Bitcoin in Lebanon: Lifeline in a Broken Banking System

Bitcoin in Lebanon is used as a lifeline to move money and preserve value in a system where banks have frozen many deposits and the Lebanese pound has lost over 98% of its value since 2019. Most people access bitcoin via P2P markets or by buying on regulated US/UK/EU exchanges, then self-custodying coins before sending them into Lebanon, while carefully managing volatility, scams and legal risk.

Bitcoin in Lebanon: Why It Matters in a Collapsing Economy

In Lebanon, bitcoin is used as an alternative store of value and payment rail as the Lebanese pound collapses, banks freeze deposits, and capital controls restrict access to dollars. That doesn’t make bitcoin a magic fix, but it does explain why a purely digital asset like bitcoin suddenly matters in Beirut, Tripoli or Zahle almost as much as in New York or London.

Since 2019, Lebanon has lived through one of the worst financial crises globally: GDP has shrunk by more than 38–40%, while the local currency has lost over 98% of its value and inflation has remained in painful double or triple digits. Poverty has more than tripled in a decade, with roughly 44% of people below the monetary poverty line and over 70% facing multidimensional poverty. Against this backdrop, it’s easier to see why many Lebanese treat “banking collapse in Lebanon and alternative stores of value” as a day-to-day survival topic, not an abstract macro debate.

From Liquidity Crisis to Hyperinflation: What Happened to Lebanon’s Money?

Lebanon’s liquidity crisis became visible in 2019 when banks quietly imposed de facto capital controls: depositors suddenly found they couldn’t withdraw their own dollar savings except in tiny amounts and at unfavourable “lollar” rates. Multiple exchange rates emerged an official rate, a Sayrafa rate set by Banque du Liban (BDL), and a black-market rate creating a “parallel exchange rate Lebanon and bitcoin premium” dynamic where on-the-ground prices had little to do with the official peg.

By 2024, the Lebanese pound had devalued by more than 98% versus the dollar; inflation soared above 200% at points, and public services largely collapsed. Parliamentary attempts to resolve a funding gap of roughly $70 billion in the banking system have been slow and politically contentious, with new bank restructuring and depositor repayment laws still evolving.

For ordinary people, this translated into.

Savings trapped or haircut in local banks

Salaries paid in a rapidly devaluing currency

Dollars shifting into a cash-based, opaque street market

In that context, both “lebanese pound hyperinflation and digital assets” and physical USD cash began competing as ways to preserve value.

Why Bitcoin Emerged as a Lifeline Amid the Banking Crisis

Bitcoin offers censorship-resistant transfers and a hedge against local currency collapse, but comes with sharp price swings and legal uncertainty. It’s not surprising that “lebanon economic crisis bitcoin” and “bitcoin lifeline amid lebanon banking crisis” became recurring themes in regional coverage as people experimented with anything that wasn’t a blocked bank account.

A few key reasons bitcoin looked attractive

No local bank needed

You can hold keys and transact via a mobile wallet, even if domestic banks refuse crypto-related transfers.

Global, 24/7 rails

Diaspora in the US, UK, Germany or France can send value without going through broken correspondent banking lines or heavy remittance fees.

(Sometimes) parallel-rate upside

When the parallel exchange rate moved faster than official prices, bitcoin priced in LBP could briefly trade at a premium, creating a “parallel exchange rate Lebanon and bitcoin premium” effect for those willing to arbitrage.

At the same time, BTC’s 50%+ drawdowns, exchange hacks and lack of deposit insurance mean it’s a risky substitute for cash USD especially for families already living on remittances or humanitarian aid. Crypto is a lifeline for some, but never a guarantee.

Who Is Actually Using Bitcoin in Lebanon? Students, SMEs, Diaspora

On-the-ground usage is less about hedge-fund speculation and more about necessity.

Urban Beirut freelancers getting paid in BTC or USDT from clients in London, Berlin or Austin to avoid blocked SWIFT transfers.

Small merchants in areas like Hamra or Mar Mikhael, quietly taking crypto for larger invoices (design, dev, imported goods) while pricing in “fresh” dollars.

Families receiving remittances from Lebanese diaspora in New York, Manchester or Munich who send crypto because bank wires are slow, expensive or simply rejected.

Tech-savvy youth and students, especially in Beirut, Tripoli and Zahle, who treat “lebanon cryptocurrency” as part of their digital skill set, trading via Telegram or OTC desks.

Tripoli and Zahle have become recognizable OTC hubs, with informal brokers running “mini-exchanges” in back offices and cafés a pattern also seen in other MENA markets in Chainalysis adoption reports.

If you’re building fintech or remittance products that need to plug into this reality, teams like Mak It Solutions can help design compliant rails, dashboards and mobile interfaces for complex, high-risk markets.

What Bitcoin in Lebanon Looks Like Day to Day

Day to day, Lebanese use bitcoin mostly for remittances, savings in USD-equivalent value, and occasional large-ticket payments, often via informal P2P markets. Retail “buy a coffee with bitcoin” use is rare; survival use cases dominate.

Everyday Use Cases: Hedge, Savings, and “Dollarization via Crypto”

Most crisis-driven users don’t care about “number go up”. They care about not waking up poorer tomorrow.

Common patterns.

Hedge vs LBP

Convert part of a salary from LBP into BTC or stablecoins every month to escape hyperinflation.

Dollarization via crypto

Use USDT or USDC as “synthetic dollars” when physical USD is scarce or sold at a premium.

Escape from stuck deposits

Some depositors will sell “lollar” balances at a discount, receive cash LBP or USD, then move into digital assets as a last resort.

For many, BTC is just one option in a messy menu.

BTC / ETH / stablecoins vs cash USD vs trapped deposits all with different liquidity, legal and security profiles.

Remittances to Lebanon Using Crypto Rails

Remittances are huge in Lebanon: they account for roughly 30–33% of GDP and reached around $6.7 billion in 2023. That’s why “remittances to Lebanon using crypto rails” and “send bitcoin remittances to Lebanon from abroad” have become practical search queries for diaspora.

Typical flows

US → Lebanon

A cousin in New York asks “how to send bitcoin remittances to family in Lebanon from USA”. They buy BTC or USDT on a regulated exchange (e.g., Coinbase, Kraken), send to a family-controlled wallet, and the family cashes out through a trusted broker.

UK → Lebanon

A nurse in London uses Open Banking rails to instantly move GBP to an FCA-registered exchange, convert to BTC/USDT, then send to relatives in Beirut.

Germany / EU → Lebanon

An engineer in Berlin wonders “wie kann ich von Deutschland aus bitcoin nach Libanon schicken”. They SEPA-transfer EUR to a BaFin-supervised CASP, buy BTC/USDT, and send to Lebanon.

Ticket sizes vary, but many remittances are in the $50–$500 range; occasional large transfers fund tuition, healthcare or rent. Routing this safely often requires careful KYC, sanctions screening (OFAC/EU lists) and record-keeping for tax.

Peer-to-Peer Bitcoin Trading Under Capital Controls

With traditional banks effectively blocked from touching crypto, peer-to-peer bitcoin trading under capital controls fills the gap.

Common setups.

Telegram/WhatsApp P2P groups matching buyers and sellers by city and payment method

OTC desks in Beirut, Tripoli and Zahle handling larger tickets in cash USD or LBP

Informal brokers who act a bit like hawala operators, swapping crypto/liquidity between networks

Spreads vs the global BTC price can be significant sometimes 2–10% depending on market stress, cash scarcity and sanctions pressure. Users face real risks: fake escrow accounts, social-engineering scams, and even physical threats when carrying cash.

If you’re designing P2P or marketplace platforms from London or Berlin, investing in robust KYC, transaction monitoring and analytics (for example, via a solid business intelligence stack) is non-negotiable.

How to Buy and Use Bitcoin in Lebanon (Step-by-Step Guide)

The safest way to get bitcoin in Lebanon is usually to buy on a regulated US/UK/EU exchange, withdraw to a self-custody wallet, then transfer to Lebanon or to use reputable P2P platforms with strong KYC and escrow. Every route must respect AML/CFT rules and sanctions; avoid any workaround that looks like deliberate evasion.

Buying from Abroad (US/UK/EU Exchanges → Lebanese Wallets)

If you’re in the diaspora, this is often the cleanest path.

Choose a regulated exchange in your country

USA

Use exchanges registered with FinCEN and state regulators (e.g., Coinbase, Kraken).

UK

Choose FCA-registered cryptoasset firms and beware of unregistered promotions.

Germany / EU

Look for BaFin-supervised or MiCA-ready CASPs that clearly state how they handle “high-risk” jurisdictions.

Complete KYC and fund your account

US users: connect a bank account, wire or ACH; keep in mind US tax reporting rules (e.g., Form 8949) if you trade actively.

UK users: use Open Banking for instant GBP deposits; expect proof-of-funds questions if volumes spike.

EU/German users: fund via low-fee SEPA transfers from EU banks.

Buy BTC (or stablecoins if that fits your risk profile)

For “how to send bitcoin remittances to family in Lebanon from USA” or “how to buy bitcoin in the UK and send to Lebanon cheaply,” keep fees low by batching purchases and avoiding peak congestion.

Self-custody, then send to Lebanon

Withdraw coins to a personal wallet you (or your family) control.

Only then send from that wallet to the Lebanese recipient, so exchanges don’t see direct links to high-risk geographies that might trigger blocks.

Always check OFAC/EU sanctions rules for counterparties and avoid mixing services that obscure funds’ origin.

Buying Bitcoin Inside Lebanon (P2P, OTC Desks, Cash Deals)

In Lebanon, most residents buy bitcoin via P2P platforms or OTC brokers using cash USD/LBP, because banks are restricted from processing crypto-related transfers.

Main channels for “how to buy bitcoin in Lebanon” or “how to buy bitcoin in Lebanon with USD or LBP”.

Global P2P platforms that support Lebanese users and escrow (always check current policies and risk warnings).

Local OTC brokers operating semi-openly in commercial districts.

Trusted social circles (coworkers, community groups) using WhatsApp/Telegram.

When evaluating “best P2P bitcoin exchanges for Lebanon”:

Prefer platforms with robust escrow and dispute processes.

Verify user histories, ratings and KYC.

Never meet strangers with large amounts of cash in isolated spots; favour public places and, ideally, known intermediaries.

If you’re building onboarding flows or compliance checks for these rails, robust identity and transaction-monitoring workflows can be implemented with modern web stacks and data pipelines exactly the sort of work a web development and data analytics partner can help with.

Storing, Sending and Cashing Out Bitcoin Safely

Whatever your route, storage and cash-out are where people most often get hurt.

Wallet choices in high-risk environments.

Mobile wallets (Android/iOS) for convenience, small balances and daily spending.

Hardware wallets (Ledger, Trezor, etc.) for larger savings, kept offline and away from curious relatives or opportunistic thieves.

Basic OPSEC.

Never share seed phrases or screenshots.

Use PINs/biometrics and keep backups in two separate safe locations.

Be discreet about holdings, especially in cash-heavy areas.

Cashing out BTC into USD/LBP:

Via trusted brokers who convert BTC → cash at street rates.

Using OMT/Western Union-style networks that accept crypto via upstream partners (where allowed)

Spending directly for large items (e.g., tuition, rent, imported goods) where counterparties accept BTC or stablecoins.

For “peer-to-peer bitcoin trading under capital controls”, a simple safety checklist includes:

Start with small test trades.

Use platforms with escrow; avoid sending BTC first in OTC chats.

Check addresses carefully; use QR codes, not manual copy-paste.

Keep tax and transaction records even if the local regime is murky, your US/UK/EU obligations may not be.

Is Crypto Legal in Lebanon? Regulation, Grey Areas and Risk

Crypto ownership and P2P use are not outright banned in Lebanon, but Banque du Liban prohibits banks and financial institutions from handling crypto transactions and repeatedly warns the public about the risks. This creates a legal grey zone: private holding is tolerated in practice, regulated intermediation is largely blocked.

Banque du Liban’s Position on Bitcoin and Cryptocurrencies

Questions like “is crypto legal in Lebanon” or “Lebanon cryptocurrency regulation BDL” don’t have neat yes/no answers.

Broadly.

2013

BDL issued one of the region’s first bitcoin warnings, highlighting volatility, fraud and terror-finance risks.

2018

The Capital Markets Authority prohibited licensed firms from engaging in crypto activities, tightening the ban on regulated intermediaries.

Banks are barred from processing card or wire payments related to crypto; yet P2P trading and informal OTC activity have grown anyway.

Holding BTC or USDT on your phone is not criminalized per se, but offering crypto services to the public without a license is highly risky.

AML/CFT, Sanctions and Terrorist Financing Concerns

Lebanon was added to the FATF “grey list” of jurisdictions under increased monitoring in 2024, partly due to concerns about money laundering and terrorism financing in a heavily cash-based economy. That status affects how US, UK and EU institutions perceive transactions connected to Lebanon.

For US senders.

You must avoid dealings with sanctioned entities under OFAC rules and be careful if counterparties are not properly KYC’d.

Using regulated US exchanges and sending only to known relatives or vetted partners reduces risk.

For EU/UK entities, crypto transfers touching Lebanon may be scrutinized more closely for AML/CFT exposure, especially if flows intersect with high-risk sectors or regions.

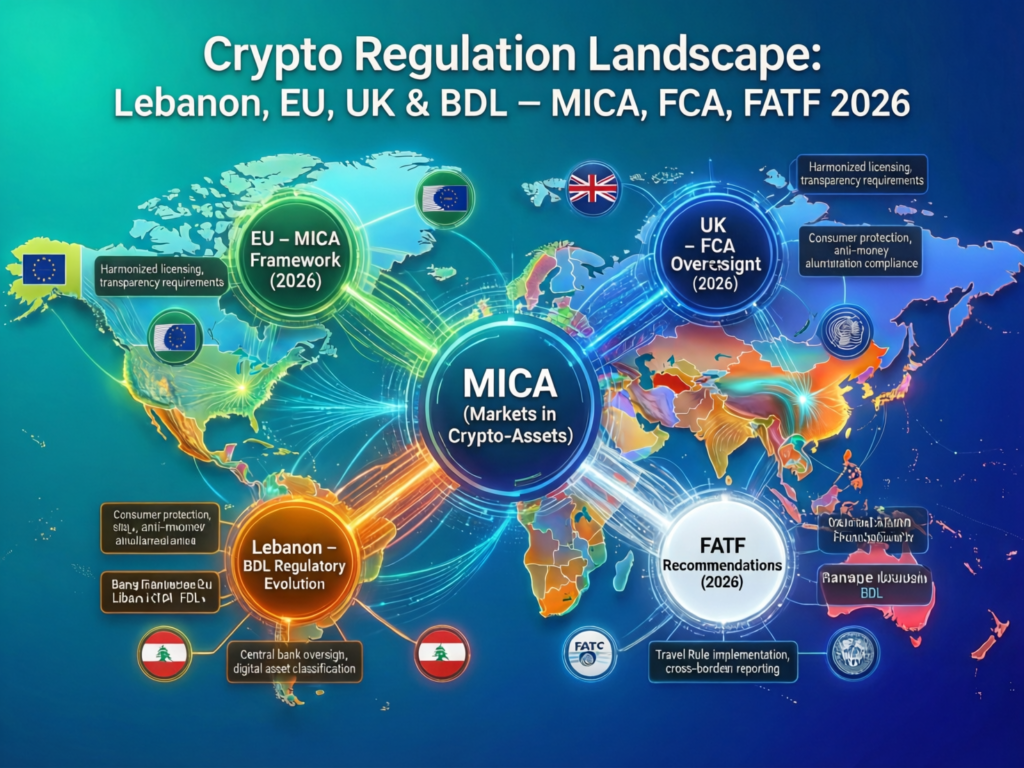

How EU/UK Rules (MiCA, BaFin, FCA, GDPR) Shape Lebanon-Facing Crypto Flows

European and UK frameworks indirectly shape “Lebanon-facing” crypto activity.

MiCA/MiCAR (EU)

Introduces a harmonised regime for crypto-asset service providers (CASPs), including strict rules on transparency, governance and AML.

BaFin (Germany)

Treats crypto custody and trading as regulated financial services, requiring licenses and careful risk management for high-risk countries.

FCA (UK)

From 2023, crypto financial promotions to UK consumers are tightly controlled, with guidance like FG23/3 and PS23/6 defining what “fair, clear and not misleading” looks like.

GDPR/DSGVO and UK-GDPR.

Any European platform handling Lebanese users still has to treat their personal data under EU/UK privacy rules.

Practically, this means many EU/UK CASPs will allow Lebanese residents or diaspora to use their platforms but may impose stricter onboarding, transaction limits or enhanced due-diligence flags on “high-risk” corridors.

Bitcoin in Lebanon for US, UK and EU/German Readers

If you’re reading this from the US, UK or EU and considering sending BTC into Lebanon, you’re juggling three things: helping real people, staying compliant, and managing investment risk.

For US Residents and Lebanese Diaspora in America

“Is it legal for US residents to buy bitcoin for relatives in Lebanon?”

Generally yes US law doesn’t ban sending crypto to non-sanctioned individuals in Lebanon, but sanctions, tax and AML rules still apply.

You should.

Use US-regulated exchanges with strong compliance.

Keep clear records of “best US exchanges to buy bitcoin then transfer to Lebanese wallets” you use, plus transaction hashes and recipients.

Treat BTC holdings as taxable property; remittances may be gifts but capital gains still matter.

If you’re also investing in BTC to gain exposure to the crisis driving bitcoin in Lebanon, be clear that you’re not buying a “Lebanon trade” you’re buying bitcoin, whose price reflects global risk sentiment, not just Baabda politics.

For UK Residents: Open Banking, FCA Rules and Bank Friction

UK residents often enjoy low-fee, fast GBP→BTC conversions thanks to Open Banking and Faster Payments. That’s great for “open banking and instant GBP to BTC transfers for Lebanon remittances” until banks get nervous.

Expect.

Some banks to block or slow payments to crypto exchanges as part of de-risking.

Routine source-of-funds and source-of-wealth questions for larger wires.

FCA-registered firms to ask more about why you’re sending BTC into a grey-listed country.

Using reputable, FCA-registered providers and keeping transfers clearly documented as family support goes a long way.

For Germany and Wider EU: BaFin, MiCA and SEPA Transfers

In Germany and the wider EU, “bafin-regulated exchanges sending to Lebanon” and “MiCA-Regeln für europäische Kryptobörsen mit Kunden im Libanon” sit within a conservative but increasingly clear regime.

For you, that means.

Cheap SEPA deposits into licensed exchanges from Berlin, Munich, Paris or Madrid.

More legal certainty under MiCA about custody, whitepapers and consumer protection.

Potential extra checks when you regularly send funds to wallets that appear to be cashed out in Lebanon.

Many German/EU investors read Lebanon as a “stress-test” case study in research from organizations like Chainalysis or KPMG, rather than a direct allocation thesis but if you have family ties, remittance-driven flows are still common.

Should You Use Bitcoin in Lebanon? Benefits, Limits and Safety Tips

When Bitcoin Helps: Hedge, Remittances and Access to Global Markets

Bitcoin can help in three main ways.

Hedge vs currency collapse

For some, a mix of BTC and stablecoins has outperformed holding lira or “lollar” bank balances since 2019.

Remittances

Crypto rails can be faster and cheaper than traditional remittances in a system where remittance inflows already exceed 30% of GDP.

Access to global markets

Once you’re on-chain, you can interact with exchanges, DeFi or even tokenised assets that local banks won’t touch.

“Lebanon bitcoin adoption” is therefore less about speculation and more about survival, especially for freelancers, SMEs and families cut off from normal banking.

When Bitcoin Hurts: Volatility, Scams and Legal Uncertainty

BTC is a high-volatility, high-risk asset. In some periods, simply holding cash USD in a safe at home would have outperformed a poorly timed BTC purchase.

Risks include.

Price crashes wiping out months of savings.

Ponzi schemes and fake OTC desks promising unrealistic returns or “guaranteed” arbitrage on the parallel rate.

Custody mistakes lost seed phrases, mis-sent coins that no bank or regulator will reverse.

Legal/regulatory shifts that could suddenly make certain on-ramps or off-ramps disappear.

Treat bitcoin in Lebanon as one tool among many, not the only exit from a broken system.

Practical Safety Checklist for Lebanese Users and Diaspora

Here’s a quick, snippet-friendly checklist.

Use regulated exchanges where possible (US/UK/EU) and avoid shady offshore platforms.

Always self-custody larger balances; never leave significant funds on exchanges or in P2P escrow.

Verify counterparties via ratings, reviews and small test trades before larger OTC deals.

Spread risk across BTC, stablecoins and (where practical) cash USD don’t bet everything on one asset.

Keep written backups of seed phrases in two secure locations; never store only on your phone.

Track transactions for tax and compliance in your home country, even if local Lebanese rules are unclear.

If you’re building mobile apps, wallets or dashboards serving this audience, you’ll want UX patterns that foreground these safeguards the same design discipline used in modern mobile app development and SEO-driven education, or in regional fintech content like MENA mobile app trends.

Key Takeaways

Lebanon’s banking collapse and currency devaluation (over 98% since 2019) pushed people toward alternative stores of value and payment rails like bitcoin and stablecoins.

Day-to-day, bitcoin in Lebanon mostly means remittances, savings and P2P trading under tight capital controls, not casual retail payments.

The safest flows usually start on regulated US/UK/EU exchanges, move to self-custody, then into Lebanon through vetted brokers and platforms.

Crypto in Lebanon lives in a regulatory grey zone: banks are prohibited from processing crypto, but private holding is widely tolerated; FATF grey-listing increases scrutiny on international flows.

Bitcoin can be a lifeline but it’s no panacea, and misuse can deepen losses via volatility, scams or legal trouble.

Who This Guide Is For and What to Do Next

This guide on bitcoin in Lebanon is for.

Lebanese residents navigating remittances, savings and P2P markets under capital controls.

Diaspora in the US, UK, Germany and wider EU who want to support family while staying onside with tax and sanctions rules.

Researchers, analysts and builders looking at Lebanon as a case study in crisis-driven bitcoin adoption.

Nothing here is financial, legal or tax advice. Before acting, talk to qualified professionals in your jurisdiction particularly around tax, sanctions and AML. If you’re designing crypto-enabled products, analytics stacks or cross-border payment apps, a specialist engineering partner like Mak It Solutions can help architect compliant web, mobile and data solutions for complex markets.

If you’re exploring bitcoin in Lebanon or broader crypto rails for remittances, crisis-resilient savings or fintech products touching the Lebanese market, you don’t have to figure out the tech and compliance alone. Mak It Solutions helps teams in the USA, UK, Germany and across the EU design secure, data-driven web and mobile experiences that respect both user reality and regulatory lines.

Ready to map out a safer architecture or analytics stack for high-risk corridors? Start a conversation with the team via the Mak It Solutions contact page and request a scoped, no-obligation review.

FAQs

Q : Can Lebanese residents still use global exchanges like Binance or Coinbase, and what are the main limitations?

A : Some Lebanese residents do manage to open accounts on large global exchanges, but they face stricter KYC, potential geo-blocking and limits on card or bank transfers because local banks are barred from processing crypto transactions. Even when accounts are open, funding them often requires offshore cards, foreign bank accounts or P2P workarounds, so most everyday users rely on local OTC brokers and P2P platforms instead of direct exchange access.

Q : How do bitcoin prices and spreads in Lebanon compare to global BTC markets on most days?

A : On calm days, Lebanese BTC prices usually track global exchanges plus a modest spread that reflects cash handling costs and local risk. During periods of currency turmoil or liquidity shortages, spreads can widen sharply sometimes several percent or more especially in cash-heavy OTC trades, as traders price in capital controls, sanctions exposure and counterparty risk.

Q : Does it make sense to mine bitcoin in Lebanon given electricity costs, outages and regulatory risk?

A : For most individuals, bitcoin mining in Lebanon is not attractive: chronic power cuts mean heavy reliance on generators and fuel, which erodes any potential margin, and there’s limited regulatory clarity around large-scale mining. A few operators may exploit subsidised or alternative energy sources, but for typical households or SMEs, buying BTC or stablecoins with remittance inflows or earned income is usually more realistic than trying to run mining rigs.

Q : What alternatives to bitcoin (such as stablecoins or USD cash) are Lebanese savers actually using in 2026?

A : In practice, many Lebanese savers prefer a basket: physical USD cash where available, USD-pegged stablecoins like USDT and USDC for digital “dollarization”, and sometimes short-term BTC exposure when they can tolerate volatility. Trapped bank deposits and lira balances are treated as unavoidable residual exposure rather than true savings, so people mix cash, stablecoins and BTC based on their access to remittances, brokers and trusted platforms.

Q : How are bitcoin gains treated for Lebanese diaspora paying taxes in the US, UK or EU countries?

A : Diaspora tax treatment depends on residency, not Lebanon: US taxpayers generally owe capital gains tax on BTC disposals worldwide; UK residents face capital gains and sometimes income tax; and EU countries like Germany apply their own rules (for instance, potential tax-free disposals after a holding period in some cases). Crypto sent to relatives in Lebanon might count as a gift, but gains realised before sending are usually taxable, so diaspora should consult local tax advisers and keep detailed transaction records even if recipients are in a crisis zone.