Bitcoin Greed & Fear Index Shows Extreme Pessimism, Tactical Bottom May Be Near: Analyst

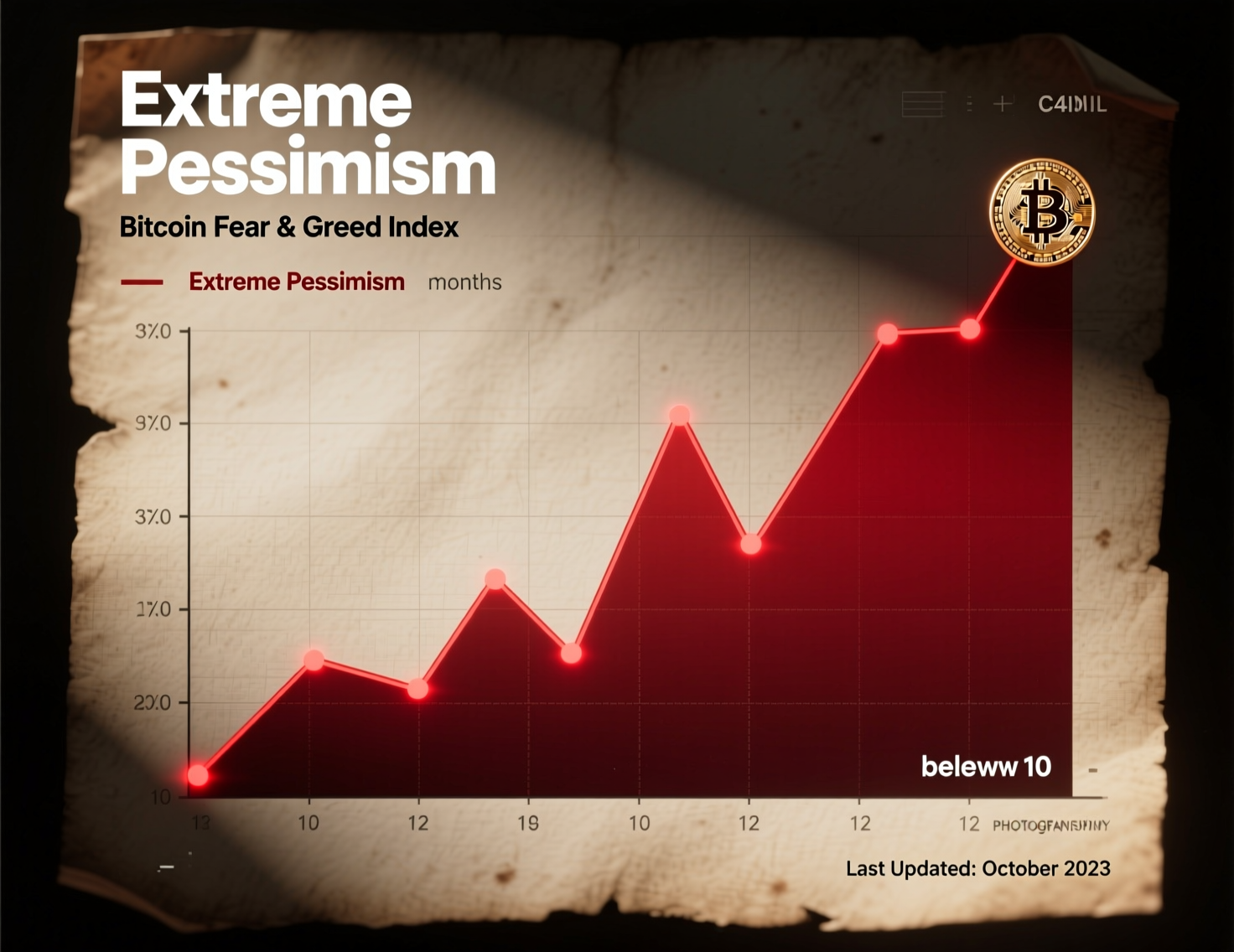

Market sentiment around bitcoin has taken a sharp downturn, with indicators turning decisively negative. According to 10x Research, its Greed & Fear Index has plunged to extreme pessimism, dropping below a reading of 5. Such levels have historically appeared during periods when the market is nearing exhaustion on the downside. The firm noted that these conditions often emerge when traders become overly risk-averse, creating an environment where selling pressure may start to fade.

In addition, the index’s 21-day simple moving average has slipped to roughly 10%, reinforcing the view that bitcoin may be approaching a tactical bottom. Similar readings in the past have aligned with short-term reversal zones, suggesting downside may be limited from here. While not a guarantee, these signals highlight the possibility of a near-term stabilization or rebound.

What the latest reading means

The 10x Research measure is a proprietary sentiment gauge. Founder Markus Thielen told CoinDesk that when the slower-moving average reaches the 10% zone, it has “often” marked a tactical low in prior episodes even if prices sometimes continue to drift lower before rebounding.CoinDesk+1

Price action: fear is elevated, volatility persists

Bitcoin (BTC) hovered in the mid-$84,000s today after bottoming near $80,880 on Friday amid a sharp intraday downdraft on derivatives venues. Despite the bounce, BTC remains down ~10% week-over-week and ~23% on the month, according to CoinDesk price data and prior coverage of the brief plunge.

Why this matters for traders

Episodes of peak pessimism have sometimes preceded short-lived bounces. Thielen noted a March example where sentiment bottomed before BTC slid further into April, yet still delivered a ~10% rebound immediately after the initial sentiment low. Today’s setup could rhyme, but it is not a guarantee of a durable trend change.

Bitcoin Greed & Fear Index extreme pessimism in context

Other well-known sentiment meters (e.g., public Crypto Fear & Greed dashboards) also treat sub-10 readings as “Extreme Fear,” illustrating how such thresholds are commonly interpreted though 10x Research’s model is distinct and proprietary.

How the Bitcoin Greed & Fear Index extreme pessimism signal is typically read

Traders often view extreme fear as a contrarian input: markets may be near exhaustion on the downside, increasing odds of a tactical bounce. However, macro drivers, liquidity, and positioning can delay or mute any rebound.

Analysis

At face value, today’s extreme pessimism aligns with prior “wash-out then bounce” setups. Still, the macro backdrop (liquidity conditions, miner flows, derivatives positioning) can extend drawdowns, so risk management remains key.

Conclusion

Market sentiment appears deeply washed out, and the Bitcoin Greed & Fear Index’s move into extreme pessimism reinforces the possibility of a short-term rebound. Such levels often signal that selling pressure may be stretched, creating conditions where buyers could start stepping back in if momentum begins to stabilize.

However, a convincing turnaround will depend on bitcoin breaking above nearby resistance zones and showing steady improvement in derivatives activity. Sustained follow-through, rather than a brief bounce, will be key to confirming whether a tactical recovery is truly underway or if the market remains vulnerable to renewed volatility.

FAQs

Q : What is the Bitcoin Greed & Fear Index extreme pessimism reading?

A : 10x Research reports its index at below 5, indicating extreme pessimism.

Q : How does the 21-day average factor into the signal?

A : When the 21-day average approaches ~10%, 10x Research notes it has often aligned with tactical lows historically.

Q : Did bitcoin just see a sharp low?

A : Yes. BTC briefly fell toward $80.9K on Friday during a fast drop before rebounding.

Q : Is extreme fear a buy signal?

A : It can precede short-term bounces, but it’s not a guaranteed trend reversal.

Q : How is this index different from public fear/greed dashboards?

A : 10x Research’s model is proprietary, whereas public dashboards like Alternative.me use separate methodologies.

Q : Where can I check current BTC prices?

A : You can view real-time prices and charts on CoinDesk’s price page.

Facts

Event

10x Research flags extreme pessimism on its Bitcoin Greed & Fear Index; tactical low may be nearDate/Time

2025-11-22T09:15:00+05:00Entities

Bitcoin (BTC); 10x Research; Markus Thielen; CoinDeskFigures

Index <5; 21-day SMA ~10%; BTC around mid-$84Ks; recent low ~$80,880Quotes

“…often marks a tactical low.” Markus Thielen, 10x Research (to CoinDesk) CoinDeskSources

CoinDesk report Tactical Bottom May Be Near; CoinDesk price page; CoinDesk flash-crash piece; Yahoo Finance syndication. Yahoo Finance+3CoinDesk+3CoinDesk+3