-friendly” jurisdiction overnight, but it is moving quickly on state-controlled digital currency.

SAMA’s Digital Riyal and CBDC Experiments

SAMA’s CBDC journey runs through

Project Aber (with the UAE) to test wholesale cross-border settlement.

Joining the BIS-led Project mBridge MVP alongside other major central banks.

Domestic pilots to explore how a digital riyal could modernise government payments and high-value transfers under Vision 2030.

Policymakers appear to prefer programmable, sovereign money over liberalising unregulated crypto a trend also noted in wider GCC analysis.

Could Saudi Arabia Create a Formal Crypto Framework?

Possible scenarios over the next few years include.

Status quo plus: continued grey zone for individuals, strong warnings, strict banking ban.

Limited licensing: tightly controlled institutional or sandbox licences for specific use-cases.

Regional alignment: gradual convergence with GCC neighbours through carefully scoped crypto frameworks.

Consultancies and auditors tracking digital currency and auditing trends in the Kingdom expect more structure, but not necessarily rapid liberalisation.

Practical Checklist Before You Act

Before taking any real exposure, residents and expats should.

Clarify objectives speculation, long-term store of value, cross-border payments, or business use-case.

Check home-country tax rules especially for US, UK and EU citizens who remain taxable on worldwide gains.

Obtain local Saudi legal advice particularly before launching products, running investment schemes, or handling large volumes.

Confirm bank and employer policies some employers and banks explicitly prohibit crypto-related activity.

Document everything keep clear records of sources of funds, transactions and counterparties in case of future questions.

Concluding Remarks

In 2026, Bitcoin in Saudi Arabia sits in a high-risk grey zone. It is not legal tender; a 2018 Standing Committee statement calls virtual currencies illegal and unlicensed; banks and licensed institutions are effectively banned from dealing in them; but there is still no dedicated criminal law that clearly outlaws every private holder.

For individuals and businesses, the real risk lies in how visible, leveraged and systemic your activity becomes and in how well you manage overlapping Saudi, US, UK and EU rules.

If your organisation needs to design compliant data flows, reporting dashboards or cross-border payment logic that touches Bitcoin or other digital assets, the technology foundations matter as much as the legal ones.

Mak It Solutions works with teams from San Francisco and New York to London, Berlin and the Gulf to build analytics, integration and cloud platforms that respect regional regulations while staying fast and user-friendly.

Let’s talk about how to structure your data, dashboards and workflows so that when your legal and tax advisors set the rules, your systems are ready to enforce them.( Click Here’s )

FAQs

Q : Can my Saudi employer pay my salary or bonus in Bitcoin, and what are the risks?

A : In practice, it is very unlikely that a Saudi employer will pay salary or bonuses directly in Bitcoin. Bitcoin is not legal tender, and the 2018 committee statement warned that virtual currencies are illegal and unlicensed in the Kingdom, which makes HR and payroll departments extremely cautious. Even if a foreign employer were willing to pay in Bitcoin offshore, you could face problems converting it into riyals, explaining large inflows to your Saudi bank, and complying with home-country tax reporting. Always confirm your employer’s policies and seek legal and tax advice before accepting crypto-linked compensation.

Q : Will my Saudi bank account be frozen if I send or receive money linked to crypto exchanges?

A : Saudi banks and payment providers are under strong pressure to detect and block flows linked to unauthorised forex and virtual currency activity. There is no automatic rule that any crypto-related transaction equals an immediate freeze, but patterns like repeated transfers to or from known exchanges, large unexplained cash deposits or acting as an informal broker for others can all trigger investigations. In serious cases, accounts can be frozen while compliance officers review your activity, and you may be asked to provide documents proving the source of funds and purpose of transactions.

Q : Is it safer for expats in Saudi Arabia to buy Bitcoin through US/UK/EU exchanges instead of local channels?

A : Using a well-regulated US, UK or EU exchange is usually safer from a platform-risk perspective than informal local P2P deals, because those exchanges must follow strong KYC/AML and security standards. However, this does not remove Saudi-side risk: banks may still question transfers, and Saudi regulators still view virtual currency trading as unauthorised. At the same time, you must comply with home-country tax and reporting rules (IRS, HMRC, BaFin, etc.). So foreign exchanges can reduce some risks, but they don’t make Bitcoin “legal” in Saudi Arabia or eliminate your compliance obligations.

Q : Do I need to declare Saudi-based Bitcoin holdings to the IRS, HMRC or BaFin even if KSA treats them as a grey area?

A : Yes. Most major tax authorities care about your residence and citizenship, not whether the host country has a clear crypto law. US citizens must declare worldwide crypto income and gains to the IRS; UK residents and many UK-domiciled expats may have HMRC obligations; German and other EU residents need to consider BaFin-aligned and MiCA-linked rules. The fact that Saudi Arabia treats Bitcoin as a grey-zone asset does not excuse non-reporting elsewhere, and failure to disclose can carry significant penalties in your home jurisdiction.

Q : Can a foreign crypto company legally market its services to customers living in Saudi Arabia in 2026?

A : A foreign crypto exchange or broker that actively markets into the Kingdom risks being treated as dealing in unauthorised securities or FX and could be targeted by Saudi regulators, especially if local residents suffer losses. At the same time, regulators in the US, UK, EU and UAE including the FCA, BaFin and VARA increasingly police cross-border promotions, especially where retail consumers are involved.Any firm with meaningful Saudi user numbers should treat the Kingdom as an explicit risk jurisdiction and seek advice on licensing, marketing restrictions, geofencing and KYC/AML controls before running campaigns or onboarding programmes.