Bitcoin (BTC) Weekly Update Price Analysis This Week & Key Levels After the February Crash (Feb 20, 2026)

This week’s Bitcoin weekly update has BTC trading around $67,000, up roughly 2–3% over the last 7 days after a sharp February sell-off. The 7-day high/low is near $70,786 and $65,373, with price repeatedly failing to hold above the $70K area. Short term, the key resistance zone is $70K–$71K, while support sits around $65K, then the psychologically important $60K region if downside resumes.

ETF outflows, macro uncertainty and cooling volatility keep Bitcoin in a cautious, range-bound environment rather than a clear trend.

Key Data Snapshot (as of 19 Feb 2026)

Current price: ≈ $66,900–$67,000 per BTC

24h change: +~1.2%

7d change: +~2.4%

7d high / low: $70,786.27 – $65,373.15

Market cap: ≈ $1.34 trillion

24h volume: ≈ $35.2 billion

Bitcoin dominance

~56.5% of total crypto market cap (global crypto cap ≈ $2.37T)

Main data sources.

CoinGecko, CoinMarketCap, Reuters, Barron’s, Amber Group, Santiment, KuCoin research, ETF flow dashboards.

All figures are approximate and can change quickly in volatile crypto markets.

Bitcoin Weekly Update What Happened This Week?

After last week’s dramatic drop toward $60K Bitcoin’s sharpest decline in several years—BTC has spent this week trying to steady itself in the mid-to-high $60Ks. Price briefly tested the $70K–$71K region but couldn’t break through with conviction, leaving the market stuck in a cautious, range-bound phase.

Over the last 7 days, Bitcoin is up roughly 2–3%, trading near $67K, with a weekly range of about $65.4K to $70.8K. February’s “mini-crash”, persistent ETF outflows and macro uncertainty around interest rates and growth are still the main backdrop for this Bitcoin weekly update.

Bitcoin Price Action & Key Levels

Weekly Performance: From Panic to Sideways

Live data from CoinGecko shows BTC’s 7-day range running from roughly $65,373 (low) to $70,786 (high), with spot hovering just below $67K. That still leaves Bitcoin about 47% below its all-time high near $126K set in October 2025.

This week’s price action can be summed up as

A bounce from the low-$65K area as dip-buyers stepped in after the prior week’s liquidations.

A failed push through $70K–$71K, lining up with continued net outflows from spot Bitcoin ETFs.

A drift back into the mid-$60Ks as traders absorb macro headlines, regulatory news and the prospect of slower central-bank easing.

The end result: less chaos than the February crash, but not enough momentum yet to argue for a strong new uptrend.

Short-Term Technical View: Range First, Trend Later

From a short-term technical perspective, Bitcoin currently looks like this:

Trend

Consolidating after a sharp downside shock; not clearly trending up or down on the weekly timeframe.

Key support zones

$65K lines up with this week’s 7-day low and local demand.

$60K psychological level and approximate crash low from last week. A clean break below here would likely reignite volatility and forced selling.

Key resistance zones

$70K–$71K this week’s local ceiling, where rallies keep stalling.

$74K–$75K the prior range top before the February drawdown and an area where sellers were previously active.

Options data from Amber Group suggests implied volatility has cooled to around the high-40% area for BTC, signaling that markets are now pricing in choppy range trading rather than another immediate crash.

News & Narratives Moving Bitcoin This Week

Several themes shaped this week’s Bitcoin weekly update:

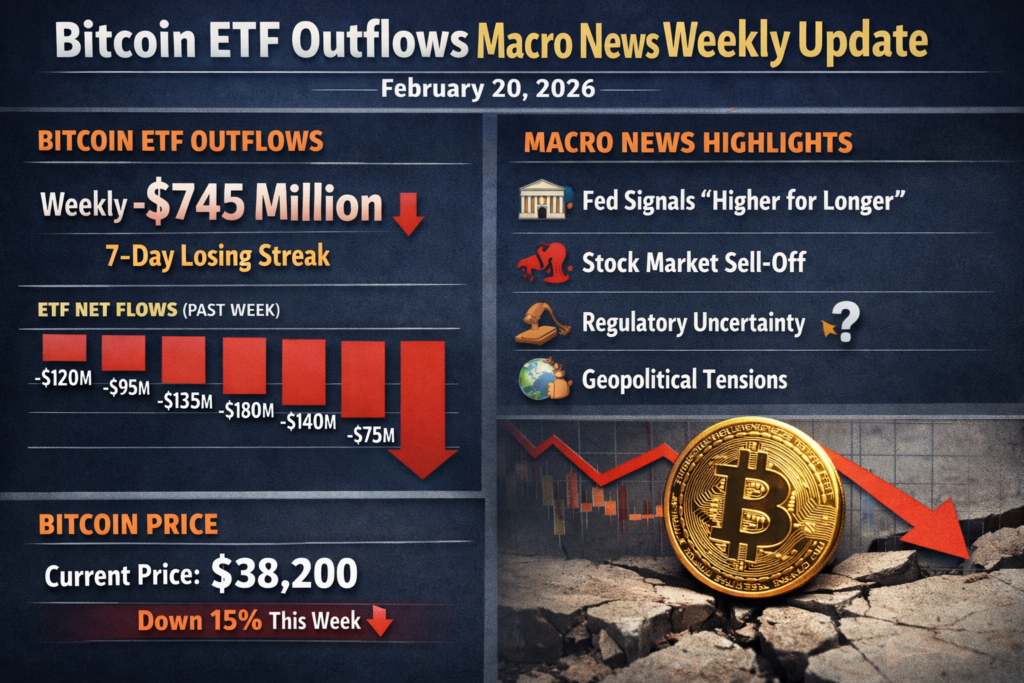

Spot ETF Outflows Near Five Straight Weeks

Research tracking US spot Bitcoin ETFs shows four consecutive weeks of net outflows, totaling several billion dollars, as some institutions trim exposure after last year’s rally. These steady outflows add background sell pressure and help explain why breakouts above $70K have faded quickly.

February Crash Still Fresh

Coverage of last week’s plunge toward $60K has focused on leverage, forced liquidations and Bitcoin-backed loans that could trigger more selling if key supports break again. Many traders still see the $60K zone as the “line in the sand” between a nasty correction and something more serious.

Macro Uncertainty & Rate-Cut Timing

Recent pieces from Barron’s and Reuters highlight how sensitive crypto remains to US inflation data and expectations for the Federal Reserve’s rate path. Mixed data and shifting odds for rate cuts have kept risk appetite fragile, muting follow-through on Bitcoin rallies.

Regulatory Overhang into Q2 2026

New regulatory frameworks for crypto and stablecoins slated for Q2 2026 in major markets are viewed as a long-term positive for institutional adoption, but a short-term uncertainty. Headlines around rule details, enforcement and political pushback can still spark bursts of volatility in either direction. ([Yahoo Finance][8])

On-Chain, Derivatives & Sentiment: Cautious Stabilization

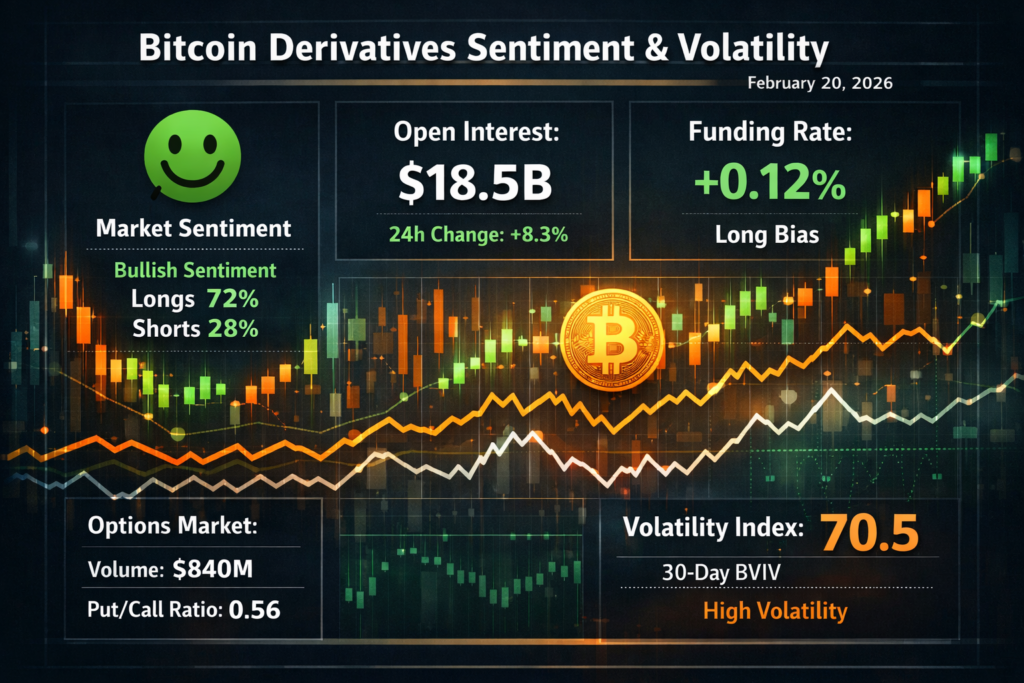

Derivatives and sentiment data this week suggest stabilization, not euphoria:

Implied vs. realized volatility

Amber Group notes BTC’s main-term implied volatility near ~48%, down from peak fear levels during the crash, implying traders now expect smaller but still meaningful swings.

Futures basis

A recent derivatives desk update pegs BTC’s 90-day futures basis around 3%, indicating a modest, not overheated, bullish bias in derivatives pricing.

Fear & Greed Index

KuCoin’s weekly overview still shows “Extreme Fear” with an index reading near 11, underscoring how fragile sentiment remains despite the bounce from $60K.

Funding and basis are positive but muted, and mood is closer to “relief after panic” than “full-on bull market.”

Bitcoin vs Ethereum and the Wider Crypto Market

The broader crypto market cap is hovering around $2.37T, with Bitcoin dominance at roughly 56–57%. In other words, BTC is still the main driver of crypto market direction.

Over the last week

Bitcoin: up roughly 2–3%.

Ethereum: roughly flat to slightly positive on a 7-day basis, with a range of around $1,940 to $2,085.

So Bitcoin is broadly in line with, or slightly ahead of, other majors, but the whole market is still digesting February’s correction rather than launching into a strong, broad-based rally.

What This Means for Traders & Long-Term Holders

Reminder

None of the following is financial advice. Always do your own research and speak to a licensed professional before investing.

For Active Traders (Not Advice)

Price is range-bound between roughly $65K and $71K, with volatility lower than last week but still elevated compared with quiet periods.

A clear move above $70K–$71K or below $65K–$60K is likely to set the tone for the next directional leg.

ETF flows and macro headlines remain the key short-term catalysts; sharp moves can still appear around major economic data releases and central bank commentary.

Options data suggests markets are pricing in swings, but not another immediate capitulation, which may influence how traders think about position sizing and hedging.

For Longer-Term Holders

Structurally, Bitcoin remains the dominant asset in crypto, with market dominance above 56% and a market cap north of $1.3T.

The latest drawdown is painful but not unusual in Bitcoin’s historical volatility profile; similar percentage pullbacks have occurred in previous cycles.

Regulatory developments in 2026, especially in major markets, could strongly influence institutional adoption, ETF demand and the overall narrative—both upside and downside scenarios exist.

Many long-term investors use periods like this to revisit their thesis, diversification and time horizon instead of reacting solely to week-by-week moves.

Scenarios, Risks

Bullish Scenario

If ETF outflows slow or flip back into sustained inflows, macro data turns supportive for risk assets, and BTC can reclaim and hold above $70K–$74K, a gradual grind higher toward the mid-$80Ks and beyond becomes a realistic medium-term scenario. ([Arkham][4])

Neutral Scenario

Bitcoin oscillates between roughly $60K and $75K, reacting in a choppy way to macro data, regulation headlines and ETF flows. Volatility stays moderate, and range trading dominates as neither bulls nor bears gain full control.

Bearish Scenario

A decisive break below $60K combined with ongoing ETF outflows, tighter financial conditions or negative regulatory surprises could open the door toward the low-$50Ks, levels some analysts have already flagged as possible in a deeper correction.

To Sum Up

Bitcoin has spent this week proving that panic can fade faster than it feels in the moment. Price is still stuck between familiar support and resistance, but the aggressive liquidations of the February crash have cooled, and markets are back to watching ETF flows, macro data and key levels around the mid-to-high $60Ks instead of bracing for freefall.

For now, this Bitcoin weekly update is about respecting the range, not chasing a trend that isn’t there yet. Whether you’re a short-term trader or a longer-term holder, sizing risk, knowing your invalidation levels and staying disciplined matters more than guessing the next candle. As always, this is not financial advice do your own research and speak with a licensed professional before making any investment decisions.

FAQs

Q : Why did Bitcoin move between about $65K and $71K this week?

A : Bitcoin spent the week consolidating after last week’s sharp sell-off toward $60K. Dip-buying interest around $65K provided support, while repeated attempts to clear $70K–$71K met selling pressure, partly due to ongoing ETF outflows and cautious macro sentiment.

Q : What are the key Bitcoin support and resistance levels right now?

A : On the downside, $65K is the first important support, followed by the psychologically critical $60K zone, which marked last week’s crash low. On the upside, $70K–$71K is the immediate resistance band, with $74K–$75K as the next major area where sellers previously stepped in.

Q : Is Bitcoin outperforming other major cryptocurrencies this week?

A : Over the past 7 days, Bitcoin has gained roughly 2–3%, while Ethereum and several other large-caps have been flat to slightly positive. That leaves BTC broadly in line with or modestly ahead of other majors, though the overall market remains in a post-correction consolidation rather than a strong uptrend.

Q : What are the main short-term risks for Bitcoin right now?

A : Key short-term risks include continued or accelerating ETF outflows, a break below the $60K support area, and negative surprises from macro data or upcoming regulatory actions. Any combination of these could trigger renewed liquidations and push volatility higher again.

Q : Is Bitcoin too volatile for long-term investors after the February crash?

A : Bitcoin is still a highly volatile asset, and the February drop is a clear reminder of that risk. Similar or larger percentage drawdowns have occurred in past cycles, and some long-term investors view these moves as part of Bitcoin’s long-term profile rather than one-off anomalies. Whether this level of volatility is acceptable depends on each investor’s risk tolerance, time horizon and diversification, so it’s important to seek professional advice before deciding on any allocation