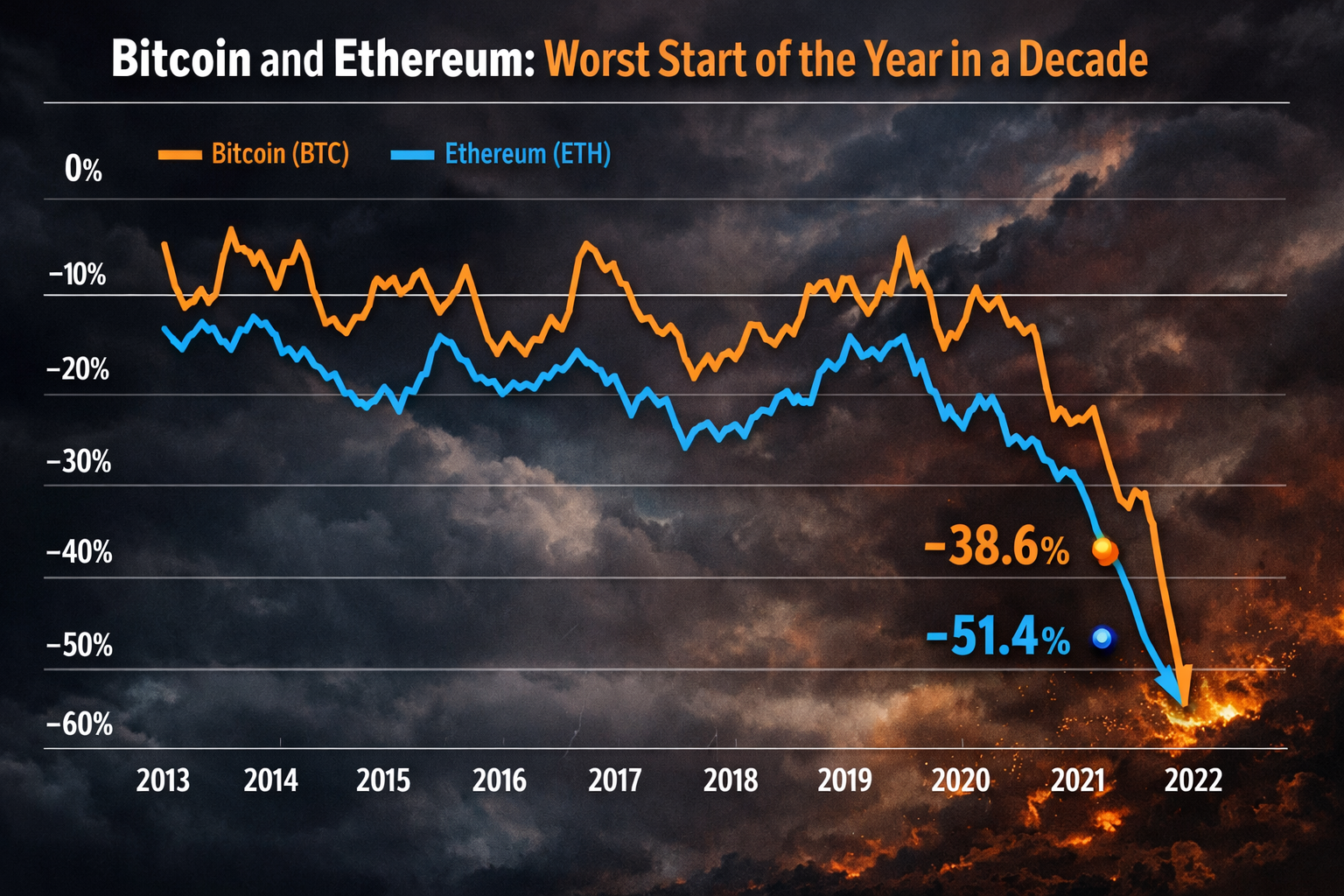

Bitcoin Ethereum post decade-worst YTD drop; markets diverge from stocks and gold

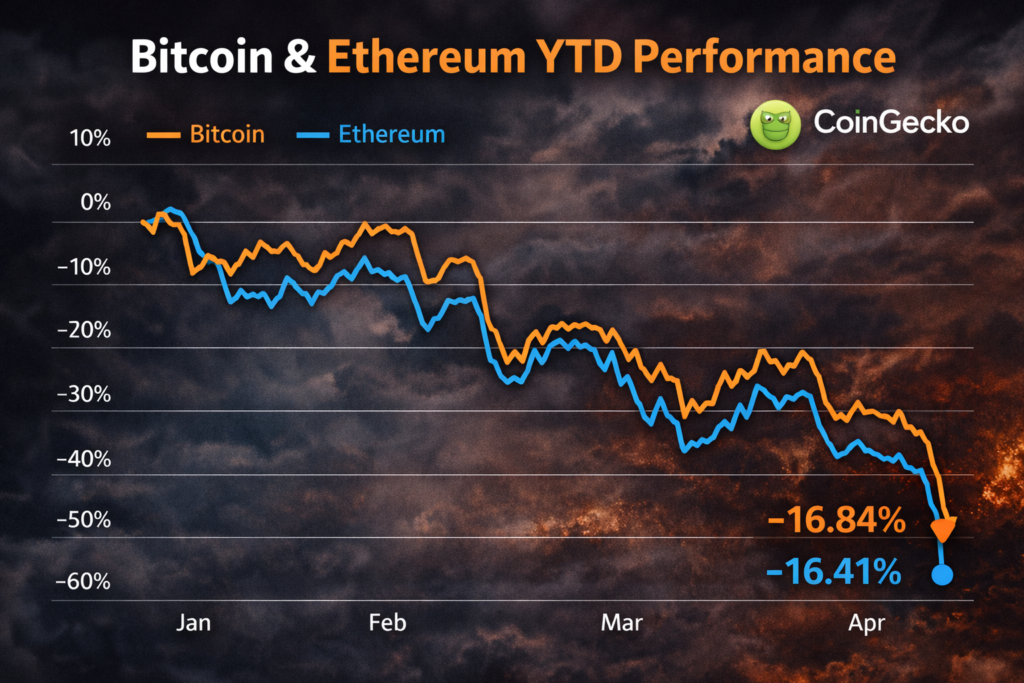

Bitcoin and Ethereum are off to a historically weak start in 2026, extending a multi-month slide that has prompted renewed “crypto winter” talk. Bitcoin and Ethereum worst start of the year in a decade has become a shorthand for the drawdown as Bitcoin trades around the high-$60,000 range and Ether near roughly $2,000, based on figures cited by Fortune and public market data.

Market snapshot

Bitcoin’s spot price was around the mid-to-high $67,000 range on Feb. 20, according to CoinGecko’s BTC/USD page.

What’s driving the Bitcoin and Ethereum worst start of the year in a decade

While crypto has often moved with risk assets, Fortune noted that crypto prices have diverged from broader markets in early 2026, with major U.S. stock indexes slightly higher year-to-date and gold sharply higher.

Analysts quoted by Fortune also tied the current malaise to how sentiment has behaved during the downturn specifically, a pattern of investors not responding strongly to favorable developments.

Market signals behind the Bitcoin and Ethereum worst start of the year in a decade

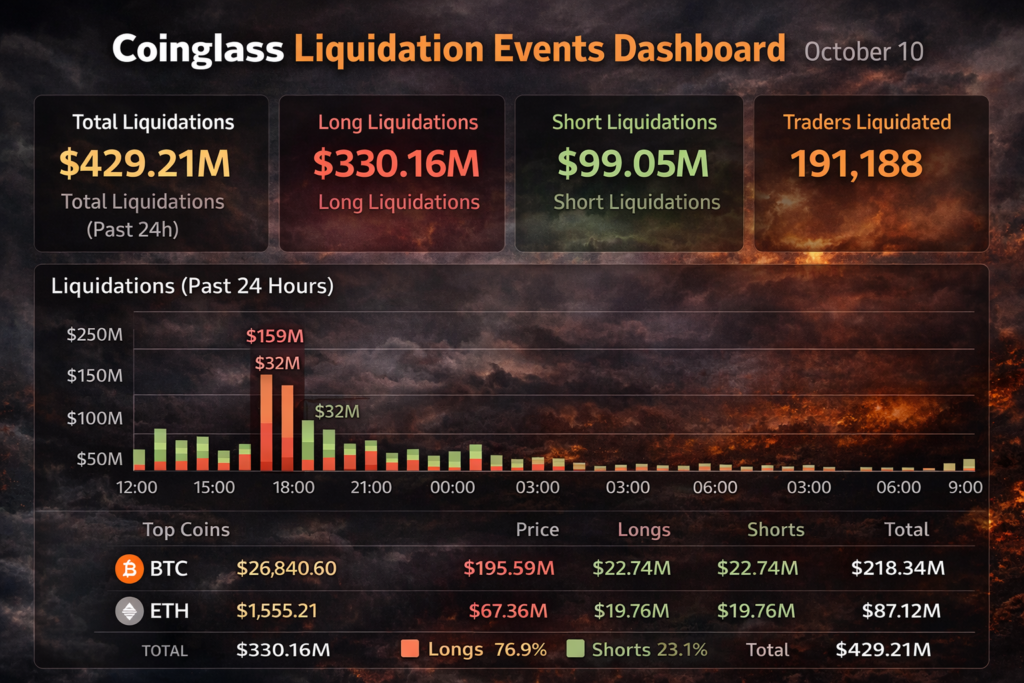

A key reference point remains the Oct. 10 liquidation shock described by Fortune, when tariff-related headlines coincided with a major wipeout of leveraged positions.

Coinglass publishes rankings and data related to large liquidation events, which the Fortune report referenced in characterizing that episode.

The broader takeaway: once leverage is forcibly unwound, rebounds can become harder—especially if fresh risk appetite doesn’t return quickly.

Industry stress points and second-order effects

Beyond spot prices, weaker market conditions can pressure lenders, brokers, and trading firms. CoinDesk reported that BlockFills backed by Susquehanna was seeking a buyer after at least $75 million in lending losses and had suspended deposits and withdrawals, according to the report.

Meanwhile, market coverage has pointed to continued caution among investors looking for a clearer catalyst before re-risking.

Context & Analysis

Some strategists argue that deeper institutional involvement could eventually damp volatility, but near-term price discovery may remain headline- and liquidity-driven. At least one research note circulating in financial media warned that prior “crypto winter” drawdowns have historically been severe, while acknowledging market structure has evolved.

Separately, analysts quoted by Fortune suggested that, despite the drawdown, “crypto’s reality is getting stronger,” framing the downturn as potentially temporary relative to longer-term adoption trends.

Concluding Remarks

Crypto’s early-2026 slump has re-opened debate about whether the market is in a prolonged winter or merely digesting an extreme leverage unwind from October. Traders and long-term holders alike are watching whether price stabilization, improved liquidity, and reduced forced selling can set the stage for a more durable rebound.

FAQs

Q : What does “crypto winter” mean?

A : A prolonged period of weak prices, reduced trading activity, and cautious investor sentiment across the cryptocurrency market.

Q : How much are Bitcoin and Ethereum down in 2026 so far?

A : Reporting by Fortune said Bitcoin was down about 24% and Ethereum about 34% year-to-date at the time of publication.

Q : Why are crypto prices diverging from stocks and gold?

A : Market commentary cited by Fortune points to crypto-specific risk appetite and reactions to sector news, even as some traditional assets have performed better.

Q : What was the October liquidation event mentioned in reports?

A : A sharp selloff on Oct. 10 tied to tariff-related headlines that coincided with a large liquidation wipeout, referenced by Fortune and tracked by CoinGlass.

Q : Is “Bitcoin and Ethereum worst start of the year in a decade” a definitive signal the cycle is over?

A : Not necessarily. Historically, large drawdowns can occur mid-cycle; analysts disagree on timing, and markets may remain volatile.

Q : What are investors watching for a rebound?

A : Signs of price stabilization, improving liquidity, and reduced forced selling, plus clearer macro or crypto-specific catalysts cited in market coverage.

Q : What risks should crypto holders consider right now?

A : Beyond price volatility, counterparty and liquidity risks can rise during downturns. CoinDesk cited BlockFills’ reported withdrawal suspension amid losses.

Facts

Event

Bitcoin and Ethereum post decade-worst year-to-date declines as “crypto winter” sentiment resurfacesDate/Time

2026-02-20T00:00:00+05:00Entities

Bitcoin (BTC), Ethereum (ETH), CoinGecko, Fortune, Bitwise, Coinglass, CoinDesk, BlockFills, S&P 500, Dow JonesFigures

BTC ~-24% YTD; ETH ~-34% YTD (as cited); Oct. 10 liquidation wipeout “more than $19B” (as cited); BlockFills losses “at least $75M” (as reported)Quotes

“We’re certainly in a Crypto Winter… You can tell by how investors react to good news. (They don’t.)” Danny Nelson, Bitwise (via Fortune)Sources

Fortune (story link below), CoinGecko, CoinDesk, Coinglass