Bitcoin ETFs post $470M outflows as Fed cuts rates, Trump talks trade

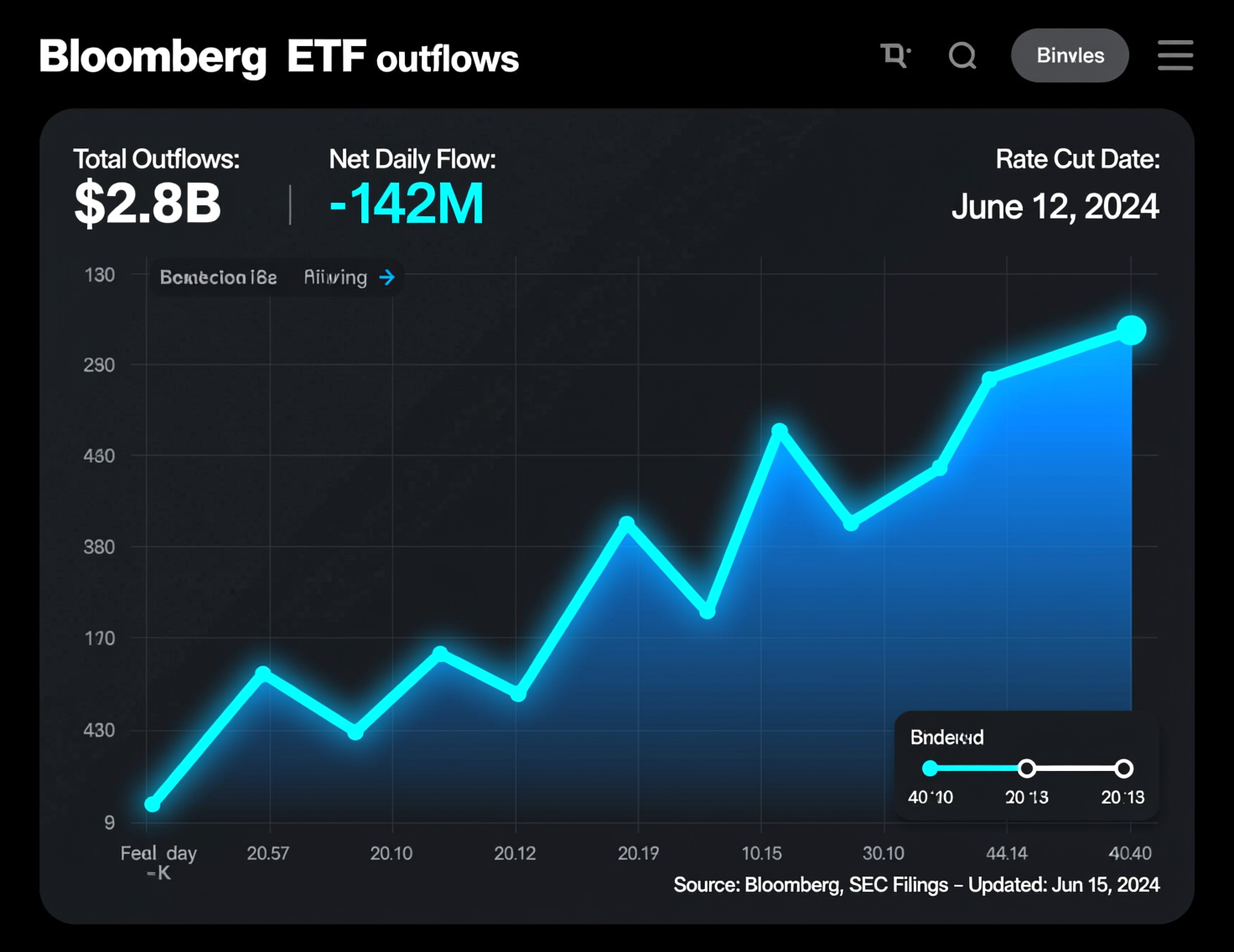

U.S. spot Bitcoin ETFs saw a sharp reversal on Wednesday, recording about $470 million in net outflows the largest single-day draw in roughly two weeks. The move followed the Federal Reserve’s quarter-point rate cut and renewed uncertainty from U.S.–China trade discussions, both of which weighed on investor sentiment toward risk assets.

Outflows were concentrated among major Bitcoin ETF issuers, with several flagship products seeing heavy redemptions after recent inflows. Analysts said the combination of profit-taking and macro volatility likely triggered the pullback, as traders reassessed positioning ahead of fresh economic data and policy signals. Despite the setback, total assets under management across U.S. spot Bitcoin funds remain near record highs, reflecting continued institutional interest in the crypto sector.

ETF flows swing negative after policy move

Data compiled by Farside show aggregate outflows near $470M, snapping a two-day inflow streak earlier in the week. Product-level moves included notable redemptions from Fidelity’s FBTC, ARK Invest’s ARKB, and BlackRock’s IBIT, alongside continued outflows from Grayscale’s GBTC. Farside Investors+1

According to crypto analytics dashboards, the pullback trimmed cumulative net inflows and AUM across the cohort; SoSoValue’s tracker showed total spot-Bitcoin ETF AUM around $149B and cumulative net inflows near $61B, equating to roughly 6.7% of BTC market cap. (Methodologies differ; figures update intraday.)

Bitcoin price action: macro and geopolitics in the mix

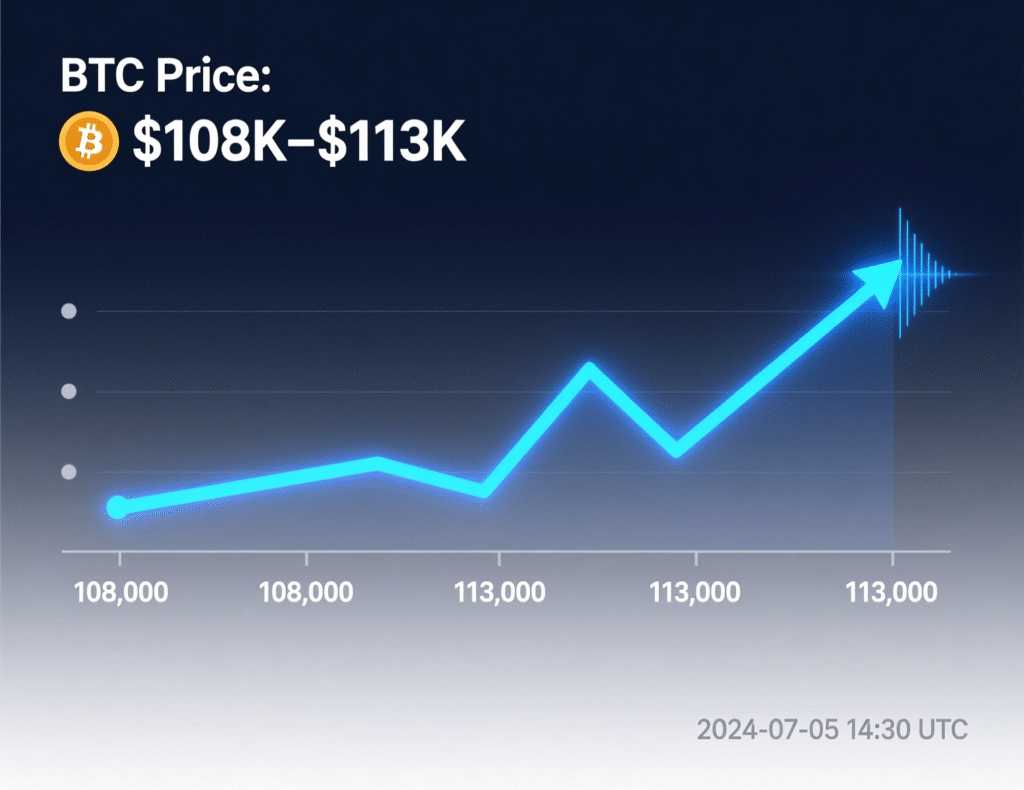

Bitcoin traded between ~$108,201 and ~$113,567 over the last 24 hours on CoinGecko as the Fed lowered the funds rate to 3.75%–4.00%. Price weakness after the decision gave way to stabilization as headlines suggested de-escalation in U.S.–China trade tensions following President Donald Trump’s talks with President Xi Jinping in South Korea.

ETFs still hold a sizable share of Bitcoin

Despite redemptions, U.S. spot ETFs collectively hold well over 1.5 million BTC. As of Oct. 28, 2025, BlackRock’s IBIT held about 805,239 BTC, Fidelity’s FBTC about 206,259 BTC, and Grayscale’s GBTC roughly 172,122 BTC, according to Bitbo filings data.

Market context and drivers

Analysts often link ETF flows and spot price momentum: inflows can amplify rallies while outflows contribute to consolidation. Wednesday’s backdrop combined (1) monetary easing with guidance that further cuts aren’t guaranteed and (2) potential tariff relief/rare-earths concessions from Trump–Xi talks both moving parts for risk assets and the dollar.

Why Bitcoin ETF outflows after Fed rate cut matter

Outflows can reflect profit-taking, rate-path uncertainty, or positioning ahead of policy/geopolitical events. With ETFs holding a meaningful share of circulating supply, even modest shifts can alter liquidity and short-term trend strength.

Reading Bitcoin ETF outflows after Fed rate cut alongside price

When flows and price move in the same direction (outflows with dips), sentiment skews cautious; when they diverge (outflows but flat/firm price), supply absorption may be improving. Wednesday leaned toward the former early, then stabilized as trade headlines emerged.

Context & Analysis

The Fed’s second cut of 2025 offers relief but also signals uncertainty on the path ahead. Meanwhile, any durable détente in U.S.–China trade could support risk assets by easing tariff-driven inflation pressures factors that feed into BTC’s macro narrative via liquidity and real-yield expectations.

Conclusion

The $470 million outflow on Wednesday highlights how quickly policy shifts and geopolitical headlines can sway crypto fund flows. The combination of the Fed’s latest rate decision and renewed U.S.–China trade uncertainty prompted investors to trim exposure and lock in gains after recent strength.

Going forward, traders will watch ETF flow data for signs of follow-through, along with the Fed’s tone on future rate moves and concrete outcomes from the Trump–Xi understanding. These factors could determine whether Bitcoin’s consolidation around the $110K level resolves into a deeper correction or sparks a renewed push toward record highs.

FAQs

Q : How big were the outflows?

A : About $470 million across U.S. spot Bitcoin ETFs on Wednesday.

Q : Did the Fed cut rates?

A : Yes, 25 bps to a 3.75%–4.00% target range.

Q : Where did Bitcoin trade during the move?

A : Roughly $108.2K–$113.6K in the past 24 hours.

Q : Which funds hold the most BTC?

A : IBIT (~805K BTC), FBTC (~206K), GBTC (~172K), per filings trackers.

Q : Did geopolitics affect sentiment?

A : Markets tracked Trump–Xi tariff and rare-earths headlines that suggested de-escalation.

Q : What are cumulative ETF inflows and AUM?

A : SoSoValue shows ~$61B cumulative net inflows and ~$149B AUM (methodologies vary).

Q : Is “Bitcoin ETF outflows after Fed rate cut” a trend?

A : Too early to say; watch multi-day flow data and Fed guidance for confirmation.

Facts

Event

U.S. spot Bitcoin ETF outflows surged after Fed cutDate/Time

2025-10-30T14:00:00+05:00Entities

iShares Bitcoin Trust (IBIT); Fidelity Wise Origin Bitcoin Fund (FBTC); Grayscale Bitcoin Trust (GBTC); ARK 21Shares Bitcoin ETF (ARKB); Bitwise Bitcoin ETF (BITB); U.S. Federal Reserve; Donald Trump; Xi Jinping; CoinGeckoFigures

$470M net outflows (ETFs); 3.75%–4.00% fed funds range; $108.2K–$113.6K BTC 24h range; IBIT ~805,239 BTC, FBTC ~206,259 BTC, GBTC ~172,122 BTCQuotes:

“The Committee decided to lower the target range for the federal funds rate by 1/4 percentage point …” FOMC statement, Oct. 29, 2025 Federal ReserveSources

Farside ETF flows (https://farside.co.uk/btc/), CoinGecko BTC price (https://www.coingecko.com/en/coins/bitcoin)