Bitcoin Crash Off the Table as Four-Year Cycle is Dead: Arthur Hayes

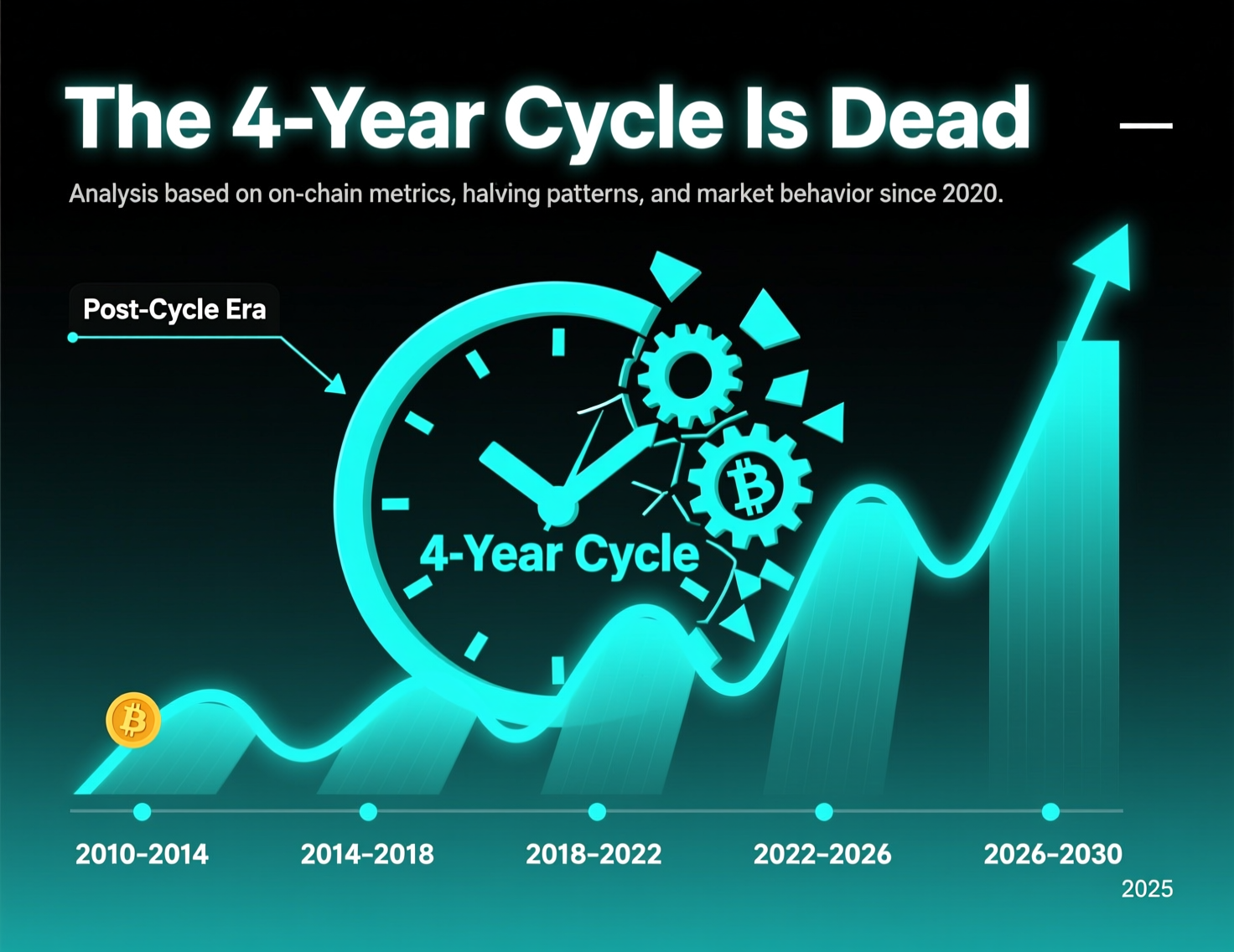

BitMEX co-founder Arthur Hayes believes the traditional four-year Bitcoin cycle has lost its relevance. He argues that previous BTC downturns were not driven by the halving schedule, as many assume, but rather by simultaneous monetary tightening across major global economies. According to Hayes, the idea that Bitcoin’s price movements strictly follow halving events no longer holds true in today’s macroeconomic environment.

He notes that global monetary policy is now shifting toward easing, with central banks expected to inject more fiat liquidity into the system. This expanding liquidity, Hayes says, reduces the likelihood of a typical post-halving bear market for Bitcoin in the coming months. Instead, he anticipates that the crypto market may remain more resilient and possibly benefit from the looser monetary conditions ahead.

What Hayes argues and why it matters

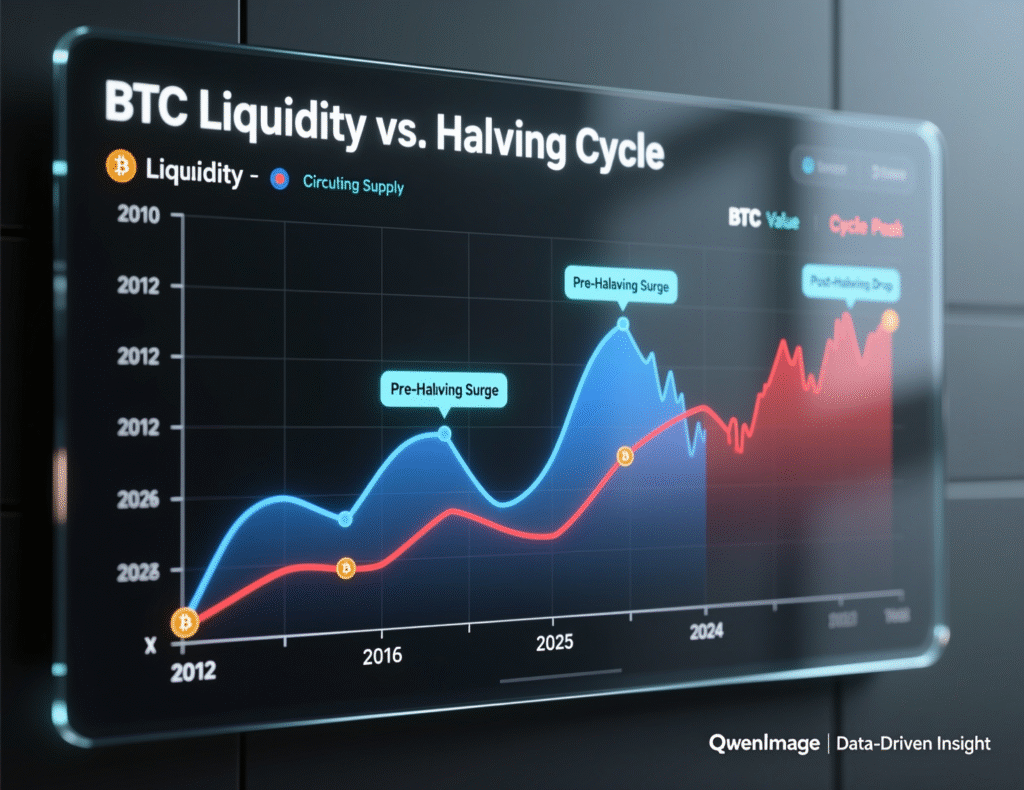

In an essay titled “Long Live the King!”, Hayes says bitcoin bear markets in 2014, 2018 and 2022 aligned with periods of monetary tightening. He asserts that this cycle differs because central banks led by the U.S. Federal Reserve are shifting toward accommodation, making liquidity more abundant and supportive for risk assets like BTC.

Macro backdrop: easing bias takes shape

The Federal Reserve lowered its policy rate by 25 basis points in September 2025 to a 4.00%–4.25% target range the first cut of the year while minutes and commentary point to a discussion about further easing depending on growth and inflation data. China’s central bank has also pledged to “step up” support and coordinate with fiscal policy, aiming to end deflationary pressures rather than drain liquidity. Together, those shifts underpin Hayes’ view that liquidity, not the halving clock, is the key driver. Federal Reserve+2AP News+2

Halvings still matter just not as a “timer”

Bitcoin’s reward halving (most recently in April 2024) historically aligned with bull phases followed by harsh drawdowns. Hayes maintains halvings can influence miner economics and sentiment but argues liquidity waves explain the depth and timing of major bear markets more convincingly than a four-year cadence alone.

Why analysts say bitcoin four-year cycle is dead

Several crypto media summaries echo Hayes’ thesis: money supply, rates, and credit conditions—especially in the U.S. and China shape BTC’s cycles. If policy remains accommodative and real yields fall, risk appetite typically improves, supporting BTC. Conversely, synchronized tightening has coincided with 70% 80% peak-to-trough drawdowns in prior cycles.

Does data support that bitcoin four-year cycle is dead?

Evidence this year includes the Fed’s rate cut and China’s policy support messaging. While neither guarantees continued gains, both point to easier liquidity than in 2022, when global tightening dominated. Skeptics note inflation uncertainty persists and could slow or reverse easing—an important risk to Hayes’ view.

<section id=”howto”> <h3>How to assess Bitcoin cycles with a macro-liquidity lens</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Track central bank policy paths (rate decisions, balance sheets, guidance) across the U.S., Europe, China, and Japan.</li> <li id=”step2″><strong>Step 2:</strong> Monitor money/credit proxies (real yields, term premia, bank lending surveys, repo/RRP flows) for direction of liquidity.</li> <li id=”step3″><strong>Step 3:</strong> Map BTC inflection points to tightening/easing episodes rather than just halving dates.</li> <li id=”step4″><strong>Step 4:</strong> Stress-test scenarios (sticky inflation vs. growth slowdown) and how each could alter the easing trajectory.</li> <li id=”step5″><strong>Step 5:</strong> Revisit positioning when policy surprises (e.g., hawkish pivots) create liquidity shocks.</li> </ol> <p><em>Note: Process may vary by jurisdiction/provider. Confirm requirements before acting.</em></p> </section>

Context & Analysis

Hayes’ liquidity-first framework aligns with macro-finance intuition: asset multiples tend to expand when policy eases and liquidity is abundant. The open question is persistence—Fed easing may be data-dependent and China’s support has been measured at times. If growth slows sharply or inflation re-accelerates, the easing path could change, reintroducing downside risk for BTC despite the thesis.

Conclusion

Arthur Hayes’ view that Bitcoin’s four-year cycle is over shifts how investors should read the market. Instead of focusing on the halving timeline, he argues that liquidity conditions not block rewards now drive Bitcoin’s major price moves. This perspective places greater emphasis on global monetary trends rather than crypto’s internal mechanics.

With current policies appearing more supportive than during previous downturns, Bitcoin could find a stronger footing. However, the lasting direction of its uptrend will depend on how inflation, economic growth, and central bank responses evolve in the months ahead, determining whether optimism can truly hold.

FAQs

Q : Why does Arthur Hayes say the bitcoin four-year cycle is dead?

A : He argues past crashes followed global monetary tightening, not a fixed halving timetable.

Q : What changed in 2025’s macro environment?

A : The Fed cut rates in September and is debating further easing; China pledged additional policy support.

Q : Does the halving still matter?

A : Yes, for miner supply and sentiment, but Hayes says liquidity explains cycle timing better than the four-year schedule.

Q : Could inflation derail the liquidity backdrop?

A : Yes. A resurgence could stall or reverse easing, raising downside risk for BTC.

Q : How should investors track macro liquidity?

A : Watch rate decisions, balance sheets, real yields, and credit data; map BTC moves to tightening/easing phases.

Q : Is a near-term BTC bear market likely?

A : Hayes says odds are lower while policy stays accommodative, but policy pivots could change that.

Q : Where can I read Hayes’ essay?

A : See media summaries and links referencing “Long Live the King!”.