Best bitcoin course in Arabic for beginners

Bitcoin education in Arabic helps beginners understand how Bitcoin works, what the major risks are, and how to stay compliant with US, UK and EU rules before sending any money. By following trusted Arabic courses, tutorials and safety checklists, you can avoid scams, respect halal/haram concerns and choose regulated platforms more confidently.

Introduction

If you’re an Arabic speaker living in the USA, UK, Germany or wider Europe, finding trusted Bitcoin education in Arabic can feel surprisingly hard. Most material assumes fluent English or German, uses heavy jargon, and barely mentions halal/haram issues or local regulations like SEC, FCA, BaFin or MiCA.

At the same time, crypto adoption keeps growing: by late 2024, estimates suggest well over 550–650 million people worldwide owned some form of cryptocurrency, with Bitcoin users making up more than half. Yet regulators and consumer bodies repeatedly warn that crypto is high risk and heavily targeted by scammers.

This guide gives you a clear, beginner-friendly roadmap in English with Arabic terms:

a simple explanation of Bitcoin,

key Arabic-friendly resources (courses, tutorials, channels),

safety, security and scam protection,

US/UK/EU regulation context,

halal/haram discussion with Sharia and legal angles,

plus a 30–90 day learning plan you can actually follow.

Whether you’re in New York, London, Berlin, Paris or a MENA hub like Dubai, Riyadh or Cairo, the goal is the same: learn safely in Arabic before you ever click “Buy Bitcoin”.

What Is Bitcoin?

Bitcoin is a digital, borderless currency that lets people send value online without a central bank, using a public network called the blockchain. For Arabic-speaking beginners, the safest approach is to first understand how Bitcoin works, what “wallets” and “private keys” mean, and why regulators in the USA, UK and EU say you should be ready to lose all the money you put in.

Bitcoin basics in plain language for Arabic speakers

At its core, Bitcoin is.

Public ledger (blockchain)

Imagine a shared accounting book that everyone can see. Every time someone sends Bitcoin, the transaction is written into this public ledger (blockchain).

Blocks

Transactions are grouped into blocks. Each block is linked to the previous one, forming a chain.

Miners

Miners are computers that bundle transactions into blocks and compete to solve a math puzzle. When a miner wins, the new block is added to the chain and the miner earns new bitcoins as a reward.

Wallets

A Bitcoin wallet is like a digital bank account, but you control it directly. It holds your public address for receiving Bitcoin and your private key that proves the coins belong to you.

Compared with traditional money in the United States, United Kingdom, Germany or EU, Bitcoin.

doesn’t come from a central bank like the Federal Reserve, ECB or Bank of England,

can be sent across borders 24/7 without bank holidays,

is extremely volatile – its price in dollars or euros can move up or down quickly,

is often treated as a high-risk investment, not a stable savings account.

Key terms every Arabic beginner must know (wallets, private keys, blockchain)

A quick bilingual mini-glossary you’ll see in most Bitcoin education in Arabic content:

Wallet

Software or hardware that stores your keys.

Private key

Secret code that proves ownership of your Bitcoin. Whoever has it, owns the coins.

Seed phrase / backup phrase

12–24 words you write down to recover your wallet.

Blockchain

The public ledger containing all Bitcoin transactions.

Transaction

Sending or receiving Bitcoin.

Rule number one.

Never share your (private key) or seed phrase with anyone.

Not with “support”, not with a “sheikh”, not with a “VIP signal group”.

If someone asks for your seed phrase, they are not helping you they are trying to take your coins.

Risks, volatility and why regulators warn about crypto

Regulators in the USA (SEC, CFTC, FinCEN), UK (FCA) and EU/Germany (BaFin, MiCA) consistently warn that:

crypto assets are high risk,

prices can crash to near zero,

you may be unable to get help if something goes wrong,

scams and fraud are common.

In 2023, the FBI’s Internet Crime Complaint Center recorded crypto investment losses of roughly $4.8 billion in the United States alone.

So from day one, keep this mindset.

Only invest what you can afford to lose and maybe less than that.

Why Bitcoin Education in Arabic Matters Before You Invest

Learning about Bitcoin in Arabic before investing helps you avoid misunderstandings, explore halal/haram questions, and build a safety-first mindset. It also reduces the cultural and language gap many Arabs feel when reading pure English or German crypto content.

Language and culture gaps that confuse Arabic-speaking beginners

Most popular Bitcoin tutorials are in English or German, using terms like “hash rate”, “self-custody” or “segregated witness” without Arabic context. For an Arabic speaker in New York, London or Berlin, this can lead to:

misunderstanding what a wallet really is (thinking it’s like a bank account backed by a government),

ignoring warnings because they’re hidden in long English paragraphs,

signing up to platforms that don’t support Arabic, making support and KYC more stressful.

For example.

An Egyptian student in London might see an English TikTok claiming “guaranteed 20% monthly return in Bitcoin” without noticing the tiny warning.

A Syrian engineer in Berlin may download a German-only wallet app and accidentally approve a malicious transaction because the UI isn’t clear.

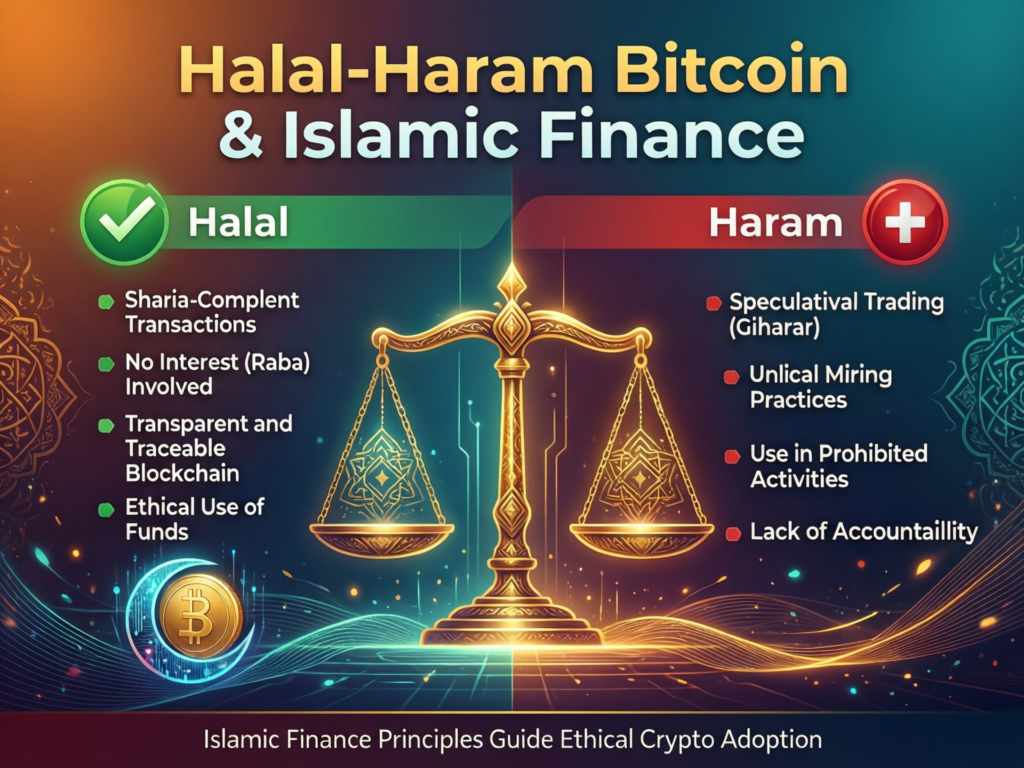

Halal/haram uncertainty and Islamic finance basics

Many Muslims feel stuck between.

scholars who say Bitcoin is closer to a currency or digital asset and may be halal under conditions,

others who say it is too speculative and full of (excessive uncertainty), so it is haram.

Because there isn’t yet a single global fatwa, Arabic speakers in the USA, UK and EU often read contradictory blog posts or Telegram messages. Proper Bitcoin education in Arabic should:

explain riba, gharar, speculation vs real economic use,

link to recognized Sharia boards or Islamic finance institutions,

encourage you to ask trusted scholars who understand both fiqh and modern finance.

How proper Arabic education prevents emotional FOMO and scam losses

Fear of missing out (FOMO) is powerful – especially when you see cousins in Dubai or Riyadh bragging about “huge crypto profits” on Snapchat. Without structured learning:

beginners join anonymous “pump-and-dump” Telegram groups,

believe fake “sheikh-endorsed” projects with AI-generated fatwa screenshots,

send savings to random wallet addresses shared on WhatsApp.

Arabic Bitcoin education that is structured, transparent and slow helps you:

learn basics step-by-step,

recognise hype language like “guaranteed”, “no risk”, “secret strategy”,

avoid relying on TikTok, short clips and anonymous signals as your only “education”.

If you eventually take Bitcoin seriously, you might even want to build your own secure learning platform or app. Partners like Mak It Solutions already help clients design safe fintech and mobile app experiences for MENA users, which is the same stack that could power serious Arabic crypto academies.

Best Bitcoin Education Resources in Arabic.

The best Bitcoin education in Arabic combines structured courses, free tutorials and trusted platforms that are open about who they are, where they’re based, and how they make money. Avoid any resource that hides its team or only talks about “guaranteed profits”.

Free Bitcoin courses and academies in Arabic (online, USA/UK/EU friendly)

When you look for crypto basics Arabic language courses, focus less on brand names and more on checkpoints:

Arabic interface & subtitles: menus, videos and quizzes should be accessible in Arabic.

Regulation-aware content: clear mention of US (SEC, CFTC, IRS, FinCEN), UK (FCA, UK-GDPR) and EU/Germany (BaFin, MiCA, GDPR) frameworks.

Clear risk warnings: phrases like “you can lose all the money you invest” should be front and center, not buried.

Reputable hosts.

university-style MOOCs,

exchange “academies” that are licensed where you live,

NGO financial literacy projects (for example, those that also teach budgeting, debt and saving).

Serious course platforms often sit on mainstream infrastructure like AWS or similar cloud providers for security and scalability, and partner with teams experienced in secure web and app development exactly the kind of architectures Mak It Solutions builds for clients in the USA, UK, Germany and across the EU.

Arabic Bitcoin YouTube channels, podcasts and blogs to follow

For a beginner’s guide to Bitcoin in Arabic, YouTube and podcasts can be excellent – if you choose carefully. Look for:

Education, not hype: playlists like “Bitcoin basics 101 in Arabic”, wallet setup walk-throughs and security deep dives.

Transparent identity: real names, LinkedIn profiles, or collaboration with known institutions or universities.

No “get rich quick”: if every thumbnail screams “100x in 7 days”, move on.

Typical content formats for Arabic learners in London, Berlin or Paris include.

step-by-step videos showing how to install a wallet, write down a seed phrase and send a tiny test transaction,

commuting-friendly podcasts for Arabic speakers in Manchester, Frankfurt or Brussels,

blogs that mix Arabic explanations with screenshots of English-language interfaces.

If you want to see how Mak It Solutions structures deep-dive tech content for Arabic and GCC audiences, check posts like their guides on open source in the Arab world, MENA fintech and mobile app trends, or digital wallets in GCC these show the same long-form, trusted tone you should expect from good Bitcoin education.

How to choose the right Arabic Bitcoin course for you

Before paying for any course billed as “best Arabic Bitcoin course for beginners in USA”:

Check the instructor.

Do they have real finance, computer science or Islamic finance background?

Can you find them on LinkedIn, or are they just a username?

Review hosting & app distribution.

Serious platforms often run on established clouds like AWS, Azure or GCP.

Mobile apps should come from Apple’s App Store or Google Play, which have rules on crypto apps and mining – they don’t allow on-device cryptomining and expect compliance with licensing where relevant.

Check compliance pages.

Does the site show a clear privacy policy referencing GDPR or UK-GDPR for EU/UK learners?

Is there a refund or guarantee policy?

Is there a physical address or at least a company registration number?

Red flags.

payment only in USDT/USDC to a random address,

no mention of where the business is registered,

pressure to “upgrade now or miss out forever”.

How to Start Learning Bitcoin in Arabic From the USA, UK or Europe

If you’re in the USA, UK or EU, you can follow a simple roadmap: learn Bitcoin basics in Arabic, pick a regulated platform, practise with very small amounts, and keep records for tax.

Step-by-step path for Arabic speakers in the USA (regulation, tax basics, KYC)

For Arab Americans in cities like New York, Chicago, Houston or Dearborn:

Learn the basics in Arabic and English:

Combine Arabic video lessons with US-centric resources about SEC, CFTC, FinCEN and IRS rules on “virtual currency”.

Choose a US-compliant, Arabic-friendly platform:

Look for exchanges registered with FinCEN as money services businesses and, where relevant, licensed under NYDFS BitLicense if you’re in New York.

KYC and ID verification tips.

Keep a valid passport or US ID ready.

For recent immigrants, ensure your proof of address (bank statement, utility bill) matches exactly what you enter.

Tax awareness.

The IRS treats crypto as property in most cases – selling, trading or spending can trigger taxable events.

Keep a simple spreadsheet or use a tax app so your future accountant doesn’t hate you.

Learning and using Bitcoin in Arabic in the UK (FCA & Open Banking context)

In the United Kingdom, the FCA classifies many cryptoassets as high-risk, “Restricted Mass Market Investments” and has strict rules for promotions and risk warnings.

For Arabic speakers in London, Birmingham or Manchester:

Use platforms registered with the FCA for anti-money laundering and financial promotions where required.

When linking a UK bank account via Open Banking, only do so with regulated providers think of it like trusting the NHS vs a random clinic’s website; the brand and supervision matter.

Remember UK-GDPR still protects your personal data; choose platforms that explain how they comply.

Learning Bitcoin in German/EU context (BaFin, MiCA and GDPR)

For Arabic speakers in Berlin, Frankfurt, Munich, Hamburg, Paris, Amsterdam or Brussels:

Understand that MiCA, the EU’s Markets in Crypto-Assets Regulation, entered into force in 2023 and becomes fully applicable between 2024–2025.

In Germany, BaFin is the national regulator; many crypto services now require authorisation under MiCA and local laws.

Choose exchanges that clearly state they’re authorised in at least one EU country and reference GDPR in their privacy policies.

If you’re building your own fintech or education platform, you may need help architecting GDPR-compliant data flows and dashboards. This is where partnering with Business Intelligence and web engineering experts (for example, Mak It Solutions’ Business Intelligence Services and web development services) can save months of trial and error.

Is Bitcoin Halal or Haram? Islamic and Legal Perspectives in Arabic

Scholars still differ on whether Bitcoin is halal or haram, so the best approach for Arabic learners is to understand the main arguments, respect local laws, and then follow reputable Sharia guidance that you trust.

Again, none of this is a fatwa. Treat it as background education and always consult qualified scholars.

Main Islamic arguments about Bitcoin in Arabic

Common scholarly views include.

Bitcoin as currency.

If it’s widely accepted as a medium of exchange and not only speculation, some argue it can be treated similarly to foreign currencies, with normal rules of sarf (currency exchange).

Bitcoin as asset.

Treated more like a high-risk asset or commodity; buying and selling may be allowed but large speculation and leverage may be discouraged.

Bitcoin as pure speculation.

Critics say volatility and lack of intrinsic value mean it’s closer to gambling (ميسر) and involves excessive gharar.

Key Sharia concerns.

Riba (interest): borrowing in order to speculate, or earning guaranteed interest via lending platforms.

Gharar (uncertainty): entering contracts you don’t fully understand.

Real use vs speculation: using Bitcoin for real payments vs day-trading with 50x leverage.

Sharia-compliant crypto education and how to evaluate it

When a site claims “Sharia-compliant Bitcoin course”:

Look for a named Sharia board or scholar with verifiable credentials.

Expect published criteria: what they check about volatility, use cases, leverage and platform regulation.

Check whether they reference local law (e.g. SEC or FCA rules) as part of avoiding fraud and money laundering.

Warning signs.

generic “Sharia-approved” badges with no scholar names,

anonymous fatwa PDFs with no date or contact details,

pressure to join a specific trading platform to be “truly halal”.

Combining Sharia guidance with US/UK/EU law

For Muslims in USA, UK, Germany or the wider EU, the reality is:

you must follow local financial and tax laws, and

within that framework, you choose a Sharia position you trust.

Think of it like medical advice: in the UK you trust the NHS for clinical safety, but you might also follow cultural or religious health practices. For Bitcoin, the “NHS layer” is regulators like SEC, FCA, BaFin and MiCA, while the “fiqh layer” is credible Sharia scholars.

Practical Skills in Arabic.

To stay safe, Arabic-speaking beginners should learn how wallets work, how to secure private keys, and how to spot common scams all before buying any Bitcoin.

Bitcoin wallet tutorials in Arabic (custodial vs non-custodial)

You’ll hear two big terms.

Custodial wallet.

A company (like an exchange) holds your keys.

Easier for beginners, but you rely on their security and honesty.

Non-custodial wallet.

You hold your own (private key).

More control, more responsibility.

A high-quality Arabic tutorial should:

Show how to install the wallet from an official store (App Store / Google Play).

Guide you to create a new wallet and write down the seed phrase on paper, not as screenshots.

Explain, in Arabic, that anyone with the seed phrase can take all your coins.

Walk through restoring a wallet using the seed phrase with a tiny test amount.

How to buy Bitcoin safely through regulated platforms (USA, UK, EU)

When you’re finally ready to buy a small amount:

Check regulation & registration:

For US: SEC/CFTC actions and FinCEN registration. ([FinCEN.gov][3])

For UK: FCA registration and “Restricted Mass Market Investment” risk warnings.

For EU/Germany: MiCA and BaFin wording on crypto-asset services.

Use strong security.

Enable 2FA (preferably via authenticator app, not SMS).

Choose platforms that mention cold storage and independent security audits.

Card and bank safety.

When linking cards, look for PCI DSS-level security practices and clear explanations of encryption.

If you ever build your own Bitcoin education platform with integrated payments or wallets, you’ll need to architect these controls carefully. Teams like Mak It Solutions have already done this for digital wallet and mobile app projects across GCC and Europe, including compliance-minded analytics via their Business Intelligence and SEO services.

Avoiding scams targeting Arabic speakers online

Scammers love group chats in Arabic because trust is often built through shared language and culture. Common patterns.

WhatsApp or Telegram “VIP signal” groups promising “sure profit”.

Fake wallet or exchange apps with Arabic names but no real company behind them.

Impersonation of well-known sheikhs or traders, asking you to send funds for “managed accounts”.

Big red flags.

unrealistic promises (“20% monthly guaranteed”, “zero risk”),

pressure tactics (“offer ends tonight”, “only 10 seats left”),

requests for your seed phrase, 2FA codes, or remote access to your phone or laptop.

If something feels off, slow down. Check independent reviews, ask in neutral Arabic crypto communities, and never be embarrassed to walk away.

Recommended Learning Roadmap & Next Steps for Arabic Bitcoin Students

Now let’s turn everything into a simple 30–90 day roadmap that takes you from zero to confident beginner – without information overload.

30–90 day roadmap from zero to confident beginner

Phase 1 (Week 1–2): Foundations

Read 1–2 beginner articles or guides in Arabic (or bilingual) explaining Bitcoin, wallets and private keys.

Build your mini glossary (like the one above).

Watch 3–5 core videos on blockchain basics, volatility and regulator warnings.

Phase 2 (Weeks 3–6): Structured learning

Choose one Arabic Bitcoin course that passes the checks we covered.

Complete the course at your own pace.

Open a demo or low-limit account with a regulated exchange in your country.

Phase 3 (Weeks 7–12): Light practice & compliance

Buy tiny amounts of Bitcoin (for example, $10–$20) just to practise deposits, withdrawals and security.

Journal every step in Arabic: what you did, what went well, what felt risky.

Read a basic guide to tax in your jurisdiction and note what records you must keep.

If you’re building a broader personal learning stack – maybe mixing Bitcoin with data, cloud or app development – Mak It Solutions’ resources on Next.js, PWAs, BI and mobile apps can help you design your own tools or dashboards around what you’re learning.

How to keep your knowledge updated without information overload

To avoid burning out.

Pick 1–2 Arabic academies, 1 reliable news site and 1–2 YouTube channels – and ignore the rest.

Schedule specific learning sessions (for example, Tuesday/Thursday evenings) instead of scrolling 24/7.

Review your notes monthly and clean up any platforms or apps you no longer use.

Join an Arabic Bitcoin learning community (newsletter, group, course)

Finally, don’t learn in isolation. Join.

an Arabic Bitcoin newsletter that summarises US/UK/EU regulation changes,

a moderated Telegram or Discord community with clear rules and no shilling,

or a structured online course cohort where you can ask live questions.

This kind of curated community is exactly where a team like Mak It Solutions can help you long-term by building secure community platforms, course portals and analytics that respect both halal concerns and Western regulatory requirements.

Key Takeaways

Start with education, not trading

Learn Bitcoin basics in Arabic – blockchain, wallets, private keys and volatility – before opening any account.

Respect both Sharia and local law

Combine guidance from trusted scholars with compliance to SEC, FCA, BaFin, MiCA, GDPR and tax rules where you live.

Use regulated, transparent platforms

Prefer exchanges and apps that clearly show their licenses, risk warnings and data protection practices.

Security is non-negotiable

Master wallet safety, seed phrase handling, 2FA and scam red flags before sending meaningful amounts of money.

Follow a 30–90 day roadmap

Move from theory to small practice gradually, keeping a learning journal and tracking tax-relevant records.

Choose curated Arabic resources

Limit yourself to a handful of trustworthy courses, channels and communities instead of chasing every hype signal.

If you’re planning an Arabic-first Bitcoin education product, or simply want a safer digital setup for your crypto-curious audience in the USA, UK, Germany or wider EU, you don’t have to architect it alone.

The team at Mak It Solutions already helps clients build secure web platforms, data dashboards and mobile apps for complex, regulated environments from web development and SEO to mobile apps and business intelligence.

Share your goals, GEO targets and timeline, and request a scoped estimate or book a short discovery call via the contact details on Mak It Solutions. Together, you can design Arabic-friendly learning experiences that feel safe, compliant and genuinely educational.( Click Here’s )

FAQs

Q : Can I learn about Bitcoin in Arabic without opening a trading account first?

A : Yes, and that’s usually the safest way to start. You can follow free Arabic-language courses, YouTube playlists and blogs that explain blockchain, wallets, private keys and regulation without asking you to deposit any money. Many US, UK and EU regulators actually encourage people to understand risks and volatility before investing, so there is no rush to open an account. When you’re ready, you can test a regulated platform with very small amounts while keeping your learning mindset.

Q : Which Arabic Bitcoin resources are suitable for teenagers and university students?

A : For teens and students, look for education-first resources: tutorials that focus on how Bitcoin works, why it’s risky and how to avoid scams, rather than on quick profits. Check that the content includes parental or guardian guidance, especially for learners under 18, and that it talks about budgeting, debt and saving not just trading. University students in London, Berlin or Paris can also check if their campuses host fintech or blockchain clubs that invite Arabic-speaking experts to give balanced talks.

Q : Do I need a local bank account in the UK or Germany to use Arabic-friendly crypto platforms?

A : In many cases, yes especially if you want to deposit via bank transfer or use Open Banking integrations. In the UK, regulated platforms typically require a local GBP account in your name; in Germany and the wider EU, SEPA transfers from a euro account are common. Some platforms let you deposit with cards or digital wallets instead, but fees can be higher. Whatever you choose, make sure the platform is regulated (FCA, BaFin or another EU authority) and that the name on your bank account matches your account details exactly.

Q : How long does it usually take to finish a beginner Bitcoin course in Arabic?

A : Most beginner-level Bitcoin courses in Arabic take a few hours to a few weeks to complete, depending on depth and whether they include quizzes, projects or live calls. A realistic pace is to aim for 2–4 hours per week over about a month, then spend another month practising with tiny real transactions and security drills. Combined with casual reading and podcasts, many learners feel like “confident beginners” after roughly 30–90 days if they follow a structured roadmap instead of random videos.

Q : Are there Arabic Bitcoin education apps I can use on my iPhone or Android safely?

A : Yes, but you should apply strict filters. On iPhone, stick to apps from the official App Store, and on Android use Google Play, both of which have specific rules for crypto wallets, exchanges and mining Choose apps from companies you can verify, with clear privacy policies referencing GDPR or UK-GDPR for EU/UK users, and check user reviews in both Arabic and English. Avoid side-loaded APKs, unofficial clones or apps that ask for excessive permissions unrelated to their function.