Unlock the Future: Bitcoin Price Blast-Off in 2023-2032!

Curious about the future of Bitcoin? Brace yourself for a thrilling ride as we unveil the potential price surges from 2023 to 2032. It’s not just about numbers; it’s about the power and resilience of Bitcoin bulls!

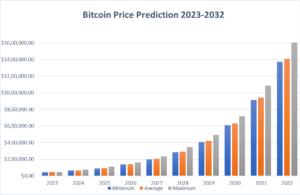

Bitcoin Price Predictions for the Next Decade:

– 2023: Buckle up as Bitcoin is expected to hit a high of $47,384.02.

– 2026: Prepare for a wild ride as the prediction soars to an impressive $160,960.69.

– 2029: The excitement continues with a forecasted high of $490,898.3.

– 2032: Get ready for the ultimate climax, with predictions soaring to a staggering $1,603,338.68!

Current Bitcoin Buzz:

Wondering what Bitcoin is worth right now? As of today, Bitcoin is standing tall at $44,132, with a jaw-dropping $24 billion traded in the last 24 hours. Its market cap? An astonishing $863 billion, capturing a dominating 53.55% of the market. In the past day alone, Bitcoin has surged by an impressive 4.9%. With 19.46 million BTC circulating out of a maximum supply of 21 million BTC, the excitement is contagious.

Bitcoin in the Market Arena:

Breaking it down further, let’s dive into the recent Bitcoin price action. The analysis reveals a thrilling narrative:

– Bitcoin faced intense buying pressure near the recent low of $40,500.

– Resistance for Bitcoin stands tall at $44,996, creating a buzz in the market.

– Meanwhile, the support for BTC/USD is rock solid at $42,409.

Decoding the Recent Surge:

In a nutshell, the Bitcoin price analysis for December 19 confirms that the bulls have ignited a buying frenzy. With a swift surge, Bitcoin has shaken off sellers’ confidence around the $40,000 mark and is now eyeing a spectacular leap towards the $45,000 milestone.

Get ready to witness the Bitcoin bulls in action – it’s not just a prediction; it’s a power-packed journey into the future of digital gold!

Breaking: Bitcoin ETF Revolution Unfolding!

Spot Bitcoin ETF Anticipation:

Get ready for a game-changer! Rumor has it that U.S. regulators are gearing up to greenlight a spot Bitcoin ETF, and the buzz is, it might happen as early as January 2024. Bitwise Asset Management is leading the charge and has kicked off a tantalizing ad campaign featuring none other than the “Most Interesting Man in the World” himself, Jonathan Goldsmith. Brace yourself for the Bitcoin allure!

SEC High-Stakes Meeting:

Big names like Fidelity, BlackRock, Franklin Templeton, and Grayscale recently gathered for a high-stakes meeting with the U.S. SEC. What’s on the agenda? Their ETF applications, of course. It’s a clash of the titans as they discuss paving the way for a spot Bitcoin ETF.

BlackRock’s Financial Power Move:

BlackRock means business! In a recent SEC filing, they proudly announced a cool $100,000 as initial funding for their Bitcoin ETF. Investors are already jumping on the bandwagon, snapping up 4,000 shares at $25 each. It’s a financial power play in the crypto world.

BlackRock’s Secret Meeting:

The plot thickens! BlackRock and Nasdaq had a hush-hush meeting with the U.S. Securities and Exchange Commission. The agenda? A potential spot Bitcoin ETF. BlackRock presented not one, but two models for their iShares Bitcoin Trust. The SEC’s response is still under wraps, keeping the crypto world on the edge of its seats.

WisdomTree’s Strategic Move:

WisdomTree is back in the spotlight with a revised spot Bitcoin ETF prospectus. They’ve updated their game plan in a fresh submission to the SEC. It’s all part of their quest for approval to list and trade shares of the WisdomTree Bitcoin Trust on the CBOE’s BZX Exchange.

SEC’s Time-Out Decision:

Hold your horses! The SEC is playing it safe and has delayed its decision on spot Bitcoin ETF applications from Franklin Templeton and Global X. The crypto world eagerly awaits the regulator’s next move.

Grayscale’s Bold Talks:

The SEC is in deep conversation with Grayscale Investments about converting GBTC to a Bitcoin ETF. This potential move could shake up the crypto market, making it easier for investors to dive into cryptocurrencies. The industry is watching with bated breath.

Valkyrie’s ETF Facelift:

Valkyrie Investments is shaking things up with a spot Bitcoin ETF filing modification. Their proposal introduces a fund allowing investors to snag shares tied to Bitcoin value. Get ready to trade it on Nasdaq as “BRRR.” The crypto world just got a whole lot cooler.

Grayscale Court Triumph:

Grayscale Investments scored big in the D.C. Circuit Court. The court overturned the SEC’s denial of Grayscale’s Bitcoin ETF application, slamming the initial rejection as baseless. This victory impacts Grayscale’s $17 billion trust, sending ripples through the crypto waters.

Tesla’s Crypto Stance:

In the Q3 2023 report, Tesla spilled the beans—no change in their Bitcoin assets, holding steady at a hefty $184 million. After a major sell-off in Q2 2022, Tesla’s playing it smart, reallocating funds to double its AI computing power.

SEC’s Time Extensions:

The SEC is buying time yet again. They’ve extended the decision timeline for Bitcoin ETF applications from ARK 21Shares, BlackRock, GlobalX, and more. The suspense continues.

Nomura’s Bitcoin Adventure:

Nomura’s digital arm, Laser Digital Asset Management, has rolled out the Bitcoin Adoption Fund. It’s a digital investment feast for institutional clients, offering direct exposure to Bitcoin. Nomura, a financial giant with over $500 billion in assets, is diving headfirst into the crypto world.

Franklin Templeton’s Bitcoin Bid:

Franklin Templeton is throwing its hat into the Bitcoin ETF ring. They’ve filed for a spot Bitcoin ETF, to be held by Coinbase and traded on Cboe BZX Exchange. The ticker symbol is still under wraps, adding an extra layer of intrigue.

Grayscale’s Urgent Call:

Grayscale Investments is turning up the heat on the SEC. Following their court victory, they’re urging the SEC to fast-track the approval of their Bitcoin ETF. The recent court win gave Bitcoin a quick 7% boost.

SEC’s Ongoing Dilemma:

The SEC is in a bind, once again delaying decisions on spot Bitcoin ETF applications until October. BlackRock, WisdomTree, Invesco Galaxy, and others are left hanging. The crypto community eagerly awaits the regulatory verdict.

Grayscale’s Green Signal:

In a thrilling turn of events, the D.C. Court of Appeals ruled in favor of Grayscale against the SEC. The conversion of Grayscale’s Bitcoin Trust to an ETF got the green light. Other giants like BlackRock and Fidelity might follow suit, sparking a new chapter in the crypto saga.

Europe’s First Bitcoin ETF:

Europe takes the lead! London’s Jacobi Asset Management unleashed the first Bitcoin ETF on Euronext Amsterdam on August 15. It’s a groundbreaking move, outpacing the U.S. in the ETF race. The ticker symbol? BCOIN, making waves across the continent.

Tether’s Mining Software Play:

Tether developers have a trick up their sleeve. New JavaScript libraries for Bitcoin mining hardware are in the works. Think WhatsMiner, AvalonMiner, and Antminer getting an efficiency upgrade. Paolo Ardoino of Bitfinex and Tether dropped hints on X, suggesting that some mining software might go open-source.

Bitcoin ETF Odds:

The odds are looking up! Bloomberg Intelligence ETF analysts have upped the ante, predicting a 75% chance of a spot Bitcoin ETF launching in the U.S. this year. The recent surge of applications from BlackRock, Fidelity, WisdomTree, and Valkyrie is creating a ripple effect. The crypto world holds its breath for the SEC’s verdict.

Institutions in the Bitcoin Arena:

Major players like BlackRock, Fidelity, WisdomTree, and Valkyrie are vying for a spot in the Bitcoin ETF arena. Despite past rejections from the SEC, optimism runs high. BlackRock, with its stellar track record, seems particularly promising. The race is on to make Bitcoin investment accessible to all. The crypto revolution is unfolding!

Unleashing the Bitcoin Thunder: Price Projections Unveiled!

Price Predictions

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2023 | 42,119.13 | 46,067.79 | 47,384.02 |

| 2024 | 64,634.71 | 66,938.10 | 77,807.95 |

| 2025 | 92,046.02 | 95,392.93 | 1,13,792.57 |

| 2026 | 1,36,139.22 | 1,39,954.94 | 1,60,960.69 |

| 2027 | 1,98,355.35 | 2,05,353.09 | 2,35,675.67 |

| 2028 | 2,84,405.26 | 2,92,619.39 | 3,45,617.11 |

| 2029 | 4,09,313.61 | 4,21,018.39 | 4,90,898.30 |

| 2030 | 6,08,695.00 | 6,29,745.92 | 7,16,210.78 |

| 2031 | 9,10,555.43 | 9,42,042.72 | 10,84,161.77 |

| 2032 | 13,71,528.68 | 14,09,210.39 | 16,03,338.68 |

Bitcoin Price Outlook for 2023:

Hold onto your hats! Bitcoin is gearing up for a thrilling ride in 2023. Brace yourself for a minimum price of $42,119.13, with the potential to skyrocket to a maximum of $47,384.02. The average price dance throughout the year is forecasted to be a dazzling $46,067.79. Get ready for a rollercoaster of Bitcoin excitement!

Epic Bitcoin Projections for 2024:

The Bitcoin saga continues into 2024 with even bolder predictions. The price is anticipated to hit a floor at $64,634.71 and could soar to a maximum of $77,807.95. The average price for the year is estimated to be an impressive $66,938.10. Buckle up for a year of Bitcoin highs!

Bitcoin’s Rise in 2025:

Looking ahead to 2025, Bitcoin is set to make waves. The forecast paints a picture of a minimum price of $92,046.02, with the potential to peak at $113,792.57. Brace yourself for an average value of $95,392.93. It’s a journey into the future of Bitcoin that promises both excitement and potential.

Bitcoin Ballet in 2026:

2026 is poised to be a year of Bitcoin ballet, with the price gracefully twirling to a low of $136,139.22. The grand finale could see it pirouette to a maximum of $160,960.69, maintaining an elegant average forecast price of $139,954.94. Get ready for a dance of numbers and possibilities!

Bitcoin’s Symphony in 2027:

As we step into 2027, Bitcoin orchestrates a symphony of prices. The melody begins at a minimum of $198,355.35, crescendoing to a maximum of $235,675.67. The harmonious average trading price is predicted to be $205,353.09. It’s a symphony of Bitcoin value that resonates throughout the year.

Technical Overture for 2028:

The technical overture for 2028 is rich in Bitcoin notes. The price is forecasted to hit a low of $284,405.26, reaching a crescendo at $345,617.11. The average trading price harmonizes at $292,619.39. It’s a performance of Bitcoin charts that captivates the audience of investors.

Bitcoin’s Grand Finale in 2029:

The grand finale in 2029 promises a captivating show. The curtain rises with a minimum value of $409,313.61, building up to a grand spectacle with a maximum of $490,898.30. The average trading value takes center stage at $421,018.39. It’s a Bitcoin performance that leaves the audience in awe.

Bitcoin’s Galactic Odyssey in 2030:

Fasten your seatbelts for Bitcoin’s galactic odyssey in 2030. The forecast predicts a low of $608,695.00, soaring to the cosmic heights of $716,210.78. The average forecast price hovers in the stratosphere at $629,745.92. It’s a journey into the unknown realms of Bitcoin possibilities!

2021: A Space Odyssey for Bitcoin in 2031:

As we enter 2031, Bitcoin embarks on a space odyssey. The journey starts with a minimum value of $910,555.43 and could reach the celestial heights of $1,084,161.77. The average trading price orbits at $942,042.72. Get ready for a Bitcoin adventure that transcends earthly expectations!

Bitcoin’s Crescendo in 2032:

The grand crescendo awaits in 2032 as Bitcoin takes center stage. The price is predicted to start at a minimum level of $1,371,528.68, building up to the climax at $1,603,338.68. The average trading price sets the tone at $1,409,210.39. It’s a finale fit for the epic tale of Bitcoin’s journey into the future!

Bitcoin’s Quantum Leap: Price Projections and Historical Insight

Coincodex’s Crystal Ball for 2023:

Coincodex, the oracle of the crypto world, foresees a remarkable 8.11% surge in Bitcoin’s price. Brace yourself for a potential jump to $47,787 by December 13, 2023. The technical indicators echo a bullish sentiment, and the Fear & Greed Index is dancing at a level of 72, signaling greed. With 16 green days out of the last 30, representing 53% of the time, and a volatility of 5.52%, the stage is set for a bullish run. According to Coincodex, it’s a favorable time to dive into the Bitcoin investment arena.

2024: Bitcoin’s Projection Beyond the Veil:

Considering the historical dance of Bitcoin and its halving cycles, the crystal ball suggests a potential lowest price of $29,564 in 2024. As the interest from Bitcoin miners intensifies, the price could ascend to a lofty $101,872. The future whispers of potential and the shadows of past trends paint a captivating picture for Bitcoin enthusiasts.

Digital Coin Price’s Symphony of Numbers:

Digital Coin Price joins the symphony with a projection that surpasses $99,544.15 for Bitcoin in 2024. The crescendo at the end of the year might reach a maximum of $114,311.68, with a minimum baseline of $94,153.10. The journey doesn’t end there; the data analysis orchestra foresees Bitcoin soaring beyond $839,768.04 in 2032. A minimum pit stop at $830,931.94 and a potential peak at $842,294.81 complete the symphony. The numbers play a harmonious melody of Bitcoin’s future.

Flashback: Bitcoin’s Price History Through the Ages:

Let’s rewind the tape to 2021, a year of Bitcoin reaching unparalleled heights, surpassing $65,000 in November. The launch of a Bitcoin ETF in the U.S. set the stage for this epic rise. Events involving Tesla and Coinbase further fueled the frenzy. Tesla’s announcement of a $1.5 billion investment in Bitcoin in March 2021 ignited massive interest, creating seismic shifts in the market.

The tide turned by the end of 2022, as Bitcoin prices dipped to approximately $17,194.91 on January 10, 2023. Another twist in the tale unfolded as the FTX crypto exchange filed for bankruptcy, altering the crypto landscape.

Behind the scenes, the so-called ‘whales,’ representing two percent of ownership accounts, held the reins, owning a whopping 92 percent of BTC. The retail clients, comprising the majority of cryptocurrency users globally, witnessed the volatility of Bitcoin prices, where the movements of a single whale could send ripples through the market.

As Bitcoin continues its cosmic journey, the interplay of historical events, market dynamics, and future projections weaves an intricate tapestry. The crypto stage is set for an encore, and Bitcoin enthusiasts eagerly await the unfolding chapters in its saga.

Bitcoin Unveiled: A Deep Dive into the Digital Gold

Genesis of Bitcoin:

Launched in 2009, Bitcoin is a revolutionary decentralized digital currency powered by blockchain technology. The enigmatic figure, Satoshi Nakamoto, birthed Bitcoin to liberate transactions from government control. This cryptocurrency operates without a central authority, providing a trustless and transparent system.

The Essence of Bitcoin (BTC):

Bitcoin transcends traditional currency as a cryptography-based e-payment system. It acts both as a store of value and a medium of exchange within the crypto realm, often referred to as “digital gold.” Its robust cryptography, underpinned by the SHA-256 algorithm from the United States National Security Agency (NSA), ensures the security of the Bitcoin network.

Bitcoin’s Meteoric Rise:

Since its humble beginnings in 2010 at less than 0.01 USD, Bitcoin has soared to unprecedented heights, reaching over 67,000 USD in November 2021. The allure of Bitcoin continues to captivate as institutional investors and traders increasingly embrace the cryptocurrency landscape.

Influences on Bitcoin’s Price:

Recent events have cast a shadow over Bitcoin’s price, dipping below $25.5K amidst the SEC’s legal action against Binance and its CEO, Changpeng Zhao. The repercussions have rippled through the broader crypto market, with Coinbase also feeling the SEC’s legal heat. Experts anticipate a potential rebound if Bitcoin maintains its resistance at $26,000, but a breach could lead to a slide to $20,000. Rising interest rates and a stricter monetary policy pose additional challenges to Bitcoin’s recovery in the short term.

2023: Bitcoin’s Digital Safe Haven:

Despite these hurdles, 2023 holds promise for Bitcoin enthusiasts who view it as a “digital safe haven” or “virtual gold.” Advocates believe Bitcoin can offer investors a hedge and attractive yields during periods of market instability, reinforcing its status as a resilient asset.

Bitcoin’s Challenges Under the Spotlight:

Bitcoin’s success hasn’t shielded it from criticism. One notable concern is its energy-intensive mining process, consuming about one-third of the UK’s total energy consumption in 2016, according to the University of Cambridge’s energy consumption tracker. The cryptocurrency has also faced scrutiny for its potential role in facilitating illicit activities on the dark web, such as illegal weapon transactions and money laundering.

Scalability: Bitcoin’s Long-standing Challenge:

The enduring challenge of scalability looms over Bitcoin. With a transaction capacity of 3-7 transactions per second (TPS), Bitcoin faces performance limitations as transaction volumes increase. While various proposals aim to address this concern, a definitive long-term solution remains elusive.

As Bitcoin continues to navigate challenges and milestones, its journey unfolds as a testament to the evolving landscape of digital currencies, promising both innovation and resilience.

Navigating the Bitcoin Landscape: A User’s Guide

1. Buying and Selling Bitcoin:

To embark on the Bitcoin journey, start by creating an account on a cryptocurrency exchange. Once your account is set up, fund it with your chosen currency, and voila, you’re ready to buy Bitcoin. Place an order on the exchange, specifying the amount you want, and watch as your digital assets come to life. Selling follows a similar process, where you place a sell order when you’re ready to cash in on your Bitcoin investment.

2. Bitcoin’s Role in Finance:

Bitcoin and its crypto counterparts are viewed as disruptors in the financial realm, challenging traditional systems. For many, they represent a pathway to greater financial autonomy. The decentralized nature of Bitcoin sparks conversations about financial freedom and innovation beyond the confines of traditional banking systems.

3. Safekeeping Your Bitcoin:

Where you store your Bitcoin matters, hardware wallets considered Fort Knox in the crypto world, keep private keys offline for top-notch security. Paper wallets, involving the old-school method of printing keys, offer security with careful handling. Software wallets, residing on computers or mobile devices, are convenient but more susceptible to cyber threats.

4. The Value Equation:

Bitcoin’s value dance is orchestrated by supply, demand, market sentiment, adoption rates, regulatory shifts, and good old investor speculation. Its scarcity, decentralization, and robust security features are key players in determining its value. The dynamic interplay of these factors shapes Bitcoin’s worth in the ever-evolving market.

5. The Bitcoin Ecosystem:

As Bitcoin strides toward mainstream adoption, its utility grows. Notably, businesses like Telefonica are embracing Bitcoin, offering settlements in cryptocurrencies. Such partnerships underscore Bitcoin’s potential to transcend its niche and become a widely accepted alternative to traditional fiat currencies.

6. Bitcoin’s Future:

Looking ahead, Bitcoin’s long-term outlook is promising. Business integrations, historical price trends, and its pioneering role in the crypto space fuel expectations of future appreciation. However, like any investment, it comes with risks. Conduct thorough research, weigh the possibilities, and be informed before taking the plunge into the world of Bitcoin and cryptocurrencies.

In the vast landscape of digital assets, Bitcoin stands as a trailblazer, with the potential to redefine the financial narrative. Whether you’re a seasoned investor or a newcomer to the crypto scene, navigating the Bitcoin frontier requires a blend of knowledge, caution, and a dash of adventurous spirit.

Conclusion: Navigating the Bitcoin Frontier

In the ever-evolving world of cryptocurrencies, Bitcoin stands tall as a pioneering force, offering users a glimpse into the future of finance. From the intricacies of buying and selling on cryptocurrency exchanges to the profound impact Bitcoin could have on traditional financial systems, this digital asset weaves a compelling narrative.

The essence of Bitcoin lies not just in its value as an investment but in its potential to redefine financial autonomy. As the crypto market leader, it has garnered attention for its disruptive nature, challenging the status quo and opening doors to greater financial freedom.

Safekeeping Bitcoin requires thoughtful consideration, with hardware wallets providing fortress-like security, paper wallets embracing tradition with a touch of caution, and software wallets offering convenience at the expense of heightened vulnerability.

Bitcoin’s value, a dynamic interplay of supply, demand, sentiment, and innovation, has not only shaped its present but holds the key to its future. The ever-growing ecosystem sees businesses like Telefonica integrating Bitcoin, hinting at its potential as a widely accepted alternative to traditional currencies.

As we gaze into the future, Bitcoin’s long-term prospects appear promising. Business partnerships, historical trends, and its role as a digital safe haven suggest a trajectory of growth. However, caution is the watchword, and potential investors are urged to conduct thorough research and understand the risks before venturing into the world of Bitcoin and cryptocurrencies.

In this conclusion, we find ourselves at the crossroads of innovation and uncertainty, with Bitcoin leading the charge into uncharted territories. Whether it’s the thrill of trading, the allure of financial autonomy, or the promise of a decentralized future, Bitcoin invites us all to be part of a transformative journey. As the digital landscape continues to evolve, Bitcoin remains a beacon, guiding us towards a new era in finance.

FAQ’s

1. How can I buy Bitcoin and navigate cryptocurrency exchanges effectively?

– To buy Bitcoin, create an account on a reputable cryptocurrency exchange, fund your account, and place a buy order. Navigate the exchange platform using user-friendly interfaces and follow security best practices.

2. What role does Bitcoin play in the broader financial system, and how can it disrupt traditional finance?

– Bitcoin is seen as a disruptive force challenging traditional financial systems by providing greater financial autonomy. Its decentralized nature and finite supply offer an alternative to government-issued currencies, fostering discussions about financial freedom and innovation.

3. What are the safest ways to store Bitcoin, and which wallet options provide the best security?

– Hardware wallets, like Ledger or Trezor, are considered the most secure as they store private keys offline. Paper wallets, involving printed keys stored securely, offer another secure option. Software wallets, while convenient, are more vulnerable to hacking and malware attacks.

4. What factors drive the value of Bitcoin, and how does its decentralized nature contribute to its market worth?

– Bitcoin’s value is influenced by supply and demand dynamics, market sentiment, adoption rates, regulatory changes, and investor speculation. Its decentralized nature, scarcity, and high-security features contribute significantly to its market value.

5. In the face of recent challenges, such as legal actions and market strain, how can one anticipate Bitcoin’s future price movements?

– Anticipating Bitcoin’s future price movements requires monitoring key support and resistance levels, staying informed about regulatory developments, and understanding market sentiment. Technical analysis and expert insights can provide valuable guidance.

6. What are the common criticisms and challenges faced by Bitcoin, including issues related to energy consumption and scalability?

– Bitcoin has faced criticism for its energy-intensive mining process and its potential role in facilitating illicit activities. Scalability remains a long-standing challenge, with the current technology limiting transaction completion times and capacity.

7. Considering Bitcoin’s historical trends and potential future price appreciation, how can investors strategically approach its inclusion in their portfolios?

– Investors can strategically approach Bitcoin by conducting thorough research, diversifying their portfolios, and being aware of the risks involved. Bitcoin’s historical trends and its potential as a digital safe haven make it an attractive addition for many investors.