Bitcoin ‘bull market is not over’ as it recovers above $112K

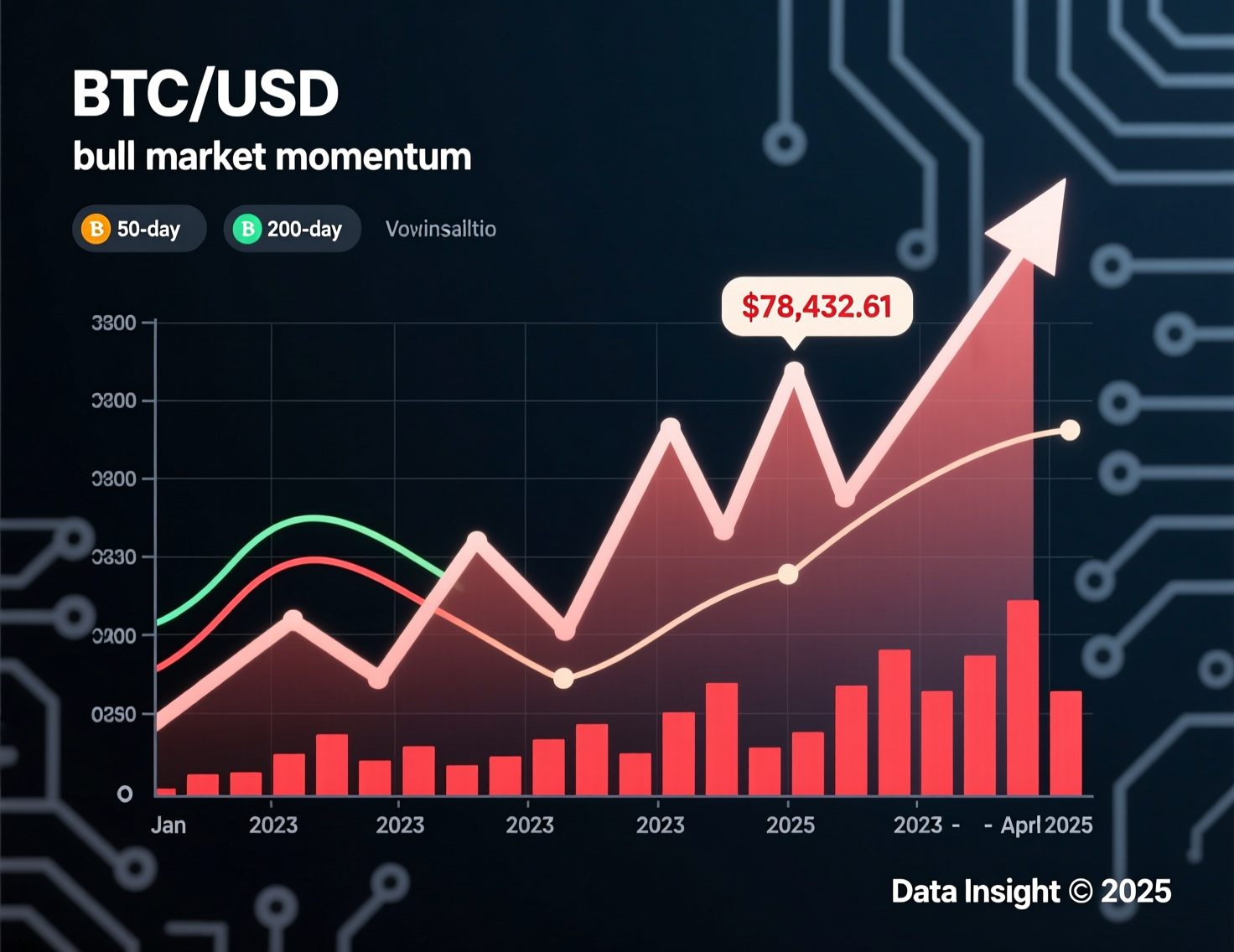

Bitcoin showed fresh strength on Monday, briefly climbing above $112,000 after a volatile week across the crypto market. Intraday charts recorded a peak close to $112,295, keeping the asset within the tight consolidation zone that has defined late September trading. Despite fluctuations, the move higher suggested renewed buying interest as traders monitored short-term support and resistance levels.

On-chain analysts continue to argue the broader bull cycle remains intact. They highlight valuation indicators and investor behavior patterns that historically emerge before sustained upward momentum. Metrics around long-term holder activity and market positioning point to resilience, offering optimism for further gains ahead. With price still holding in its range, the market is watching closely to see if Bitcoin can turn this rebound into a breakout over the coming sessions.

Why analysts say Bitcoin bull market is not over

A fresh note on CryptoQuant from XWIN Research Japan places Bitcoin’s Market Value to Realized Value (MVRV) ratio around ~2, a level historically associated with consolidation rather than euphoric peaks. The group also highlights easing profit-taking among long-term holders, which tightens liquid supply and can set the stage for renewed demand. Together, those signals suggest digestion inside an ongoing cycle rather than a terminal blow-off. Cryptoquant

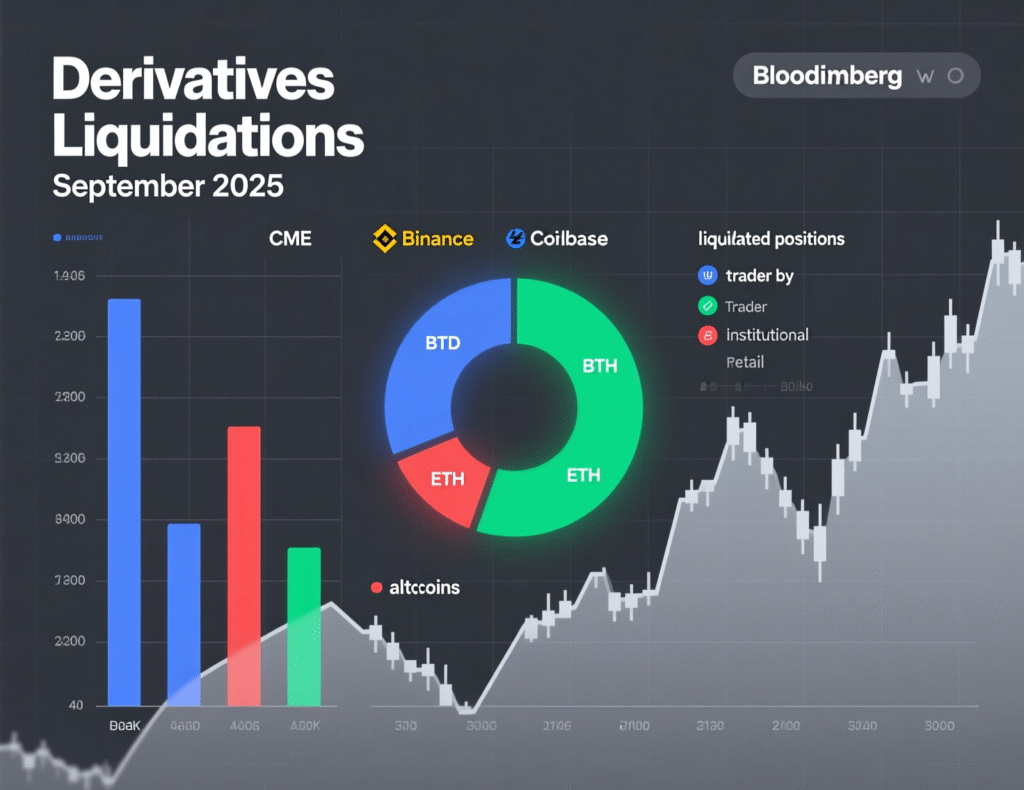

Market recap: liquidations cool as BTC stabilizes above $112K

The recovery follows two deleveraging bursts last week. On Monday, Sept. 22, crypto markets saw about $1.5B in liquidations, with BTC sliding intraday before bouncing. Thursday, Sept. 25 brought another wave, topping $1.1B, led by long ETH liquidations as prices briefly pressed sub-$109K on some venues. BTC has since steadied near the low-$112Ks.

Bitcoin Core v30 RC stirs policy debate on OP_RETURN

While price consolidates, a separate debate is heating up in development circles. The Bitcoin Core v30 release-candidate notes show the default -datacarriersize raised to 100,000 bytes (effectively limited by max tx size) and multiple OP_RETURN outputs now relayed/mined by default—changes that practically remove the old 80-byte cap unless operators override defaults. Testing remains ongoing.

Signals supporting Bitcoin bull market is not over

MVRV near ~2 historically aligns with mid-cycle consolidation.

Long-term holder profit-taking cooling = tighter liquid supply.

Deleveraging spikes often precede healthier trend continuations.

Szabo’s legal-risk warning adds a new wrinkle

Reappearing on X after years of quiet, Nick Szabo cautioned that expanding OP_RETURN allowances could worsen spam dynamics and increase legal risks for full nodes, even if miner fees act as a “spam filter.” His comments underscore tensions between Bitcoin’s monetary minimalism and broader on-chain data use.

<section id=”howto”> <h3>How to track on-chain & market signals for Bitcoin’s trend</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Check BTC’s daily high/low and close to confirm key levels (e.g., $112K) using a reputable price feed.</li> <li id=”step2″><strong>Step 2:</strong> Review MVRV and long-term holder metrics on an on-chain analytics platform (e.g., CryptoQuant) for cycle context.</li> <li id=”step3″><strong>Step 3:</strong> Monitor liquidation dashboards (e.g., CoinGlass) on high-volatility days to gauge leverage flushes.</li> <li id=”step4″><strong>Step 4:</strong> Track release notes/issues for Bitcoin Core (v30 RC) to understand policy changes like OP_RETURN defaults.</li> <li id=”step5″><strong>Step 5:</strong> Set price/volatility alerts and sentiment checks to avoid reacting emotionally to intraday swings.</li> </ol> <p><em>Note: Process may vary by data provider and jurisdiction. Confirm tool methodology before acting.</em></p> </section>

Context & Analysis

BTC’s latest bounce leaves the broader structure unchanged: valuation (MVRV) is neutral, leverage pockets have been washed out, and liquidity remains sensitive to macro catalysts. The Core v30 policy shift introduces non-price risks (node costs, legal exposure), but defaults can be overridden by operators. Net-net, cyclical bull arguments rest more on supply-demand mechanics than on short-term software debates.

Conclusion

Bitcoin’s rebound above $112,000 has strengthened sentiment, with on-chain metrics showing neutral valuations and reduced profit-taking from long-term holders. These signals suggest that the broader bull market remains in play, even after recent turbulence in crypto trading.

Still, volatility is expected to remain a key theme in the near term. Market participants are closely tracking macroeconomic data, leverage levels on major exchanges, and the upcoming Core v30 developments, which could all influence Bitcoin’s next decisive move. The balance of these factors may determine whether momentum shifts toward a breakout or another consolidation phase.

FAQs

Q : Is Bitcoin in a bull market?

A : On-chain metrics (MVRV ~2; cooler long-term holder profit-taking) point to a mid-cycle consolidation rather than a top.

Q : Does the evidence suggest the Bitcoin bull market is not over?

A : Yes several on-chain indicators and post-liquidation stabilization support that the Bitcoin bull market is not over.

Q : What triggered last week’s crypto liquidations?

A : Excess leverage met price weakness, causing ~$1.5B (Mon) and ~$1.1B (Thu) in liquidations.

Q : What’s changing in Bitcoin Core v30?

A : The RC raises the default data-carrier limit and permits multiple OP_RETURN outputs, effectively removing the 80-byte cap unless node operators override.

Q : Why are some developers concerned about OP_RETURN expansion?

A : Critics fear chain bloat, spam, and possible legal exposure for nodes storing harmful data.

Q : What price levels matter near term?

A : $112K–$113K resistance and ~$109K support were in play last week; breakouts could follow macro catalysts.

Q : Where can I monitor MVRV and liquidations?

A : CryptoQuant for MVRV/holder behavior; CoinGlass (and major outlets) for liquidation snapshots.