Bitcoin ETF Outflows Hit $1.2B Even as Wall Street Deepens Its Crypto Bets

Data curated from SoSoValue and reported by CoinDesk show roughly $1.2B in weekly net outflows from spot Bitcoin ETFs, alongside $508M from Ethereum funds and $137M of net inflows to Solana ETFs. Flows followed a volatile stretch tied to U.S. macro uncertainty. The magnitude is notable, but coming after one of 2025’s strongest inflow streaks, the pattern resembles position-trimming and profit-taking.

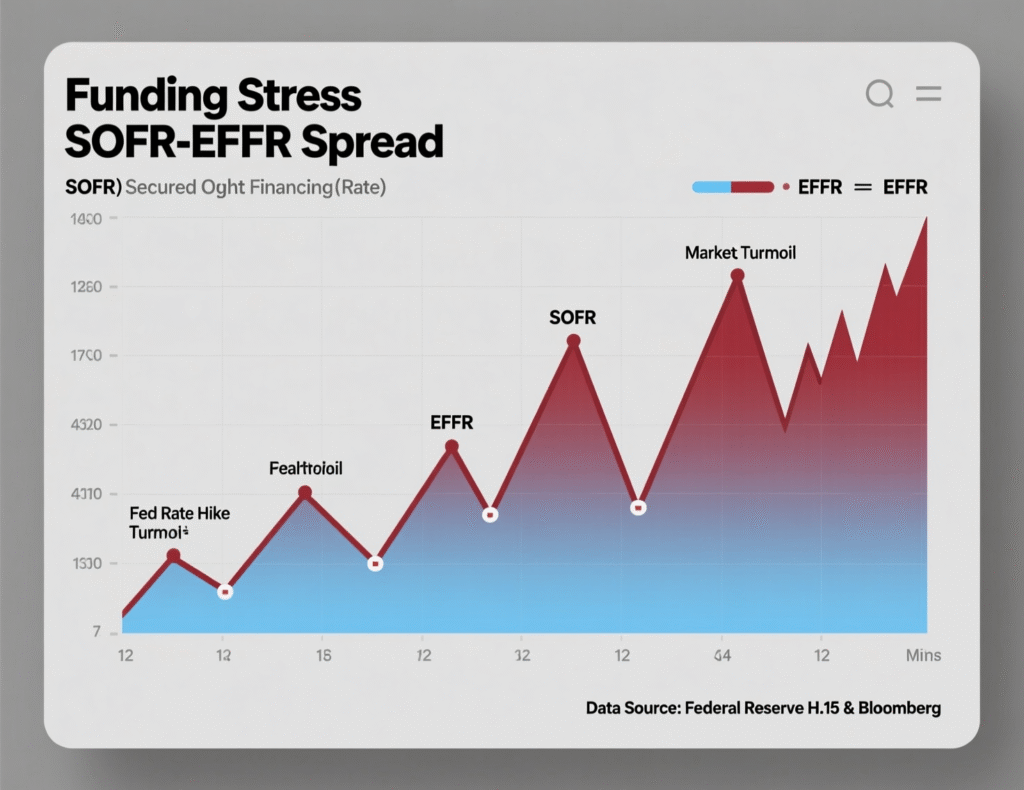

Short-dated funding indicators that flashed stress in late October have eased. CoinDesk market commentary notes the SOFR-EFFR spread tightened sharply; meanwhile, after a late-October spike, usage of the Fed’s Standing Repo Facility (SRF) fell back toward typical levels. These shifts, plus a stalled U.S. dollar index, helped crypto stabilize.

Price action and liquidity

By Monday (Nov. 10), BTC hovered near $106,000 after a weekend retest of ~$99K support, while ETH recovered toward the mid-$3,600s. The resilience aligns with easier funding and softer dollar momentum. Historically, crypto beta improves when SOFR pressures fade and the DXY consolidates. The Economic Times+2Yahoo Finance+2

What drove bitcoin ETF outflows $1.2 billion this week

Profit-taking after inflow streaks

Large redemptions often follow extended runs of net buying, especially near round-number price levels.

Macro event risk

Funding stresses (late Oct.) and shutdown headlines prompted tactical de-risking in listed vehicles.

Product substitution

Some allocators rebalanced across BTC/ETH/SOL exposures as Solana ETFs attracted fresh capital.

Off-chain adoption still dominates

Major managers (BlackRock, Fidelity, VanEck) continue to expand ETF offerings, channeling institutional participation off-chain where operations and controls meet traditional standards. That focus supports mainstream integration but keeps on-chain liquidity benefits partially unrealized for now.

Context & Analysis

Redemptions of this scale can look ominous, but the timing after heavy inflows and into a funding scaresuggests tactical re-risking rather than a structural exit. As SRF usage normalizes from the Oct. 31 record uptake and the SOFR-EFFR gap compresses, liquidity tailwinds may keep dips shallow, provided the DXY stays range-bound and policy headlines don’t reignite stress.

Conclusion

The third-largest weekly redemption on record bitcoin ETF outflows of $1.2 billion appears more like routine risk management than a broad retreat. Institutions are trimming exposure after prior inflows, keeping overall interest intact. Despite the sizable outflow, the move reflects portfolio adjustments rather than a shift in long-term conviction.

With financial conditions easing, the near-term trajectory of Bitcoin will likely hinge on funding markets and the U.S. dollar rather than ETF flows alone. A stable or weakening dollar and favorable liquidity conditions could support continued risk appetite, helping crypto prices maintain resilience in the weeks ahead.

FAQs

Q : What does “bitcoin ETF outflows $1.2 billion” indicate?

A : It signals institutions trimmed risk after strong inflows; not necessarily a long-term bearish shift.

Q : Did crypto prices crash on the outflows?

A : No. BTC rebounded toward $106K and ETH toward $3.6K early Monday.

Q : Why did Solana ETFs see inflows while BTC/ETH saw outflows?

A : Allocators often rebalance across themes; SOL ETFs attracted ~$137M as traders rotated exposure.

Q : How do SOFR and EFFR relate to crypto?

A : A narrower SOFR-EFFR spread implies easier funding, which can support broader risk appetite, including crypto.

Q : Is the dollar’s trend important for Bitcoin?

A : Yes; a stalling DXY can ease headwinds for risk assets like BTC.

Q : Are ETFs replacing on-chain activity?

A : For institutions, yes ETFs remain the preferred channel while on-chain infrastructure matures.

Q : Where can I track these flows daily?

A : Use dashboards like SoSoValue for real-time ETF flows and reputable market news for synthesis.

Facts

Event

Third-largest weekly spot Bitcoin ETF outflowsDate/Time

2025-11-10T10:36:00+05:00Entities

BlackRock (iShares Bitcoin Trust), Fidelity, VanEck; Federal Reserve (SRF); BTC, ETH, SOLFigures

~$1.2B BTC ETF outflows; ~$508M ETH outflows; ~$137M SOL inflows; BTC ~$106K, ETH ~$3.6KQuotes

“The SOFR-EFFR spread has dropped sharply… borrowing from the Federal Reserve’s repo facility has declined.” CoinDesk market commentary (Nov. 9, 2025). CoinDeskSources

CoinDesk report (Nov. 10, 2025) + SoSoValue dashboard + price data (Yahoo Finance)