Anti-DeFi ads urge senators to pass CLARITY Act without DeFi rules

An advocacy group calling itself Investors for Transparency has launched television ads on Fox News urging Americans to press their senators to pass crypto market-structure legislation without the CLARITY Act DeFi provisions.

The campaign lands just days before a scheduled Senate Banking Committee markup of the CLARITY Act, the House-passed framework now under Senate consideration.

What the ads say and why they matter

Screenshots shared on X show messages such as “Tell Your Senator: Pass Crypto Legislation Without DeFi Provisions” and “Don’t Let DeFi Stall Innovation,” alongside a hotline number for contacting senators’ offices. The language echoes long-running concerns from banking groups that DeFi and interest-bearing stablecoin products could resemble bank deposits and draw significant funding away from the traditional system.

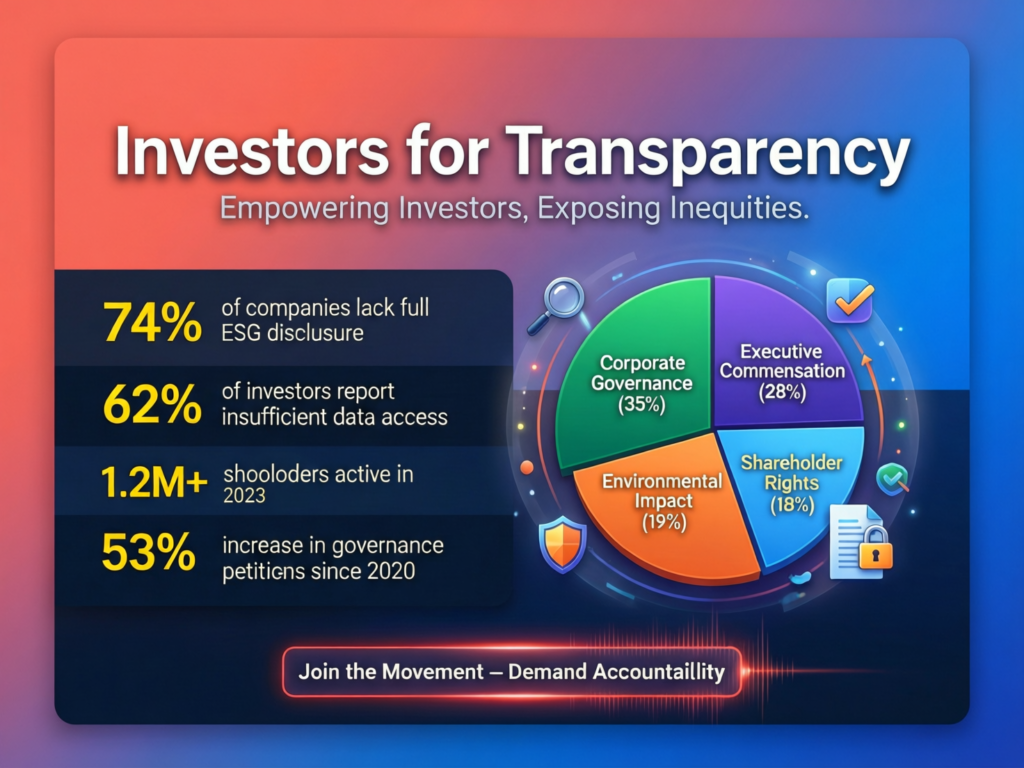

The group’s website frames its mission around “investor safeguards” and “market integrity,” but offers limited information about backers fueling criticism from crypto advocates who argue the effort lacks transparency.

What happens on January 15

Multiple industry reports indicate the Senate Banking Committee intends to hold a markup of the CLARITY Act on Thursday, Jan. 15 at 10:00 a.m. ET, a key step before any floor consideration. The House version (H.R. 3633) passed in July 2025 and was referred to Senate Banking in September 2025.

The policy fight over CLARITY Act DeFi provisions

At issue are provisions touching decentralized finance, including rules that could affect stablecoin rewards or interest-like features. Bank lobbyists warn DeFi-enabled yield could accelerate deposit flight from banks; Treasury briefings have previously modeled up to $6.6 trillion in potential outflows under widespread stablecoin adoption scenarios. Supporters counter that clear, activity-based rules would reduce risk and improve consumer protection without stifling innovation.

Industry response to CLARITY Act DeFi provisions

Crypto leaders criticized the ad push. Uniswap Labs CEO Hayden Adams called it “ironic and unsurprising” for an organization named “Investors for Transparency” to campaign against DeFi while not being transparent about its own backers.

How this fits the broader legislative picture

The Senate Agriculture Committee is also moving on digital-asset market-structure language, with both committees’ work expected to shape any final package. Observers say the Jan. 15 markups will signal whether a bipartisan path exists this session.

Context & Analysis

While the $6.6T figure is a high-end stress scenario, it underscores why DeFi and stablecoin yield remain flashpoints between banks, markets, and regulators. Stablecoin growth could both bolster demand for short-term U.S. debt and alter banks’ funding mix benefits and risks that Congress is attempting to balance in the CLARITY Act.

Bottom Lines

The recent Fox News advertising push has increased political pressure as the Jan. 15 markup approaches. This move signals growing urgency among stakeholders to influence the debate, highlighting how visible media campaigns are being used to shape public opinion and legislative priorities around digital assets and financial innovation.

How the Senate handles the DeFi-related language whether it is preserved, narrowed, or removed will have long-term consequences. The final decision will play a key role in determining the scope, direction, and speed of U.S. regulation of decentralized finance, potentially defining how the sector evolves and operates throughout 2026 and beyond.

FAQs

Q : What are the CLARITY Act DeFi provisions?

A : They are sections of the broader market-structure bill that address decentralized-finance activities, including features such as stablecoin rewards.

Q : Why are banks concerned about DeFi?

A : Banks worry that DeFi yields and stablecoins could pull deposits away from traditional banks, impacting funding and credit creation. Treasury models suggest potential outflows of up to $6.6 trillion.

Q : Who is “Investors for Transparency”?

A : It is an advocacy group that promotes investor safeguards. However, limited public information about its backers has raised concerns among DeFi supporters.

Q : When is the Senate Banking markup?

A : Reports point to Thursday, Jan. 15 at 10:00 a.m. ET, though the committee schedule should be checked for confirmation.

Q : Will the bill pass this year?

A : It remains uncertain. Bipartisan discussions are ongoing, and the markup will serve as an early indicator.

Q : How do I weigh in?

A : You can contact your senators’ offices directly or submit comments through their official websites.

Q : Does this article take a side?

A : No. It presents a neutral summary of positions, timelines, and information from public sources.

Facts

Event

Fox News ad campaign urges removal of DeFi language from CLARITY ActDate/Time

2026-01-10T18:00:00+05:00Entities

Investors for Transparency; U.S. Senate Committee on Banking, Housing, and Urban Affairs; H.R. 3633 (CLARITY Act); U.S. Department of the TreasuryFigures

Up to $6.6 trillion potential deposit outflow under widespread stablecoin adoption (scenario)Quotes

“Tell Your Senator: Pass Crypto Legislation Without DeFi Provisions.” Investors for Transparency ad copy (per screenshots)Sources

Cointelegraph via TradingView (report of ads) ; U.S. Treasury TBAC (deposit-flight scenario)