Bitcoin bull case grows as bond market volatility sinks to 2021 lows

The ICE BofA MOVE index has fallen to multi-year lows, signaling subdued volatility in the U.S. bond market and improving overall financial conditions. When Treasury markets remain calm, borrowing costs stabilize, liquidity improves, and investors tend to rotate toward higher-risk assets. This backdrop historically favors equities and digital assets alike, strengthening the bullish narrative for bitcoin as macro uncertainty fades and confidence gradually returns across global markets.

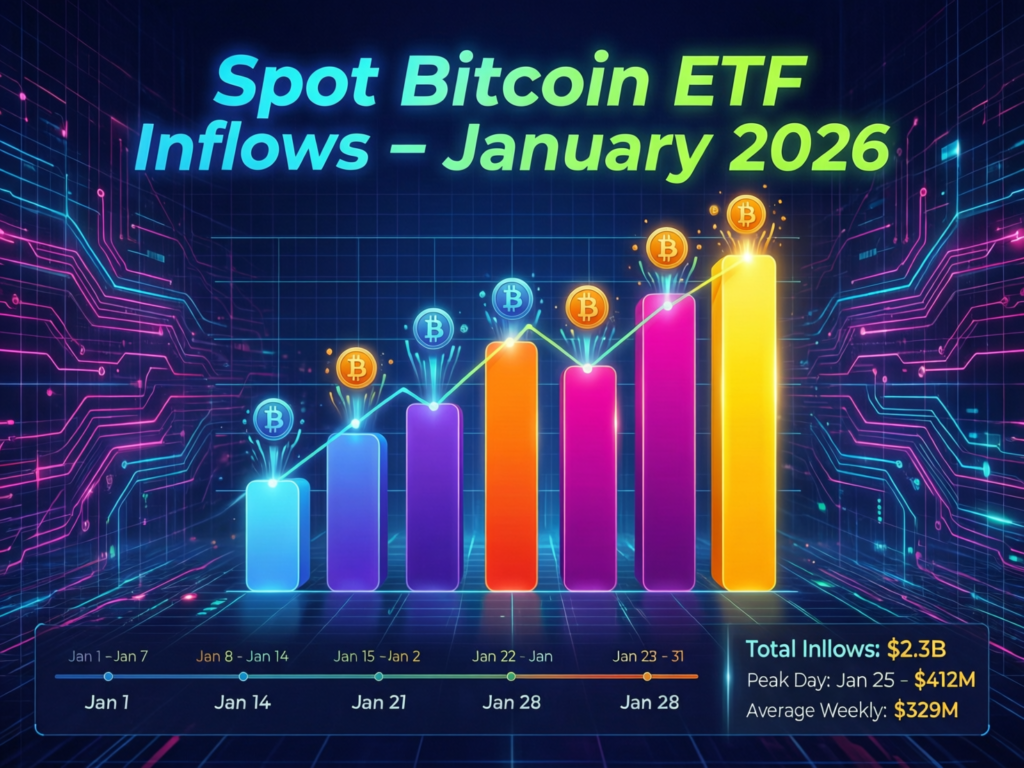

At the same time, renewed spot ETF inflows indicate rising institutional demand and fresh capital entering the crypto ecosystem. Together with easing bond volatility, these flows reinforce positive momentum and support expectations of a sustained rally. If supportive conditions persist, bitcoin’s advance toward the six-figure level appears increasingly plausible in the coming months. Market sentiment remains constructive as liquidity cycles turn favorable again.

Why the bitcoin bull case grows as bond market volatility sinks

The MOVE index, which tracks implied Treasury volatility, closed near 58 this week—its lowest level since October 2021. Lower bond volatility tends to reduce funding stress and has coincided with stronger performance in equities and crypto.

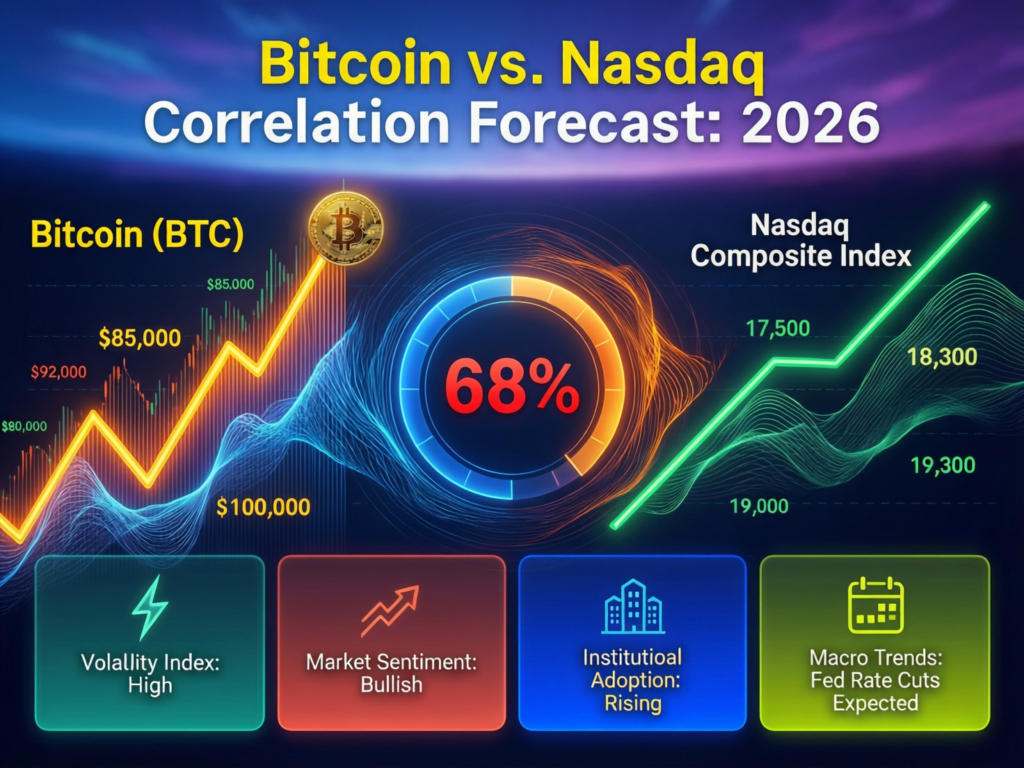

Bitcoin is hovering in the $96K area on Jan. 15, 2026, after a ~10% year-to-date rise. Risk-on periods have often seen bitcoin move directionally with the Nasdaq 100 while showing an inverse tendency to bond-volatility spikes.

Historical patterns

Rolling correlations shift over time, but recent data show a positive 12-month correlation between bitcoin and the Nasdaq 100 (approx. 0.42 as of early Jan. 2026). Meanwhile, episodes of heightened MOVE have historically aligned with crypto drawdowns; the current downswing in MOVE tilts probabilities toward risk-taking. (Correlation ≠ causation.)

ETFs add fuel

U.S. spot bitcoin ETFs recorded roughly $750–$760 million in net single-day inflows this week the strongest since October led by Fidelity’s FBTC. Robust primary-market demand increases structural buy-pressure during risk-on windows.

Context & Analysis

While the current backdrop low Treasury volatility and strong ETF demand—supports upside scenarios (e.g., retests or breakouts above $100,000), no single indicator guarantees future returns. Exogenous shocks could re-ignite bond volatility and tighten financial conditions. Near-term risks include escalations in U.S.–Iran tensions (which recently prompted temporary Iranian airspace closures) and potential disappointment around crypto policy timelines.

Concluding Remarks

A calmer U.S. bond market, with the MOVE index at its lowest level since 2021, is reinforcing bitcoin’s short-term bullish outlook. Lower rate volatility improves financial conditions, supports risk appetite, and encourages capital to flow into higher-growth assets. Alongside this, accelerating ETF inflows reflect growing investor confidence and rising institutional participation in the crypto market.

If rate stability continues, macro data remains supportive, and fund demand stays strong, bitcoin could push toward the six-figure range. However, any resurgence in bond volatility, unexpected economic shifts, or geopolitical tensions may limit upside momentum and trigger short-term corrections.

FAQs

Q : Why does low bond volatility matter for crypto?

A : Lower U.S. Treasury volatility tends to ease funding stress and align with broader risk-on behavior, which can support assets like bitcoin.

Q : Is bitcoin correlated with the Nasdaq 100?

A : Correlations vary over time, but over the past year they’ve been moderately positive (around 0.42 as of early January 2026).

Q : What is the MOVE index?

A : The MOVE index measures implied volatility in U.S. Treasuries derived from options. Recent readings near 58 mark lows not seen since October 2021.

Q : Are ETFs influencing price?

A : Yes. Spot bitcoin ETFs recently recorded their largest one-day net inflows since October, adding steady demand.

Q : What could derail the rally?

A : Rising rates volatility, adverse macro surprises, geopolitical risks (e.g., U.S.–Iran tensions), or regulatory setbacks.

Q : Where is bitcoin trading now?

A : Around the mid-$96K area as of January 15, 2026 (Asia/Karachi time).

Q : Does the exact phrase “bitcoin bull case grows as bond market volatility sinks” reflect consensus?

A : It summarizes current supportive conditions low MOVE and strong ETF inflows but it’s not determinative for price on its own.

Facts

Event

MOVE index falls to lowest since Oct. 2021 as bitcoin hovers near $96KDate/Time

2026-01-15T13:43:00+05:00Entities

Bitcoin (BTC), ICE BofA MOVE Index (^MOVE), Nasdaq 100 (NDX), Fidelity Wise Origin Bitcoin ETF (FBTC)Figures

MOVE ≈ 58; Bitcoin ≈ $96K; ETF net inflows ≈ $750–$760mn (single day)Quotes

No official quotes cited in sources.Sources

Yahoo Finance (^MOVE + BTC), Investing.com (MOVE history), Bloomberg (ETF flows), Reuters (Iran airspace/tensions)