Bitcoin volatility sparks split liquidation across crypto exchanges

Bitcoin’s sudden intraday reversal set off a rare Bitcoin split liquidation, erasing more than $625 million in leveraged positions within hours

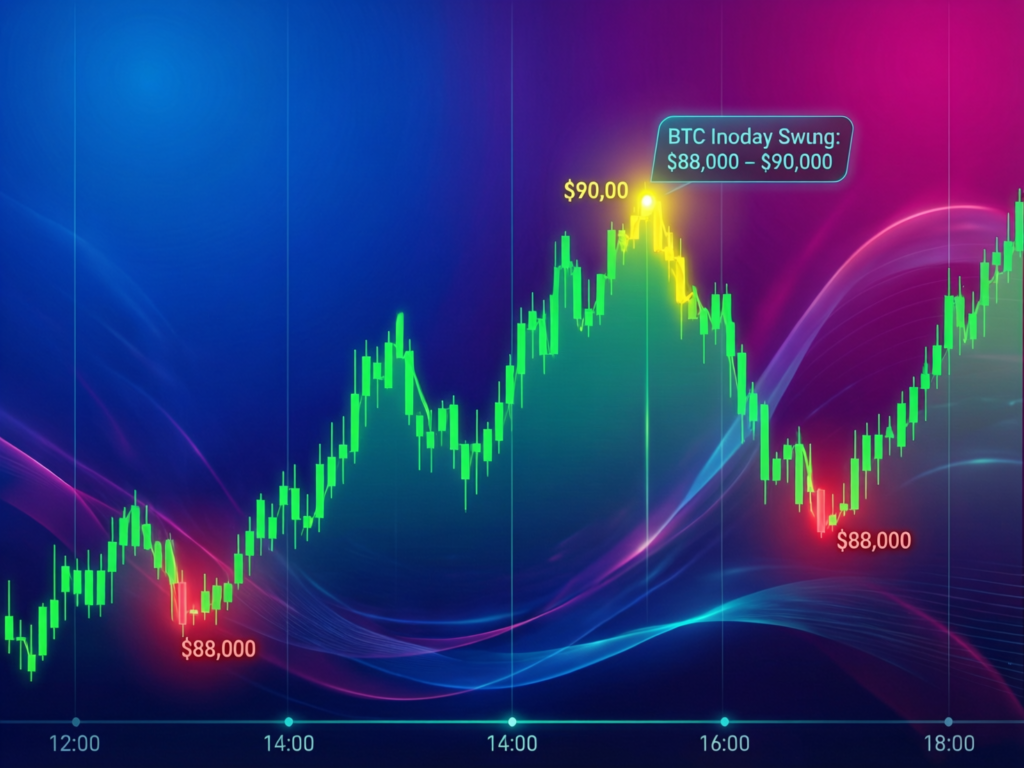

. According to CoinGlass-tracked figures reported by industry outlets, liquidations were split roughly evenly between longs and shorts across about 150,000 traders an unusual balance that underscores how quickly direction flipped during the session. Prices briefly dipped below $88,000 before rebounding toward $90,000, amplifying losses on both sides.

What happened and why it matters

The session began with downside momentum that flushed out overleveraged longs, accelerating the drop. As dip buyers stepped in and prices rebounded, shorts were caught offside, triggering a second wave of forced closures. This two-way liquidation is characteristic of thin conviction and rapidly shifting narratives, with leverage magnifying each move.

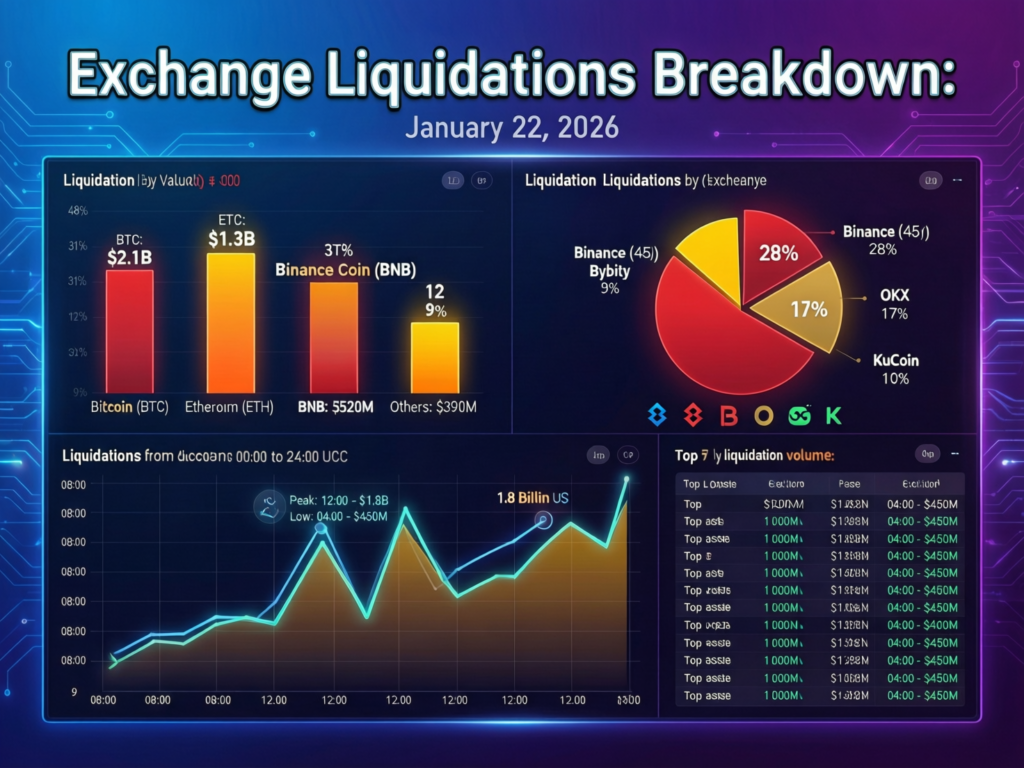

Exchange-by-exchange snapshot

Hyperliquid

~$220.8M total liquidations; largest single order was an ETH-USD position worth $40.22M. Over 72% of Hyperliquid’s liquidations were shorts, implying traders were leaning into downside just as prices recovered.

Binance

~$120.8M liquidated, skewed toward longs.

Bybit

~$95M liquidated, with longs slightly outweighing shorts.

Market backdrop

The chop coincided with macro uncertainty around U.S. trade policy, renewed bond market volatility, and attention on President Donald Trump’s remarks at the World Economic Forum (WEF) in Davos a mix that has kept risk sentiment fragile and intraday ranges wide.

Risk and positioning implications

When markets lack clear direction, aggressive leverage leaves little margin for error. The near-even long/short wipeout suggests positioning was crowded on both sides at different moments, heightening the risk of stop cascades and forced deleveraging as prices snap through liquidity pockets.

Exchange metrics at a glance

Total liquidations (24h): $625M+

Longs liquidated: ~$306M

Shorts liquidated: ~$319M

Traders affected: ~150,000

Largest single liquidation: $40.22M (ETH-USD on Hyperliquid)

Deeper look: rare balance of pain

Why a Bitcoin split liquidation is unusual

Most liquidation waves skew heavily toward one side. An almost even split indicates rapid mean-reversion and crowded positioning, where participants repeatedly fade moves only to be forced out as direction flips.

Context & Analysis

The interplay of macro headlines (trade policy, bonds, and Davos focus) with high on-exchange leverage created the classic “whipsaw” first nuking longs into the low, then squeezing shorts on the rebound. Until macro signals clarify and liquidity deepens, volatility spikes and split liquidations can recur, arguing for smaller sizing and wider risk bands.

Final Thoughts

The recent washout is a strong reminder that in choppy market conditions, protecting capital is more important than using aggressive leverage. Traders should keep their risk management strategies strong, as sudden volatility can quickly amplify losses. Patience, planning, and a disciplined approach remain the real edge for long-term survival in the market.

Now the market is watching whether Bitcoin moves into consolidation or slips back into a wide trading range. In either case, clear risk controls, proper position sizing, and avoiding emotional trading are essential. Smart traders prioritize safety and only take high probability setups.

FAQs

Q : What is a Bitcoin split liquidation?

A : A rare event where both long and short liquidations are heavy and nearly balanced within the same time window, showing high volatility and mixed trader conviction.

Q : How much was liquidated in the past 24 hours?

A : Over $625 million, affecting around 150,000 traders across major exchanges.

Q : Which exchange saw the largest single wipeout?

A : Hyperliquid, where a $40.22M ETH-USD position was forcibly closed.

Q : Did Bitcoin’s price move significantly?

A : Yes. BTC dipped intraday below $88,000 and then rebounded toward $90,000.

Q : What caused the volatility?

A : A combination of U.S. policy uncertainty, bond market swings, and market focus on President Trump’s WEF appearance.

Q: How can I avoid getting liquidated?

A : Use lower leverage, apply protective stop-losses, and consider hedging during high-risk news events.

Q : Does a Bitcoin split liquidation signal a trend change?

A : Not necessarily. It usually reflects thin conviction and short-term position squeezes, not a strong long-term trend shift.

Facts

Event

Split liquidation across longs and shorts following sharp Bitcoin whipsawDate/Time

2026-01-22T14:00:00+05:00Entities

Bitcoin (BTC), Hyperliquid, Binance, Bybit, CoinGlass (data provider), World Economic Forum (Davos)Figures

Total liquidations $625M+; ~150,000 traders; $40.22M largest single liquidation (ETH-USD); ~$220.8M Hyperliquid total; ~$120.8M Binance; ~$95M BybitQuotes

Sources

CoinDesk report; Yahoo Finance syndication; CoinGlass dashboards; Reuters Davos context