Bitcoin (BTC) Weekly Update Price Analysis This Week (13 Feb 2026)

Bitcoin (BTC) has slipped into “chop mode” this week still volatile, but no clear runaway trend. Prices are hanging around the mid-$60k region after a wild start to 2026. (See also: [Internal link: Weekly Market Updates archive])

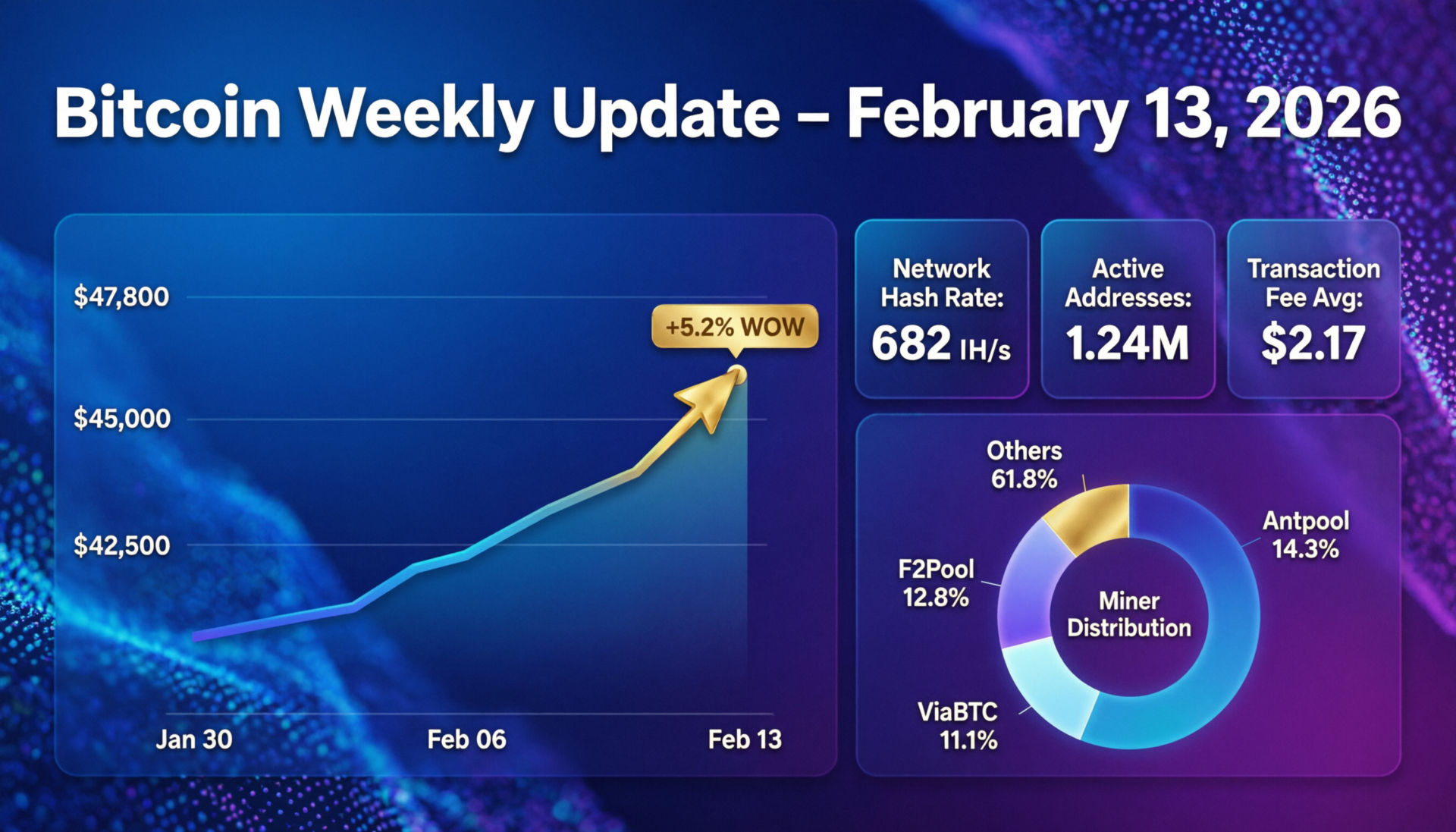

As of 13 Feb 2026, Bitcoin is trading near $66.9k, with a 7-day gain of roughly +1–2% and a weekly range between about $64.8k and $71.5k.

That range points to continued consolidation after the sharp late-2025 correction. The main drivers this week are spot ETF outflows, derivatives deleveraging, and a cautious macro backdrop, with key short-term levels around $65k–$64.5k (support) and $71k–$72k (resistance). A lasting break above or below this band is likely to set up the next major move.

Key Data Snapshot (13 Feb 2026, 10:32 UTC)

Current price: ≈ $66,859

Source: CoinMarketCap & major exchanges.

24h change: roughly -1–1.3% (mildly red day)

7d change: roughly +1–2% (slightly positive week)

7d high / low: $71,450 / $64,762

Market cap: ≈ $1.33T

24h spot volume: ≈ $45B

BTC dominance: just above 50% of total crypto market cap (still the clear market leader)

Stock market information for Bitcoin (BTC)

Bitcoin is listed as a crypto asset in the CRYPTO market.

The price is 66859.0 USD currently, with a change of -848.00 USD (-0.01%) from the previous close.

The intraday high is 68318.0 USD and the intraday low is 65148.0 USD.

(Exact figures may vary slightly across exchanges and data providers.)

At the post this time

This Week in Bitcoin Quick Summary

The Bitcoin (BTC) weekly update for mid-February 2026 captures a market that’s stuck between narratives. BTC has spent the last seven days bouncing between roughly $64.8k and $71.5k, with buyers and sellers taking turns but neither side fully in control.

ETF flows flipped back to sizeable outflows, derivatives leverage was flushed out after early-February liquidations, and macro commentary is leaning toward a sideways accumulation phase that could stretch into mid-2026.(For background on how ETFs affect BTC, see.

Bitcoin Price Action & Key Levels

Weekly performance

Over the last week, Bitcoin has:

Traded in a $64.8k – $71.5k range.

Logged a net 7-day gain of roughly +1–2% despite some sharp intraday reversals.

Pulled back about 1% over the last 24 hours, currently sitting near $66.9k.

Zooming out, BTC is still well below its October 2025 all-time high near $126k, but it continues to command a market cap north of $1.3T and remains the dominant asset in crypto.

Short-term technical view

From a non-advisory, purely analytical perspective:

Immediate support:

The $65k–$64.5k zone, close to this week’s low and a recent demand area where dip buyers have stepped in.

Deeper support:

The low-$60k region if current support fails, overlapping with prior consolidation after the late-2025 correction.

Near-term resistance:

The $71k–$72k area, lining up with this week’s high and the upper edge of the recent range.

Volatility has cooled off compared with early February, when cascading liquidations wiped out billions in leverage. Still, derivatives metrics show a market that can move quickly if a new macro or regulatory story catches fire.

News & Narratives Moving Bitcoin This Week

Several storylines are shaping this week’s Bitcoin (BTC) weekly update

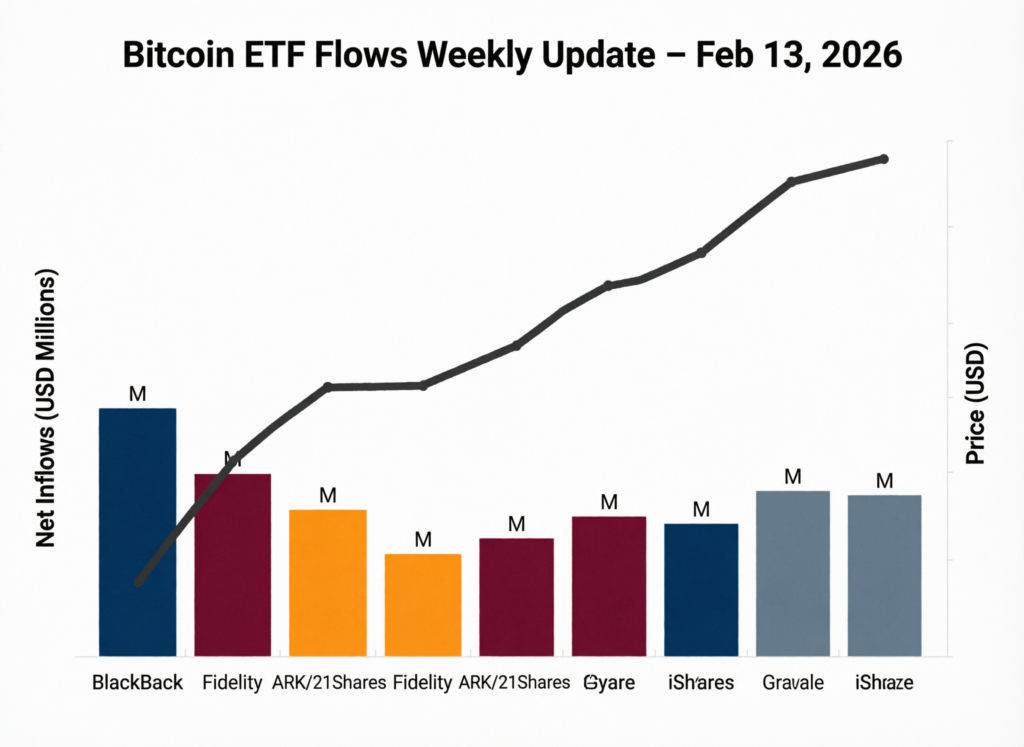

ETF flows flip back to outflows

Digital asset funds recently recorded about $1.7B in outflows, with U.S. spot Bitcoin ETFs alone seeing roughly $410M of outflows in a single day.That kind of institutional selling pressure has made it harder for rallies to extend, even when spot demand looks healthy.

“Chop season” after violent volatility

CoinMarketCap’s research desk describes BTC as having “chopped” this week, up around 1.5% after two highly volatile weeks, which fits the current tight range and mixed sentiment.

JPMorgan revises its Bitcoin “production cost floor”

Analysts at JPMorgan cut their estimated Bitcoin production cost floor to about $77k, hinting that miners could stay under pressure and that the market might tolerate lower prices before cost-based support becomes a major factor.

Binance completes a $1B BTC accumulation for its emergency fund

Binance finalised a purchase that brings its SAFU fund to 15,000 BTC, roughly $1B at current prices a reminder that large industry players still want substantial BTC reserves on their balance sheets.

Miners diversify into AI infrastructure

A separate analysis notes miners shifting about $800M into AI-related infrastructure, as pure BTC mining margins tighten post-halving and post-ATH.This diversification underscores how mining economics are evolving as the cycle matures.

On-Chain, Derivatives & Sentiment

Derivatives and on-chain data add more color to this week’s Bitcoin price analysis:

Open interest reset

Open interest has shrunk sharply versus early-2026 levels. One analytics summary highlights a ~42% drop (about $15B) in BTC open interest over recent weeks, pointing to substantial deleveraging.

Futures positioning

Coindesk reports BTC futures open interest around $15–16B, still sizeable but well below peak levels, reflecting a more cautious stance from leveraged traders.

Funding and short interest

Some derivatives venues continue to show negative funding and elevated short positioning, which leaves the door open for a short squeeze if spot demand suddenly accelerates but it also means downside can extend if key support breaks.

Put together, sentiment sits somewhere between cautiously bearish and neutral. Leverage is lower and panic has faded, but ETF outflows and macro uncertainty are keeping a lot of participants in “wait-and-see” mode.

Bitcoin vs. the Wider Crypto Market

Relative to the rest of crypto.

BTC is still the heavyweight, with market-cap dominance just over half of total crypto value.

Major large caps have mostly mirrored Bitcoin’s sideways action, with little sign of sustained rotation into high-beta altcoins while ETF flows are negative and global liquidity feels tight.

In this kind of backdrop, markets tend to favor range-trading and gradual accumulation (for those who use such strategies) over aggressive trend-chasing though that can flip quickly if macro or regulatory news surprises the market.

What This Means for Traders & Long-Term Holders

For short-term traders (not financial advice)

Keep an eye on $65k–$64.5k as immediate support and $71k–$72k as near-term resistance. ([CoinGecko][1]) These levels define the current range where many intraday strategies are anchored.

ETF flows and derivatives funding remain key intraday catalysts. Persistent outflows and negative funding have often coincided with downside tests or failed breakouts.

With open interest lower, there’s less risk of huge liquidation cascades than we saw in early February, but also fewer oversized moves driven purely by leverage resets.

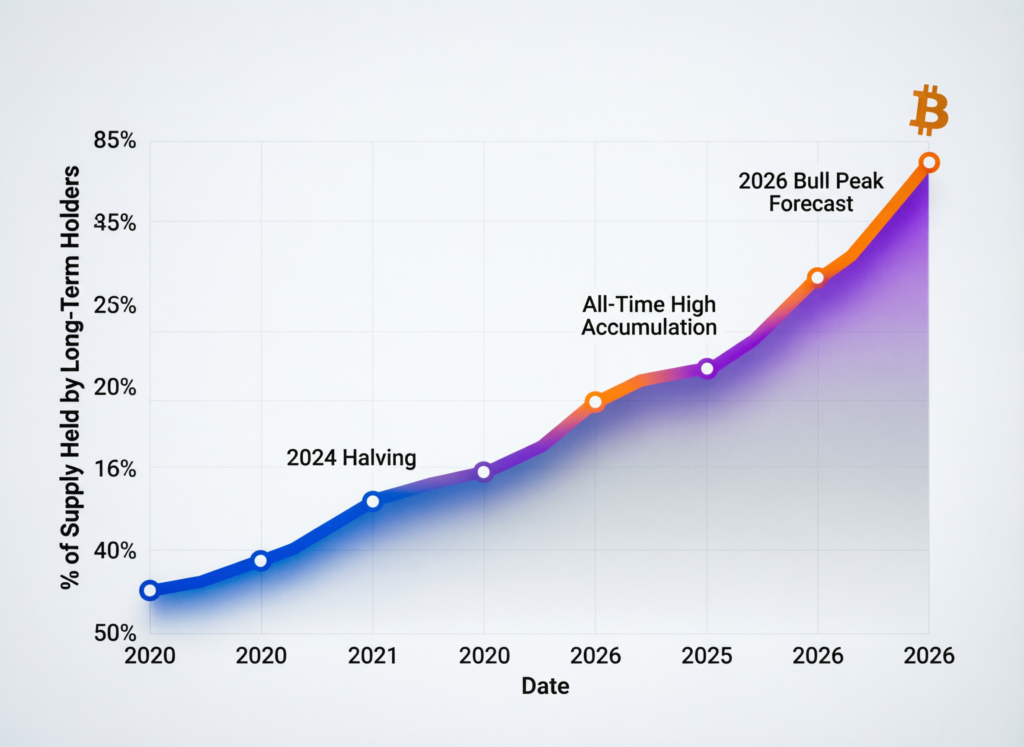

For long-term holders

BTC still looks like it’s in a post-ATH consolidation phase, trading roughly 45% below its late-2025 peak while maintaining structural dominance.

Longer-term themes ETF adoption, miners’ shifting economics and institutional treasury use continue to underpin the multi-year narrative, even when weekly candles look messy.

Long-horizon investors usually pay more attention to multi-year cycles, evolving regulation and global liquidity than to week-by-week price moves.

Risks, Scenarios.

No Bitcoin (BTC) weekly update is complete without thinking in scenarios rather than certainties:

Bullish scenario

BTC holds above $65k, ETF outflows slow, derivatives funding normalises and macro data improves. In that case, the market could set up another test of $70k+, with an eventual push toward the mid-$70k region if momentum really returns.

Neutral scenario

BTC continues to range between roughly $60k and $72k, as liquidity remains patchy and investors wait for clearer signals from macro data, central banks and ETF flows.

Bearish scenario

Persistent ETF outflows, a fresh risk-off wave in global markets or new regulatory shocks push BTC convincingly below the low-$60k band, opening the door to deeper downside and more pressure on miners.

Last Words

This Bitcoin (BTC) weekly update shows a market still trapped in a broad consolidation zone, with price holding the mid-$60k region and key levels clustered between the low-$60ks and low-$70ks. ETF outflows, reduced leverage and a cooler macro mood are capping momentum but also preventing the kind of panic we saw earlier.

For now, Bitcoin price analysis this week still favors a range-driven environment rather than a clear bull or bear trend. Traders may keep focusing on support, resistance and flows, while long-term holders are likely to watch multi-year narratives, regulation and liquidity instead of reacting to every move inside this band.

FAQs

Q : Why did Bitcoin move mostly sideways this week?

A : Bitcoin’s price spent the week consolidating between roughly $64.8k and $71.5k, following a stretch of heavy liquidations and ETF-driven volatility earlier in the month.With leverage reduced and ETF flows choppy, the market is effectively in “wait mode” rather than a strong directional trend.

Q : What are the key Bitcoin support and resistance levels right now?

A : In the very short term, many analysts are watching $65k–$64.5k as a key support zone because it lines up with this week’s low and a recent demand area. On the upside, the $71k–$72k band is the first resistance zone, and a decisive break beyond that could clear space toward the mid-$70k region.

Q : How important are ETF flows for Bitcoin in this week’s market?

A : ETF flows remain one of the main sentiment drivers. Recent data shows around $1.7B in outflows from digital asset funds and about $410M in outflows in a single day from U.S. spot BTC ETFs.These flows don’t control every tick, but they strongly influence whether rallies get real follow-through or fade quickly.

Q : What do derivatives and on-chain metrics say about Bitcoin right now?

A : Derivatives data shows a much less leveraged market: one report estimates a ~42% drop, or around $15B of BTC futures exposure wiped out in recent weeks.Funding has sometimes turned negative and short interest remains elevated on some venues, pointing to cautious or mildly bearish positioning with the potential for sharp squeezes if positive news hits.

Q : Is Bitcoin still considered high risk at these levels?

A : Yes. Bitcoin remains a high-volatility, high-risk asset, even in quieter weeks: it still trades in wide ranges and reacts quickly to ETF flows, macro data and regulatory headlines. Both short-term traders and long-term investors should treat BTC as a speculative asset class and size positions conservatively according to their own risk tolerance.