Banks Partnering with Crypto Companies in 2025: Models, Custody Choices, Tokenization & a Practical GRC Playbook

Introduction

Banks are partnering with crypto companies because client demand, instant settlement, and tokenization-driven efficiency have moved from “innovation lab” to board mandate. In 2025, integration spans liquidity and on-/off-ramps, crypto custody, stablecoin settlement, and tokenized fund infrastructure built under clearer EU rules and tighter U.S./UK supervision.

In this guide you’ll learn why this shift is accelerating, the partnership models that work, how to evaluate crypto custody (build/buy/partner), where tokenization is real today, what M&A signals to watch, and a pragmatic governance, risk, and compliance (GRC) playbook.

Why Banks Are Partnering with Crypto Companies Now

Demand Drivers

Institutional adoption has matured: treasurers want 24/7 liquidity, product teams want programmable money, and CIOs want operational alpha from faster settlement. BNY Mellon publicly launched digital asset custody for select clients back in 2022, putting blue-chip weight behind institutional-grade servicing and opening the door for peers to follow.

Moreover, central-bank and market-infrastructure work has normalized the conversation. The ECB continues preparation for a potential digital euro—focusing on technical readiness and fraud controls while deferring any issuance decision until EU law is finalized. That clarity pulls banks into the build phase with well-scoped roles for private partners.

Actionable example

A corporate treasury sets up always-on settlement between a USD account and a regulated stablecoin, freeing trapped cash on weekends. Using an exchange/prime broker for liquidity plus a qualified custodian reduces operational risk while enabling instant internal transfers for payouts.

Stat to know

Clearstream’s D7 platform reports millions of digital securities issued and tens of billions of euros in digital issuance volume—evidence that digital asset rails and tokenized issuance are scaling in mainstream market plumbing.

Risk & Compliance Catalysts

Banks are more comfortable because frameworks matured:

EU MiCA

Crypto-asset service providers (CASPs) face licensing, disclosure, and custody rules, with a transition window through July 1, 2026. This gives banks a way to vet counterparties across Europe.

U.S. supervision

The SEC’s safeguarding proposal and subsequent clarifications keep “qualified custodian” top-of-mind for advisers; FINRA reiterates oversight expectations for crypto asset activities and communications.

UK

FCA financial-promotion rules and RTGS renewal (with ISO 20022) tighten conduct while enabling future DLT/tokenization experiments in wholesale markets.

Actionable takeaway

Prioritize partners already aligning to MiCA and able to provide SOC reports, Travel Rule compliance attestations, and regulator-facing reporting.

Competitive Pressure

Neobanks and fintechs are pushing global payout speeds and user experiences. Stablecoin rails from firms like PayPal (PYUSD) are being positioned for faster cross-border flows and low-cost payouts, signaling where merchant services and treasury ops are headed.

At the same time, JPMorgan’s Onyx rebrand to Kinexys underscores how major banks are formalizing tokenization rails for funds, collateral, and cash-like assets.

Partnership & Rail-Building Models That Work

(Core keyword used: banks partnering with crypto companies)

Direct answer

Banks partnering with crypto companies typically combine regulated liquidity (exchanges/prime), institutional custody, and compliant data feeds (KYC/AML analytics) behind bank-grade APIs. This mix gives clients seamless on-/off-ramps and tokenization workflows without compromising standards.

Exchange & Liquidity Partnerships.

When banks partner with institutional exchanges/prime brokers, they gain deep pools of liquidity, smart order routing, credit lines, and segregated custody. Coinbase Prime, for example, positions itself as an integrated execution and custody stack for institutions, while highlighting controls and security designed for fiduciary mandates.

Model flow (diagram suggestion)

Client ↔ Bank App/Portal ↔ Bank’s Crypto Services Layer (KYB/KYC + approvals) ↔ Prime/Exchange (execution & financing) ↔ Qualified Custodian (segregated accounts) ↔ Bank Ledger & Reports (ISO 20022 statements)

Actionable advice

In contracts, split “execution” vs. “custody and settlement” to isolate failure domains, and require trade lifecycle transparency (pre-/post-trade data, best-ex rules).

Stablecoin Partnerships with Banks.

Stablecoin tie-ups are surging because they reduce friction across time zones. Circle and Fireblocks announced a collaboration to expand institutional stablecoin usage for treasury and cross-border settlement; network partners like Thunes are building 24/7 liquidity for faster global payouts.

In Europe, Société Générale–Forge’s EUR CoinVertible (EURCV) is positioned as MiCA-compliant; SG-Forge notes EURCV compliance from July 1, 2024, with additional products launched in 2025 an indicator of how euro stablecoins will slot into wholesale flows under EU rules.

Actionable example

A bank embeds stablecoin rails into its cross-border product: invoices settle in minutes; treasury rebalances intraday; compliance screens counterparties and wallets pre- and post-payment.

Banking-as-a-Service & API Integrations.

Banks partnering with crypto companies succeed when compliance and data plumbing are first-class citizens

Identity & AML tooling

Chainalysis (KYT, address screening) and TRM Labs (transaction monitoring, wallet screening) integrate via APIs to automate Travel Rule and sanctions controls.

Reporting

FINRA and EU reporting needs inform archive formats, evidence trails, and audit exports; wire up ISO 20022 statements and crypto-native proofs.

Actionable advice

Map every API to a control objective (e.g., “beneficial ownership validation” → KYB provider; “counterparty wallet risk” → risk scoring engine). This is how banks partnering with crypto companies maintain regulator-grade assurance while adding new rails.

Crypto Custody for Banks: Build, Buy, or Partner?

Operating Models (Direct Custody vs. Sub-Custodian vs. Qualified Custodian)

Direct custody (build)

Highest control; heavy capex/opex (HSMs/MPC ops, 24/7 SOC, recovery drills).

Sub-custodian (buy/partner)

Faster to market; ensure segregation, SLAs, and insolvency-remote design.

Qualified custodian

For U.S. advisers, “qualified custodian” status is pivotal. SEC messaging around safeguarding has emphasized using qualified custodians for crypto assets; 2025 commentary and legal analyses further clarified pathways for state trust companies under certain conditions.

Example

BNY Mellon’s institutional platform pairs traditional asset servicing strengths with crypto custody, showing how incumbent custodians can extend service models.

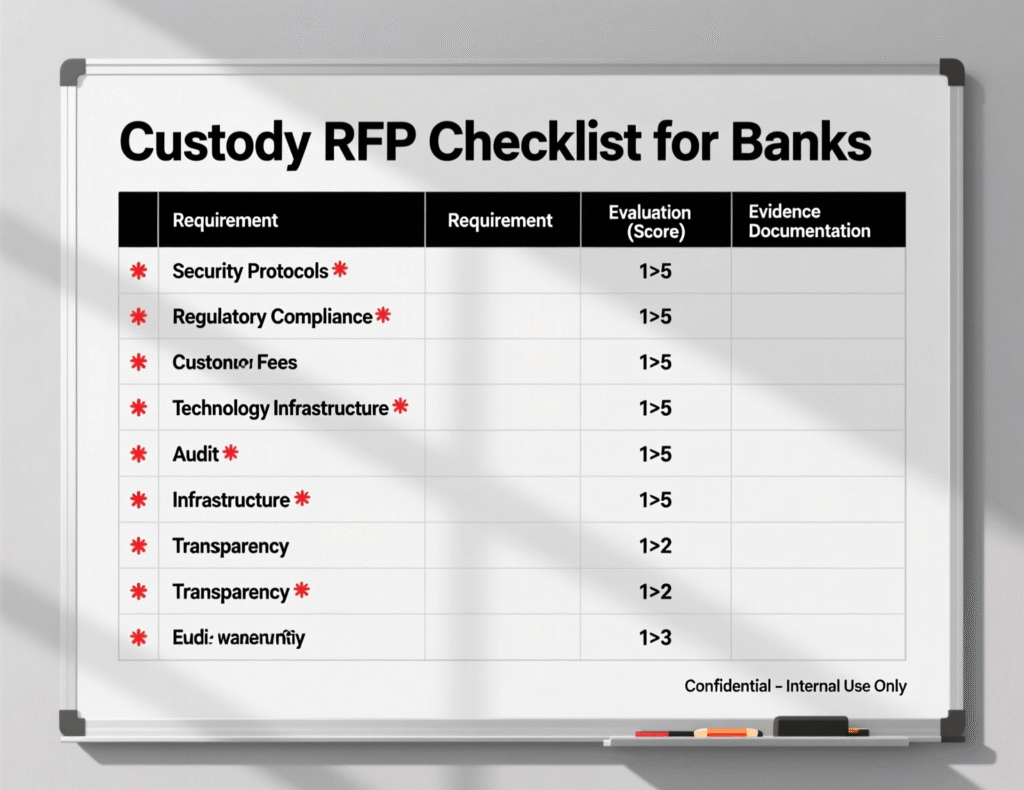

Evaluation Checklist (Key Controls, SOC Reports, Segregation, Cold/Warm Storage, SLAs)

RFP Checklist (bank-grade)

Assurance & reporting

SOC 1/2 Type II, penetration tests, incident response runbooks.

Asset segregation

Legal opinions; omnibus vs. segregated wallets; bankruptcy-remote structures.

Key management

HSMs and/or MPC, quorum policies, geographic shard dispersion, disaster recovery.

Storage policies

Cold/warm thresholds, velocity controls, policy engines, allow/deny lists.

Availability & SLAs

99.9%+ uptime; swap/upgrade windows; signed RTO/RPO.

Compliance APIs

Travel Rule, sanctions, address screening logs; end-to-end auditability.

Reconciliation

Daily on-chain↔ledger proofs; fiat settlement controls.

Change control

Dual approvals; code-signing; production access governance.

(Tip: Tie the evaluation to FINRA communications supervision requirements when investor-facing and to internal model risk for transaction monitoring.)

Regulatory Frames.

US

The SEC’s safeguarding initiative (2023 onward) pushed advisers toward qualified custodians for digital assets; 2025 discussions and state trust company clarifications give banks more certainty on structures that can satisfy the rule’s spirit.

EU (MiCA)

CASPs require authorization, with transitional grandfathering for pre-Dec 30, 2024 providers until July 1, 2026; custody requirements include organizational controls, conflicts policies, and asset safeguards. Banks partnering with crypto companies in Europe should confirm counterparties’ MiCA status and timelines.

Tokenization in Traditional Finance

What Gets Tokenized Today.

Tokenization is live across money market funds (MMFs), short-duration treasuries, deposit tokens, and RWA funds often on permissioned networks. JPMorgan’s Kinexys platform and recent fund tokenization steps illustrate how private assets and fund interests can be digitized for lifecycle efficiency.

Clearstream’s D7 and related initiatives show market infrastructures digitizing issuance under CSDR, including pilots in 2024–2025.

Actionable example

A bank’s fund services unit pilots tokenized feeder funds for qualified investors, integrating with custodians and transfer agents to compress onboarding and capital call cycles.

Workflow Impact

Tokenized assets enable near-instant delivery-versus-payment (DvP) and collateral movement across venues. BIS’s mBridge reached MVP in 2024, exploring instant cross-border settlement of tokenized central-bank money shaping how wholesale rails might evolve.

In the UK, RTGS renewal and ISO 20022 support are the basis for DLT-enabled settlement experiments and tokenized bond pilots laying groundwork for broader interoperability.

Actionable advice

Map “T+n” frictions in your current ops (cut-offs, nostro delays, affirmations) and calculate value-at-risk (VaR) savings from moving high-volume legs to programmable settlement windows.

Limits & Risks

Interoperability

Bridge risks, messaging standards alignment (ISO 20022), and atomic settlement across chains remain open engineering questions.

Legal finality

Settlement finality on DLT must align with CSD/RTGS regimes.

Privacy

Role-based access and data minimization are essential in permissioned networks.

Vendor lock-in

Prefer open standards and exportable state proofs to avoid dependency.

Actionable advice

Run legal “finality mapping” for each chain, and require portability clauses (data, keys, proofs) in vendor contracts.

2025 Crypto M&A and Investment Signals

Who’s Buying What

Deal flow points to consolidation in infrastructure: custody platforms, analytics/AML vendors, tokenization/issuance stacks, and payout rails. Architect Partners’ Q3 2025 report lists active buyers (including incumbents and exchange groups) and notes multiple Coinbase acquisitions in developer tools and trading infrastructure signaling platform build-outs in prime and custody adjacencies.

Valuation & Deal Dynamics

Valuations have rebounded in categories tied to compliance and enterprise rails. Minority stakes and structured partnerships lower integration risk while preserving strategic options. Where pricing is opaque (many deals undisclosed), diligence the resilience: runway, revenue concentration, and regulatory posture.

What It Means for Bank Strategy

Build

Core controls (identity, surveillance) and sensitive key-management layers.

Partner

Liquidity, staking, and tokenization workflows where time-to-market matters.

Invest

Strategic stakes in vendors critical to your roadmap (e.g., compliance analytics, issuance platforms).

Actionable takeaway

Track concentration risk: if three vendors dominate custody/monitoring in your region, design a second-source plan before contract year two. Use M&A trackers to anticipate service disruptions.

Governance, Risk, and Compliance Playbook

Policy & Control Stack.

Foundations for banks partnering with crypto companies

Identity & onboarding

KYB/KYC with PEP/sanctions screening; enhanced due diligence on high-risk geographies.

Transaction monitoring

Continuous wallet screening and KYT; typologies for mixers, darknet, sanctions evasion (e.g., Chainalysis, TRM).

Travel Rule & disclosures

Align to FATF standards and local transpositions; maintain evidence of originator/beneficiary data transmission.

Conduct/communications

FINRA-aligned supervision for communications; robust recordkeeping for investor materials.

Actionable example

Implement pre-trade wallet screening and post-trade anomaly detection; quarantine funds until screening passes; log regulator-ready evidence.

Tech Architecture Guardrails.

Key security

HSM-backed or MPC key orchestration with quorum policies; shard distribution across regions and cloud/on-prem mixes.

Segregation

Separate hot/warm/cold paths; enforce address allowlists; use just-in-time approvals.

Auditability

Immutable logs, code-signed deploys, and periodic recovery drills with provable RTO/RPO.

Actionable advice

Require monthly key-ceremony attestations and quarterly disaster-recovery failovers with signed audit artifacts.

Operating Model & Vendor Oversight.

TPRM

Assess financial health, incident history, and regulator interactions; demand SOC reports and breach notifications.

Contingency

Define sub-custodian switch plans; escrow critical configs; insist on exportable data formats.

Cadence

Quarterly risk reviews, monthly SLA reports, and annual tabletop exercises with executives and lines of defense.

Global standards to watch

BIS experiments (mBridge), ISO 20022 adoption curves, and national competent authority updates under MiCA.

Summary / Key Takeaways

Map use-cases first (treasury, payments, custody, tokenization), then select partners to fit not the other way around.

In the EU, verify MiCA authorization pathways and transitional status through July 1, 2026.

In the U.S., structure models to satisfy qualified custodian expectations and FINRA communications oversight.

Tokenization is real in issuance and funds; watch Kinexys, D7, and digital euro prep work for interoperability clues.

Bake in KYC/AML/KYT and Travel Rule from day one with vendors like Chainalysis/TRM.

Monitor M&A concentration risk and keep a second source for custody and analytics.

If you’re evaluating how your bank should partner with crypto companies in 2025, Mak It Solutions can help you assess readiness, shortlist compliant partners, and stand up pilot rails safely. Get a free consultation with our Editorial Analytics Team contact us through the form below or book a discovery call today.( Click Here’s)

FAQs

Q : What’s the difference between partnering with an exchange vs. a prime broker for banks?

A : Exchanges provide matching engines and raw liquidity, while prime brokers bundle execution, credit, settlement, and custody coordination. For banks partnering with crypto companies, a prime can simplify onboarding (credit lines, cross-venue access) and centralize reporting, but you should still segregate execution from custody in contracts. Require best-execution policies, venue transparency, and SOC attestations, and confirm that any custody component meets “qualified custodian” standards in the U.S. and MiCA authorization in the EU.

Q : Are tokenized MMFs and treasuries actually improving settlement speed today?

A : Yes tokenized instruments reduce cut-off risks and can enable near-instant settlement when both legs are on compatible rails. Market infrastructure like Clearstream’s D7 digitizes issuance and lifecycle events, while bank platforms (e.g., Kinexys) are piloting tokenized fund flows. The net effect is shorter settlement cycles and better intraday liquidity, though interoperability with RTGS/CSD systems and legal finality remain constraints.

Q : How do MPC and HSM approaches differ for bank-grade key management?

A : HSMs are certified hardware modules that secure keys in tamper-resistant devices; MPC uses distributed cryptography to split signing authority across nodes. Many banks use them together: HSMs for secure root-of-trust and MPC for operational resilience and geo-distribution. Whichever you choose, enforce quorum policies, separation of duties, and periodic recovery tests; demand audit logs and attestations from custodians and sub-custodians.

Q : What vendor due-diligence evidence should banks require from crypto partners?

A : Start with SOC 1/2 Type II, pen-test summaries, incident histories, and regulator engagement letters. Add Travel Rule compliance evidence, sanctions-screening coverage, and customer-asset segregation legal opinions. For EU partners, request MiCA authorization status and transition plans; for U.S. partners, map how they meet qualified custodian expectations and FINRA communications oversight.

Q : How are 2025 crypto M&A trends affecting vendor concentration risk for banks?

A : Consolidation is strongest in infrastructure (custody, analytics, issuance), which can raise concentration risk. Architect Partners’ Q3 2025 report shows an active market with multiple deals use it to anticipate support/roadmap changes and to plan dual-vendor strategies. Insert exit clauses and data-portability requirements to mitigate surprises.