Bitcoin (BTC) Weekly Update: ETF Outflows, Risk-Off Macro and Key Levels to Watch January 23, 2026

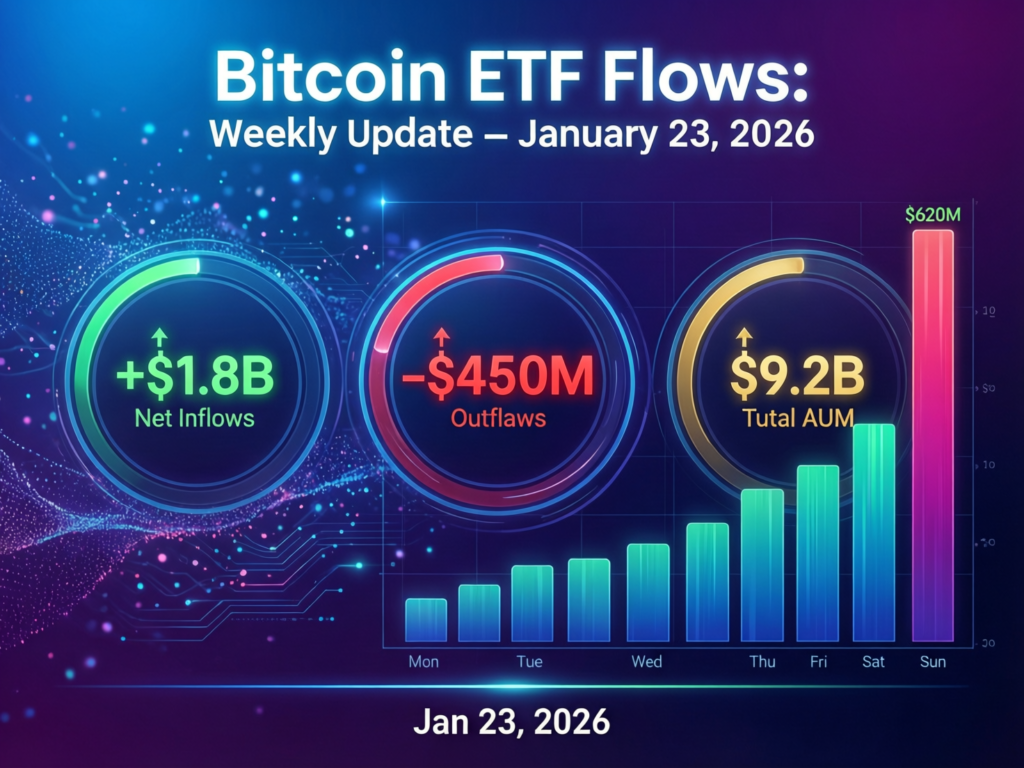

Bitcoin is hovering near $89,000, sliding about 6–7% over the past week and trading inside a seven day band of roughly $87,653 to $95,520. The pullback reflects a brief wave of global risk off sentiment that dragged prices under the $90,000 mark before stabilizing. At the same time, U.S. spot bitcoin ETFs have shifted into heavy weekly outflows near $1.2 billion, signaling reduced institutional appetite and short term caution across crypto markets.

On the chart, immediate support is concentrated around the $87,000 to $88,000 zone, where buyers previously stepped in. A decisive break below could invite deeper consolidation, while upside resistance is clustered near $92,000 to $95,500. Traders are watching volume, ETF flows, and macro headlines for confirmation of the next directional move. Volatility may remain elevated during upcoming data.

Key Data Snapshot (as of 23 January 2026, 11:47 UTC)

Current price: ≈ $89,100.

CoinMarketCap: $89,107.79; our market feed: ~$89,143.

24h change: about -0.8% to -1.1%.

7d change: around -6.5%.

7d high / low: $95,520 – $87,653.

24h high / low: roughly $90,250 – $88,400.

Market cap: ≈ $1.78T.

24h volume: ≈ $35–36B.

Bitcoin dominance: about 57.5% of total crypto market cap (CoinGecko)

Main data sources: CoinMarketCap, CoinGecko, Binance, Bitbo, Coinbase, CoinDesk, Glassnode, VanEck, MacroMicro.

Intraday Market Snapshot for Bitcoin (BTC)

Bitcoin is a cryptocurrency trading in the CRYPTO market.

The price is approximately $89,143.0 with a change of about -$812.00 (around -0.01%) from the previous close.

Intraday high: ~$90,141.0

Intraday low: ~$88,523.0

This Week in Bitcoin (BTC) Quick Summary

This Bitcoin (BTC) weekly update finds BTC consolidating just below the psychological $90k mark after a choppy, risk-off week. Prices pulled back from highs near $95k toward the high-$80k zone, leaving BTC down mid-single digits on the week as global risk sentiment soured and leveraged longs were flushed out. (CoinGecko)

The main storyline: spot bitcoin ETF flows flipped from strong inflows earlier in January to significant outflows this week, lining up with a spike in liquidations and a rotation into traditional safe havens such as gold. (Yahoo Finance) On-chain data shows network activity still muted versus cycle highs but gradually stabilising, pointing more toward consolidation than an outright breakdown.

Bitcoin Price Action & Key Levels

Weekly Performance

Over the past 7 days, Bitcoin has traded in a wide band of roughly $87,653–$95,520, with most spot markets now clustering around $89k. Across major venues, this translates into a 7-day decline of about 6–7%, reflecting a shift from ETF-driven optimism to short-term profit-taking and risk reduction.

Intraday volatility remains notable: 24-hour ranges continue to span about $2k per day, even though realized volatility has cooled compared with the most explosive phases of the 2025 bull leg.

Short-Term Technical View (Not Financial Advice)

From a purely price-action perspective (no signals implied)

Trend

BTC appears to be in a shallow corrective phase within a broader uptrend, still trading comfortably above its major 2025 breakout levels despite the recent pullback.

Support.

First support sits around the $88k area (recent 24h lows).

Deeper support is near the 7-day low around $87.6k; losing this zone could open room toward mid-$80k liquidity pockets.

Resistance.

Immediate resistance comes in at $92k–$94k, where sellers repeatedly capped bounces earlier in the week.

Above that, $95k–$96k aligns with last week’s highs and the top of the recent range.

Volatility

7-day volatility metrics show elevated but not extreme swings, typical of a consolidation phase after strong prior gains.

For traders watching this Bitcoin (BTC) weekly update, the battle between the $87k–$88k support band and the $94k–$96k resistance zone is central to the near-term outlook.

News & Narratives That Moved BTC This Week

ETF flows flip to outflows.

U.S. spot bitcoin ETFs saw about $1.22B in weekly outflows, the largest since November, as risk-off sentiment returned. Historically, similar outflow spikes have sometimes preceded short-term rebounds, but the pattern is far from guaranteed.

Macro risk-off and liquidations.

A global macro wobble – including tariff headlines and rising bond yields – helped drag BTC below $90k, alongside reports of $700M+ in futures liquidations and heavy single-day ETF redemptions.

From strong inflows to rotation.

Earlier in January, crypto investment products recorded over $2B in net inflows, led by bitcoin, before flows turned negative in the latest week. The quick swing highlights how fast institutional positioning can rotate when macro conditions and sentiment shift.

New “currency debasement” ETF includes BTC.

Bitwise and Proficio launched an ETF mixing gold, bitcoin and other “hard currency” assets as a hedge against fiat debasement, reinforcing BTC’s long-term macro narrative even in the middle of short-term turbulence.

On-Chain, Derivatives & Sentiment

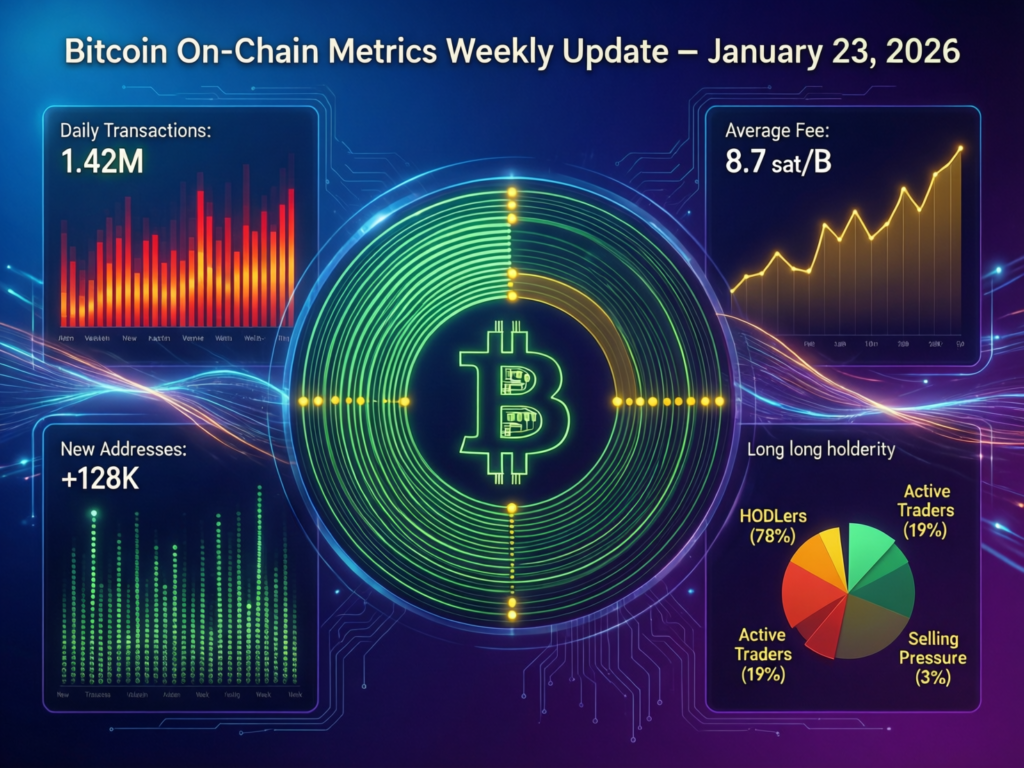

On-chain signals this week are mixed but not alarming.

Network activity.

VanEck’s mid-January Chain Check notes active addresses down ~6%, new addresses down ~4% and daily network revenue down ~15% over 30 days, pointing to softer blockspace demand compared with the most active phases of the cycle.

Stabilising usage.

Glassnode’s Week 4 “BTC Market Pulse” characterises activity as subdued but stabilising, with active addresses improving gradually and transfer volume trending higher – consistent with a consolidation phase rather than euphoric blow-off or capitulation.

Active addresses level.

MacroMicro data shows the 7-day moving average of active addresses around 660k, below cycle peaks but well above bear-market lows.

Exchange balances & flows.

Recent analysis still points to continued net outflows of BTC from exchanges earlier in January, hinting at a bias toward longer-term holding even as price chops around.

Funding rates & leverage.

Derivatives data indicates funding rates oscillating around neutral with occasional negative prints, suggesting a reset in aggressive long positioning and a more balanced futures market after this week’s liquidations.

Sentiment-wise, community polling on major trackers remains modestly bullish overall, though the ETF-outflow headlines have clearly cooled short-term enthusiasm.

Bitcoin vs the Rest of the Crypto Market

Relative to the broader crypto space, Bitcoin remains the dominant driver, with ~57.5% market dominance and a market cap around $1.78T out of an estimated global crypto cap near $3.1T.

On a 7-day basis, BTC’s -6–7% pullback is roughly in line with, or slightly better than, many high-beta altcoins, which typically fall harder during risk-off stretches. Large-cap ETH and several other majors have posted similar or marginally worse performance, leaving BTC’s dominance little changed week-on-week.

What This Means for Traders & Long-Term Holders

For Short-Term Traders (Not Advice)

Expect continued intraday ranges of roughly $1.5k–$2k while the market digests ETF flows and macro headlines.

Watch $87k–$88k as a key near-term support band; repeated tests without breakdown could invite short-covering and range-trading strategies.

Upside bounces face resistance in the $92k–$96k band, where sellers have repeatedly taken profit and where the 7-day high near $95.5k sits.

Funding and open interest have reset after this week’s liquidations, reducing “one-sided” positioning risk but not removing macro uncertainty.

For Long-Term Holders

Structurally, BTC is still well above 2024–2025 cycle base levels despite the latest pullback; the drawdown so far is modest compared with past bull-market corrections.

ETF developments highlight both sides of institutional adoption: strong inflows when conditions are favourable, but also sizable redemptions when risk appetite fades.

On-chain indicators suggest a cooling but broadly healthy network, with usage and transfer volume consolidating rather than collapsing.

Miner dynamics including soft spots in hash rate and some pivot toward AI-related workloads are worth watching but have not yet signalled systemic stress.

Risks, Scenarios.

Bullish scenario.

BTC holds the $87k–$88k support zone, ETF flows stabilise or turn modestly positive, and improving on-chain activity helps push price back through $95k, reopening the path toward prior highs.

Neutral scenario.

Price continues to range between high-$80k and mid-$90k, with mixed ETF flows and sideways on-chain metrics as the market waits for clearer macro signals on rates, regulation and broader risk sentiment.

Bearish scenario

A deeper macro or regulatory shock aligns with renewed ETF outflows, dragging BTC below the $87k zone and triggering another wave of liquidations, which could extend the correction toward prior consolidation areas.

Wrapping It Up

Bitcoin’s latest move looks less like the end of a cycle and more like a classic post-rally cooldown. As this Bitcoin (BTC) weekly update shows, price is chopping between $87k $96k, ETF flows have turned cautious, and on-chain metrics signal consolidation rather than capitulation. In other words: the market is catching its breath.

For traders, that means respecting key levels and volatility; for long-term holders, it means focusing on structure, not headlines. Flows, macro and derivatives can all flip quickly in either direction. This is not financial advice always do your own research and size risk carefully.

FAQs

Q : Why did Bitcoin (BTC) drop below $90k this week?

A : Bitcoin slipped under $90k as global markets shifted into risk-off mode, with rising bond yields and geopolitical headlines pushing investors toward traditional safe havens like gold. At the same time, U.S. spot bitcoin ETFs saw large weekly outflows and futures markets experienced hundreds of millions of dollars in liquidations, amplifying downside pressure.

Q : What are the most important Bitcoin price levels to watch right now?

A : In the very short term, traders are watching $87k–$88k as a key support band, close to this week’s lows. On the upside, the $92k–$96k region has acted as resistance, capping bounces and aligning with the 7-day high near $95.5k. A sustained move beyond either boundary could define BTC’s next directional leg.

Q : How did ETF flows impact Bitcoin this week?

A : After strong inflows earlier in January, U.S. spot bitcoin ETFs recorded about $1.2B in net outflows this week – the largest since November. These redemptions reduced buy-side support, added to volatility, and signalled that some institutional holders were trimming exposure amid macro uncertainty.

Q : What do on-chain metrics say about Bitcoin’s health right now?

A : On-chain data paints a consolidation picture: active and new addresses are down modestly on a 30-day basis, but overall activity remains far above bear-market levels. Transfer volume is gradually improving, exchange balances have trended lower over recent weeks, and no acute stress is visible in core metrics, suggesting the network remains structurally healthy.

Q : Is Bitcoin still considered high risk after this week’s move?

A : Yes. Despite its growing institutional adoption and ETF presence, Bitcoin is still treated as a high-risk asset by most market participants. This week underscored that reality: when macro fear rose, capital moved out of BTC toward bonds and precious metals, and BTC’s volatility remained much higher than that of traditional safe-haven assets.