Aave founder outlines $50T abundance-asset-tokenization thesis for DeFi collateral

Stani Kulechov, the founder of Aave, is promoting a bold vision centered on “abundance-asset tokenization” to reshape decentralized finance. The idea focuses on bringing real-world assets that are plentiful, scalable, and increasingly cost-efficient such as solar energy—onto blockchain networks. By tokenizing these assets, Kulechov argues they can become transparent, liquid, and globally accessible within onchain financial systems.

Looking ahead to 2050, this approach could unlock trillions of dollars’ worth of value from abundance assets, transforming them into a new category of collateral for DeFi lending. Tokenized solar capacity and similar resources could be used to secure loans, improve capital efficiency, and broaden participation in decentralized markets. If successful, abundance-asset tokenization may expand DeFi beyond crypto-native assets and link sustainable real-world production with onchain credit and liquidity.

Current tokenization is still dominated by “scarce” assets

Kulechov said tokenization of traditional, scarce assets such as U.S. Treasurys and real estate is likely to keep growing, but argued the larger opportunity is tokenizing assets whose supply can scale with technology and deployment—what he called “abundance assets.”

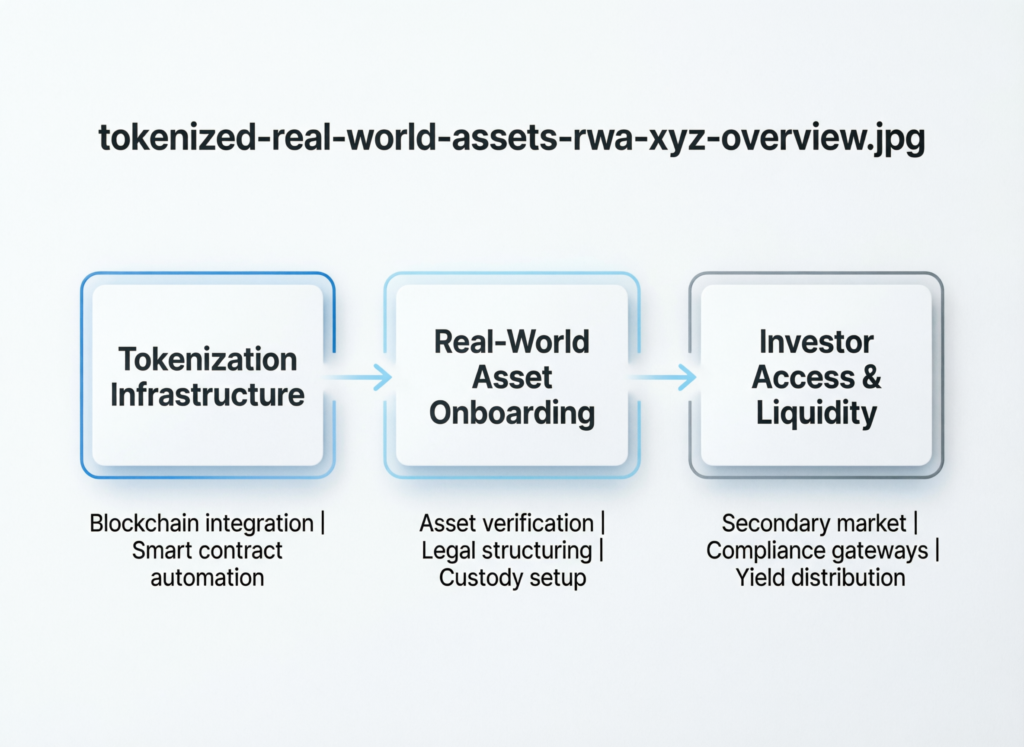

Data from RWA.xyz’s dashboard shows $24.83B in “Distributed Asset Value” for tokenized real-world assets, alongside broader “represented asset value” figures shown on the site.

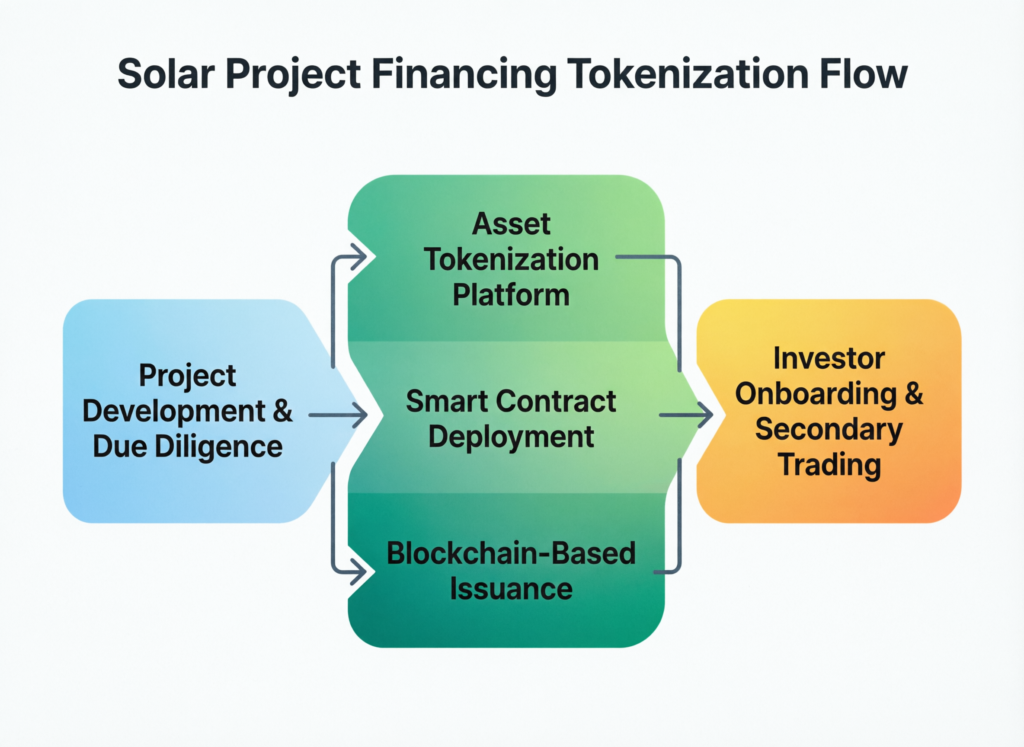

What abundance-asset-tokenization could look like for solar projects

Kulechov’s example: a solar debt financier could tokenize a $100 million solar project and borrow $70 million in stablecoins, then redeploy that capital into additional projects while depositors access what he described as scalable, diversified yield.

He also argued tokenization could improve “capital efficiency” versus traditional infrastructure finance, which is often locked up for long periods, by enabling continuous trading and faster recycling of capital.

Where else Kulechov sees abundance assets forming onchain collateral

Beyond solar, he extended the concept to:

Batteries for energy storage

Robotics for labor

Vertical farming and lab-grown food

Semiconductors for computation

3D printing for materials

Aave’s scale in DeFi lending

Aave is widely tracked as one of the largest DeFi protocols by TVL. DeFiLlama’s Aave page shows roughly $27B total value locked at the time of publication.

Context & Analysis

Kulechov’s framing positions “abundance assets” as a potential next wave after early RWA growth driven by more familiar instruments like Treasurys. The key open question is whether infrastructure-linked tokens can achieve reliable legal enforceability, standardized disclosures, and sufficient liquidity to function as robust DeFi collateral at scale.

Concluding Remarks

Stani Kulechov argues that tokenizing scalable, real-economy assets could dramatically expand the pool of onchain collateral. He believes assets tied to large, growing sectors especially solar are better suited for tokenization than today’s limited mix of real-world assets used in DeFi. Because these assets are abundant and cost-efficient, they could support far greater financial activity onchain.

If such assets become widely tradable and financeable on blockchain networks, decentralized lending markets could benefit significantly. Tokenized solar and similar assets could unlock deeper liquidity, improve capital efficiency, and allow DeFi protocols to support larger loan volumes backed by productive, real-world value.

FAQs

Q : What is abundance-asset-tokenization?

A : It is the idea of tokenizing scalable “abundance assets,” such as solar projects, so they can be traded onchain and used as collateral for decentralized lending. The goal is to connect large real-economy asset bases with DeFi markets.

Q : How big does Kulechov think the abundance-asset market could be by 2050?

A : Stani Kulechov estimates the overall abundance-asset market could reach around $50 trillion by 2050, with solar alone accounting for roughly $15–$30 trillion.

Q : What’s tokenized today in RWAs, according to RWA.xyz?

A : RWA.xyz reports about $24.83 billion in distributed tokenized assets, mainly focused on Treasurys and other traditional financial instruments.

Q : How would tokenized solar help DeFi lending in practice?

A : Kulechov describes tokenizing a solar project and borrowing stablecoins against it, allowing capital to be recycled faster into new projects.

Q : Why does he contrast “abundance” vs “scarce” assets?

A : He argues scarce assets may face declining margins over time, while abundance-backed assets could offer stronger long-term returns—though this is unproven at scale.

Q : How large is Aave relative to other DeFi protocols?

A : Data from DeFiLlama shows Aave has roughly $27 billion in total value locked, ranking it among the largest DeFi platforms.

Facts

Event

Aave founder Stani Kulechov promotes tokenizing “abundance assets” (e.g., solar) as new DeFi collateralDate/Time

2026-02-16T00:00:00+05:00 (article publication date; X post referenced as “Sunday,” which would be 2026-02-15 based on publication timing)Entities

Stani Kulechov; Aave; Aave Labs; RWA.xyz; DeFiLlamaFigures

$50T (projected abundance asset market by 2050); $15–$30T (solar range); $100M project example; $70M borrowing example; $24.83B (RWA.xyz dashboard distributed asset value); ~$27B (Aave TVL)Quotes

“Capital is hungry for new collateral…” Stani Kulechov (as cited in report)Sources

Cointelegraph via TradingView; RWA.xyz dashboard; DeFiLlama Aave page