Bitcoin worst first 50-day start to a year on record, data shows

Data cited by Checkonchain shows that Bitcoin has fallen by roughly 23% during the first 50 days of 2026, marking its weakest start to a year within the dataset commonly referenced by market commentators. This sharp downturn stands out against historical openings, where early-year performance has often been mixed but rarely this consistently negative. Analysts note that the magnitude and speed of the decline have raised concerns about near-term momentum and investor confidence.

Reports attribute most of the losses to a two-step slide. Bitcoin dropped by about 10% in January, followed by an additional decline of nearly 15% in February, based on prices tracked up to the report date. Combined, these moves leave Bitcoin on course for an unusually poor first two months of the year, intensifyi

What’s unusual: January and February both negative

According to CoinGlass monthly return data cited in coverage, bitcoin has not previously recorded back-to-back declines in January and February—years with steep January drops (such as 2015, 2016, and 2018) were followed by positive February performance in those historical comparisons. If February’s losses persist into month-end, the two-month streak would also rank among the weakest consecutive monthly performances since 2022, per the same reporting.

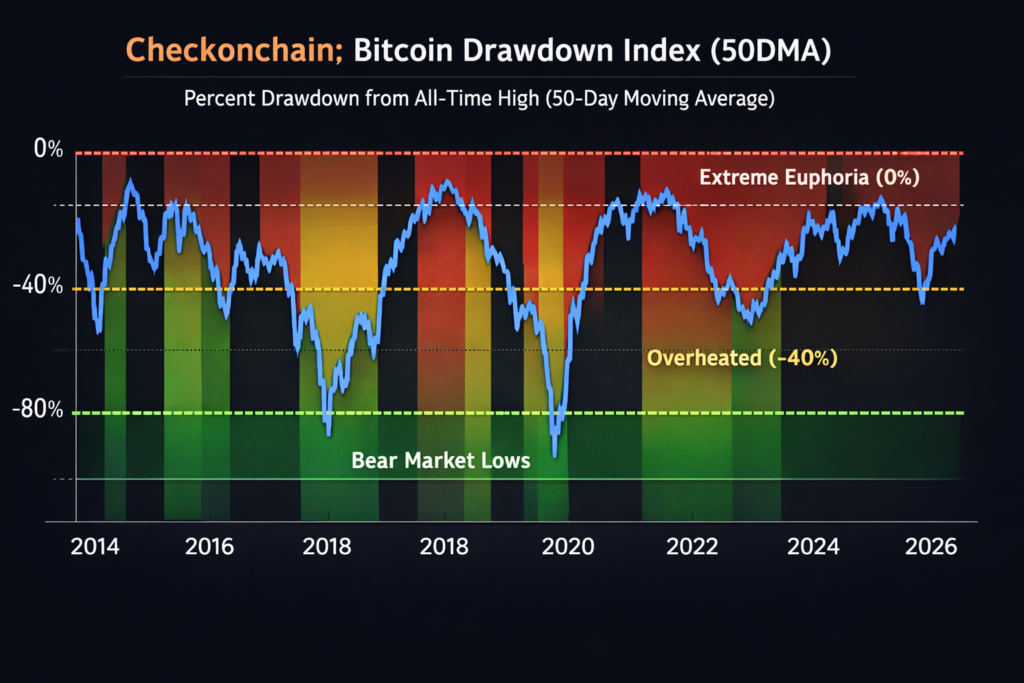

Bitcoin worst first 50-day start to a year in on-chain context

Checkonchain’s “index reading” referenced in reports compares current drawdowns with patterns observed in prior “down years.” In the cited framing, a “typical down year” averages around 0.84 by day 50, while bitcoin is currently around 0.77, signaling a deeper-than-typical early drawdown versus that benchmark.

Context & Analysis

Bitcoin’s weak start is unfolding alongside broader risk-asset volatility highlighted in recent market reporting, including episodes of sharp crypto selloffs and large liquidations tied to shifting macro sentiment. While on-chain and seasonality statistics can contextualize the move, they do not by themselves explain causality and the “record” framing depends on each dataset’s history and methodology.

Concluding Remarks

With the first 50 days of 2026 already marking a sharp drawdown, and February still showing negative momentum in the referenced data, market participants are closely monitoring Bitcoin’s next move. The focus is on whether prices will continue to weaken or begin forming a base after one of the poorest early-year performances in recent history.

Traders are especially attentive to whether Bitcoin breaks the historically rare pattern of back-to-back January and February declines. At the same time, attention is shifting toward on-chain drawdown indicators, as signs of stabilization during the remainder of the quarter could signal easing downside pressure and a potential shift in market sentiment.

FAQs

Q : What does “bitcoin worst first 50-day start to a year” mean?

A : It refers to Bitcoin’s year-to-date performance through the first 50 calendar days showing the largest percentage decline within the historical dataset cited by analysts.

Q : How much is bitcoin down in 2026 so far?

A : Cited figures indicate Bitcoin is down roughly 23% through the first 50 days of 2026, based on prices at the time of reporting.

Q : Why is the January–February streak notable?

A : Data cited from CoinGlass suggests Bitcoin has not previously recorded losses in both January and February within the same year.

Q : Is February’s decline final?

A : No. The reporting described February as “on track,” meaning the figures reflected month-to-date performance rather than a finalized monthly close.

Q : What is the Checkonchain “index reading” mentioned?

A : It refers to an on-chain or market-cycle metric from Checkonchain used to contextualize drawdowns, comparing a 0.77 reading to a typical down-year level of around 0.84 at day 50.

Q : Does a weak start guarantee a down year?

A : No. Early-year weakness provides context but does not determine full-year outcomes, which can shift due to macroeconomic factors and market structure.

Q : Where can I verify the monthly returns myself?

A : You can review Bitcoin’s monthly return data on CoinGlass and cross-check it with other price indices and on-chain analytics dashboards.

Facts

Event

Bitcoin posts its weakest first-50-days start to a year in the cited dataset; January and February both tracking declines.Date/Time

2026-02-19T00:00:00+05:00 (50th day of 2026; reference point used in the report)Entities

Bitcoin (BTC); Checkonchain; CoinGlassFigures

~23% YTD through day 50; ~-10% January; ~-15% February (tracking); index reading ~0.77 vs ~0.84 benchmark (as cited)Quotes

No direct quotations were included in the provided excerpt.Sources

CoinDesk mirror/reporting and referenced data-provider pages (see Sources below).