Bitcoin (BTC) Weekly Update Price Analysis This Week as Bulls Defend $85K Support (Dec 19, 2025)

As of 19 December 2025, 11:25 UTC, Bitcoin (BTC) is trading near $88,200, down roughly 4–5% over the past 7 days after rejecting above $92K and briefly dipping toward the mid-$85K area. According to Forbes and other market data, this week’s 7-day high is about $92,562, with a low near $85,614.

The move has been driven by macro headlines (U.S. inflation data, the Bank of Japan’s rate hike) and increasingly bearish derivatives funding as leverage cools. In the short term, key support is clustered around $85K, while resistance and a “supply wall” sit in the $92–93K zone.

Key Data Snapshot

Data as of: 19 December 2025, 11:25 UTC

Current price: ~$88,200 per BTC

24h change: roughly +1.0% to +1.2%

7d change: around -4.7%

7d high / low: $92,562 / $85,614

Market cap: about $1.76 trillion

24h volume: roughly $58–59 billion

Bitcoin dominance: ~59% of total crypto market cap

Main data sources: CoinMarketCap, Binance, Investing.com, Forbes, Bitbo

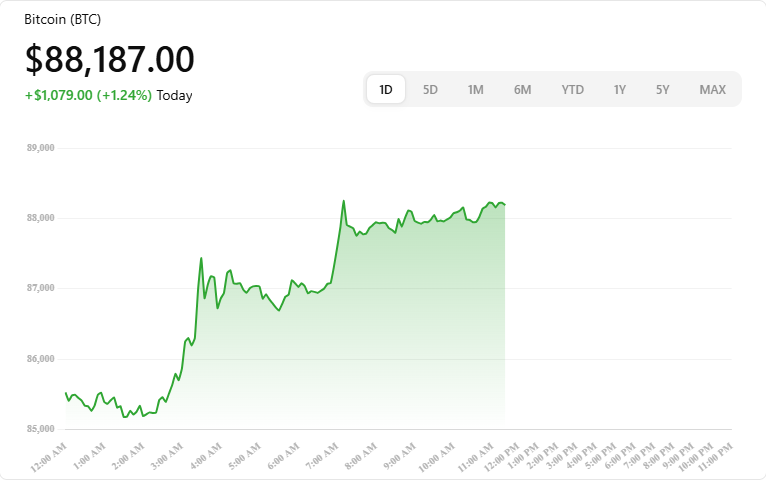

Stock Market Information for Bitcoin (BTC)

Bitcoin is a crypto asset trading in the CRYPTO market.

The latest referenced price is $88,187.0 per BTC, a change of about $1,079.00 (~1.2%) from the previous close.

The intraday high is $89,230.0, and the intraday low is $84,461.0.

Bitcoin (BTC) Weekly Update

Bitcoin’s price action this week reflects a moderate pullback after the all-time highs above $120K seen earlier in the year. BTC is holding around $88K, with most of the week spent chopping between the mid-$80Ks and low-$90Ks.

Macro events set much of the tone: U.S. inflation data briefly pushed BTC below $85K before a rebound, while the Bank of Japan’s surprise rate hike kept risk sentiment fragile without causing a clean breakdown.So far, the structure still looks like post-rally consolidation, not a confirmed long-term trend reversal.

Bitcoin Price Action & Key Levels

Weekly Performance

Over the last 7 days, Bitcoin is down roughly 4–5%, giving back some of its early-December strength while still trading far above this year’s lows.Historical data show a 7-day high near $92,562 and a low around $85,614, highlighting a wide range as traders fade both upside breakouts and deep dips.

On the daily chart, multiple wicks above $92K and below $86K underline an aggressive mean-reversion regime, with profit-taking after months of strong gains capping rallies and dip-buyers stepping in near support.

Short-Term Technical View (No Signals Implied)

From a purely technical perspective:

Immediate support:

The $85K zone remains key short-term support, having absorbed several intraday tests this week and lining up with recent daily lows.

Key resistance

The $92–93K band is the first serious resistance. On-chain positioning suggests a “hidden supply wall” here, with spot sellers and previously trapped buyers willing to offload exposure in this region.

Broader context.

Even after this pullback, BTC trades roughly 30% below its October peak above $126K, keeping current action in the realm of mid-cycle consolidation rather than late-cycle euphoria.

Volatility is still elevated relative to traditional markets but notably calmer than during the spring mania: ranges remain active-trader-friendly but are not yet at capitulation extremes.

News & Narratives That Moved Bitcoin This Week

Macro data & inflation jitters

U.S. inflation data sparked an initial jump toward $89K, followed by a slide under $85K as markets reassessed the timing and pace of rate cuts. (Barron’s) In the short run, BTC continues to behave like a high-beta risk asset, closely tracking shifts in macro expectations.

Bank of Japan’s surprise rate hike

The Bank of Japan’s 25 bps move marking a sharp turn from years of ultra-easy policy—briefly rattled global risk assets. Bitcoin dipped but then stabilised around $87K, which some analysts frame as a sign of growing macro resilience compared with previous cycles. (The Economic Times)

Regulation momentum in the UK

The UK finance ministry confirmed that a comprehensive cryptoasset regime is expected to take effect in October 2027, with the FCA and Bank of England working on detailed rules for trading, custody and stablecoins. While this timeline is long-dated, it reinforces a global trend toward clearer, rules-based oversight rather than outright bans.

Corporate accumulation slows

A major publicly listed company with heavy Bitcoin exposure has reportedly added more than 20,000 BTC this month but faces growing constraints from higher funding costs and weaker equity prices. The market seems increasingly aware that external “whale” buying can complement but not permanently substitute broad, organic demand.

On-Chain, Derivatives & Sentiment

Derivatives and on-chain data point to cooling leverage and cautious sentiment:

Futures open interest

A recent report notes that Bitcoin perpetual futures open interest has slid to around $28B from cycle highs near $50B, a sizeable de-risking that signals far less leverage than earlier in the year.

Funding rates turn bearish

Across major exchanges, funding rates have flipped broadly bearish, meaning traders are paying to hold short positions. That tilt hints at a more defensive stance, with speculators positioning for downside or at least hedging existing spot exposure.

Network security & issuance

On-chain and mining metrics from Bitbo show hash rate around 1,100 EH/s and a very secure network, with roughly 95% of total BTC supply already issued. In other words, even as speculative leverage gets washed out, Bitcoin’s base-layer fundamentals remain robust.

Bitcoin vs the Wider Crypto Market

The global crypto market cap is hovering near $2.95–3.0T, while Bitcoin dominance sits close to 59%, slightly higher on the week.BTC has broadly held its share of the total market, despite its own pullback, as some high-beta altcoins have seen even sharper swings.

Relative-performance data from major trackers show BTC modestly negative over the last 7 days, while the wider market has also struggled.This looks more like a broad risk-off drift than a Bitcoin-specific capitulation, with many large-caps reacting in parallel to macro and liquidity signals.

What This Means for Traders & Long-Term Holders

Nothing in this section is financial advice only market context.

For Short-Term Traders

The $85K area is the main line in the sand for now. Repeated bounces make it a natural reference point for setting invalidation levels or thinking about downside risk.

Attempts to push through $92–93K have been consistently sold, turning this region into a clear technical and on-chain resistance zone.

Bearish funding and reduced open interest mean fewer crowded longs, which can limit forced liquidations on the way down but also reduce the fuel available for sharp short squeezes.

For Long-Term Holders

Even after roughly a 30% drawdown from October’s highs, Bitcoin still boasts a $1.7T+ market cap and near-record dominance, underlining its role as the benchmark crypto asset.

Regulatory moves in the UK, U.S. and other large markets increasingly point to regulated, not banned, crypto markets over the next few years a backdrop that has historically favoured BTC over smaller, riskier tokens.

Strong network security and high hash rate show miners are still investing in the chain, even while price digests prior gains a constructive sign for long-term network health.

For readers building long-term frameworks, it can be useful to pair weekly updates like this with deeper explainers on topics such as Bitcoin halving economics and crypto ETF flows (see your internal guides: {{internal_link_bitcoin_halving_guide}} and {{internal_link_crypto_etf_flows_explainer}}).

Risks, Scenarios & Closing Thoughts

Looking ahead, the key scenarios many traders are watching.

Bullish scenario

BTC reclaims $93K, chews through the current supply wall, and grinds back toward the psychological $100K level possibly supported by renewed ETF inflows and a friendlier global monetary backdrop.

Neutral scenario

Bitcoin stays range-bound between $85K and $93K, with slightly bearish funding and mixed macro data. In this case, traders could be stuck in a choppy, mean-reverting environment where tight risk management matters more than big directional calls.

Bearish scenario

A decisive break and daily close below $85K would open space toward the high-$70Ks / low-$80Ks, especially if macro risk-off accelerates or derivatives positioning becomes crowded again on the short side.

For this week, Bitcoin’s story is less about new highs and more about digesting past gains in a macro-sensitive setting. Weekly swings may be uncomfortable, but they remain a normal feature of BTC’s maturing, yet still highly volatile, market structure.

Final Words

Bitcoin’s price action this week has been less about fireworks and more about digestion. After rejecting above $92K and briefly testing the $85K region, BTC is consolidating near $88K with cooler leverage, cautious sentiment, and still-strong network fundamentals. For traders, the $85K–$93K range remains the key battleground; for long-term holders, Bitcoin’s dominance, liquidity, and regulatory trajectory still underpin the bigger thesis.

As this Bitcoin (BTC) weekly update wraps up, remember that volatility cuts both ways build your own plan, size risk carefully, and always treat this as information, not financial advice. Stay curious, stay patient, and stay humble with every trade.

FAQs

Q : Why did Bitcoin (BTC) drop this week?

A : Bitcoin slipped roughly 4–5% this week as traders reacted to U.S. inflation data, shifting rate-cut expectations and the Bank of Japan’s surprise rate hike—all of which weighed on risk assets.At the same time, derivatives funding has turned bearish and open interest has fallen, pointing to less aggressive long leverage and a more cautious market tone.

Q : What are the key Bitcoin support and resistance levels right now?

A : The main short-term support is around $85K, where price has bounced several times over the past week. On the upside, the $92–93K region is the first significant resistance, backed by both recent failed breakouts and on-chain data indicating a “supply wall” near $93K.

Q : Is Bitcoin underperforming the wider crypto market this week?

A : Bitcoin’s 7-day performance of about -4–5% is broadly in line with a softer tone across large-cap cryptocurrencies, even though some altcoins are moving more violently. With BTC dominance around 59%, Bitcoin has mostly maintained its share of total market cap despite the pullback.

Q : What are the main short-term risks for Bitcoin right now?

A : Short-term risks include a decisive break below $85K, which could open the door to a deeper correction, as well as further negative macro surprises such as sticky inflation or slower-than-expected rate cuts.Bearish funding rates show traders leaning defensive; if sentiment flips quickly, that positioning could amplify volatility in either direction.

Q : Is Bitcoin still a long-term play after this week’s volatility?

A : This week’s volatility does not change Bitcoin’s core long-term features: capped supply, deep liquidity and a large share of overall crypto market value. However, regulatory changes in major markets and macro conditions will continue to shape adoption and pricing, so long-term holders should stay informed and comfortable with high risk and significant drawdowns.