Axie Infinity (AXS) Weekly Update Price Analysis, Ronin Momentum & GameFi Outlook (Feb 20, 2026)

The latest Axie Infinity (AXS) weekly update finds the token drifting lower on the week but catching a sharp bid into the daily close. After January’s hot GameFi rotation, AXS is now in a classic “post-rally digestion” phase, with traders watching whether the Ronin momentum and Axie roadmap can keep fresh capital interested.

This Axie Infinity (AXS) weekly update focuses on where price is trading now, the key support and resistance zones, what’s happening on Ronin, and how AXS is behaving versus majors like BTC and ETH.

Right now, AXS is trading around $1.29, up roughly 4% over the last 24 hours but still down about 6% over the past 7 days. According to CoinMarketCap, the 24-hour range has sat between about $1.24 and $1.37, while the broader 7-day range is estimated near $1.15–$1.40 depending on the exchange.

Recent moves have been driven mainly by technical rebounds from oversold RSI levels, a pickup in volume, and rising activity on the Ronin sidechain, while resistance is forming near the mid-$1.30s and short-term support around the low-$1.20s.

Key Data Snapshot (Feb 20, 2026 – 20:25 UTC)

Current AXS price: ≈ $1.29

24h change: +3.9% (approx.)

7d change: ≈ –6% (estimate; varies slightly by data source)

Estimated 7d high / low: ≈ $1.40 – $1.15 (approximate across top exchanges)

Market cap: ≈ $218M

24h volume: ≈ $80–$90M

Main data sources: CoinMarketCap, CoinGecko, Binance, MEXC, DropsTa

Exact figures differ a bit between providers due to methodology and update times, so always double-check if you need precision.

Axie Infinity (AXS) Weekly Update: Quick Summary

Axie Infinity (AXS) has had a choppy but constructive week. Price has pulled back from recent local highs, leaving AXS down mid-single digits on the week, even as it logged a solid intraday rebound of roughly 4% in the last 24 hours.

The backdrop is a GameFi sector that has cooled after January’s explosive rallies, but AXS is still showing up in altcoin “watch lists” and sector round-ups.On the charts, the token is bouncing from oversold readings. On the fundamentals side, attention is locked on the Ronin ecosystem and Axie’s broader 2026 roadmap.

AXS Price Action & Key Levels

Weekly performance

Spot price is hovering around $1.29.

Over 24 hours, AXS is up about 4%, but over 7 days it’s still down roughly 6%, pointing to a net cooling after earlier surges.

Across major exchanges, AXS traded roughly within an estimated $1.15–$1.40 band this week; on CoinMarketCap specifically, the 24h low / high sits near $1.24–$1.37, so the weekly extremes are not far beyond that.

Taken together, the tape leans more toward post-rally consolidation than a clear trend reversal.

Short-term technical view

Recent analyses highlight that.

AXS dropped into oversold territory, with 7-day RSI briefly in the high-20s before rebounding.

The rebound featured rapid 15–20% intraday spikes, with one move essentially wiping out the previous week’s losses while open interest jumped more than 50%.

From a level-mapping perspective (not signals, just reference zones)

Immediate resistance

$1.35–$1.40: recent local high zone, where multiple reports flag “testing key resistance”.

Higher resistance

Around $1.60–$1.70: a recent year-to-date high cluster on some screeners.

Near-term support

$1.20–$1.22: recent reaction lows after sell-offs.

Below that, the psychological $1.00 area is the next big “line in the sand”.

Volatility is high compared with large caps, but still modest relative to the wild swings seen at the peak of the 2021 play-to-earn mania.

News & Narratives That Moved AXS This Week

Coverage this week has focused on a blend of technical catalysts and ecosystem-level developments:

Oversold bounce & volume spike

With RSI slipping below 30, contrarian traders stepped in, and one report noted over 200% 24h volume growth during a sharp rebound. The move was framed more as a momentum-driven squeeze than a headline-driven rally.

GameFi & Ronin momentum

A CoinMarketCap Academy piece highlights renewed interest in Web3 gaming, crediting Axie’s comeback partly to growing activity on its Ronin sidechain and the success of titles like Pixels. Ronin active wallets reportedly tripled over a short period, underscoring the chain’s growing pull for gaming projects.

Strategic “Lunacian Lounge” update

The team hosted a “Lunacian Lounge” on February 3, 2026 to outline the 2026 strategic plan, roadmap, and potential incentive tweaks. Some traders viewed this as a volatility catalyst because it can reset expectations around token demand and supply.

Macro GameFi sentiment

Sector round-ups note that GameFi has cooled after a strong start to January, but AXS keeps appearing as one of the gaming tokens still drawing notable swings and trader focus.

None of these stories is a simple “buy/sell” trigger on its own, but together they explain why AXS remains a high-beta GameFi play in the news cycle.

On-Chain, Derivatives & Sentiment

Data-driven commentary this week points to a familiar mix of leverage, whales, and shifting sentiment:

Open interest surge

One analysis cites open interest jumping ~56% during the February rally, a sign that leveraged traders are piling into AXS.

Rising active addresses & whale-heavy flows

An AMBCrypto piece notes that active AXS addresses nearly doubled and that large holders dominate trading activity, implying that bigger players are steering short-term price action.

From oversold back toward neutral

Technical dashboards describe AXS moving from “deeply oversold” back toward more neutral territory as price rebounded, while the broader tone around the token is still cautious to bearish.

For traders, that combination usually means sharp moves in both directions are possible, especially when funding gets crowded and leverage is high.

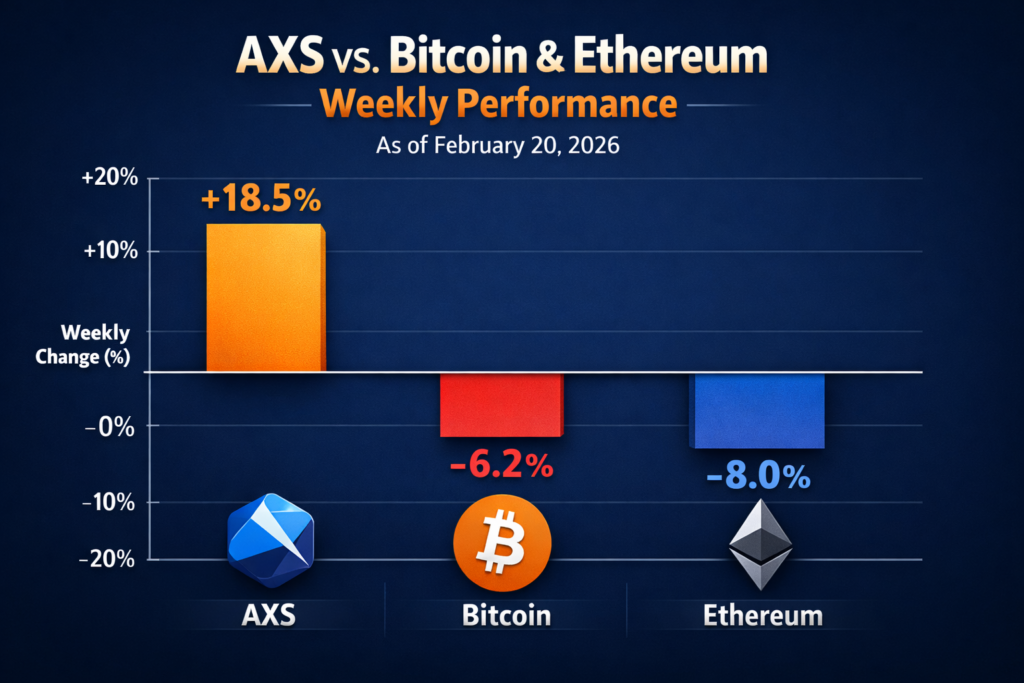

AXS vs Bitcoin & the Wider Crypto Market

Relative to the majors this week.

Bitcoin (BTC) is roughly flat to slightly down (~-2% over 7 days)

Ethereum (ETH) is about flat to slightly up (~+1% over 7 days)

With AXS sitting at around –6% on the week, the token is clearly underperforming BTC and ETH in the short term, despite strong outperformance back in January and early February.

Within the gaming / GameFi slice of the market, trackers still list Axie among the larger tokens by market cap, but AXS remains roughly 99% below its 2021 all-time high.That gap is a reminder of how cyclical and speculative this niche can be, even after big percentage bounces.

What This Means for Traders & Long-Term Holders

For short-term traders (general, not advice)

Expect two-sided volatility inside roughly the $1.20–$1.40 range while markets digest the oversold bounce and the latest GameFi headlines.

Watch how price behaves near $1.35–$1.40; repeated failures to break through can reinforce that band as resistance.

Elevated open interest and concentrated whale activity mean liquidation cascades (both up and down) are on the table.

Funding rates, perp basis, and intraday volume spikes are key context when taking positions in a comparatively illiquid altcoin versus BTC or ETH.

For longer-term holders and observers

The core thesis now ties AXS more to Ronin network growth and Axie’s evolving game design than to the 2021 “play-to-earn” hype loop.

Ongoing 2026 tokenomics and roadmap discussions (Treasury usage, staking mechanisms, in-game sinks) are critical for building a sustainable demand engine for AXS.

Regulatory risk for gaming/NFT tokens is generally viewed as lower than some DeFi sectors, but business-model risk is high: studios and players need compelling reasons to stick with Web3 games.

Even after a strong start to the year, AXS is still deep below prior highs, so drawdown risk remains significant if sentiment flips again.

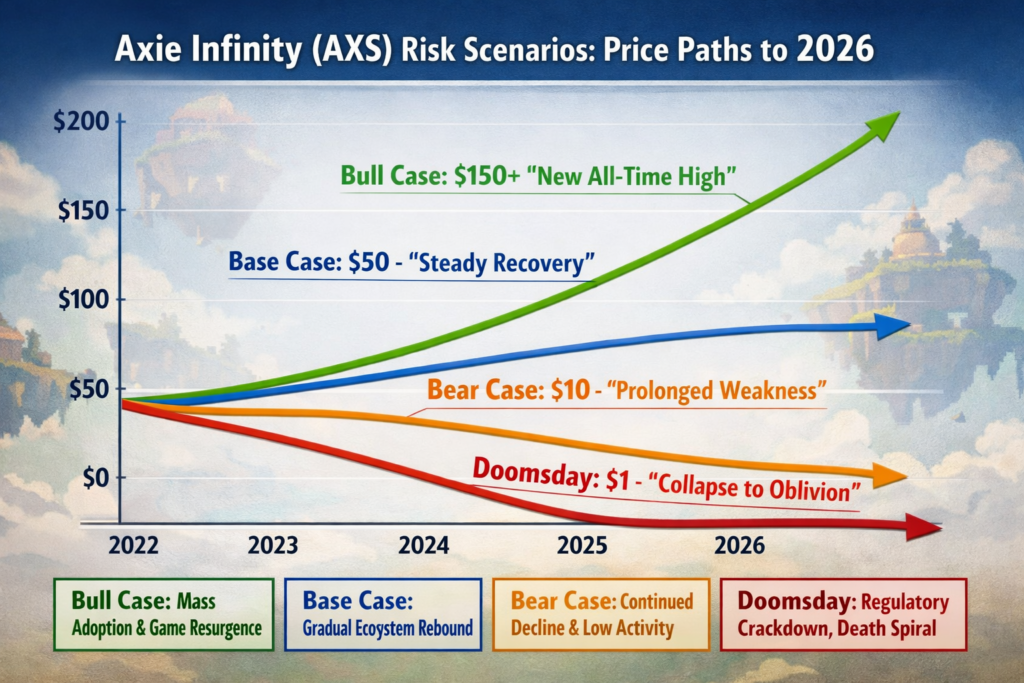

Risks, Scenarios.

As usual with a high-beta token like AXS, there’s a spread of possible paths

Bullish scenario

GameFi flows rotate back in, Ronin continues onboarding new titles and wallets, and Axie’s 2026 updates convince the market that AXS captures a larger slice of ecosystem value. In that case, reclaiming and holding above the $1.40–$1.60 region would be a constructive sign

Neutral / range-bound scenario

AXS chops between roughly $1.00 and $1.60 as traders fade rallies and buy dips, while fundamentals evolve without a knockout catalyst.

Bearish scenario

A risk-off macro backdrop or a renewed GameFi de-risking wave drains liquidity from gaming tokens, pushing AXS back toward the low-$1 or sub-$1 area, especially if high-beta leverage unwinds.

To Sum Up

FAQs

Q : Why did Axie Infinity (AXS) move this week?

A : AXS price action this week has been driven mostly by technical factors—a rebound from oversold RSI levels and a jump in volume rather than a single headline event. At the same time, ecosystem news around Ronin activity and Axie’s 2026 strategy session helped keep the token on traders’ radar.

Q : What are the key support and resistance levels for AXS right now?

A : In the short term, traders are watching $1.20–$1.22 as support and $1.35–$1.40 as near-term resistance, with a broader range extending toward $1.60–$1.70 based on recent highs. A clear break and sustained move above or below these zones could set up the next leg of the trend, but levels can shift quickly in a volatile market.

Q : Is AXS more or less risky than Bitcoin and Ethereum this week?

A : AXS has shown larger percentage swings than Bitcoin or Ethereum over the last 7 days, and it’s still trading more than 99% below its all-time high. Combined with whale-driven flows and heavy use of leverage in derivatives, that typically makes AXS riskier than large-cap coins from a price-volatility standpoint.

Q : What should long-term observers focus on in the Axie Infinity ecosystem?

A : For long-term observers, the big questions are whether Ronin can continue to grow as a gaming chain, whether updated tokenomics align AXS more closely with real usage, and how sticky player engagement proves to be in the refreshed game economy. Treasury strategy, staking design, and new game launches on Ronin are all key signals to watch.

Q : Is Axie Infinity (AXS) safe to invest in right now?

A : “Safe” is relative: AXS is a speculative altcoin in a niche sector, with a history of deep drawdowns and sharp rallies. It may not suit conservative investors, and anyone considering exposure should size positions carefully, be prepared for high volatility, and consult a qualified financial advisor rather than relying solely on online commentary.