AI Crypto Portfolio Management: A 2025 Guide

AI crypto portfolio management uses machine learning and automation to monitor, rebalance and optimize a cryptocurrency portfolio across exchanges and wallets. Unlike basic trackers or manual spreadsheets, it can score risk, simulate scenarios and execute rules-based trades in real time based on data, not emotion.

Introduction

Cryptocurrency has moved from a niche hobby to a serious asset class for both retail and institutional investors in New York, London, Frankfurt and beyond. Global crypto ownership is estimated at roughly 6–7% of the world’s population, with hundreds of millions of users now holding digital assets. At the same time, volatility, complex tax rules and constantly changing regulation make it hard to manage a portfolio safely and efficiently.

That’s where AI crypto portfolio management comes in: a category of tools and platforms that use algorithms, on-chain data and automation to help you construct, monitor and rebalance portfolios with far more discipline than checking prices on your phone every hour.

What Is AI Crypto Portfolio Management?

AEO micro-answer

AI crypto portfolio management is the use of machine learning, rules engines and automation to build, monitor and rebalance a portfolio of digital assets across exchanges and wallets. It differs from traditional crypto tools by combining tracking, risk scoring, tax-aware analytics and (optionally) automated trading into one decision-making layer rather than just showing prices or executing isolated orders.

From Manual Tracking to AI-Driven Crypto Portfolios

Most investors still manage crypto with a mix of exchange apps, hardware wallets, DeFi dashboards and maybe a spreadsheet. That approach breaks down when you:

Hold 20+ assets across 3–4 exchanges

Use DeFi protocols for lending, staking or liquidity provision

Need tax reports for the IRS, HMRC or German tax authorities

AI crypto portfolio management platforms sit above all this. They connect to exchanges and wallets, aggregate balances, classify transactions and use algorithms to propose portfolio weights or rebalance actions. Think of it as a crypto robo-advisor using AI, rather than a simple portfolio tracker.

How AI Crypto Portfolio Management Differs From Trading Bots

Classic crypto trading bots focus on short-term trade execution: grid bots, DCA bots, arbitrage bots and so on. They usually run on one exchange at a time and don’t think about your total net worth, tax impact or risk budget.

AI crypto portfolio managers, by contrast.

Start from portfolio objectives (e.g., volatility target, BTC/ETH core, stablecoin buffer)

Use machine learning for crypto portfolio optimization, not just fixed strategies

Track risk across all holdings, including DeFi positions and stablecoins

Integrate with tax and reporting tools

You might still use bots inside this stack, but the portfolio manager orchestrates them in line with your overall plan.

Key Components: Data, Models, Integrations, Governance

Any serious AI crypto portfolio platform typically includes four building blocks:

Data

Prices, order books, volumes, on-chain metrics, DeFi yields, funding rates, plus macro and sentiment data.

Models

ML models for AI-driven risk scoring for digital assets, factor models, scenario analysis, and sometimes reinforcement learning strategies for crypto trading.

Integrations

Read-only and trading APIs to major exchanges (e.g., Coinbase, Kraken), wallet connections, DeFi protocol integrations and tax/reporting tools.

Governance

Role-based access control (RBAC), approval workflows, audit trails and kill switches so humans stay in charge especially important for institutions and MiCA-regulated CASPs in the EU.

How AI Crypto Portfolio Management Works in 2025

AEO micro-answer

In 2025, most AI crypto portfolio tools follow a similar workflow: you connect exchanges and wallets, the platform ingests historical and live data, ML models analyze risk and optimization options, then the system proposes or executes rebalancing and trade orders according to rules. Finally, it continuously monitors risk and performance, surfacing alerts when exposures drift outside agreed limits.

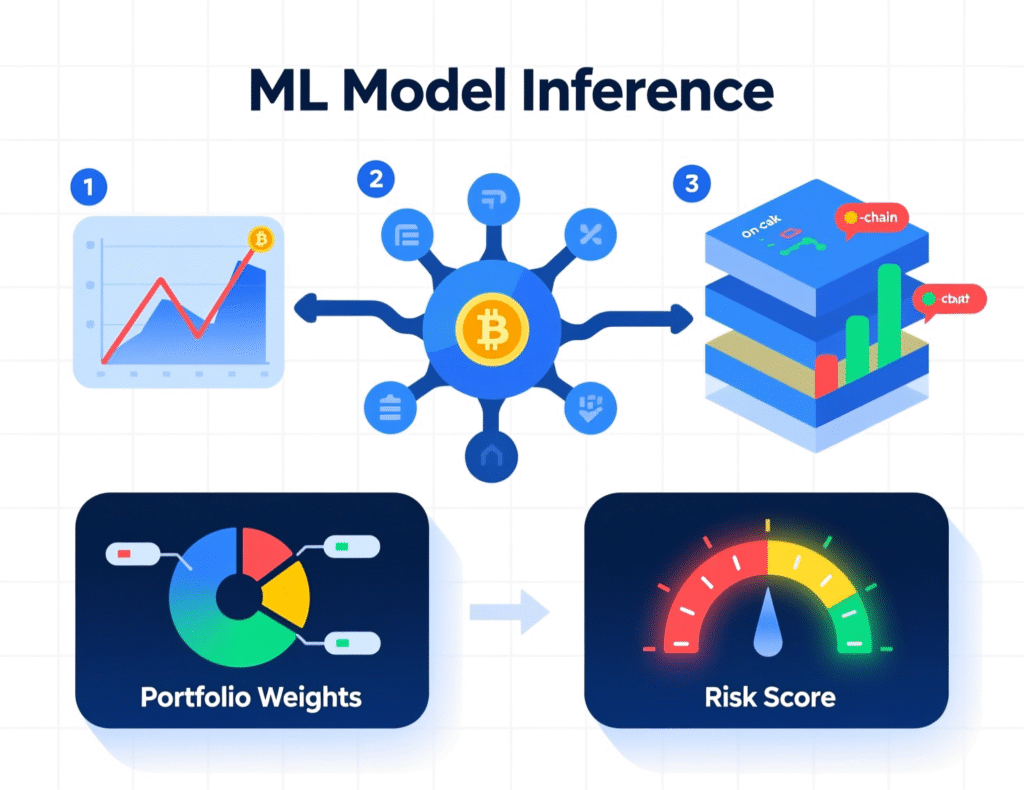

Machine Learning for Crypto Portfolio Optimization & Risk Scoring

Machine learning for crypto portfolio optimization doesn’t magically “beat the market,” but it can help you.

Estimate risk/return characteristics for assets and strategies

Cluster assets by behavior (e.g., high-beta DeFi tokens vs. low-volatility stablecoins)

Build portfolios that target a volatility or drawdown constraint

Some platforms train models on price, volume, on-chain flows and derivatives data to produce risk scores for each asset or strategy. These can inform:

Maximum position size per token

Leverage limits for futures/Perps

Dynamic stablecoin buffers in high-volatility regimes

For retail users, this often shows up as intuitive dashboards (“high risk”, “medium risk”) rather than raw model outputs.

AI Crypto Portfolio Rebalancing Automation Across Multiple Exchanges

Manually rebalancing across Coinbase, Kraken and a couple of local EU exchanges is error-prone and slow. AI crypto portfolio managers automate this via:

Targets: e.g., 40% BTC, 30% ETH, 20% majors, 10% long-tail

Tolerances: e.g., rebalance only when weights drift by >5%

Constraints: no single asset >15%, no single exchange >50% of holdings

The engine then calculates the trades needed and either:

Proposes them for your approval (semi-autonomous), or

Executes automatically within defined rules (autonomous mode)

In practice, institutions often keep approval workflows, while advanced retail investors in the US or UK may opt into partial automation for small accounts.

On-Chain Data, DeFi Signals & Multi-Agent Systems for Portfolio Decisions

A key 2025 trend is using on-chain data analytics for AI crypto agents. Instead of only looking at centralized exchange prices, platforms ingest:

Wallet flows (whale movements, smart money addresses)

DeFi protocol metrics (TVL shifts, yield changes, liquidation levels)

Governance and protocol upgrade signals

Some cutting-edge systems use multi-agent architectures, where:

One agent scans on-chain data for anomalies

Another evaluates strategies (e.g., rotate from staking into restaking)

A risk agent checks exposures vs. constraints

A coordinator agent proposes a final action or flags a human for review

This “agents inside a portfolio manager” model is still emerging but is particularly relevant for DeFi-heavy portfolios in Berlin, Zurich or London.

Benefits & Limitations for US, UK, German & EU Investors

AEO micro-answer (bullets)

Top benefits

Better diversification and risk controls across exchanges and wallets

24/7 monitoring and alerts during volatile markets

Tax-aware transaction tagging and reporting flows for IRS, HMRC and German/EU tax rules

Less emotional decision-making; more rules and data

Main risks

Model risk and overfitting to historical data

Exchange, wallet and smart contract risk still remain

Regulatory uncertainty, especially in the US, and evolving MiCA rules in the EU

Over-trusting “autonomous” systems without human oversight

Core Benefits: Diversification, 24/7 Monitoring, Tax-Aware Decisions

For investors in New York or San Francisco, AI crypto portfolio managers help diversify across venues (e.g., Coinbase plus a qualified custodian) while tracking total exposure in one place. In London, UK investors can combine Open Banking data with crypto holdings to see total net worth, enabling smarter allocation decisions.

Many tools run 24/7 monitoring, sending alerts when:

Leverage exceeds thresholds

Stablecoin depegs are detected

Positions hit pre-defined loss limits

Some platforms also integrate with tax engines to support capital gains calculations for the US, UK and Germany. They can flag tax-loss harvesting opportunities and produce reports aligned with local guidance (e.g., HMRC’s share pooling rules or German one-year holding exemptions), though you should still confirm with a tax advisor.

What Can Go Wrong? Model Risk, Overfitting & Exchange/Wallet Risk

Even the best machine learning model is trained on past data. In a market where regimes shift overnight, overfitting is a real danger: models that looked brilliant on backtests may fail quickly in live trading.

Other key risks

Exchange risk

Custody failures, hacks, sudden delistings

Wallet risk

Compromised keys, signing malicious transactions

Smart contract risk

DeFi exploits or governance attacks

Regulators like the SEC and CFTC stress that crypto remains high risk and that investors should only risk money they can afford to lose.

In short

AI tools can help manage risk, but they can’t eliminate it.

GEO Nuances: US, UK, Germany & EU Investor Protections and Expectations

United States

Oversight from the SEC, CFTC and FinCEN, plus state regimes. Enforcement around crypto offerings and AI-themed scams has been rising.

United Kingdom

FCA rules on financial promotions, fair disclosures and risk warnings apply to many crypto products aimed at UK retail investors.

Germany & EU

Under MiCA/MiCAR, Crypto-Asset Service Providers (CASPs) will operate under a harmonized framework with passporting rights, but also stricter conduct and disclosure obligations.

For EU investors in Frankfurt or Berlin, this means AI crypto portfolio platforms will increasingly need MiCA-compliant licenses plus GDPR/DSGVO-aligned data protection measures.

Autonomous Crypto Trading Agents Inside a Portfolio

AEO micro-answer

AI agents for crypto trading are software entities that can observe market and on-chain data, decide on actions such as rebalance, hedge or deploy to DeFi, and then execute transactions via smart contracts or exchange APIs with little or no human intervention. To keep them safe, investors and platforms should enforce guardrails like position limits, whitelisting of contracts and exchanges, multi-signature approvals and emergency kill switches.

What Are AI Agents for Crypto Trading and DeFi?

An AI trading agent is like a programmable junior portfolio manager: it has goals, tools and constraints. In DeFi this could mean:

Monitoring yield opportunities across lending protocols

Moving liquidity when rates change

Adjusting collateral before liquidation thresholds are hit

Some agents use reinforcement learning strategies for crypto trading, learning from simulated outcomes to refine their policies. Others rely on rule-based logic plus ML-based alerts.

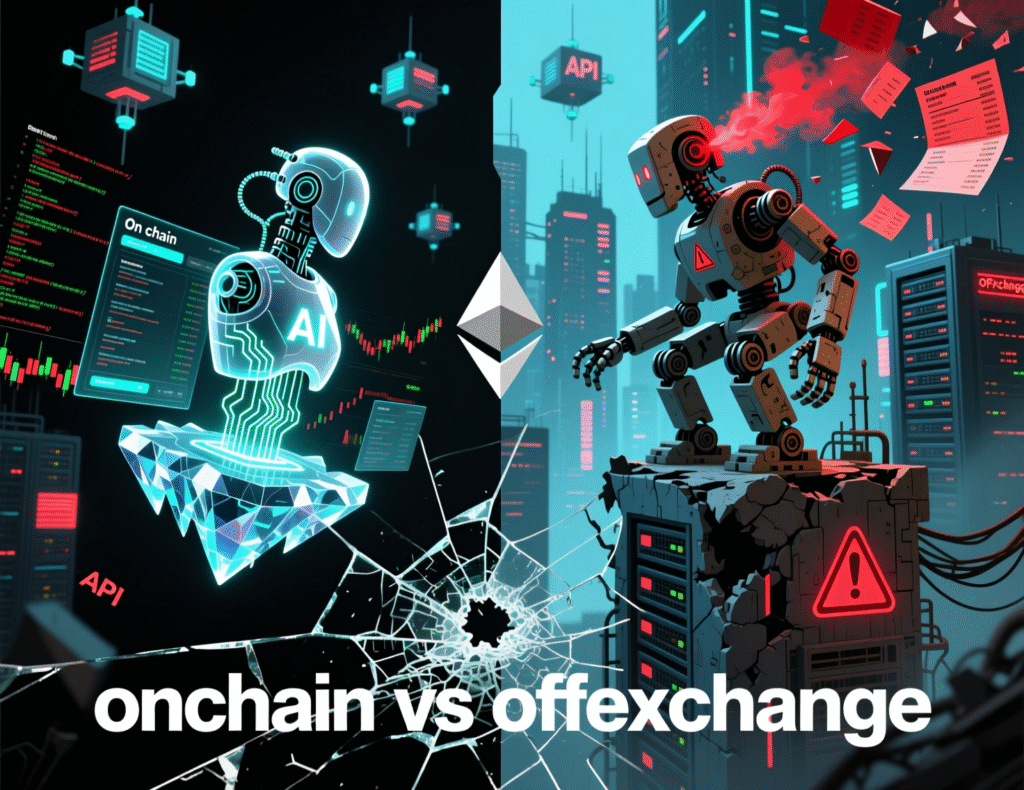

Autonomous Crypto Trading Agents On-Chain vs Off-Exchange

There are two main deployment patterns.

On-chain agents

Operate via smart contracts and on-chain instructions

Common in Ethereum, L2 and DeFi ecosystems

Benefits

Transparency and composability

Risks

Smart contract bugs, MEV, gas spikes

Off-exchange / off-chain agents

Run on infrastructure that calls centralized exchange APIs

Good for managing positions on Coinbase, Kraken or BaFin-/FCA-registered platforms

Benefits

better integration with KYC/AML and traditional risk systems

Risks

API key leakage, exchange outages

Serious platforms increasingly combine both, with strict controls over what each agent can do.

Agentic AI Risk, Governance & Kill-Switch Design

For institutions, agentic AI must be governed like any other trading system:

Clear policies and maximum risk budgets per strategy

Pre-trade and post-trade checks

Independent risk oversight

Awell-designed kill switch can:

Disable all new orders from an agent

Cancel outstanding DeFi positions where possible

Force human review before re-activation

This is especially important for MiCA-regulated CASPs and European banks who must show supervisors (e.g., BaFin, ESMA, ECB) that they can stop autonomous behavior quickly if it misfires.

Tools, Platforms & AI-Powered Crypto Portfolio Manager Apps

AEO micro-answer.

Most AI crypto portfolio management tools offer portfolio tracking across exchanges and wallets, automated or rules-based rebalancing, risk scoring, tax reporting integrations and sometimes autonomous DeFi strategies. When evaluating tools, look for must-have capabilities such as read-only and trade APIs, granular permissioning, transparent fee structures, MiCA/FCA alignment where relevant, and exportable audit logs.

AI Crypto Portfolio Managers vs AI Trading Bots: Which Do You Need?

If your main problem is time and discipline, an AI crypto portfolio manager is usually the better starting point. It.

Tracks all holdings

Offers high-level strategy controls

Integrates with tax and reporting

If you’re a more advanced trader wanting to run specific high-frequency or arbitrage strategies, dedicated AI trading bots (or custom infrastructure) may make sense but they should still be coordinated via a portfolio view to avoid hidden risks.

Best AI Crypto Portfolio Management Tools: US, UK & EU Snapshot

Rather than naming winners, it’s better to think in categories.

Retail-friendly apps

CoinStats, CoinTracker and similar products focus on tracking, analytics and sometimes light automation, with support for major US, UK and EU exchanges.

Exchange + portfolio suites

Some exchanges offer built-in AI-driven analytics and simple robo-advisor style allocations.

Institutional platforms

Combined portfolio, risk and reporting systems built for funds, family offices and CASPs, often with SOC 2 reports and data center audits.

For investors in London, Frankfurt or Berlin, check whether a platform is registered with the FCA, BaFin or another national EU regulator and whether any MiCA-related CASP authorization is in progress or granted.

Enterprise-Grade & API-Based AI Crypto Portfolio Management for Fintechs

Fintechs and neobanks increasingly want to embed crypto robo-advisors using AI directly into their apps. They look for:

REST/GraphQL APIs to pull risk metrics and portfolio proposals

Webhooks for alerts and rebalancing events

Compliance documentation (GDPR/DSGVO, SOC 2, PCI DSS where card data is involved)

Mak It Solutions helps teams design data and analytics architectures underpinning these experiences from event pipelines to BI dashboards using modern cloud platforms and business intelligence tools.

Compliance, Data Protection & Regulation

AEO micro-answer.

MiCA, GDPR/DSGVO, UK-GDPR and FCA rules matter because they define how AI crypto portfolio platforms must handle custody, transparency, marketing, data protection and investor rights across Europe and the UK. Investors should look for platforms with clear regulatory status (e.g., MiCA-aligned CASP licensing), strong privacy policies, explicit data processing bases, and independent security attestations like SOC 2 or PCI DSS for payment data.

Operating Under SEC/CFTC/FinCEN Expectations in US Crypto Markets

In the US, AI crypto portfolio tools intersect with several regulators:

SEC

Oversight of securities and certain crypto assets; active enforcement and investor alerts, including AI-themed fraud warnings.

CFTC

Oversight of crypto derivatives and some spot markets.

FinCEN

AML/KYC expectations for money services businesses.

Retail-oriented apps must avoid implying guaranteed returns or “risk-free” strategies. Institutional platforms working with hedge funds in New York or San Francisco should have robust compliance integrations (KYC providers, trade surveillance, suspicious activity reporting).

FCA Rules, UK-GDPR & Risk Warnings for UK Retail Investors

In the UK, the FCA has tightened crypto financial promotion rules. That impacts AI-powered dashboards in London which:

Send performance notifications

Suggest allocations

Offer “copy strategies” or “smart portfolios”

These can be treated as promotions and must include fair risk warnings, not just glossy UI. Developers also need to align with UK-GDPR (the UK’s version of GDPR) when processing personal data such as transaction histories and KYC data.

BaFin, MiCA/MiCAR & GDPR/DSGVO for German/EU AI Crypto Platforms

For Germany and the wider EU, three pillars matter

MiCA/MiCAR

New EU-wide framework for crypto-asset issuance and CASPs, including conduct, disclosure, and prudential rules.

BaFin

For German firms, supervision and licensing under both national and EU rules.

GDPR/DSGVO

Strict requirements on consent, data minimization, cross-border transfers and subject rights.

This means an AI crypto portfolio manager marketed to Berlin or Frankfurt clients must handle both financial regulation and data protection correctly.

Data Residency, PCI DSS, SOC 2 and Security Expectations

Beyond financial rules, serious investors expect:

Data residency controls (e.g., EU data stored in EU cloud regions)

PCI DSS compliance when payment card data is involved

SOC 2 reports demonstrating security and availability controls

Mak It Solutions frequently works with clients to architect cloud environments, logging and BI layers that respect these constraints while still enabling real-time analytics and AI workloads.

How AI Crypto Portfolio Tools Connect to Exchanges, Wallets & Tax

AEO micro-answer

Most AI crypto portfolio managers connect to exchanges via API keys or OAuth, with separate scopes for read-only vs trading permissions. Wallets and DeFi positions are synced using public addresses, wallet connectors or signing challenges, and tax modules then use this combined transaction data to compute capital gains, income and jurisdiction-specific tax reports.

Connecting to US, UK & EU Exchanges

Connections typically use

API keys

With configurable permissions (read, trade, withdrawal — avoid granting withdrawal when not required)

OAuth flows

Where exchanges support them for better key hygiene

IP whitelisting and HMAC signatures

For security

US investors often connect Coinbase or Kraken; EU investors may add BaFin-/FCA-registered platforms as they seek MiCA-aligned infrastructure. Always verify that the AI tool stores keys securely (e.g., HSMs, vaults) and supports key rotation.

Wallets, DeFi Protocols and On-Chain Agents

Wallet connectivity often works via:

Public addresses you paste or import

Wallet connectors (e.g., WalletConnect) and signing a message to prove ownership

Direct smart contract integrations for DeFi protocols

Agentic AI systems can then:

Monitor DeFi positions

Suggest strategy changes

In some setups, submit transactions for your approval

For security, many investors keep cold storage offline and only connect hot wallets or exchange accounts with limited balances to AI agents.

Tax-Aware Reporting: US Capital Gains, UK HMRC and German/EU Tax Rules

Tax engines inside portfolio managers pull transaction histories and classify:

Buys/sells and capital gains events

Income from staking, airdrops or liquidity mining

Fees, funding payments and interest

They then apply rules for the US (e.g., short vs long-term capital gains), UK (share pooling) and Germany/EU (e.g., one-year holding periods, specific national nuances) Reports can often be exported for your tax advisor or uploaded into tax filing software.

How to Evaluate and Choose an AI Crypto Portfolio Manager

AEO micro-answer

Before granting any AI crypto tool trading permissions or API keys, investors should check its regulatory status, security architecture, data protection practices, fee model, performance transparency and the presence of clear kill switches and permission controls. If any of these are missing or vague, treat it as a red flag.

Due Diligence Checklist: Security, Compliance, Transparency, Performance

Key questions to ask vendors

Security

How are API keys stored and rotated? Is there a recent SOC 2 report or independent penetration test?

Compliance

Are they registered or licensed in your jurisdiction? How do they handle MiCA/FCA/SEC expectations?

Transparency

Are algorithms described at a high level? Are risks clearly disclosed?

Performance

Do they show realistic, net-of-fees performance with clear methodology, not only cherry-picked examples?

Mak It Solutions often helps fintechs and funds evaluate platforms and design bespoke analytics stacks instead of blindly trusting black boxes.

Comparing Pricing, Fees and Value vs DIY or Bots

Compare

Flat subscription vs AUM-based fees

Extra costs for tax reports, DeFi scanning or additional accounts

Cloud costs if you self-host open-source tools

For some smaller portfolios, a well-designed DIY process with a few dashboards (e.g., built with BI tools and analytics services like those Mak It Solutions implements) may beat fancy AI tools on cost but at the expense of automation and 24/7 monitoring.

Red Flags and “Too Good To Be True” AI Performance Claims

Be skeptical of.

Guaranteed returns or “can’t lose AI strategies”

Anonymous teams with no regulatory footprint

No clear explanation of how risk is managed

Aggressive affiliate schemes and social media hype

Regulators and bodies like IOSCO have explicitly warned about AI-related investment scams. If it sounds too good to be true, it almost certainly is.

Practical Use Cases & Examples Across US, UK, Germany and EU

AEO micro-answer

Imagine a US hedge fund in New York using AI to rebalance between BTC, ETH and regulated futures; a UK retail investor in London using a dashboard that combines Open Banking data with crypto holdings; and a MiCA-regulated CASP in Frankfurt offering AI-assisted, risk-controlled portfolios to EU clients with full GDPR/DSGVO compliance. These scenarios show how the same core technology adapts to different regulatory and risk profiles.

US Retail and Hedge Fund Use Cases (New York, San Francisco)

A San Francisco retail investor connects Coinbase and a hardware wallet, sets a simple rules-based AI policy (“keep 30% in BTC/ETH, cap any alt at 5%”), and uses tax reports each April.

A New York hedge fund combines internal quant models with an AI portfolio layer to enforce firm-wide risk limits and monitor DeFi exposures, with compliance teams receiving automated alerts.

UK Retail Dashboards with Open Banking & GBP On-Ramps (London)

In London, a fintech app connects Open Banking, GBP bank accounts and multiple exchanges. The AI engine:

Sees the user’s total financial picture

Suggests safe allocation bands for crypto relative to income and savings

Produces FCA-friendly risk warnings while aligning with UK-GDPR privacy standards

German/EU Institutional and MiCA-Regulated CASP Scenarios

A Frankfurt-based CASP under MiCA uses AI tools internally for risk monitoring while offering more conservative, diversified portfolios to EU retail clients. A Berlin or Zurich asset manager might go deeper into DeFi but still operate with strict internal governance, data residency in EU regions and GDPR/DSGVO-compliant analytics pipelines.

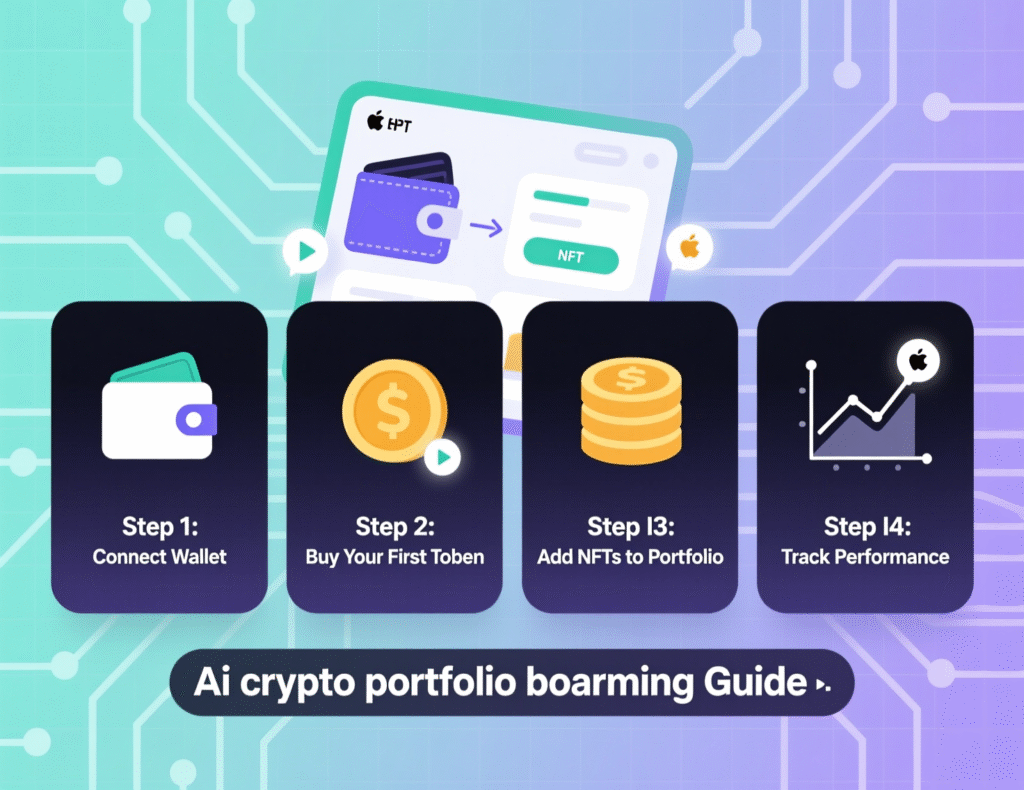

Getting Started Safely With AI Crypto Portfolio Management

AEO micro-answer

New users should start with read-only connections to exchanges and wallets, test analytics and reports, then gradually enable limited trading permissions with clear limits and ongoing monitoring. Always diversify across platforms, keep critical funds in secure custody and consult professional advisors on tax and legal questions.

From Read-Only Tracking to Autonomous Agents

Inventory your holdings

List all exchanges, wallets and DeFi protocols you use.

Choose a reputable platform

Check security, regulation, privacy policy and independent reviews.

Start with read-only APIs and public addresses

Import data, verify balances and test reports for a few weeks.

Define rules and limits

Decide max drawdowns, allocations and leverage before enabling any automation.

Enable limited trading permissions

Start small: maybe only rebalance between BTC/ETH and stablecoins.

Gradually introduce agentic features

Let agents propose actions first; move to partial autonomy only after you’re comfortable.

Review regularly

Revisit rules after major market or life events.

Setting Guardrails: Limits, Permissions and Ongoing Monitoring

Practical guardrails include.

No withdrawal permissions for third-party platforms

Per-strategy and per-day loss limits

Email/SMS/app alerts for unusual behavior

Multi-signature approvals for institutional accounts

Logging and analytics areas where Mak It Solutions specializes are crucial so you can reconstruct what happened if an agent behaves unexpectedly.

When to Work With Advisors, Custodians or Regulated Platforms

If you manage large sums or client assets, consider:

Regulated custodians with insurance

Investment advisors who understand digital assets and your local rules

Platforms with clear MiCA/FCA/SEC/CFTC positions

Key Takeaways

AI crypto portfolio management focuses on whole-portfolio risk, rebalancing and tax-aware workflows, not just isolated trading bots.

In 2025, serious platforms must align with MiCA, GDPR/DSGVO, UK-GDPR and US regulatory expectations, especially for CASPs and fintechs.

Tools connect to exchanges and wallets using scoped API keys, OAuth and wallet connectors, with tax engines reusing this data for reporting.

Investors should evaluate security, compliance, transparency and realistic performance before granting any trading permissions.

A safe adoption path starts with read-only tracking, then limited rules-based automation, then (if needed) agentic AI under strict guardrails.

If you’re exploring AI crypto portfolio tools for a product, fund or fintech platform, Mak It Solutions can help you design the analytics, cloud and governance layers that make them safe and scalable. From BI dashboards and data pipelines to secure cloud architectures, our team focuses on the plumbing so your teams can focus on strategy. Reach out to request a scoped estimate or schedule a no-pressure architecture review. ( Click Here’s )

FAQs

Q : Is AI crypto portfolio management legal for retail investors in the US, UK and EU?

A : Yes, AI crypto portfolio management is generally legal for retail investors in the US, UK and EU, provided the tools and providers comply with local regulation. In the US, that means respecting SEC, CFTC and FinCEN rules around securities, derivatives and AML. In the UK, the FCA oversees promotions and consumer protection. In the EU (including Germany), MiCA and national regimes govern CASPs, while GDPR/DSGVO covers data protection. What matters most for you as an individual investor is choosing regulated or well-documented platforms, understanding their terms and avoiding tools that make unrealistic promises.

Q : Do AI crypto portfolio managers guarantee profits or “beat the market” in volatile conditions?

A : No legitimate AI crypto portfolio manager can guarantee profits or consistently “beat the market,” especially in highly volatile environments. Machine learning models can help with diversification, risk scoring and disciplined execution, but they are still based on assumptions and historical data that may break when regimes change. Regulators and investor protection bodies explicitly warn that crypto remains high risk and that AI branding is often used in scams. Treat any claim of “guaranteed returns,” “risk-free arbitrage” or “never-losing AI strategy” as a major red flag.

Q : How much starting capital do you realistically need to benefit from an AI crypto portfolio manager?

A : There is no fixed minimum, but below a few hundred dollars, trading fees and spreads can easily eat most of the benefits. Many retail investors start seeing value once they have low four figures in crypto, especially if they use multiple exchanges or DeFi protocols and need consolidated tracking and tax reports. Above that level, the ability to optimize risk, automate rebalancing and streamline tax reporting can justify modest subscription fees. For high-net-worth and institutional investors in places like New York, London or Frankfurt, even small efficiency gains can translate into meaningful savings — but they also need stronger governance and compliance.

Q : Can AI crypto portfolio tools handle both centralized exchanges and DeFi wallets in one dashboard?

A : Yes, many modern platforms are designed to connect to both centralized exchanges and DeFi wallets in a single dashboard. They typically integrate via API keys for exchanges and wallet connectors or public addresses for DeFi positions. This unified view is essential for AI-driven risk scoring and on-chain data analytics, allowing the system to see leverage, collateral and yield strategies together. However, coverage varies widely: some tools specialize in CeFi only, others in DeFi. Always check which chains, protocols and exchanges are supported, and verify how they protect your keys and data before connecting everything.

Q : What data and permissions should I avoid giving to an AI crypto portfolio platform or agent?

A : As a rule, avoid giving any third-party platform withdrawal permissions on your exchange APIs unless there is an extremely strong business case and institutional-grade controls. For most retail and many professional setups, read-only and (optionally) trading permissions are sufficient. You should also minimize sharing unrelated personal data (e.g., unnecessary KYC documents, unrelated bank statements) and carefully review privacy policies under GDPR/DSGVO or UK-GDPR. Platforms should explain exactly how they store and process data, how long they retain it and whether they share it with third parties. If any of this is unclear or hidden behind vague marketing, walk away.