Bitcoin Breaks $126K, What For XRP, ETH, ADA as Shutdown Fears Keep Bulls in Control

Bitcoin surged past $126,000, marking a new all-time high near $126,223 on October 7 as strong ETF inflows and shrinking on-exchange supply fueled renewed momentum. The rally underscored growing institutional demand, with traders positioning for further upside as liquidity tightened across major platforms.

The breakout came amid a softer U.S. dollar, political uncertainty from a government shutdown, and improving risk sentiment across global markets. Altcoins followed the bullish trend, with Ethereum, Binance Coin, and Solana all advancing, while XRP held steady near the $3 mark. The combination of macro tailwinds and tightening Bitcoin supply reinforced optimism that digital assets may be entering a fresh expansion phase, supported by sustained investor interest and favorable market conditions.

ETF flows, supply squeeze, and macro backdrop

Spot ETF bid

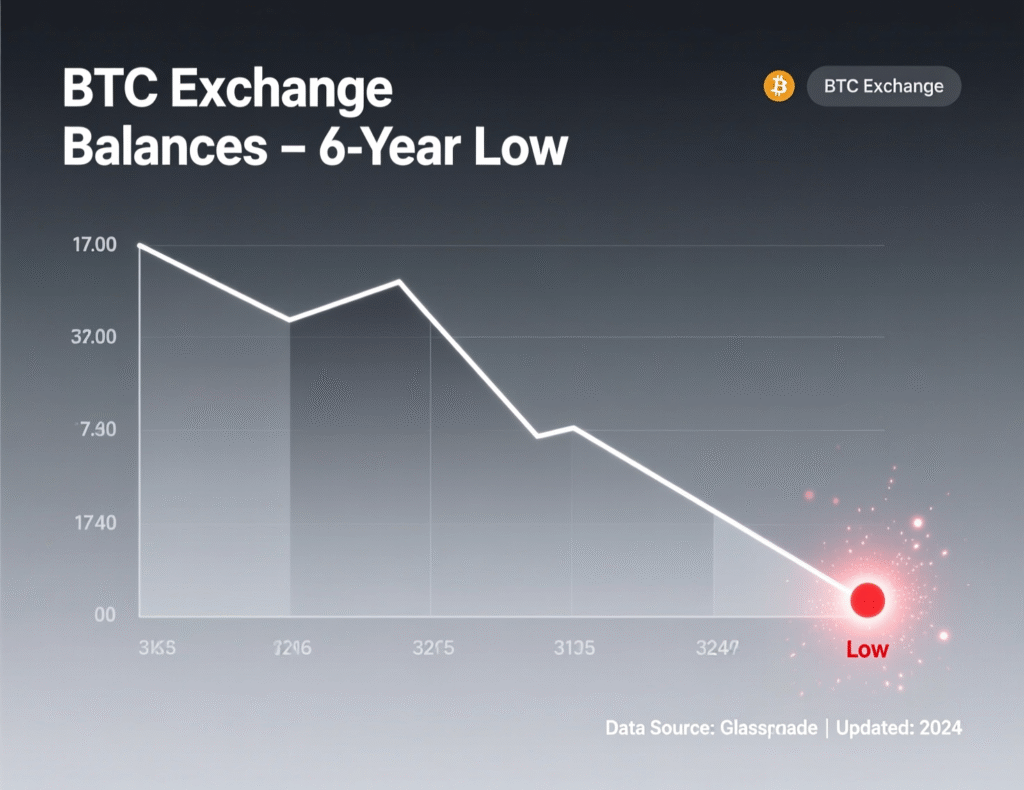

U.S. spot Bitcoin ETFs drew about $3.2B in net weekly inflows, the strongest since Nov. 2024 and the second-largest on record, according to SoSoValue-tracked data summarized by multiple outlets.Shrinking on-exchange supply

BTC exchange balances slid to ~2.83M BTC (six-year low), with ~170K BTC leaving venues in the past month consistent with long-term storage trends.Macro assist

With the U.S. shutdown entering week two and the dollar easing on a multi-week basis, liquidity expectations turned more supportive for risk assets.

What “Bitcoin breaks $126K” signals for majors

ETH

Reclaimed the $4.7K area; momentum eyes the $4.8K–$5K band if BTC stability persists.BNB

Continued to outperform, printing fresh records above ~$1,200–$1,240 as rotation favored ecosystem names.XRP

Hovered near $3, with mixed probes above/below the level in recent sessions.SOL/DOGE

Broad-based bid—SOL extended 7-day gains; DOGE pushed toward $0.26 amid improved beta.Market breadth

Total crypto cap approached $4.24T before a modest pullback; sentiment sat in “greed” (index ~71).

Technical context: “Bitcoin breaks $126K” across currencies

BTC’s USD record coincided with EUR and CHF highs (≈EUR 106k, CHF ~99.6k–100k) and a yen record as Japan’s new PM signaled Abenomics-style easing—reinforcing the global breadth of demand. Yahoo Finance+3CoinDesk+3Investing.com+3

<section id=”howto”> <h3>How to track ETF flows and on-exchange supply during rallies</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Check a trusted ETF dashboard (e.g., SoSoValue) for daily/weekly net inflows and cumulative totals.</li> <li id=”step2″><strong>Step 2:</strong> Monitor on-chain analytics (e.g., Glassnode via reliable reports) for exchange balance trends.</li> <li id=”step3″><strong>Step 3:</strong> Cross-reference price action with USD and non-USD pairs (EUR/CHF/JPY) to gauge global breadth.</li> <li id=”step4″><strong>Step 4:</strong> Overlay macro signals—DXY moves, policy headlines (e.g., shutdown updates)—to assess liquidity tone.</li> <li id=”step5″><strong>Step 5:</strong> Set alerts for key levels (BTC ATH zones; ETH $4.8–$5K; XRP $3) and reassess when ETF flow regimes shift.</li> </ol> <p><em>Note: Process may vary by data providers. Confirm sources and timestamps before acting.</em></p> </section>

Context & Analysis

The flow-plus-supply dynamic ETF accumulation versus shrinking exchange reserves—remains the dominant driver of BTC’s price discovery. Historically, large weekly inflows can mark either trend continuation or local tops depending on positioning; recent $1B-plus single-day inflows have sometimes preceded near-term peaks. For alts, sustained BTC consolidation above prior highs tends to favor rotation (BNB outperformance illustrates this), while a sharp BTC drawdown could compress beta quickly, especially in XRP/ETH high-beta pairs.

Conclusion

Bitcoin’s surge to around $126,000 highlights rising institutional demand amid a tightening supply backdrop. The rally reflects confidence driven by ETF inflows and reduced exchange balances, signaling continued investor interest in digital assets despite macro uncertainty.

In the near term, traders should monitor ETF flow momentum, exchange reserves, and the U.S. dollar’s direction as key drivers. Sustained positive flows and sideways consolidation could keep major altcoins like ETH, BNB, SOL, and XRP on an upward path, while a pullback in flows or a stronger dollar may limit risk appetite and pause the current market momentum.

FAQs

Q : Why did Bitcoin rally now?

A : Strong spot ETF inflows, shrinking exchange balances, and supportive macro (shutdown uncertainty, softer dollar) aligned to tighten supply.

Q : Does ‘Bitcoin breaks $126K’ mean altcoins will keep rising?

A : Not guaranteed; if BTC consolidates with continued ETF inflows, alts often catch a bid. A sharp BTC reversal can pressure alts first.

Q : Is the dollar still a headwind for crypto?

A : Recently the DXY trend softened, aiding risk assets; short-term rebounds are possible, so watch levels near 98–99.

Q : Are new highs confirmed in EUR/CHF?

A : Yes BTC crossed ~EUR 106k and tested CHF ~99.6k–100k in early Oct. 2025.

Q: What data confirms a supply squeeze?

A : Glassnode-referenced figures show ~2.83M BTC on exchanges and ~170K BTC withdrawn over 30 days multi-year lows.

Q : Where does ETH stand technically?

A : ETH reclaimed ~$4.7K; bulls eye $4.8–$5K if momentum holds and BTC stabilizes.

Q : Is sentiment overheated?

A : The Crypto Fear & Greed Index around 71 (greed) suggests optimism but not full euphoria.