Bitcoin vs Real Estate 2025: Where Smart Money Flows

In 2025, Bitcoin is a high-volatility, high-upside macro hedge, while real estate remains the primary store-of-value asset for most long-term investors in the US, UK, EU and Middle East. For most globally mobile investors, a diversified mix core property plus a modest Bitcoin allocation sized to their risk tolerance and tax position is more resilient than betting on either asset alone.

Put simply.

keep property as your anchor, and treat Bitcoin as a satellite bet that you can afford to see swing sharply in both directions.

Introduction

“Bitcoin vs real estate 2025” isn’t just a Reddit debate it’s a real allocation question for US, UK, EU and Middle East wealth. Bitcoin has delivered triple-digit annual gains in 2023 and 2024, but with brutal drawdowns along the way. Prime real estate in cities like Dubai, London, New York and Frankfurt has moved slower, but offers rental income, leverage and something you can actually live in.

This guide compares Bitcoin vs real estate as store-of-value assets in 2025, explains how Gulf capital is being used to buy luxury property (sometimes via crypto), and shows how international investors can blend digital assets and real estate into one global, compliant portfolio.

This is educational only not personal investment, tax or legal advice.

Bitcoin vs Real Estate in 2025.

What this guide covers for US, UK, EU and Middle East investors

For US, UK, EU and Gulf investors, the core question is simple: is Bitcoin better than real estate for long-term investment in 2025, or should you keep property at the core of your wealth? We’ll look at:

Store-of-value roles in high inflation / high rate environments

Middle East wealth management trends 2025 and what they signal

Cross-border risk, regulation and tax for Bitcoin vs property

Practical portfolio structures (BTC, tokenized real estate, REITs and direct assets)

Whether you’re in London, New York, Berlin, Dubai or Riyadh, the mechanics are different, but the trade-offs are surprisingly similar.

How Bitcoin and real estate performed into 2025

From 2023–2024, Bitcoin delivered roughly 155% and 120% annual returns, but also saw deep drawdowns along the way. It behaved more like a leveraged macro asset than a sleepy store of value.

In contrast, global real estate investment volumes have been recovering, with European volumes expected around €215 billion in 2025, up about 9% vs 2024.

Dubai is a good example of the “real asset” story: real estate transactions in 2024 reached about AED 761 billion (≈US$207B) across 226,000 deals, up 36% in volume and 20% in value year-on-year an all-time record for the city’s property market.

When Bitcoin wins, when property wins in 2025

Bitcoin “wins” in 2025 when.

You size it as a small (say 1–5%) asymmetric bet

You can tolerate 60–80% drawdowns without panicking

You care more about upside and inflation-hedge potential than day-to-day stability

Real estate “wins” in 2025 when:

You want income, leverage, and something your family can live in

You value local legal protections (Dubai Land Department, UK Land Registry, German Grundbuch)

You’re planning intergenerational wealth, not just a 3-year trade

For most serious investors in the US, UK, Germany and the Gulf, it’s not strictly Bitcoin vs property it’s which one sits at the core, and how big the satellite Bitcoin sleeve should be.

Is Bitcoin or Real Estate a Better Store of Value in 2025?

In 2025 there is no single “better” store of value. For cautious investors especially families and family offices prime real estate in stable jurisdictions still acts as the core store-of-value asset, while Bitcoin is better treated as a high-risk, high-potential satellite.

Bitcoin as a 2025 store of value.

Bitcoin is provably scarce (hard cap of 21 million BTC) and globally tradeable, which is attractive if you’re worried about fiat debasement or capital controls. It has shown it can outpace inflation by a wide margin over multi-year cycles but with huge volatility and multi-year drawdowns.

In 2025, Bitcoin looks more like an inflation hedge investment plus a bet on digital monetary infrastructure than a classic “store of value” like a paid-off apartment in Dubai Marina or a townhouse in London Zone 1. For US or UK investors used to FDIC-insured bank accounts and regulated brokers, self-custody, hacks, exchange failures and regulatory uncertainty add a very different risk stack.

Real estate as a 2025 store of value.

Real estate’s store-of-value power in 2025 still comes from three levers:

Income

Rental yield in New York, London, Dubai or Munich that can, in many cases, float with inflation

Leverage

Long-term fixed or semi-fixed mortgages in the US, UK or EU

Legal protection

Strong title and courts in places like the UAE, UK and Germany

The flip side is local market risk oversupply in Dubai, regulatory crackdowns in Berlin, or affordability pressure in London. You also face concentration risk: a single building vs divisible BTC that you can trim in small increments.

Still, for many Middle East and European families, paid-off property is the default store of value their parents and grandparents used, and that behavioural habit still matters in 2025.

Bitcoin vs property investment

Bitcoin in 2025 suits investors who.

Have high risk tolerance and long time horizons

Are comfortable with wallets, custody and on-chain transparency

Can lose a large portion of the allocation without threatening their lifestyle

Real estate in 2025 suits investors who.

Want visible, usable assets (homes, offices, logistics, hospitality)

Need leverage and relatively predictable cash flow

Prioritise family wealth preservation over maximising returns

German investors literally searching “bitcoin oder immobilien 2025 was lohnt sich mehr” are asking the same thing as a doctor in London or an entrepreneur in Dubai: how much risk can I really live with, and in which jurisdiction?

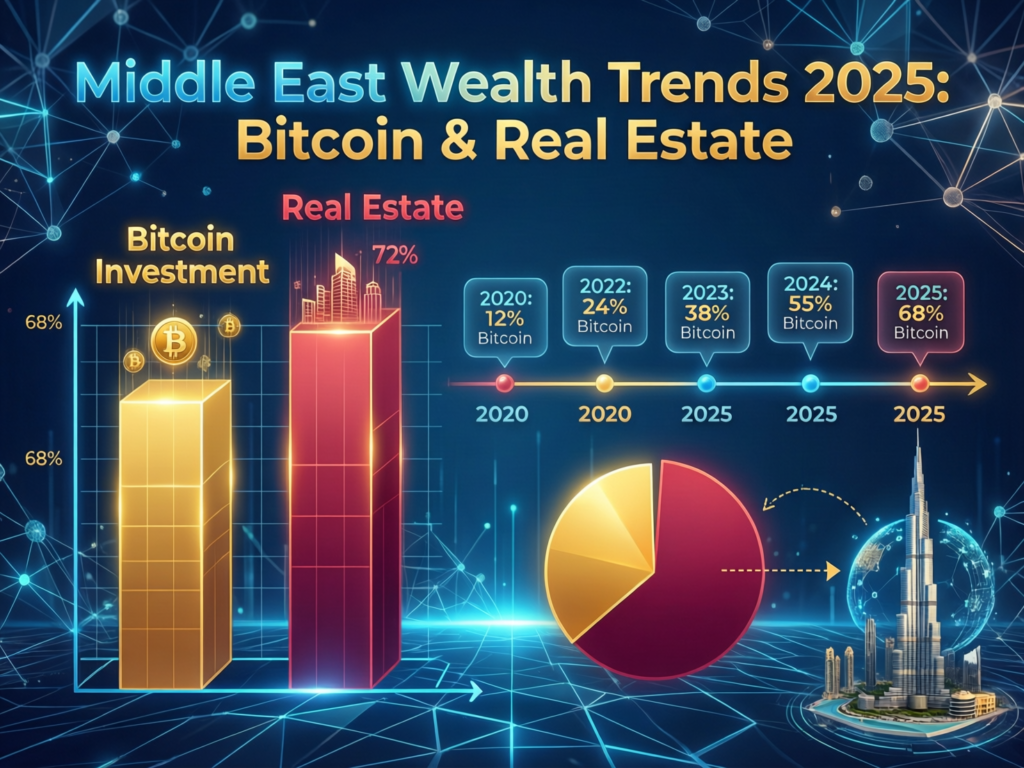

Middle East Investors in 2025.

For many Middle East investors in 2025, real estate remains the core store of value, while Bitcoin and other digital assets are used as a growth and diversification sleeve. Gulf sovereign wealth funds and family offices still allocate heavily to real-world assets (RWA) especially real estate, hospitality and infrastructure but are experimenting more aggressively with digital assets and tokenization.

What is a better store of value in 2025 for Middle East investors: Bitcoin or real estate?

At the level of Gulf families, sovereign wealth funds and regional UHNWIs, high-quality property still wins as the primary store of value. Middle East sovereign wealth fund assets under management reached around US$4.9 trillion in 2024, with real estate, hospitality and construction as major target sectors.

However, Bitcoin and digital assets are increasingly used as.

A hedge against oil-linked macro risk

A way to diversify away from local currencies

A bridge into tokenized real estate and global deal flow

So the “Middle East answer” isn’t Bitcoin instead of real estate. It’s property first, Bitcoin as an opportunistic add-on.

What allocation between Bitcoin and real estate are high-net-worth Middle East investors using in 2025?

Exact numbers vary by family and adviser, but 2025 model portfolios for Gulf HNWIs often look roughly like.

30–60%

Direct and indirect real estate (Dubai, Abu Dhabi, Riyadh, London, Zurich, Frankfurt)

10–25%

Listed equities and private equity

5–15%

Alternatives (hedge funds, infrastructure, venture, RWAs)

1–5%

(sometimes 10%+ for risk-takers): Bitcoin and digital assets

These ranges mirror what global allocators are doing, but with a heavier tilt to real estate and private markets and more appetite for frontier bets in AI, data centres and digital infrastructure.

Why Gulf investors are using Bitcoin and digital assets to enter luxury real estate

Gulf investors increasingly use Bitcoin and other digital assets to access luxury real estate in Dubai, London and Southern Europe because.

Crypto wealth can be converted into prime property a status and safety asset

Tokenized real estate and RWAs allow fractional ownership of assets previously reserved for institutions

Certain UAE structures (VARA-regulated platforms, ADGM/DIFC regimes) make it easier to hold digital assets inside compliant vehicles

For a founder who made money in crypto, using BTC to step into a branded residence in Dubai or a Mayfair apartment is a natural “on-ramp” to the traditional wealth world.

How Middle East Capital Is Reshaping US, UK and European Property & Crypto

Dubai, Abu Dhabi and Riyadh vs London, Frankfurt and Zurich in 2025

Capital is now flowing in both directions.

From the Gulf (Dubai, Abu Dhabi, Riyadh, Doha) into London, Frankfurt, Zurich and New York real estate, infrastructure and funds

From European managers into Gulf-based funds and platforms designed to tap Middle East sovereign and family capital

Dubai has emerged as a global hub for both ultra-luxury residential and regulated virtual assets, sometimes beating New York and London in US$10m+ home sales London and Frankfurt still matter for institutional deals and BaFin/FCA-regulated structures, but Gulf hubs are now peers, not satellites.

Dubai and UAE case study.

In Dubai and Abu Dhabi in 2025, it is increasingly feasible to:

Buy approved real estate projects with Bitcoin or stablecoins via regulated intermediaries

Own tokenized property fractional interests in Dubai apartments or villas, recorded on chain but enforced by Dubai Land Department records

Use ADGM, DIFC and VARA-regulated platforms to structure RWAs and investor on boarding

For US, UK or EU investors, the key is KYC/AML and source-of-funds: regulators like the SEC, FCA, BaFin and EU tax authorities will still look through your structure if you repatriate profits.

Why real estate still attracts large Middle East capital flows even as crypto adoption grows

Even as adoption of Bitcoin, stablecoins and tokenized funds accelerates, Middle East capital continues to favour:

Tangible assets: towers in Riyadh, logistics in Jeddah, waterfront apartments in Dubai

Status: trophy real estate in London, Paris, Geneva and New York

Legacy: assets that can be clearly divided among heirs under local inheritance and Sharia rules

Crypto is the growth and optionality layer. Real estate is still the safety and family wealth preservation layer.

Risk, Regulation and Tax.

Bitcoin volatility vs real estate risk in 2025 for US/UK/German and Gulf investors

In 2025, Bitcoin can still move 20–30% in a week. Real estate can’t – but it can suffer:

Liquidity crunches (no bids in a downturn)

Regulatory shocks (Berlin rental caps, UK stamp duty changes, UAE visa rules)

Leverage risk (rising US, UK or EU interest rates)

For a US or UK investor, a 5% Bitcoin sleeve is often less dangerous than five highly leveraged rental properties in a single city. For a Gulf investor heavily concentrated in local property, Bitcoin can be a way to diversify out of home-market risk if they accept the volatility.

US, UK, Germany vs UAE/GCC

Broadly (details change and you must check locally)

US

Bitcoin is taxed as property; selling or spending BTC triggers capital gains, while rental income is taxed as ordinary income with specific depreciation rules (IRS).

UK

HMRC treats crypto as property subject to Capital Gains Tax on disposal; rental income is taxed separately as income (GOV.UK).

Germany

Crypto held for more than 12 months is often tax-free for private investors; earlier disposals above a small threshold are taxable. Real estate has its own rules and holding-period requirements.

UAE (e.g., Dubai)

For many individuals, there is currently no personal income or capital gains tax on crypto or rental income, but corporate, VAT and international reporting obligations can still bite especially for US citizens.

A 2025 US expat in Dubai holding BTC and Dubai apartments is in a completely different tax situation to a German resident in Munich or a UK resident in Manchester. Always coordinate Bitcoin and real estate decisions with a cross-border tax adviser. This is not tax advice.

Sharia-compliant Bitcoin vs real estate strategies and local rules

For Sharia-conscious investors in Saudi Arabia, UAE, Qatar, Kuwait, Oman and Bahrain.

Real estate (especially low-leverage, income-producing property) is widely seen as Sharia-compatible

Bitcoin is treated differently by scholars some view it as permissible commodity money; others emphasise speculation and gharar

At the regulatory level, VARA (Dubai), ADGM and DIFC offer rulebooks for virtual assets and digital securities, while BaFin, the FCA and the SEC provide regimes for crypto custody, trading and tokenized securities in Germany, the UK and the US.

The takeaway: you can build Sharia-sensitive, compliant digital asset and real estate portfolios but you must align religious, legal and tax opinions, not just chase returns.

How to Use Middle East Trends When Choosing Between Bitcoin and Real Estate

How should an international investor in the US or UK think about Middle East trends?

If you’re based in the US, UK or EU, Gulf trends are useful as signal, not instruction. Middle East sovereign funds and family offices typically:

Lean into real assets (property, infrastructure, data centres)

Use small but meaningful digital asset sleeves

Diversify across jurisdictions (London, Frankfurt, New York, Dubai, Riyadh)

This doesn’t mean you should copy allocations directly, but you can.

Treat real estate as your core store of value

Use Bitcoin as a measured macro and innovation bet, not an all-in trade

Reading Gulf allocations as a signal for US, UK and EU markets

Middle East capital flows can act as a “smart money” indicator.

Rising GCC allocations to London or Frankfurt offices can signal confidence in those markets

Increased funding of tokenization platforms, custodians and exchanges in ADGM, DIFC and Zurich hints where regulation is becoming more crypto-friendly

Continued appetite for Dubai and Abu Dhabi luxury property shows where global UHNWIs see status + safety

But remember: Gulf investors often negotiate terms (co-investment rights, downside protection) that retail investors in New York, Manchester or Berlin simply don’t get.

Common mistakes global investors make copying Middle East HNWI strategies

Over-concentrating

In one city (e.g., only Dubai or only London)

Ignoring leverage risk

Gulf buyers often use much lower debt than US or UK landlords

Not matching the time horizon

PIF-style bets can be truly long-term; an individual investor in Germany might need liquidity in five years

Blindly copying Bitcoin allocations

Without the same income buffer or risk budget

Use Gulf strategies as inspiration, but translate them to your own balance sheet, income, tax residence and risk capacity.

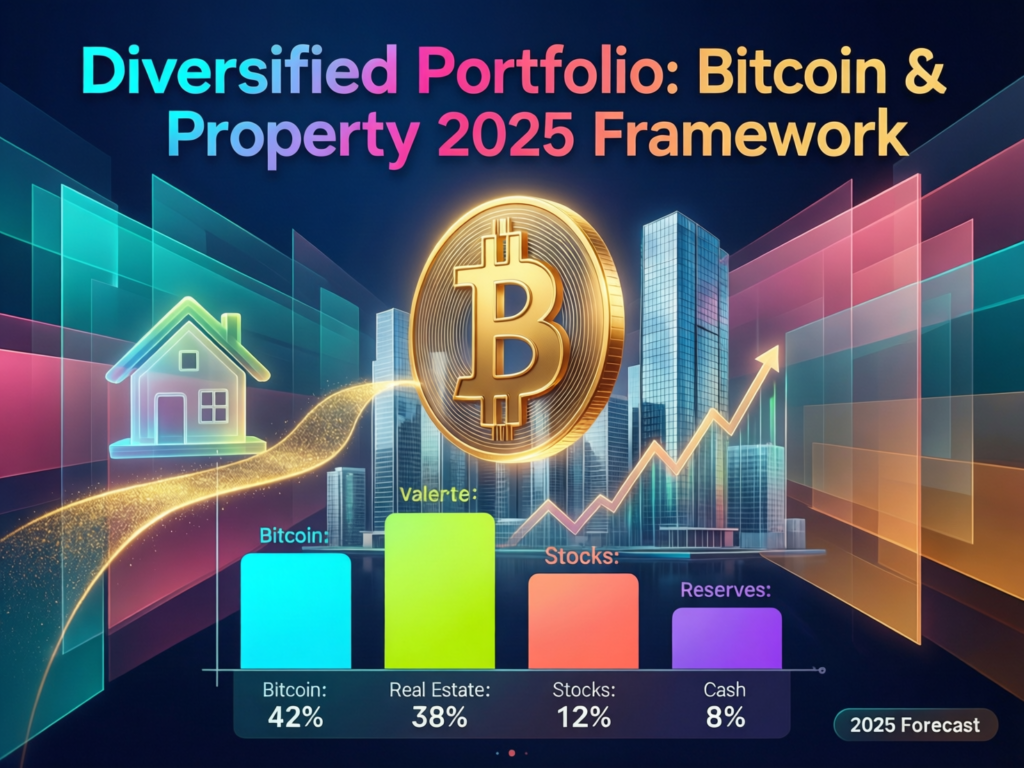

Building a Diversified Bitcoin and Real Estate Portfolio in 2025

In 2025, you can absolutely combine Bitcoin and real estate in a global, compliant portfolio if you respect regulation, custody and basic risk management.

How can investors combine Bitcoin and real estate in a compliant global portfolio?

A practical framework many investors use.

Decide on a core/satellite split: property as core, Bitcoin as satellite

Keep Bitcoin inside regulated wrappers where possible (ETPs, funds, regulated platforms)

Match structures to jurisdictions: US, UK, EU, UAE/GCC each have different tax and reporting rules

For example.

A London-based investor might hold UK rental property plus a small Bitcoin allocation through a regulated exchange.

A Dubai-based entrepreneur might hold Dubai apartments plus on-shore, VARA-regulated exposure to BTC.

BTC, tokenized property, REITs and direct Dubai/London assets

You don’t have to choose between 100% physical property vs 100% spot BTC. A diversified 2025 mix might include:

Direct property: Dubai freehold, London apartments, Berlin multi-family

REITs and listed property funds: for liquidity and sector exposure

Tokenized real estate / RWAs: fractional stakes in UAE or European properties

Bitcoin and leading digital assets: sized to your risk tolerance and legal/tax framework

Fintech and wealth platforms that offer this mix need solid cloud, security, GDPR/UK-GDPR and PCI DSS foundations – areas where partners like Mak It Solutions help with architecture, data pipelines and compliance-ready analytics.

From thesis to allocation, custody, KYC/AML and ongoing monitoring

Here’s a simple “how to” for 2025–2026.

Write your thesis

Clarify why you want Bitcoin (inflation hedge? tech bet?) and why you want real estate (income? residency? status?).

Map jurisdictions and tax

List where you are taxed (US, UK, Germany, UAE, etc.) and what rules apply to Bitcoin and rental income.

Set allocation ranges

Decide target bands for example, 40–60% property, 20–40% listed securities, 1–5% Bitcoin and digital assets, with clear max drawdown tolerance.

Choose wrappers and custody

For Bitcoin, decide between regulated platforms, funds or self-custody with hardware wallets. For property, choose between direct, SPVs, REITs and tokenized structures.

Implement KYC/AML and monitoring

Use reputable, regulated providers; keep documentation on source-of-funds, and review allocations at least annually as regulations (VARA, BaFin, FCA, SEC, MiCAR) evolve.

Action Plan and Next Steps for 2025–2026 Investors

Bitcoin-heavy, property-heavy or barbell mix?

By 2025, three broad paths have emerged.

Bitcoin-heavy

For tech-savvy, high-risk investors comfortable with large drawdowns and long horizons

Property-heavy

For families that care most about capital preservation, income and status

Barbell mix

Property core + small BTC/digital asset sleeve + diversified listed assets in between

Most US, UK, EU and Gulf wealth ends up on the property-heavy or barbell end of the spectrum, not on an all-in Bitcoin bet.

Questions to ask your tax and wealth adviser in the US, UK, EU or Middle East

When you talk to your adviser (or advisers across countries), ask.

How are Bitcoin and other digital assets taxed in each jurisdiction where I file?

What’s the most efficient way to hold cross-border real estate (SPVs, funds, trusts)?

How do US, UK, EU and GCC reporting regimes (FATCA, CRS, DAC6, local rules) treat my holdings?

What happens if I move e.g., from London to Dubai, or from Dubai back to Munich or New York?

Document the answers; they’re as important as your target return assumptions.

How to stay ahead of VARA, BaFin, FCA, SEC and tax changes impacting Bitcoin and real estate

Regulators are moving fast.

VARA is updating Dubai’s Virtual Assets and Related Activities Regulations.

ADGM and DIFC keep refining digital asset frameworks.

BaFin, the FCA and the SEC are expanding crypto regimes (MiCAR in the EU, new UK crypto regulations, US enforcement focus)

Set a recurring reminder (at least annually) to review:

Regulatory changes in your home and investing jurisdictions

Tax rules for crypto and property

Whether your Bitcoin vs real estate allocation still matches your real-world risk capacity.

Key Takeaways

In 2025, real estate remains the core store of value for most US, UK, EU and Middle East investors, while Bitcoin is best treated as a high-volatility, high-upside satellite.

Middle East sovereign funds and HNWIs use a property-heavy, alternative-rich, modest-crypto allocation a useful signal, not a blueprint.

Gulf hubs like Dubai, Abu Dhabi and Riyadh are reshaping both luxury real estate and regulated digital asset markets, influencing flows into London, Frankfurt, Zurich and New York.

Cross-border tax and regulation (IRS, HMRC, BaFin, VARA, ADGM, FCA, SEC) matter as much as price charts when you mix Bitcoin and real estate.

A practical 2025–2026 plan starts with a written thesis, clear allocation ranges, careful custody choices and ongoing compliance monitoring.

If you’re building a fintech, family office platform, or analytics stack that needs to model Bitcoin vs real estate 2025 portfolios across US, UK, EU and Middle East markets, you don’t just need opinions you need solid data, cloud and compliance foundations.

Mak It Solutions helps teams design and build the BI dashboards, backend services and secure integrations that sit behind modern investment platforms.

When you’re ready to turn “Bitcoin vs real estate 2025” from a question into a product roadmap, reach out to Mak It Solutions to discuss architecture, data engineering and compliant analytics tailored to your use case.( Click Here’s )

FAQs

Q : Is Bitcoin safer than real estate for long-term investors in 2025?

A : No. In 2025, Bitcoin still carries far higher price volatility, regulatory uncertainty and operational risks than most core real estate in markets like the US, UK, Germany or the UAE. For long-term investors, Bitcoin can act as a powerful growth and hedge asset, but it is not “safer” than property you own outright, especially when that property also generates rental income. A common approach is to keep real estate as the safety anchor and size Bitcoin as a small, high-risk sleeve.

Q : Can I legally buy Dubai or UAE property with Bitcoin as a US, UK or EU investor?

A : In practice, yes but only via structures and intermediaries that satisfy UAE and home-country regulations. In Dubai, some developers and brokers accept Bitcoin or stablecoins through regulated partners, and VARA/ADGM/DIFC frameworks cover many virtual asset activities . However, you still need to pass full KYC/AML checks, prove source of funds, and in many cases your BTC will be converted to fiat before hitting the seller. US, UK and EU tax authorities will usually treat this as a taxable disposal of Bitcoin, so always get advice before proceeding.

Q : How do taxes on Bitcoin profits compare to rental income for expats in the US, UK and Germany?

A : For US citizens, Bitcoin is taxed as property, with capital gains on each disposal; rental income is taxed as ordinary income with depreciation and expense rules . In the UK, both crypto gains and property sales can trigger Capital Gains Tax, while rental income is taxed separately as income . In Germany, private crypto held for more than 12 months can be tax-free, whereas property has different holding-period and income rules . For expats, double-tax treaties and residence rules make things more complex, so personalised advice is critical.

Q : What are the main risks of copying Middle East HNWI Bitcoin and real estate strategies?

A : The biggest risks are scale, leverage and time horizon. Gulf families and sovereign funds often have diversified operating businesses, low leverage and extremely long horizons; copying their 2025 allocations without that buffer can leave a UK, US or EU investor dangerously exposed. There’s also governance risk: they may have access to bespoke deals, tokenization platforms or legal structures you can’t access. Treat Gulf strategies as directional signals (property core, selective Bitcoin/digital assets, strong global diversification), not one-click templates.

Q : Is tokenized real estate a better compromise between crypto and traditional property investing?

A : Tokenized real estate can be a useful bridge: you get exposure to real-world assets like Dubai or London property through digital tokens, often with lower minimums and better fractional liquidity. In 2025, more platforms operate under frameworks like VARA, ADGM, BaFin and other regulators, improving investor protection – but platform risk, smart-contract risk and regulatory change remain. Tokenized property can be a good complement to direct ownership and REITs, but it’s not a magic shortcut; you still need to assess the underlying asset, operator quality and legal enforceability of your claim.