Bitcoin new year bear flag sparks $76K BTC price target next

Bitcoin (BTC) continued its fragile relief rebound on Thursday, but market analysts remain cautious. Technical indicators on the daily chart show the formation of a potential New Year bear flag, a pattern that often signals renewed downside pressure. Momentum has been fading, and multiple bearish divergences are beginning to appear, raising concerns that the recent bounce may not be sustainable.

If the bear flag breaks lower, technicians warn that BTC could first slide toward the $76,000 zone, which sits near a key support level. In a deeper corrective leg, the price may even extend its decline toward the $50,000 area as sellers regain control. Until momentum improves and divergences fade, traders expect volatility to remain elevated and sentiment to stay defensive.

Bearish setup builds as momentum fades

A growing cohort of traders points to an upward-sloping consolidation that followed recent local lows—classical bear-flag behavior that often precedes new lows in a downtrend. Independent analyst “Roman” argued that Bitcoin has likely ended its cyclical upswing, calling for a drop toward $76,000 and cautioning that the broader “bull run is over,” with a possible cycle landing near $50,000.TradingView+1

Why the Bitcoin new year bear flag matters

Pattern-based targets often cluster near prior demand zones; traders also note multiple bearish divergences across RSI/MACD on higher time frames, reinforcing the risk of continuation to the downside if buyers fail to reclaim momentum.

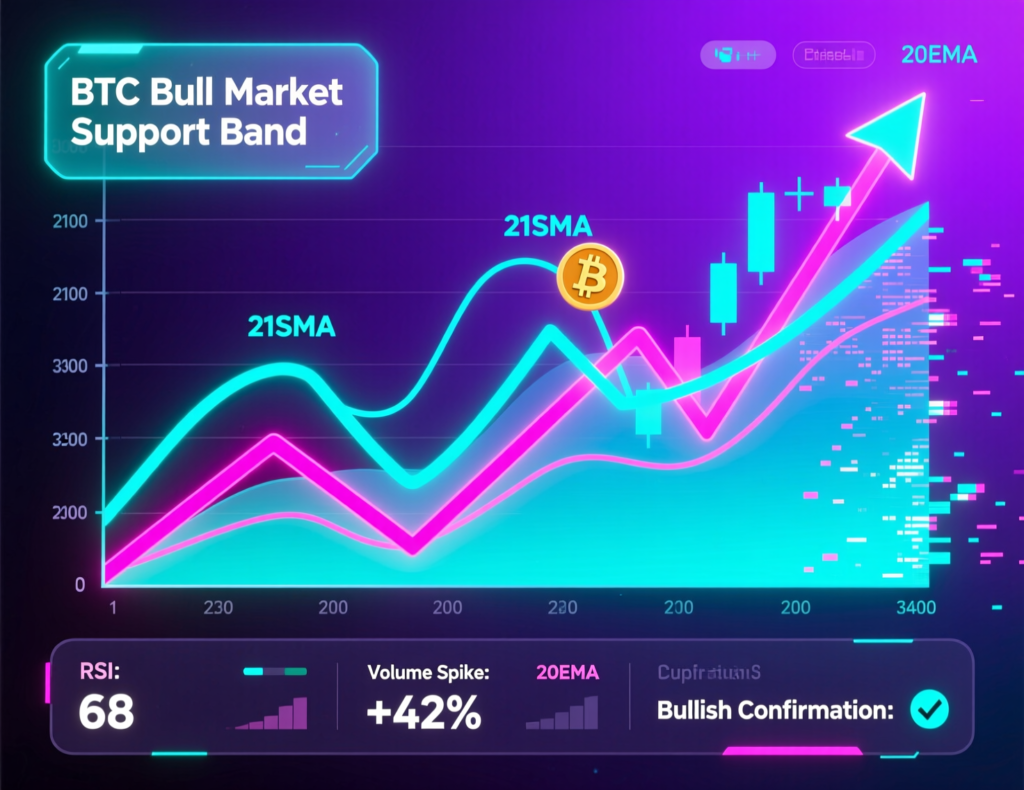

Relief bounce and the bull market support band

Countering the gloom, some chart watchers highlight Bitcoin’s position relative to the bull market support band commonly defined as the 21-period SMA and 20-period EMA where sustained closes above can stabilize pullbacks within longer-term uptrends. A durable bounce from this band would improve the medium-term outlook, even as the near-term structure remains vulnerable.

Community split echoes 2022 playbook

Elsewhere, trader “Ted Pillows” compared current structure with 2022 dynamics, warning of a final squeeze before deeper downside another nod to the bear-flag thesis. Opinions remain polarized as liquidity thins into year-end.

Context & Analysis

Bear flags are continuation patterns not guarantees. The path to $76K requires confirmation via a decisive breakdown; conversely, holding above the support band and reclaiming high-volume nodes could squeeze shorts and negate the setup. Traders should weigh macro catalysts, liquidity conditions, and ETF flows alongside technicals.

Conclusion

Bitcoin’s December price action keeps both bullish and bearish outcomes in play. The market is watching a potential bear-flag setup that could push the price toward $76,000, with a deeper downside risk extending to $50,000 if momentum weakens further. This structure reflects hesitation among traders as trend signals remain mixed.

On the upside, Bitcoin still has room for a rebound if the broader support band holds and buying interest returns. A sustained recovery would allow momentum to rebuild and invalidate the bearish pattern. Ultimately, confirmation will depend on how daily candles close relative to the flag boundaries and the bull market support band.

FAQs

Q : What is a bear flag on Bitcoin?

A : A continuation pattern where a sharp drop is followed by an upward-sloping consolidation that often breaks lower.

Q : Why do analysts target $76,000?

A : It aligns with a measured move from the flag and prior demand areas noted by traders tracking BTC’s daily structure.

Q : Is the bull run over?

A : Some traders, such as Roman, argue it is; others see potential if key supports hold.

Q : How does the support band factor in?

A : Sustained closes above the 21-SMA/20-EMA band can keep a relief bounce alive during corrections.

Q : Could BTC still rally first?

A : Yes some expect a squeeze before any deeper move, echoing 2022 behavior.

Q : Where does risk concentrate if the flag breaks down?

A : Below flag support and key volume nodes; technicians watch for momentum confirmation on the break.

Q : Does the exact phrase “Bitcoin new year bear flag” refer to a formal indicator?

A : No, it describes the current pattern context and timing, not a standalone indicator.

Facts

Event

Traders flag a potential bear-flag continuation on BTC with targets near $76K ($50K in an extended downswing).Date/Time

2025-12-12T00:00:00+05:00Entities

Bitcoin (BTC); “Roman” (trader on X); “Ted Pillows” (analyst on X); bull market support band (21 SMA/20 EMA).Figures

Targets: $76,000; extended: $50,000; BTC price ~$92,343 at publication.Quotes

“The bull run is over… plan for the next one when we land around 50k.” Roman (X). (formerly Twitter)Sources

Cointelegraph/TradingView piece on bear flag + $76K (URL), Roman post on X (URL)