Bitcoin may go ‘boring’ as institutional interest ramps up: Michael Saylor

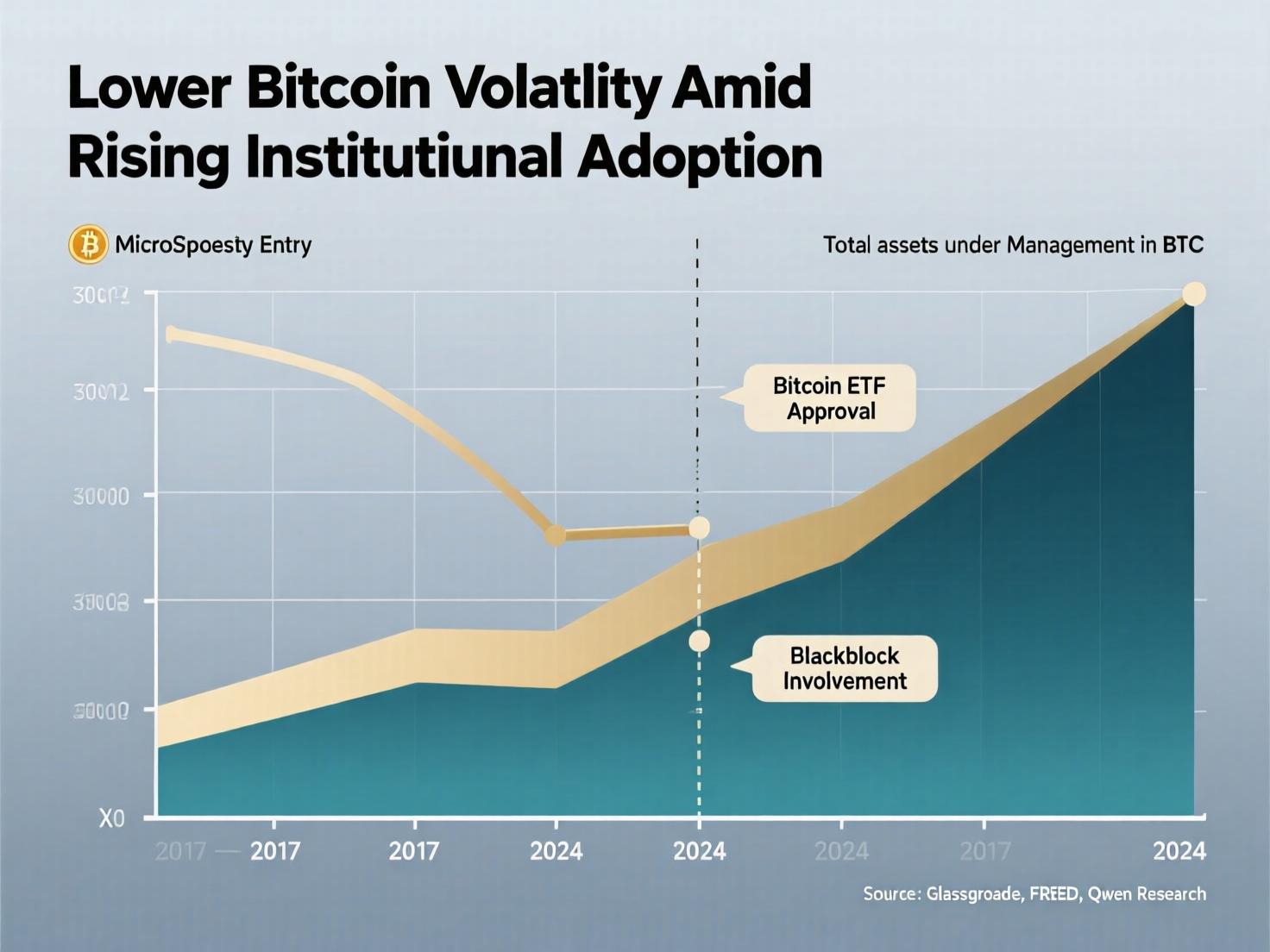

Bitcoin’s recent period of consolidation has reignited the debate over whether reduced volatility signals a maturing market or dampens trading excitement. Michael Saylor, Strategy Executive Chairman, suggests that smaller price swings reflect healthy growth, reassuring large institutional investors. While this stability may frustrate short-term thrill-seekers, it could encourage long-term participation and broader adoption among major players.

Adding another layer, the U.S. Federal Reserve’s first rate cut of 2025 introduces a potential macro catalyst for crypto markets. Some economists believe this easing could boost liquidity and investor appetite, possibly re-energizing Bitcoin and other digital assets in the months ahead. Market watchers are closely observing how these combined factors may shape crypto sentiment moving forward.

uration over adrenaline

Saylor told the Coin Stories podcast that as volatility subsides, institutions “feel comfortable entering the space and size,” even if markets feel “boring for a while.” He framed it as a “growing stage” where volatility “coming out” is constructive, though it may dampen retail sentiment conditioned by large price swings.

Why lower Bitcoin volatility institutional adoption matters

Risk frameworks:

Lower realized and implied volatility improve VaR and risk-budget optics for pensions, insurers and asset managers.Product design:

Stable underlying moves make ETF creations/redemptions and futures basis trades more scalable.Treasury policies:

Corporates are more likely to add BTC when drawdowns are less severe.

Publicly traded treasuries now hold around 1.0M BTC, reflecting the footprint of institutional vehicles and corporates. Bitcoin Treasuries

Fed easing and market odds

On Sept. 17, the Federal Reserve cut its policy rate by 25 bps, and futures markets quickly priced high odds of another quarter-point move at the Oct. 29 meeting, with more easing likely into year-end. The Fed says policy is “not on a preset path,” but looser conditions generally support risk assets.

Economist’s call: A “jolt” ahead

Economist Timothy Peterson argues markets underprice rapid cuts, adding that the “surprise effect” of faster easing could “jolt Bitcoin and alts up substantially” within 3–9 months potentially catching traders offsides.

From ATH to range-bound

Bitcoin set a mid-August record around $124,100–$124,457 and has since hovered near $116,000. Consolidation alongside falling volatility is consistent with a maturing market structure even as bulls and bears debate the path into Q4.

Lower Bitcoin volatility institutional adoption in practice

Liquidity pockets:

Tighter spreads and deeper books on major venues.Basis & carry:

More predictable futures basis aids institutional carry strategies.Drawdown math:

Smaller amplitude reduces forced-seller cascades but tempers upside blow-offs.

Forecasts diverge

Outlooks are split: BitMEX co-founder Arthur Hayes has floated a $250,000 target contingent on abundant liquidity; others expect a slower grind or even a classic drawdown following the eventual top.

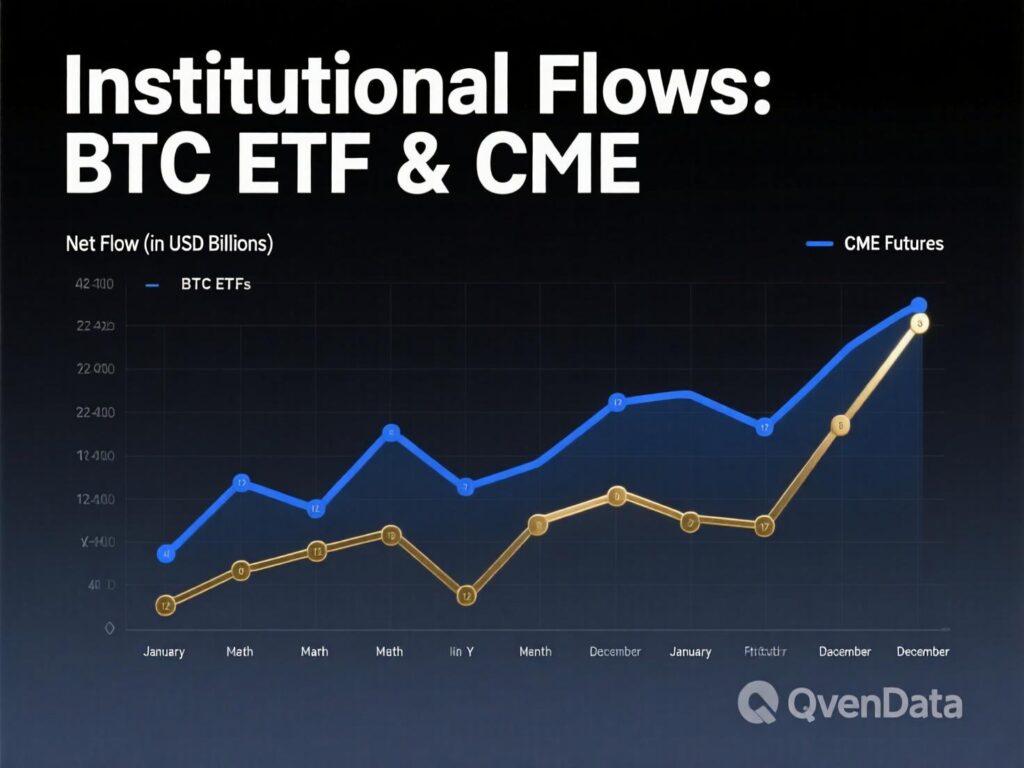

<section id=”howto”> <h3>How to monitor volatility and institutional flows</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Track 30-day/90-day BTC realized volatility and options IV on major analytics dashboards.</li> <li id=”step2″><strong>Step 2:</strong> Watch spot Bitcoin ETF flows and CME futures open interest for signs of institutional demand.</li> <li id=”step3″><strong>Step 3:</strong> Check Fed dates and CME FedWatch probabilities ahead of each FOMC meeting.</li> <li id=”step4″><strong>Step 4:</strong> Compare BTC price to recent ATH and key ranges (e.g., \$108K–\$116K) to gauge regime.</li> <li id=”step5″><strong>Step 5:</strong> Review corporate/ETF treasury dashboards (e.g., BitcoinTreasuries) for holdings growth.</li> </ol> <p><em>Note: Process may vary by provider. Confirm data sources and methodologies before acting.</em></p> </section>

Context & Analysis

Institutional adoption thrives on predictability: lower dispersion lowers tracking error and headline risk. The trade-off is narrative less spectacle can sap retail momentum. If the Fed’s easing accelerates, improving liquidity and risk appetite could offset “boring” tape action by supporting a steadier uptrend rather than parabolic spikes. (Analysis)

Conclusion

Bitcoin’s recent volatility compression is a natural part of its institutionalization, reflecting growing stability rather than weakness. As major players like treasuries and ETFs accumulate positions, the market is shifting from speculative excitement toward more structured participation. This trend underscores a focus on long-term foundations over short-term price swings, signaling a maturing ecosystem that can attract serious investors.

With central banks easing policies, macroeconomic conditions now play a bigger role in shaping Bitcoin’s next phase. Sustained inflows and steady demand, rather than sudden spikes, are likely to drive growth. The future may prioritize stability, resilience, and institutional confidence over headline-grabbing volatility.

FAQs

Q : What does “institutional adoption” mean for Bitcoin?

A : Large asset managers, corporates, ETFs and pensions increasing direct or indirect BTC exposure.

Q : Is Bitcoin less risky if volatility falls?

A : Lower volatility reduces day-to-day swings, but BTC remains a high-beta asset with drawdown risk.

Q : Will the Fed’s cuts push BTC higher?

A : Easier policy often supports risk assets; economists see potential for a crypto “jolt” within months.

Q : Did Bitcoin just hit a new all-time high?

A : Yes, in mid-August 2025 BTC topped out near $124.5K before consolidating around $116K.

Q : Are corporate treasuries still buying?

A : Publicly listed treasuries hold roughly 1.0M BTC, with values near $113bn as of Sept. 19, 2025.

Q : Does lower Bitcoin volatility institutional adoption hurt retail traders?

A : It may reduce short-term thrills, but can improve market depth, spreads and product quality over time.