Bitcoin ends October in red, but now enters its biggest month for gains

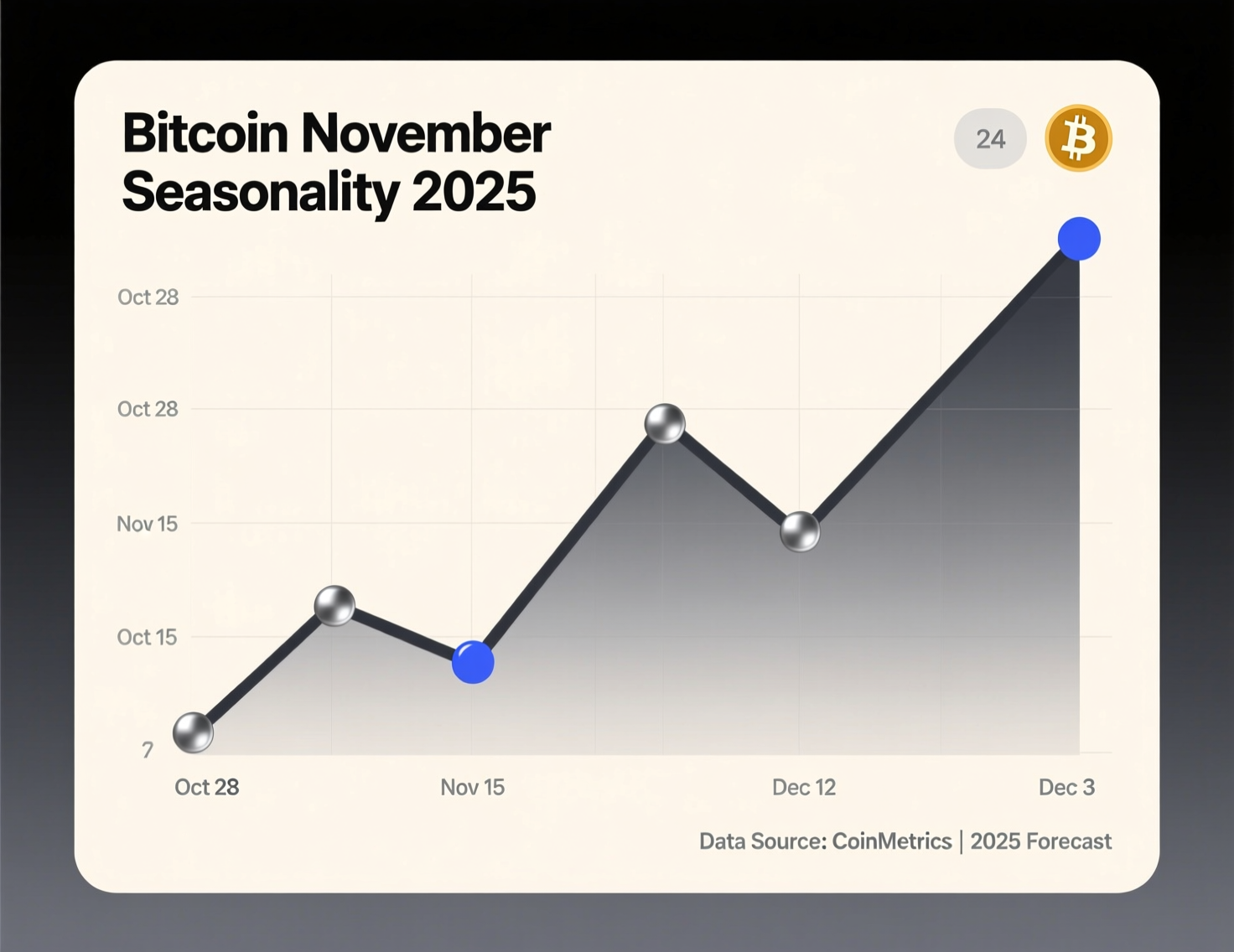

Bitcoin closed October in the red but enters November 2025 with a historically favorable trend. Since 2013, November has been Bitcoin’s best-performing month on average, often marking strong rebounds and renewed investor optimism. However, past performance doesn’t ensure a repeat, especially in a market now driven by institutional flows and macro headlines.

This year, Bitcoin’s November outlook hinges on broader economic signals. The Federal Reserve’s next policy moves and potential easing in U.S.–China trade tensions could influence market sentiment and liquidity. If risk appetite improves, Bitcoin may again benefit from its seasonal strength but caution remains as volatility and external factors continue to steer short-term price action.

November’s track record and why it matters

Analyses of monthly returns show November averaging roughly +42% for Bitcoin since 2013, with multiple winning years and several notable misses. Seasonality reflects behavioral and structural patterns, but dispersion is high; traders should view it as context, not a forecast.

What changed since October’s sell-off

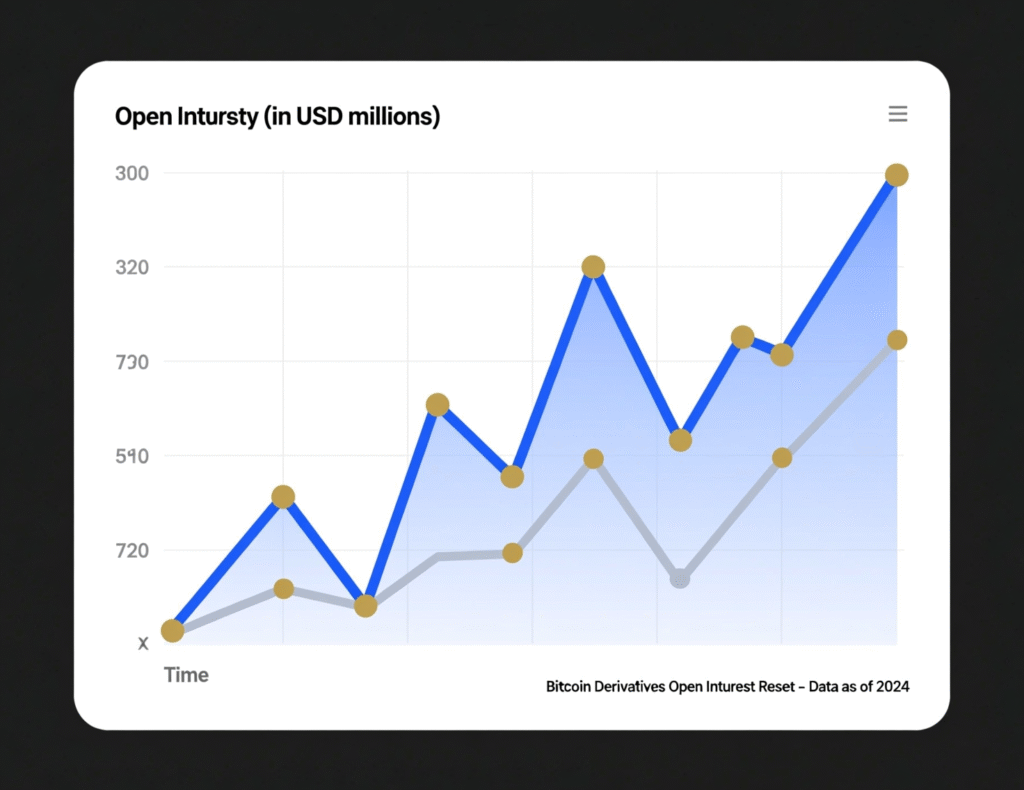

On Oct. 11, crypto saw ~$19bn in liquidations within 24 hours—its largest single-day wipeout on record leaving derivatives positioning lighter heading into November. Post-shock markets can be more sensitive to new catalysts, raising the odds of outsized swings in either direction.

Macro watch: Fed policy, liquidity, and growth

The FOMC meets Dec. 9–10, 2025. While markets had leaned toward another cut, Powell said a further reduction is “not a foregone conclusion,” prompting traders to recalibrate probabilities tracked by CME FedWatch. Shifts in those odds often ripple through risk assets, including BTC, as funding costs and dollar dynamics adjust. Federal Reserve+2Reuters+2

Trade winds: US–China signals

A Trump–Xi meeting in South Korea was framed as constructive, with reports of tariff trims and commodity commitments that, if sustained, could ease a growth headwind and support risk appetite. Markets will watch for follow-through and policy text; prior truces have unraveled.

Scenario planning for Bitcoin November seasonality 2025

Bullish case

Fed-cut odds firm, trade detente persists, post-crash positioning fuels momentum; BTC revisits prior highs.

Base case

Mixed macro signals; BTC grinds with elevated volatility; seasonality aids but doesn’t dominate.

Bearish case

Fed pushes back, trade tension re-flares; dollar strengthens; crypto risk unwinds post-October.

Indicator checklist (watch these)

FedWatch probabilities for Dec. 9–10 outcomes.

Dollar and real yields vs. BTC.

Tariff/commodity headlines from Washington/Beijing.

Perp funding and open interest after the Oct. 11 reset.

Trading playbook for Bitcoin November seasonality 2025

Short-term traders may lean on historical tailwinds, but risk controls are essential. Use seasonality as context, not a trigger.

Position sizing under Bitcoin November seasonality 2025

Size positions assuming higher-than-usual volatility and headline risk around the Fed and trade talks. Keep dry powder for dislocations.

Context & Analysis

Seasonality can be a useful frame when macro currents aren’t overpowering. This November, policy (Fed), policy risk (tariffs/export controls), and positioning (post-liquidation) could each eclipse historical patterns. A constructive trade backdrop and steady easing expectations would aid BTC; the opposite would test the seasonality thesis.

Conclusion

Historically, November has been one of Bitcoin’s strongest months, often bringing renewed momentum after weaker periods. As Bitcoin enters November 2025, investors are watching to see if this seasonal strength can repeat amid shifting global conditions and market uncertainty.

This time, the outcome may depend more on macro factors than history alone. The Federal Reserve’s policy signals and any progress in U.S.–China trade relations could heavily influence sentiment and risk appetite. Traders are advised to remain flexible, data-driven, and ready to adjust positions as economic cues and market reactions unfold through the month.

FAQs

Q : Does seasonality guarantee Bitcoin will rise in November?

A : No. It’s a historical tendency with wide dispersion; macro news can easily override it.

Q : What dates matter for policy this month?

A : The next FOMC is scheduled for Dec. 9–10, 2025. However, any Fed-related commentary before then can shift market odds and impact sentiment.

Q : How did October’s crash affect the November setup?

A : The ~$19 billion liquidation reset positioning, which could amplify subsequent moves in either direction.

Q : Could US–China trade developments help BTC?

A : Yes. Reduced tariff anxiety and improved commodity flow clarity can lift risk sentiment, indirectly supporting Bitcoin.

Q : Where can I track real-time rate odds?

A : Check the CME FedWatch Tool for implied probabilities of upcoming Federal Reserve policy moves.

Q : What is the primary risk to the seasonality view?

A : A hawkish Fed shift or renewed tariff escalation that threatens global growth remains the main downside risk.

Q : How does Bitcoin November seasonality 2025 affect long-term investors?

A : It shouldn’t dictate long-term allocation decisions; treat it as secondary context alongside fundamentals and individual risk tolerance.

Facts

Event

Bitcoin enters historically strong month (November) amid shifting macro signalsDate/Time

2025-11-01T12:00:00+05:00Entities

Bitcoin (BTC); Federal Reserve (FOMC); Jerome Powell; U.S. President Donald Trump; China’s President Xi Jinping; CME FedWatchFigures

~+42% average BTC November return since 2013; ~$19bn crypto liquidations on 2025-10-11; FOMC meeting on 2025-12-09 to 2025-12-10Quotes

“A further reduction in the policy rate at the December meeting is not a foregone conclusion.” Jerome Powell (Reuters) ReutersSources

CoinGlass monthly returns (https://www.coinglass.com/today); Reuters on Powell (https://www.reuters.com/world/us/fed-meeting-updates-rate-cut-expected-powell-speak-2025-10-29/)