AI-Driven On-Chain Compliance and Risk Scoring Guide

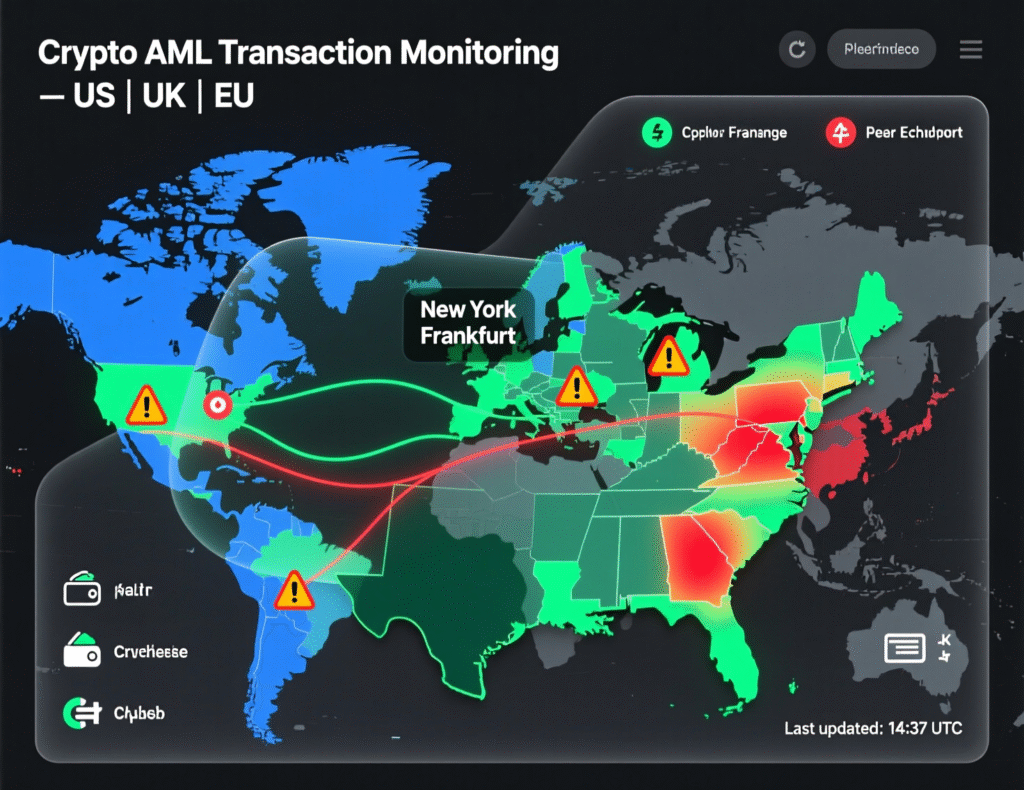

AI-driven on-chain compliance and risk scoring applies machine learning to blockchain and intelligence data to assign dynamic risk scores to wallets, counterparties and transactions. This helps regulated firms in the US, UK and EU monitor crypto flows in real time, meet AML and travel rule obligations, and be exam-ready for regulators.

Introduction

Regulators in the United States, United Kingdom and European Union now expect crypto firms, banks and VASPs to understand where crypto funds come from and how they move, not just to “do some blockchain analytics.” FinCEN, the FCA and BaFin all explicitly reference blockchain analysis and travel rule obligations in their AML expectations for crypto businesses.

At the same time, crypto adoption is no longer niche: around one in eight UK adults now own cryptoassets, which amplifies systemic and financial crime risk for neobanks, payments firms and custodians.Global AML fines still total several billions of dollars each year, with banks and crypto firms regularly paying nine-figure penalties for weak controls.

That’s why the question has shifted from “Can we trace this transaction?” to “Could we defend this control to FinCEN, the FCA, BaFin or the ECB in an exam?” AI-driven on-chain compliance and risk scoring gives compliance, risk and product teams a path to do exactly that, at scale.

The shift from “can we trace crypto?” to “are we exam-ready?”

In the 2017–2020 era, most firms treated blockchain AML analytics as a specialist, investigative add-on. You pulled a few high-risk addresses into a tool, printed a graph and attached it to a SAR. Today, supervisors assume that high-risk crypto activity is being monitored with appropriate tools and that results are feeding into your financial crime framework. BaFin, for example, now explicitly expects crypto-asset service providers to use blockchain analysis to monitor transactions.

Being “exam-ready” means you can.

Explain how your models or rules generate risk scores

Evidence tuning, feedback loops and governance

Show that on-chain insights actually change decisions (KYC/KYB, transaction blocking, SAR filing)

Static, rules-only tooling struggles to keep up with new chains, DeFi patterns and evolving typologies. AI-driven risk scoring engines are designed to adapt.

Who this guide is for: compliance, risk and product teams

This guide is for.

Compliance & MLRO teams

At US crypto exchanges in New York, Miami or San Francisco, FCA-registered UK cryptoasset firms in London or Manchester, and BaFin-supervised German banks in Frankfurt, Berlin and Munich.

Risk, fraud and financial crime teams

At neobanks, brokers, payments firms and OTC desks that handle even limited crypto flows.

Product & engineering teams

Embedding crypto rails into banking apps, fintech platforms or Web3 front-ends across the EU, Switzerland, France, the Netherlands and beyond.

If you’re evaluating blockchain AML analytics, VASP compliance monitoring or considering an AI-driven on-chain compliance and risk scoring platform, this is your buyer’s guide.

TL;DR: What AI-driven on-chain compliance and risk scoring delivers in 30 seconds

AI-driven on-chain compliance and risk scoring uses machine learning on blockchain data to flag high-risk wallets and transactions in real time so regulated firms can meet AML, sanctions and travel rule obligations across US, UK and EU regimes. It combines on-chain signals and off-chain intelligence to prioritize cases, reduce false positives, and give exam-ready explanations for why a wallet or transaction is considered risky.

What Is AI-Driven On-Chain Compliance and Risk Scoring?

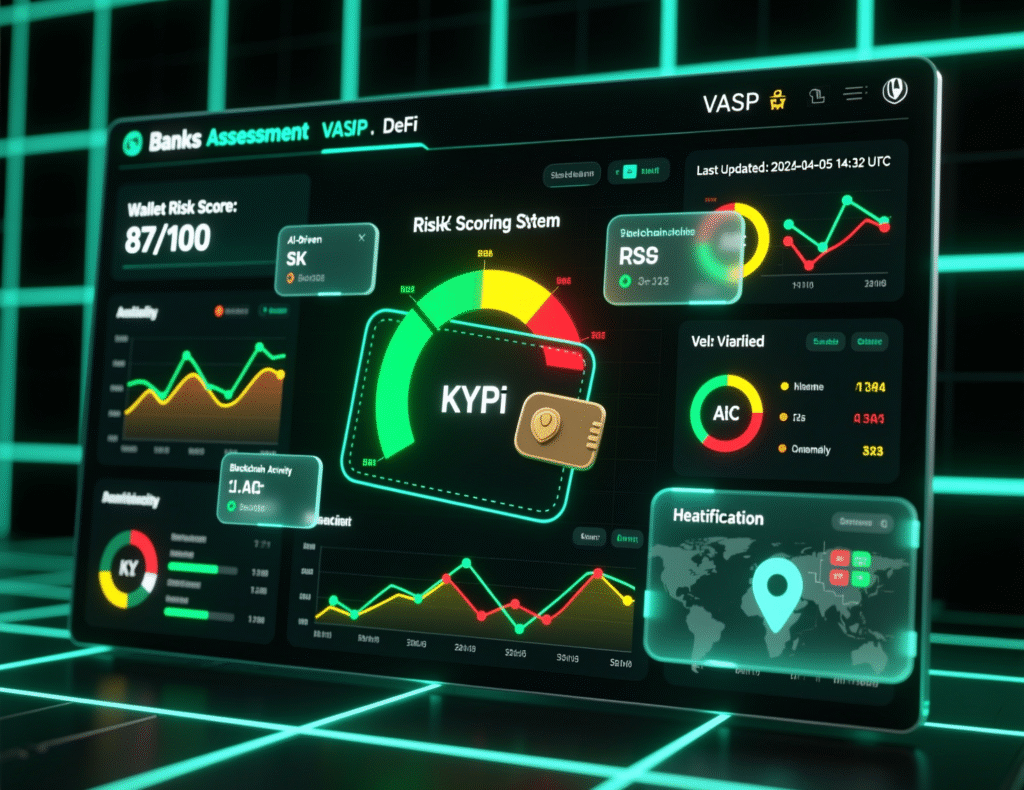

AI-driven on-chain compliance and risk scoring is the use of ML models on on-chain data and off-chain intelligence to assign dynamic risk scores to wallets, counterparties and transactions for AML, sanctions and fraud controls. In practice, it’s the evolution of blockchain AML analytics into a full-stack, API-driven risk engine that can plug into bank-grade transaction monitoring, case management and SAR processes.

Definition: From blockchain analytics to AI-driven on-chain compliance

Traditional blockchain analytics tools label addresses (e.g., exchanges, darknet markets, mixers) and show transaction graphs. AI-driven on-chain compliance goes further:

Models infer risk from patterns, not just direct exposure to known bad actors

Risk scores are dynamic, adjusting as new transactions and labels arrive

Signals are combined with KYC/KYB and behavioral data for crypto transaction risk assessment

In other words, you’re not just asking “Has this wallet ever touched a sanctioned mixer?” You’re asking, “Given everything we know, how likely is this wallet to be involved in money laundering, sanctions evasion or fraud now?”

Key components: on-chain monitoring, wallet risk scoring and case management

Most AI-driven crypto AML stacks consist of three layers:

On-chain transaction monitoring

Real-time screening of deposits, withdrawals, swaps and transfers across major L1/L2 chains, NFTs and cross-chain bridges.

Risk rules and models that trigger alerts (e.g., large inflows from high-risk clusters, DeFi protocol abuse, peeling chains).

Wallet / address risk scoring tools

Continuous scoring of customer and counterparty wallets using taxonomies like sanctions, darknet, scam, mixer, ransomware, fraud and gambling.

Support for sanctions and PEP screening for crypto, often aligning with existing name screening stacks.

Case management & workflows

Alert triage, SAR workflows, audit trails and integrations into existing bank or VASP case management.

Evidence packs suitable for FinCEN SARs, FCA reports, BaFin reports and law-enforcement requests.

How AI blockchain risk scoring differs from rules-only blockchain analytics

Rules-only tools tend to.

Struggle with novel patterns (new DeFi protocols, cross-chain bridges, creative obfuscation)

Trigger lots of false positives (any exposure to “high-risk” categories gets flagged)

Provide little prioritization across thousands of alerts

AI-driven risk engines:

Use supervised and unsupervised models to spot anomalies and risk clusters that rules don’t capture

Continuously learn from human feedback (e.g., cleared vs escalated cases)

Produce explainable risk factors that you can show to model risk management, internal audit and supervisors

Vendors like Chainalysis, TRM Labs and Elliptic have already moved in this direction; new entrants are building “AI-first” stacks from day one.

How AI On-Chain Risk Scoring Works Under the Hood

A modern AI risk engine combines address clusters, transaction graphs and label databases (e.g. sanctions lists) to infer how risky a wallet or transaction is, even when it hasn’t directly touched a known bad actor. Underneath, it looks more like a graph-ML platform than a simple rules engine.

On-chain signals that drive a crypto wallet’s risk score

Wallet risk scores typically blend dozens of signals, including:

Exposure to darknet markets, mixers, scams and sanctioned entities

Direct and indirect flows from OFAC-sanctioned services, high-risk exchanges and darknet marketplaces.

Smart contract interactions and DeFi protocol usage

Interactions with high-risk or hacked DeFi protocols, risky liquidity pools, or cross-chain bridges frequently used in hacks.

Cross-chain behavior

Rapid movement across chains and tokens to obfuscate provenance.

Address clustering heuristics

Techniques to link multiple addresses into an entity (e.g., VASP deposit addresses, mixer clusters).

VASP identification

Labelling wallets as belonging to exchanges, brokers, neobanks or custodians to contextualize risk.

The engine walks the transaction graph (often multiple hops) and calculates probabilities that a given wallet or transfer is connected to illicit activity. Chainalysis, for example, estimated tens of billions of dollars flowing to illicit addresses in 2024 alone, highlighting how much signal exists on-chain.

Machine learning for on-chain risk detection: models, feedback loops and explainability

Under the hood, you’ll typically find.

Supervised models

Trained on labeled cases (confirmed scams, mixers, ransomware, sanctions hits) to predict the likelihood of illicit behavior.

Unsupervised models

(clustering, anomaly detection) to surface new, unknown patterns of risk that don’t match existing typologies.

Human-in-the-loop feedback loops

Where investigators mark alerts as “true hit,” “false positive” or “escalated,” and that feedback feeds back into the models.

For US, UK and EU firms, explainability is critical. Model risk management and regulators expect to see:

The key features that drove the score (e.g., “two hops from sanctioned exchange,” “large inflows from darknet cluster”)

Stability over time and model monitoring

Documentation of training data, limitations and governance

FCA and BaFin guidance already highlight that cryptoasset businesses must understand why their controls work, not just buy tools.

Real-time on-chain risk scoring engines at scale

For high-volume exchanges in New York or San Francisco, or EU neobanks in Berlin, Amsterdam or Paris, latency and uptime are non-negotiable:

Infrastructure patterns

Cloud-native stacks on AWS or Azure with EU regional data residency (e.g., Frankfurt, Paris) for GDPR/DSGVO compliance.

Service levels

Sub-second response times for wallet screening APIs used at onboarding and withdrawal.

99.9%+ uptime SLAs for transaction monitoring pipelines.

API-first design

REST/GraphQL APIs to embed risk scoring into KYC/KYB flows, core banking systems, payment orchestration engines, and DeFi front-ends.

In the UK, for example, a London-based FCA-regulated neobank might call a wallet risk scoring API whenever a customer tries to connect an external wallet to their app. In Germany, a Frankfurt-based bank might query an AI-driven on-chain compliance platform before processing a large OTC trade for a corporate client.

Transaction Monitoring & Crypto AML Software Use Cases

Regulated exchanges in the US, UK and EU need on-chain transaction monitoring because regulators expect them to understand the provenance of crypto funds and demonstrate effective AML and sanctions controls during exams. For many firms, AI-driven on-chain transaction monitoring becomes the crypto counterpart to their fiat AML transaction monitoring system.

On-chain transaction monitoring vs traditional AML transaction monitoring

Traditional AML transaction monitoring systems focus on fiat transfers, card payments and account behavior. On-chain transaction monitoring:

Complements existing systems

For a New York-based exchange, crypto flows are monitored on-chain, while USD wires and ACH move through a BSA/AML system.

For a London bank, card and Faster Payments flows stay in the bank AML engine, with crypto deposits/withdrawals monitored in a blockchain AML analytics platform.

Combines data for PCI DSS-style thinking

Just as PCI DSS pushed card environments to isolate and monitor sensitive cardholder data, crypto AML pushes firms to treat blockchain exposures as a distinct but integrated risk domain.

Better platforms join up crypto transaction risk assessment with fiat and card data, enabling full-journey monitoring: on-ramp, on-chain, off-ramp.

Meeting US, UK and EU AML expectations with blockchain analytics

Regulators are increasingly explicit.

United States

FinCEN applies the Bank Secrecy Act to many virtual asset business models and has issued specific guidance and advisories on convertible virtual currencies.

OFAC expects screening of crypto wallets and services against sanctions lists.

NYDFS, the SEC and CFTC have all brought enforcement actions tied to weak AML programs at crypto platforms.

United Kingdom

FCA-registered cryptoasset businesses fall under the Money Laundering Regulations (MLR 2017) and must submit annual financial crime reports and consult the Financial Crime Guide.

Germany / EU

BaFin’s guidance under the Geldwäschegesetz (GwG) treats cryptoasset service providers as obliged entities and expects the use of blockchain analysis software.

AMLD5/6, MiCA and the new EU AML package aim to harmonize AML and travel rule expectations across the EU/EEA.

In all three regions, the message is similar: if you deal with crypto, you must monitor the provenance and destination of funds using appropriate tools and governance.

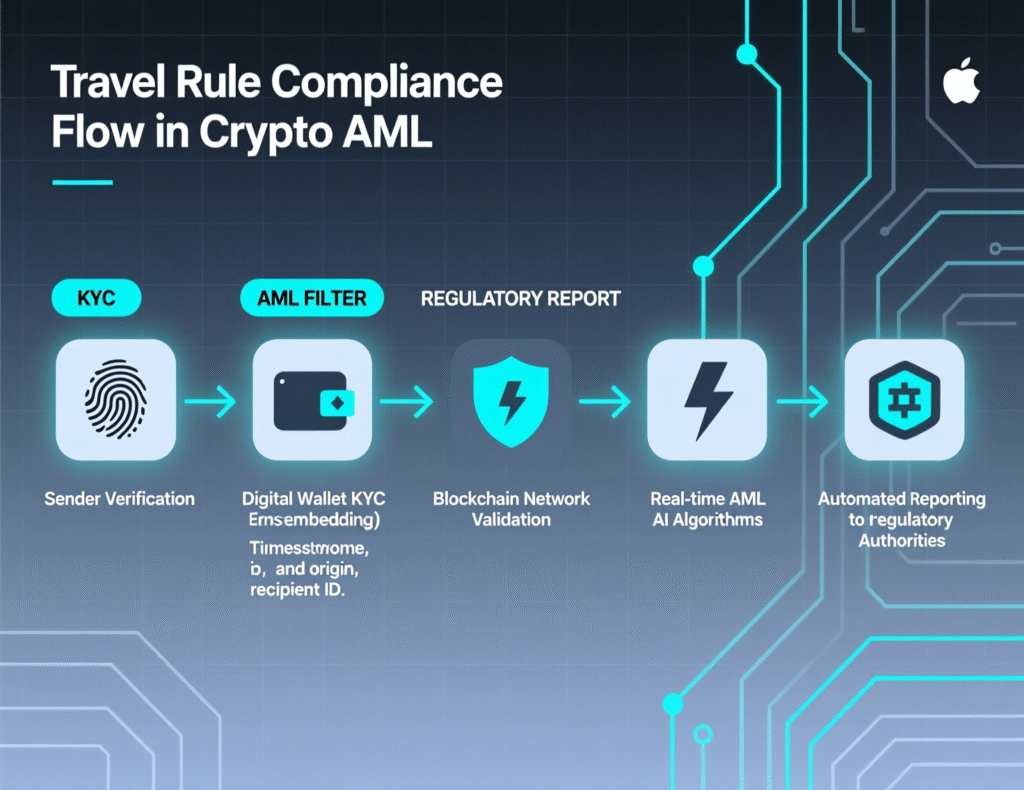

Travel rule and cross-border VASP compliance with AI-powered monitoring

The travel rule is moving from theory to operational reality.

Screening originator/beneficiary wallets in real time

AI-driven engines check not only whether VASP information is present in the travel rule message but whether the on-chain behavior of those wallets is consistent with declared counterparties.

Reconciling off-chain messages with on-chain flows

In the EU, Regulation (EU) 2023/1113 and EBA Travel Rule Guidelines require CASPs to include and verify originator/beneficiary information with crypto transfers.

Regional examples

US

FinCEN’s travel rule expectations for CVC mirror wire-transfer obligations.

UK

The UK travel rule regime applies to FCA-registered cryptoasset businesses handling cross-border transfers.

EU

As of late 2024, the travel rule is fully in force with no de minimis threshold for many transfers, pushing CASPs to adopt robust screening solutions.

AI-driven on-chain compliance platforms help match travel rule messages to actual on-chain behavior, which is increasingly a focus area in inspections.

Wallet / Address Risk Scoring for Banks, VASPs and DeFi

Crypto address risk scoring and wallet risk scoring tools let you treat wallets and counterparties like parties in your KYC/KYB file—not anonymous strings. You can screen them once, monitor them continuously and make risk-based decisions.

Crypto address risk scoring and wallet risk scoring tools explained

A typical wallet risk scoring product gives you

Risk taxonomies

For sanctions, darknet markets, scams, mixers, ransomware, fraud and gambling

Risk bands

(e.g., low/medium/high/critical) with underlying factors

Counterparty-level crypto transaction risk assessment

So you can assess not just your customers, but who they interact with on-chain

This matters for

US banks considering crypto custody or stablecoin deposits in New York or Miami

FCA-regulated UK neobanks letting customers connect external wallets

BaFin-regulated German institutions taking crypto as collateral or enabling trading desks in Frankfurt or Munich

Use cases by segment: US banks, UK neobanks, German and EU VASPs

US banks and custodians

OFAC-focused screening of inbound and outbound crypto wallets.

High-risk counterparty detection to support BSA/AML programs and SEC/CFTC investigations.

FCA-regulated UK neobanks and fintechs

Wallet risk scoring for embedded crypto features (e.g., buy/sell/hold in a super-app).

Fraud and scam detection as more UK retail users invest and stake cryptoassets.

BaFin-regulated German banks and EU VASPs

“Krypto-Wallet-Risiko-Scoring” aligned with GwG, MiCA and AMLD6, plus the EU single AML rulebook.

In all segments, the aim is the same: unify on-chain intelligence with your broader risk view.

Counterparty risk scoring in DeFi and Web3

DeFi protocol risk intelligence is becoming its own category

Protocol-level scoring

Understanding risk at the smart-contract level (e.g., hacked, admin-key risk, OFAC-sanctioned front-ends).

Pool-level risk

Evaluating liquidity pools on DEXs and cross-chain bridges used to launder stolen or ransomware funds.

Privacy-aware patterns

Applying risk-based controls without trying to fully de-anonymize every wallet, using scoring bands and thresholds instead.

For a DeFi project based in Zurich or Amsterdam, AI-driven counterparty scoring enables compliance-by-design while still supporting pseudonymous user experiences.

Regulatory & Data Protection Considerations

AI-driven on-chain compliance lives at the intersection of AML, sanctions and data protection. Getting the governance right is as important as picking the right vendor.

Aligning on-chain analytics with US, UK and EU regulatory frameworks

You should be able to map risk scoring outputs directly to regulatory artifacts:

FinCEN red flags and BSA expectations in the US.

FCA guidance and Financial Crime Guide references for cryptoasset firms in the UK.

BaFin Merkblätter and GwG guidance in Germany, as well as EBA and ESMA expectations for CASPs in the EU.

Your AI-driven on-chain compliance and risk scoring platform should help produce evidence for SARs, suspicious activity reporting, and law-enforcement requests across jurisdictions.

GDPR-compliant blockchain analytics and DSGVO constraints

Under GDPR/DSGVO and UK-GDPR you must.

Distinguish between pseudonymous on-chain public data and personal data (e.g., KYC details, IPs, device IDs).

Apply data minimization and retention principles to analytics outputs (risk scores, labels, case notes).

Consider data residency e.g., processing within EU regions like Frankfurt or Paris when serving EU/EEA and Swiss clients.

Many teams deploy regional data processing, encrypt identifiers, and keep clear retention policies for analytics artifacts, not just customer records.

Governance, model risk and internal audit expectations

Regulators such as NYDFS, FCA and BaFin increasingly expect banks and large VASPs to treat AI risk engines like any other model:

Document the model inventory, assumptions and limitations

Run independent validation and periodic reviews

Monitor for bias and drift, especially where models influence onboarding or blocking decisions

Internal audit will ask: “If the model failed or mis-scored a risky counterparty in Berlin or London, how would we know—and what’s the fallback?”

Evaluating AI-Driven On-Chain Compliance Vendors

Choosing a vendor is about more than coverage charts. You’re buying a core part of your AML stack.

Must-have capabilities checklist for crypto AML transaction monitoring software

When you review vendors

Coverage

Major L1/L2 chains (BTC, ETH, stablecoins, newer smart-contract chains), DeFi, NFTs and cross-chain bridges.

On-chain transaction monitoring + wallet risk scoring in one platform, not two loosely-coupled products.

Sanctions and PEP screening for crypto.

Plus case management and SAR workflows.

GEO fit

controls that are FinCEN-ready, FCA-aligned and BaFin/MiCA-aware, including reporting exports tailored to regional expectations.

Ask for customer references in your segment (e.g., a US exchange in New York, a UK neobank in London, a German VASP in Frankfurt).

Data quality, explainability and integrations with KYC/KYB stacks

For risk and IT buyers, three issues dominate.

Data quality

Clear methodology for clustering, labels and false-positive management.

Explainability

Human-readable reasons for risk scores, with links back to on-chain transactions.

Integrations

Connectors or APIs to:

US KYC providers and sanctions screening tools

UK open banking data sources

EU identity providers and trust frameworks

Check SLAs, throughput benchmarks and sandbox environments for engineering teams to test against realistic loads.

Deployment, security and cloud choices

Most vendors offer

SaaS

Fastest to adopt, typically hosted on AWS or Azure with options for US, UK or EU regions.

Private cloud or on-prem

For highly regulated banks or Swiss/EEA institutions with strict data residency or banking secrecy rules.

Security expectations include:

Independent certifications (e.g., ISO 27001, SOC 2)

Granular internal access controls, audit trails and strong key management

Logging that aligns with your own SIEM and fraud platforms

Pricing models range from volume-based (alerts, API calls, assets under screening), seat-based for investigators, to enterprise contracts for large, multi-entity groups.

Implementation Roadmap, ROI and Next Steps

Even the best AI-driven on-chain compliance and risk scoring platform will underperform without a structured rollout. A phased approach lets you prove value while keeping regulators comfortable.

Phased rollout for US, UK and EU compliance teams

A pragmatic roadmap looks like this:

Pilot with one entity or region

For example, your US exchange in New York or your UK cryptoasset subsidiary in London.

Prioritize high-impact use cases

Sanctions screening, travel rule reconciliation, high-risk wallet monitoring for large deposits/withdrawals.

Integrate with existing stacks

Wire results into KYC/KYB, fiat AML transaction monitoring and case management.

Expand to multi-entity coverage

Roll out to EU entities in Berlin, Paris, Amsterdam and Zurich, harmonizing policies under your group AML framework.

You don’t need to solve every Web3 risk pattern on day one—start with clear, exam-visible improvements.

Measuring ROI: fewer false positives, better SARs, smoother exams

To make the business case, track

Alert-to-case conversion and reduction in low-value alerts

Investigator time saved per alert or SAR

Exam outcomes fewer findings, remediation items and enforcement risks

Global reports show AML penalties routinely exceed several billions per year across banking and crypto, which means even moderate efficiency and effectiveness gains can have outsized financial impact. Law-enforcement collaboration wins (asset freezes, recovered funds, successful prosecutions) are powerful proof points with boards and regulators.

Building the business case and choosing your AI-driven partner

To align stakeholders

Map the stakeholder group compliance/MLRO, risk, fraud, data, engineering, product and regional MLROs.

Create a vendor evaluation matrix based on this guide: coverage, GEO fit, explainability, integrations, security and cost.

Prepare a POC plan

Specific chains and use cases

Historical data to backtest

Success metrics (false-positive lift, time-to-investigate, coverage gains)

Then run time-boxed demos and proof-of-concepts with two or three shortlisted vendors and document outcomes in language an examiner would appreciate.

FAQs

Q : How accurate are AI-based crypto wallet risk scores compared with traditional rules engines?

A : AI-based crypto wallet risk scores are generally more adaptive and nuanced than traditional rules engines because they use many more signals and can learn from investigator feedback. Rules-only approaches treat every exposure to a risky cluster the same way, which often creates noisy alerts and blind spots. AI models, by contrast, combine on-chain transaction graphs, address clustering and off-chain labels to estimate the probability of illicit behavior, then update those estimates as new data arrives. Accuracy still depends on data quality, model governance and continuous tuning, but in well-run programs firms often see both fewer false positives and better detection of complex patterns like cross-chain laundering.

Q : What data should a VASP share with an AI-driven on-chain compliance vendor, and what stays in-house?

A : Most VASPs share public on-chain data and case metadata required to tune risk models but keep sensitive PII and commercial secrets tightly controlled. Typically, vendors ingest address labels, risk ratings, alert dispositions and sometimes pseudonymous user IDs or internal wallet tags, with PII either tokenized or retained in-house behind your own APIs. For cloud deployments, it’s common to require regional data residency (e.g., EU data centers for GDPR/DSGVO) and strict data processing agreements. High-risk or banking groups sometimes choose private cloud or on-prem deployments so that all KYC/KYB and transaction data stays within their own perimeter and the vendor supplies only software and model updates.

Q : Can AI-driven on-chain compliance and risk scoring be used by traditional banks with only limited direct crypto exposure?

A : Yes. Many traditional banks in New York, London, Frankfurt and Zurich use AI-driven on-chain compliance even when their direct crypto activity is relatively small. Typical use cases include screening wallets involved in OTC trades, custody services, tokenized assets, or collateral arrangements, and assessing counterparties like crypto exchanges or fintech partners. Banks also use these tools to monitor customer flows to and from external VASPs, especially where scams and fraud are prevalent. From a supervisory perspective, regulators increasingly expect banks with any material crypto exposure to demonstrate they understand the associated financial crime risks, so an AI-enabled view of key wallets and flows can be a strong part of that story.

Q : How do AI blockchain risk scoring tools handle new chains, tokens and DeFi protocols as they emerge?

A : Modern AI blockchain risk scoring tools are built to be chain-agnostic, so adding new L1/L2 chains and DeFi protocols is mainly an ingestion, labeling and model-tuning problem. Vendors typically maintain continuous integration pipelines that parse new chain data, normalize it, and apply address clustering and labelling heuristics. For DeFi, they map smart contracts, pools and bridges, then train models on interaction patterns (e.g., high churn, mixer-like flows, links to hack addresses). In your due diligence, ask how quickly the vendor can support a new chain or protocol, what percentage of on-chain value on that chain they can attribute, and how they validate labels especially for emerging ecosystems that might be popular with your customers.

Q : What are the biggest implementation pitfalls when rolling out crypto AML transaction monitoring software across multiple regions?

A : The biggest pitfalls usually involve governance and scope, not just technology. First, firms underestimate how different US, UK and EU expectations are, so they deploy a single global rule set that doesn’t map cleanly to local laws and exam practices. Second, they fail to align data protection and secrecy rules with AML needs especially for GDPR/DSGVO and local banking secrecy regimes leading to internal pushback. Third, they treat the rollout as a one-off IT project rather than an ongoing model and controls program, so feedback loops and periodic tuning never materialize. Successful programs define a global policy, then localize thresholds and reports by region, embed compliance and data protection stakeholders early, and budget for continuous tuning, not just implementation.

Key Takeaways

AI-driven on-chain compliance and risk scoring turns raw blockchain data into dynamic wallet, counterparty and transaction risk scores that regulators increasingly expect to see.

Regulated entities in the US, UK, Germany and across the EU must align on-chain transaction monitoring with FinCEN, FCA, BaFin, MiCA and travel rule requirements, including evidence-ready SAR processes.

The best platforms combine on-chain transaction monitoring, wallet risk scoring, case management and strong integrations with existing KYC/KYB and AML systems.

Governance, GDPR/DSGVO compliance, model risk management and data residency are as important as chain coverage and detection performance.

A phased rollout starting with one entity or region, then expanding helps prove ROI, reduce false positives and build internal and supervisory trust.

If you’re responsible for crypto AML, sanctions or financial crime controls, AI-driven on-chain compliance and risk scoring is quickly moving from “nice-to-have” to “exam question.” The good news: you can start small, prove value in one region or product, and then standardize across your group.

Consider mapping your current crypto risk posture against the capabilities in this guide, then shortlist vendors and design a focused POC. When you’re ready to turn that roadmap into a concrete implementation, partner with an experienced engineering team (like Mak It Solutions) Makitsol+1 that can integrate AI-driven risk engines into your broader cloud, data and compliance stack.( Click Here’s )