Bitcoin Market Memory Shaken: BTC’s Bounce Zone Broken In Strategy-Like Bear Move

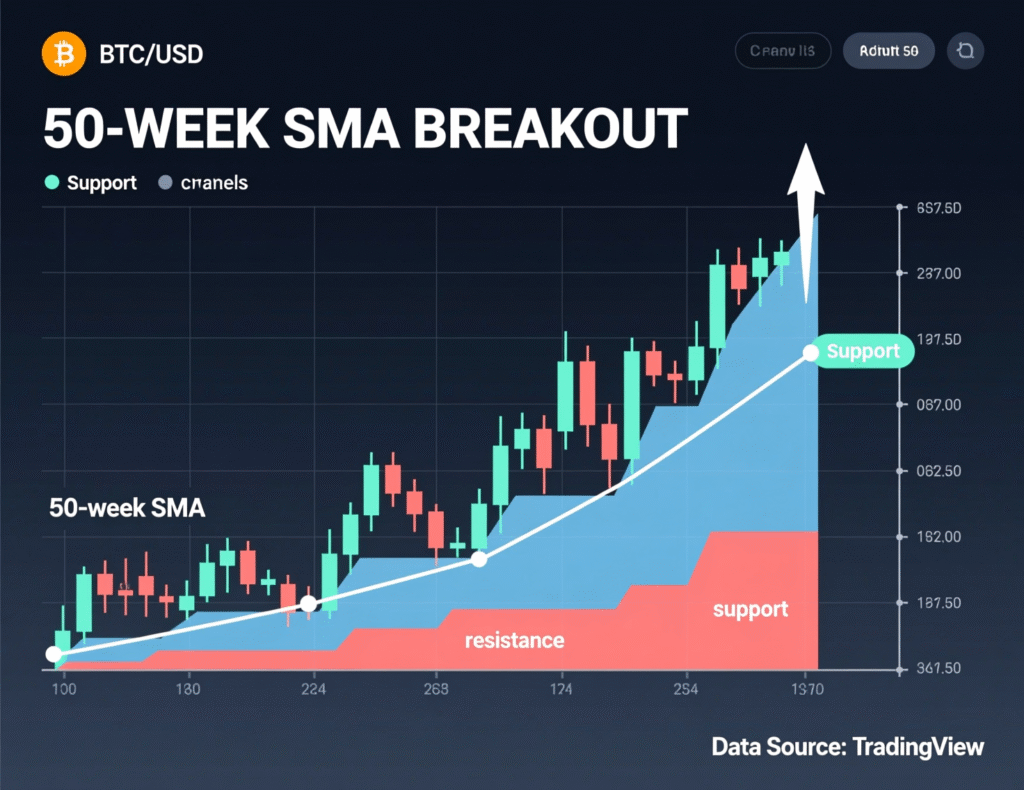

Bitcoin has slipped below its 50-week simple moving average (SMA) following a week-long decline, signaling a potential shift in the market’s momentum. Since early 2023, this SMA has served as a reliable support zone for traders, often acting as a “bounce point” in sustaining the broader bull-market trend. Breaking below it raises concerns about the durability of the upward trajectory and has prompted traders to reassess short-term expectations.

The breach of this key technical level shifts market sentiment toward caution. Until Bitcoin can reclaim and close above the 50-week SMA on a weekly timeframe, traders may remain hesitant to fully commit to long positions. This development underscores the importance of monitoring weekly closes and trend confirmation before assuming the continuation of the bullish structure.

Why the 50-week matters

The 50-week SMA is a slow-moving trend gauge that many market participants use to separate trending phases from corrective ones. Throughout 2023–2024, buyers repeatedly defended this line, reinforcing a buy-the-dip playbook. Last week’s decisive close beneath it suggests that memory may have faded, with rallies now more likely to meet supply near the average.

Market context: volatility and nearby levels

The breakdown followed a roughly 10% weekly slide into Nov. 16, accompanied by broader crypto weakness. Other majors fell 8–16% over the week, and intraday analyses flagged $93k–$95k as a near-term support pocket as liquidity thinned below six figures.

Lessons from MicroStrategy’s path

MicroStrategy (MSTR), a large corporate holder of bitcoin, slipped below its own 50-week SMA in September and subsequently extended losses to a 13-month low in mid-November. The episode illustrates how breaches of long-held weekly support can precede prolonged digestion unless quickly reclaimed.

What would re-validate the uptrend?

Historically, weekly closes back above the 50-week SMA tend to restore positive momentum. Until then, traders may shift from buying dips to selling rallies into the average, using it as dynamic resistance. Independent charting on TradingView can help verify where the current 50-week print sits and how far price must travel to recapture it.

Strategy watch: risk signals to monitor

Weekly close relative to the 50-week SMA (trend filter).

Breadth across majors (are declines broadening or narrowing?).

Equity proxy (MSTR) behavior as a high-beta analog.

Analysis

While death-cross chatter dominates shorter time frames, prior cycle data show mixed outcomes around such signals. The weekly-trend breach is the higher-signal event to watch; swift reclamation would argue for a failed breakdown, whereas continued rejection at the average would keep downside risks alive.

Conclusion

Bitcoin’s weekly close beneath the 50-week SMA signals a significant shift in market dynamics. This moving average has long acted as a key support level, and its breach suggests that rallies could face increased selling pressure. Traders and investors may need to exercise caution and prioritize risk management as the market seeks direction.

A sustained weekly close back above the 50-week SMA would provide the clearest confirmation that bullish momentum is returning. Until that happens, market participants should remain vigilant, as short-term swings may continue to test support and resistance levels around this critical average.

FAQs

Q : What does it mean when Bitcoin breaks the 50-week SMA?

A : It signals potential trend deterioration until weekly closes reclaim the average.

Q : Where is near-term support now?

A : Analysts flagged $93k–$95k as a local support pocket following the slide below six figures.

Q : Did MicroStrategy’s breakdown foreshadow BTC’s move?

A : MSTR broke its 50-week SMA in September and later hit a 13-month low; BTC’s similar breach raises caution.

Q : What would turn the outlook bullish again?

A : A sustained weekly close back above the 50-week SMA, turning it from resistance back into support.

Q : Is a ‘death cross’ on lower time frames decisive?

A : Death crosses can be noisy; weekly trend reclamation is a cleaner signal in this context.

Q : How can traders use the 50-week SMA in risk management?

A : As a trend filter: maintain smaller positions and tighter risk while below; scale exposure if reclaimed.

Q : Does this confirm a bear market?

A : Not by itself. It increases risk until reclaimed; confirmation depends on follow-through and market breadth.

Facts

Event

Weekly close places BTC below the 50-week SMA (“bounce zone” broken)Date/Time

2025-11-17T12:07:00+05:00Entities

Bitcoin (BTC); MicroStrategy Inc. (MSTR); TradingView (data); CoinDesk (analysis)Figures

~10% 7-day decline into Nov. 16; support focus near $93k–$95k; 50-week SMA as trend pivot. CoinDesk+1Quotes

“Bitcoin has fallen below a key support level, breaking a pattern of reliability as a bounce zone.” CoinDesk analysis. CoinDeskSources

CoinDesk report; TradingView charts.