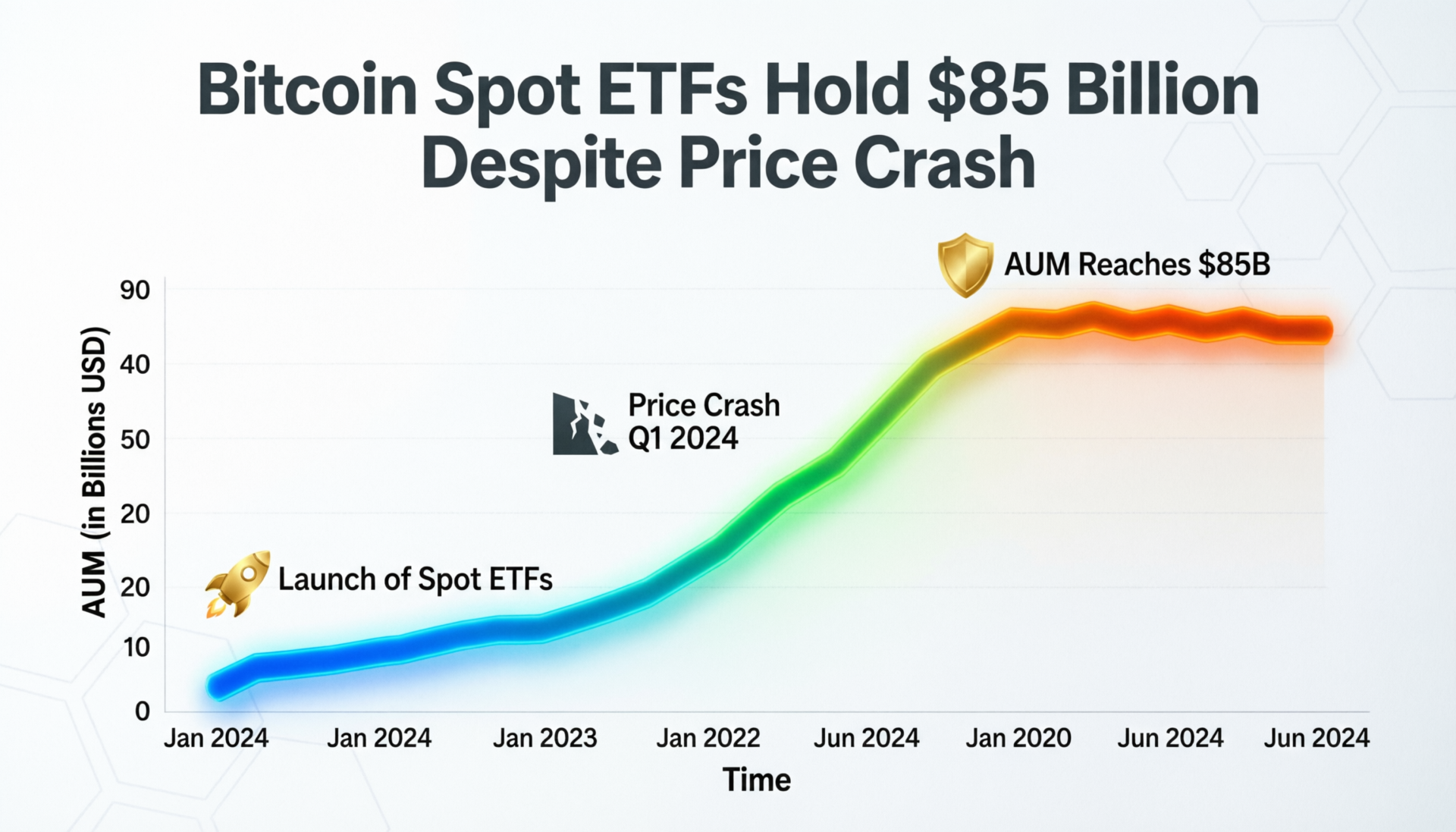

Bitcoin spot ETFs hold $85 billion despite price crash why flows can mislead

US-listed spot bitcoin funds may look surprisingly steady after bitcoin’s steep drop. Bitcoin spot ETFs hold $85 billion despite price crash, and the limited net outflows have been cited as evidence of durable institutional demand. But one analyst warns that the headline stability can mask a more mechanical reality: much of the exposure is held by market makers and arbitrage funds that are designed to stay close to market-neutral.

What happened: ETF assets stayed high even as bitcoin slid.

Bitcoin set a fresh peak above $125,000 in early October 2025, then fell sharply in the months that followed touching levels near $60,000 during the drawdown.

Even with that move, the 11 US spot bitcoin ETFs have recorded only about $8.5 billion in cumulative net outflows, while still holding about $85 billion in assets under management roughly 6% of bitcoin supply, according to the analyst note cited in reporting.

Why Bitcoin spot ETFs hold $85 billion despite price crash

Markus Thielen (10x Research) argues the apparent “diamond hands” signal is often misread. In his view, ETF ownership is “structural”:

Market makers hold inventory to provide liquidity and typically hedge risk rather than bet directionally.

Arbitrage-focused hedge funds may buy ETF shares while shorting futures (or similar spreads), aiming to capture pricing differences not a view that bitcoin must rise.

This matters because a large AUM figure can persist even when the marginal buyer isn’t making a long-only, price-up bet.

Bitcoin spot ETFs hold $85 billion despite price crash what 13F ownership implies

Thielen pointed to late-2025 institutional filings (13Fs) suggesting that 55% to 75% of BlackRock’s iShares Bitcoin Trust (IBIT) ownership was attributed to market makers and arbitrage-focused hedge funds, in the framing referenced by the report.

IBIT is designed to track bitcoin’s price performance (before fees and expenses) and trades as an ETF share on US exchanges making it convenient for institutions to implement hedged or spread strategies at scale.

Context & Analysis

If a big slice of ETF ownership is hedged, then “ETF holdings stayed high” can mean.

Liquidity providers didn’t need to dump inventory as aggressively as expected, or

Arbitrage inventory needs remained sizable even as speculative demand cooled.

Thielen also said market makers trimmed exposure by about $1.6B–$2.4B in Q4 2025 as bitcoin traded around the high-$80,000s, which he interpreted as easing speculative demand and reduced arbitrage inventory requirements.

Final Thoughts

US spot bitcoin ETF AUM remaining near $85 billion after a major drawdown is notable but it’s not automatically a clean “bullish” signal. The ownership mix and the mechanics of market-making and arbitrage can keep assets sticky even when directional demand is fading. Investors watching flows may need to focus less on headline AUM and more on who holds the exposure and why.

FAQs

Q : Why did US spot bitcoin ETFs keep so much AUM after BTC fell?

A : Because AUM can remain high if holders are structural participants (such as market makers and arbitrage funds), and price declines don’t necessarily trigger equivalent redemptions.

Q : Are ETF holdings proof institutions are bullish on bitcoin?

A : Not necessarily. Some large holders may be hedged and focused on spreads or basis trades rather than outright price appreciation.

Q : What does “arbitrage” mean in bitcoin ETFs?

A : It typically refers to holding ETF shares while taking an offsetting position (often in futures) to capture pricing differences, aiming to remain market-neutral.

Q : When did bitcoin peak above $126,000?

A : Reporting shows bitcoin hit a record above $125,000–$126,000 in early October 2025.

Q : What is the significance of “$8.5B net outflows”?

A : It suggests ETF investors have reduced exposure, but not enough to unwind the bulk of ETF assets supporting the idea that holdings can be sticky for structural reasons.

Q : Bitcoin spot ETFs hold $85 billion despite a price crash—should I treat that as a buy signal?

A : It’s better viewed as a market-structure datapoint rather than a standalone buy signal; it should be combined with price action, liquidity conditions, and positioning data.

Facts

Event

US spot bitcoin ETFs retained roughly $85B AUM despite bitcoin’s steep drawdown; analysts debate what that “resilience” signals.Date/Time

2026-02-18T12:03:01+05:00Entities

Bitcoin (BTC); US spot bitcoin ETFs; 10x Research (Markus Thielen); BlackRock iShares Bitcoin Trust (IBIT)Figures

~$85B AUM; ~$8.5B net outflows (cumulative); BTC peak >$125K–$126K (Oct 2025); drawdown toward ~$60KQuote

“This reflects the structural nature of ETF ownership…” — Markus Thielen (as quoted in reporting)Sources

CoinDesk (article summary snippet); Reuters (Oct 2025 peak context); Investors.com (drawdown framing); BlackRock/iShares (IBIT product)