Bitcoin price below 91000 as altcoins underperform on tariff tension

Bitcoin prices dipped below the $91,000 level on Tuesday, setting a cautious tone across the cryptocurrency market as investors reacted to tariff-related headlines and shifted interest toward traditional safe-haven assets. During early European trading hours, BTC briefly slipped under $91,000, reflecting uncertainty among traders. Despite the broader market weakness, ether managed to hold steady near the $3,200 mark, offering some stability while market participants assessed global economic signals and potential policy impacts.

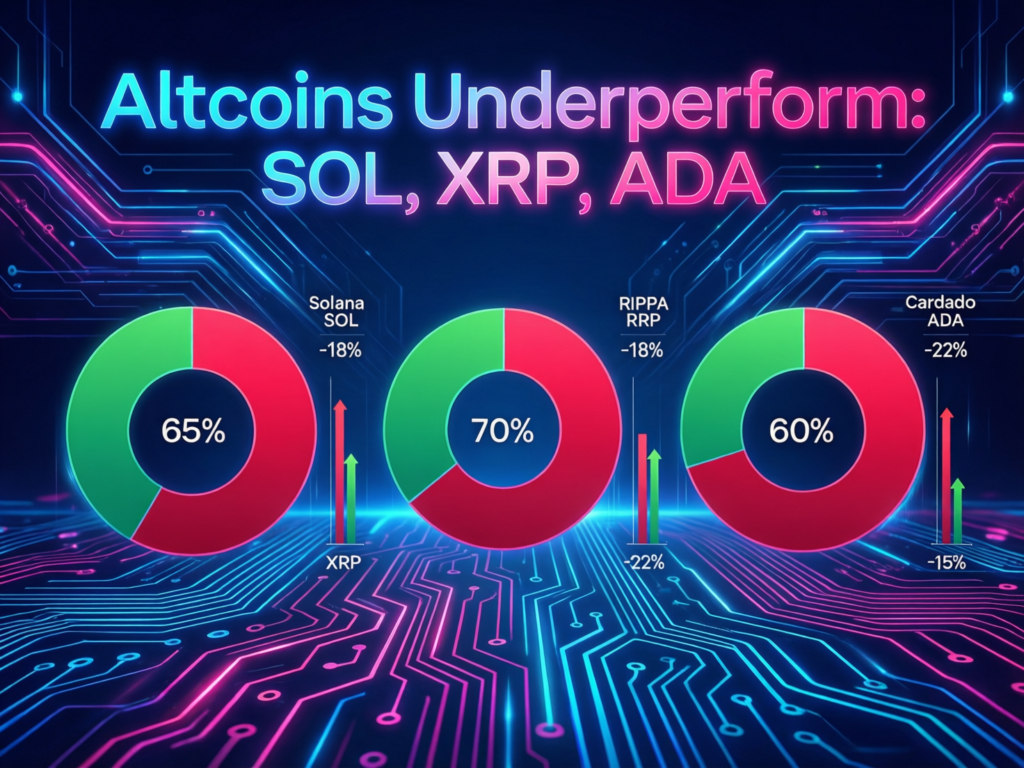

Meanwhile, major altcoins continued to face pressure, recording sharper weekly losses. Solana (SOL), XRP, and Cardano (ADA) struggled to regain momentum as risk appetite weakened. The overall sentiment remained defensive, with traders closely monitoring macroeconomic developments and adjusting their positions cautiously amid ongoing market volatility and shifting investment preferences.

Bitcoin price below 91000 amid tariff jitters

Bitcoin dipped below $91k before stabilizing, reflecting a broader risk-off move tied to renewed U.S.–EU tariff tensions. Ether traded around the $3,200 mark, and traders remained wary of a catalyst to break the market’s low-volatility range.

Gold surged to fresh records north of $4,700/oz as investors sought safety, underscoring crypto’s underperformance versus classic havens during macro shocks. Silver also spiked before paring gains.

Altcoins lag as bitcoin price below 91000 steadies

Altcoins posted sharper weekly losses than BTC, consistent with their higher sensitivity to risk conditions. SOL, XRP, and ADA were mixed intraday but remained lower on the week since last week’s peak.

Macro backdrop: tariffs, Greenland, and haven flows

European leaders criticized fresh tariff threats linked to U.S. comments about Greenland, elevating trade frictions that weighed on risk assets. The dispute helped channel flows into gold and silver while crypto underperformed, even as some equities steadied.

At Davos, U.S. Treasury Secretary Scott Bessent urged restraint from Europe, signaling ongoing policy uncertainty that markets continue to price.

Derivatives positioning stays defensive

Options data indicate traders are hedging into mid-year, with implied odds assigned to deeper BTC downside scenarios (e.g., sub-$80k by late June). That posture aligns with the current wait-and-see approach for clearer catalysts such as rate-cut signals or renewed institutional inflows.

Context & Analysis

The tape resembles a classic “risk-off rotation” where crypto behaves as a high-beta asset. With safe-haven metals at records and bond yields fluctuating on policy noise, BTC may require a dovish rates signal or sizeable inflows to regain momentum. Until then, dispersion likely favors BTC over altcoins during macro stress.

Concluding Remarks

In the absence of a strong macroeconomic catalyst, market positioning is expected to remain cautious. Bitcoin is likely to stay anchored near important support and resistance levels, reflecting limited momentum and reduced risk appetite among traders. Meanwhile, altcoins may face sharper declines during periods of market stress, as investors tend to rotate toward safer and more liquid assets. Overall sentiment remains defensive as participants wait for clearer signals.

Traders will closely monitor developments in tariff-related statements and changes in interest rate expectations for the next major directional move. Any shift in policy tone or economic outlook could quickly influence market momentum and capital flows.

FAQs

Q : Why did bitcoin fall below $91,000?

A : Renewed U.S.–EU tariff tensions pushed investors toward safe-haven assets like gold, which pressured risk assets including cryptocurrencies.

Q : Are altcoins dropping more than bitcoin?

A : Yes. SOL, XRP, and ADA recorded steeper weekly losses, reflecting their higher volatility compared to BTC.

Q : Where is ether trading now?

A : Ether is trading around the $3,200 level during Tuesday’s session.

Q : What could stabilize the market?

A : Clearer signals on interest rate cuts or renewed institutional inflows could act as a positive catalyst.

Q : Does gold’s rally affect crypto?

A : Yes. A rising gold price signals risk-off sentiment, often drawing capital away from crypto markets.

Q : Is there a chance BTC drops further?

A : Options pricing suggests a meaningful probability of BTC falling below $80k by late June.

Q : How does BTC below $91,000 impact altcoin strategy?

A : It usually favors reducing altcoin exposure first due to their higher volatility during market stress.

Facts

Event

Bitcoin slips as altcoins underperform during tariff-driven risk-offDate/Time

2026-01-20T12:00:00+05:00Entities

Bitcoin (BTC), Ether (ETH), Solana (SOL), XRP, Cardano (ADA); U.S. administration; EU leadersFigures

BTC < $91,000; ETH ≈ $3,200; gold > $4,700/oz (spot) (units: USD)Quotes

“Capital is rotating into established safe havens, while crypto continues to trade as a high-beta risk asset.” Farzam Ehsani, CEO, VALR (as reported)Sources

CoinDesk “Bitcoin steady above $91,500 as solana, xrp and cardano nurse weekly losses” (coindesk.com), Reuters “Gold holds near record high…” (reuters.com)