Bitcoin and alts set for Fed ‘jolt,’ market isn’t ready: Economist

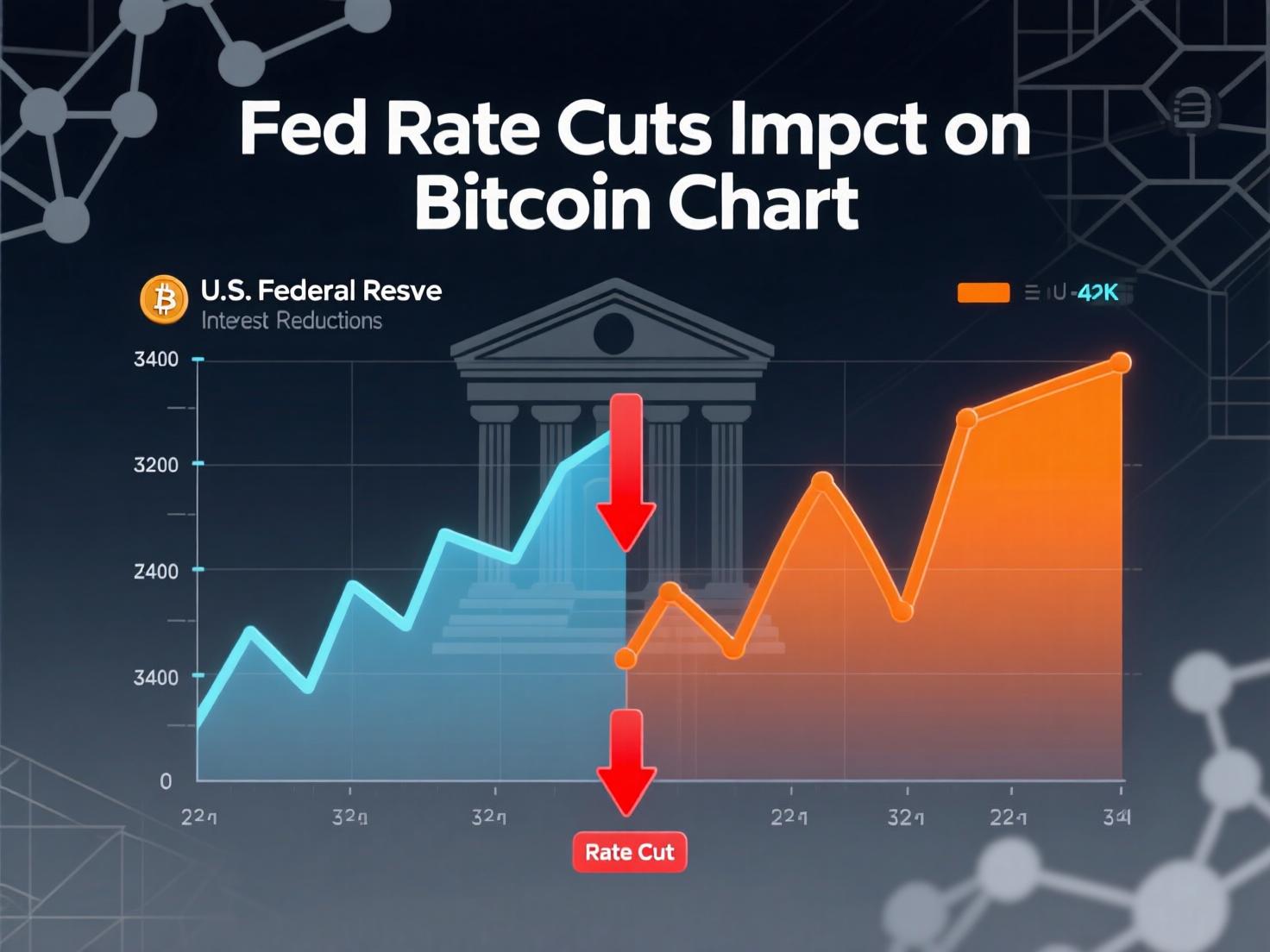

Economist Timothy Peterson believes a quicker-than-expected pivot by the U.S. Federal Reserve could deliver a major boost to Bitcoin. Speaking to Cointelegraph, he explained that markets are currently underestimating the possibility of rapid rate cuts. If the Fed changes course sooner than anticipated, it could create strong upward momentum for digital assets.

Peterson noted that such a surprise move would likely send Bitcoin and altcoins significantly higher within the next three to nine months. With investors bracing for more gradual policy shifts, a sudden wave of rate reductions could catch markets off guard, sparking fresh demand for cryptocurrencies. This potential scenario highlights how closely crypto prices remain tied to macroeconomic signals and central bank policy decisions.

Fed trims rates; markets price in more easing

The Fed delivered its first 2025 cut on Sept. 17, lowering the target range by 25 basis points to 4.00%–4.25%. Stephen Miran dissented in favor of a larger 50 bps move. Chair Jerome Powell reiterated that policy is “not on a preset path,” signaling decisions will remain data-dependent.

Fed rate cuts impact on Bitcoin what analysts say

Derivative markets show elevated odds of another reduction on Oct. 29. Post-meeting snapshots put the probability of a 25 bps October cut around the low-90s. Historically, easier policy supports risk assets as bond yields fall, though crypto’s response can be uneven across cycles.

Why an abrupt path could ‘jolt’ crypto

Peterson argues the Fed rarely eases as gradually as current projections imply; if cuts accelerate, a “surprise effect” could reprice crypto quickly. Bitcoin briefly spiked near $117,000 around the decision window before settling near $115,000, highlighting sensitivity to macro cues.

BTC and altcoins around the Fed

At publication time cited by Cointelegraph, Bitcoin traded near $115,570 after the cut, up modestly over 30 days, with altcoins mixed as traders reassessed the path of policy and liquidity conditions.

EU eyes crypto in Russia sanctions

In parallel to U.S. policy easing, the European Union’s proposed 19th sanctions package would, for the first time, directly include cryptocurrency platforms and restrict related transactions pending unanimous approval by member states. Macro compliance shifts like these can alter crypto flows and liquidity.

FTX Recovery Trust sets ~$1.6B September payout

The FTX Recovery Trust announced a third distribution, targeting Sept. 30 for roughly $1.6 billion to eligible creditors, with funds expected to arrive within three business days of the payment date adding incremental fiat liquidity to parts of the market.

<section id=”howto”> <h3>How to monitor rate-cut odds and crypto signals</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Check the CME FedWatch Tool daily for the next FOMC meeting probabilities.</li> <li id=”step2″><strong>Step 2:</strong> Read the latest FOMC statement and press-conference transcript for tone shifts.</li> <li id=”step3″><strong>Step 3:</strong> Track BTC price/volume around macro events via reputable market dashboards.</li> <li id=”step4″><strong>Step 4:</strong> Watch funding rates, perp basis, and DXY/U.S. yields for cross-asset context.</li> <li id=”step5″><strong>Step 5:</strong> Note regulatory headlines (e.g., EU sanctions) that can affect liquidity channels.</li> </ol> <p><em>Note: Process may vary by provider/source. Confirm requirements before acting.</em></p> </section>

Context & Analysis

Analysis: A “faster cuts” scenario would compress real yields and typically favor risk assets; in crypto, beta often concentrates in BTC first before rotating. However, if cuts coincide with weak growth or tightening liquidity elsewhere (e.g., sanctions or bank-funding stress), performance can diverge across tokens. Markets are also digesting estate-driven flows (e.g., FTX distributions) and structural trends like restaking’s rise, which may shift capital within crypto rather than expand it uniformly.

What to watch next

Two additional cuts remain plausible for 2025, but Powell stressed decisions are data-driven, not pre-set. Traders will zero in on October’s FOMC and any labor/inflation surprises that could steepen or slow the easing path. The Economic Times

Conclusion

The current macro outlook depends largely on how quickly the Federal Reserve decides to ease rates. If the shift comes faster than market models suggest, Timothy Peterson’s “jolt” scenario could play out, with Bitcoin benefiting from stronger liquidity and altcoins showing higher beta moves.

On the other hand, if the Fed maintains a slower, more measured pace, the crypto market may remain range-bound for the time being. Investors would likely wait for clearer signals of policy acceleration before committing to larger positions, keeping momentum subdued until the direction of monetary policy becomes more certain.

FAQs

Q : What is the expected timeline for additional Fed cuts?

A : Futures price high odds of another reduction at the Oct. 29 meeting, with scope for further easing in 2025 if data allow.

Q : How do rate cuts usually affect crypto?

A : Lower yields can support risk assets by reducing opportunity cost, but crypto reactions vary with growth, liquidity, and regulatory headlines.

Q : What did Timothy Peterson say about the outlook?

A : He said markets are underpricing rapid cuts and that a surprise path could “jolt Bitcoin and alts up substantially” in 3–9 months.

Q : Did the Fed say it is committed to a preset pace of cuts?

A : No. Powell said the Fed is not on a preset path; decisions depend on incoming data.

Q : Where can I see probabilities for the next FOMC decision?

A : The CME FedWatch Tool aggregates fed funds futures to show market-implied odds.

Q : What is the FTX Recovery Trust paying in September?

A : About $1.6 billion in a third distribution, targeted for Sept. 30, with funds arriving within three business days.

Q : Does the EU’s latest Russia package include crypto?

A : The proposed 19th package would directly target cryptocurrency platforms for the first time, pending member-state approval.

Q : Is there a Fed rate cuts impact on Bitcoin right now?

A : The immediate effect has been choppy; Bitcoin hovered around $115K after briefly touching ~$117K around the decision window.