‘Bitcoin Never Shuts Down’: U.S. Treasury Secretary Marks Anniversary, Needles Democrats

U.S. Treasury Secretary Scott Bessent marked the Bitcoin white paper anniversary with a sharp message on X: “Scott Bessent Bitcoin never shuts down.” His remark praised the cryptocurrency’s always-on, decentralized design, highlighting its resilience compared to traditional financial systems.

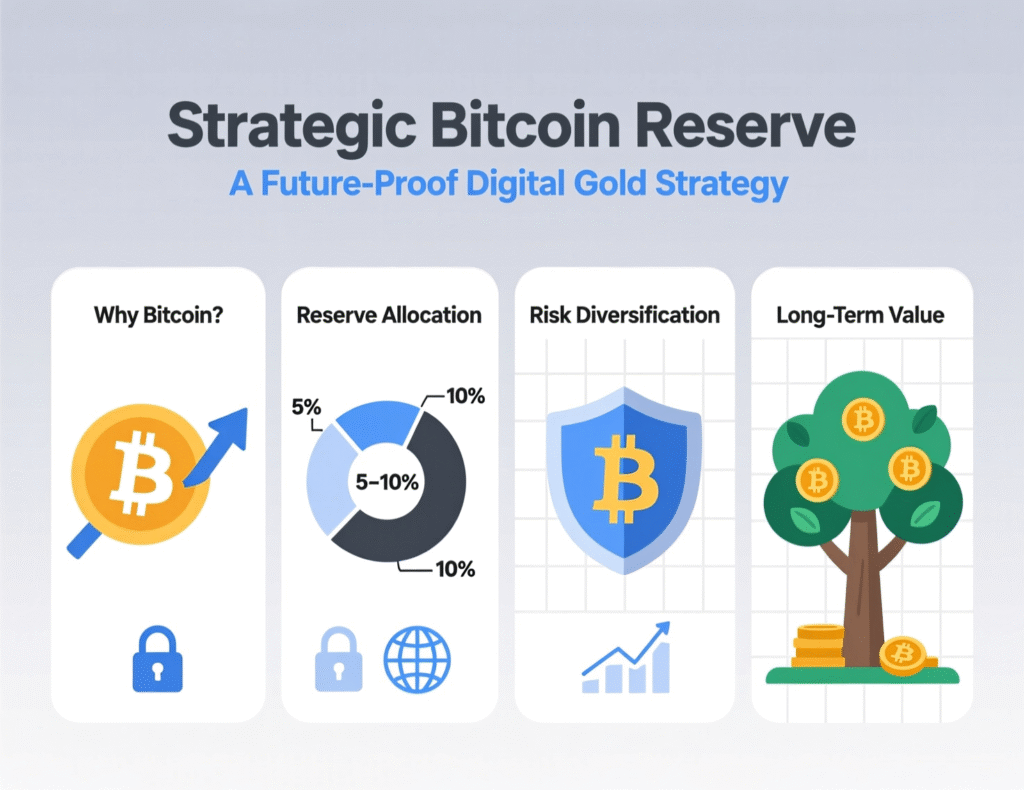

The post also carried a political undertone, subtly aimed at Senate Democrats, reflecting the growing partisan tone around digital assets. It comes in a year when the Treasury Department has actively pushed for stablecoin regulation and even floated the idea of creating a strategic Bitcoin reserve using seized crypto assets — signaling how deeply digital currency policy has entered the U.S. financial agenda.

Policy Signal on an Anniversary

Bessent’s Oct. 31 message highlighted Bitcoin’s uptime as the crypto industry celebrated the white paper’s release date. Beyond symbolism, it follows a series of Treasury moves: public support for the GENIUS Act’s stablecoin framework and acknowledgment of a Strategic Bitcoin Reserve strategy that emphasizes budget-neutral accumulation through seized assets. U.S. Department of the Treasury+1

What Bessent Meant by “Scott Bessent bitcoin never shuts down”

The phrase underscores two points: Bitcoin’s 24/7 operation and a contrast with government shutdowns. Advocates say always-on rails can complement dollar infrastructure; critics warn of policy and market risks if adoption outpaces safeguards. Treasury’s line so far: regulate stablecoins to protect consumers and reinforce dollar rails, while holding seized BTC and studying neutral ways to expand reserves.

Reaction Across Crypto

Responses split between technical purists who argued resilience claims gloss over software disputes and market voices urging Treasury to “put BTC on the balance sheet.” The broader takeaway: Bessent’s post kept digital assets in the policy conversation on a busy Washington news day. (Reaction roundup based on public posts referenced by CoinDesk’s report.)

Shutdown Context and Optics

The timing amplified the post’s political edge. The federal government has been in a partial shutdown since Oct. 1, with roughly 900,000 furloughs and curtailed operations at agencies such as the NIH and CDC, according to contemporaneous reporting and agency notices. The juxtaposition: a network that “never shuts down” versus a government still negotiating funding.

Reactions to “Scott Bessent bitcoin never shuts down”

Industry figures alternated between skepticism about Bitcoin’s “purity” and appeals for Treasury to accumulate BTC under the strategic reserve framework. The policy fulcrum remains whether and how Treasury could add to holdings without new appropriations, a concept the administration has linked to seized assets and budget-neutral methods.

Context & Analysis

Bessent’s framing dovetails with two policy arcs. First, stablecoin regulation positions dollar-linked tokens as an “internet-native rail,” potentially deepening demand for Treasuries while raising oversight questions. Second, a strategic reserve composed of seized BTC minimizes budget optics yet still ties federal balance sheets to crypto price cycles. The politics especially during a shutdown ensure crypto remains a lever in broader fiscal debates.

Conclusion

Scott Bessent’s anniversary post was brief yet deliberate, celebrating Bitcoin’s unmatched uptime while hinting at a continued policy drive around stablecoins and the proposed U.S. Bitcoin reserve. His timing underscored how digital assets are becoming a core theme in Treasury strategy.

Observers expect closer scrutiny of the next steps particularly how such initiatives would balance consumer protection, market stability, and regulatory transparency. Questions also remain about the mechanics of any “budget-neutral” Bitcoin accumulation, a concept that could redefine how the U.S. manages seized digital assets within its broader financial framework.

FAQs

Q : What did Bessent mean by “never shuts down”?

A : He highlighted Bitcoin’s 24/7 operation, contrasting it with government shutdown disruptions.

Q : Is Treasury buying Bitcoin for a Strategic Bitcoin Reserve?

A : The policy focuses on holding seized BTC and exploring budget-neutral ways to accumulate more not through taxpayer-funded purchases.

Q : How does the GENIUS Act affect stablecoins?

A : It creates a federal regulatory framework that Treasury says can enable an “internet-native dollar rail” with consumer protections.

Q : Did the shutdown affect health agencies?

A : Yes. Reports confirm furloughs and limited operations at NIH and CDC during the partial shutdown.

Q : Why is this significant for markets?

A : Treasury signals can shape expectations around stablecoin adoption and potential official BTC holdings.

Q : Where can I read the official policy steps on the reserve?

A : See detailed coverage of the executive order establishing a U.S. Strategic Bitcoin Reserve.

Q : Does this article use the phrase “Scott Bessent bitcoin never shuts down”?

A : Yes, the exact phrase appears it’s central to the story and aligns with search intent.

Facts

Event

Treasury Secretary Scott Bessent marks Bitcoin white paper anniversary with “never shuts down” comment on XDate/Time

2025-10-31T00:00:00+05:00 (post date local equivalent)Entities

Scott Bessent (U.S. Treasury Secretary); U.S. Department of the Treasury; Bitcoin (BTC); U.S. CongressFigures

~900,000 furloughs during partial shutdown (staff affected); stablecoin market growth potential noted by Treasury (context). Wikipedia+1Quotes

“A revolution in digital finance.” Scott Bessent (Treasury statement on GENIUS Act) U.S. Department of the TreasurySources

CoinDesk report on Bessent’s post (https://www.coindesk.com/policy/2025/11/01/bitcoin-never-shuts-down-treasury-s-bessent-marks-anniversary-needles-democrats), U.S. Treasury press release on GENIUS Act (https://home.treasury.gov/news/press-releases/sb0197)