AAVE Breaks Resistance as DeFi Market Hits Record $219B Size

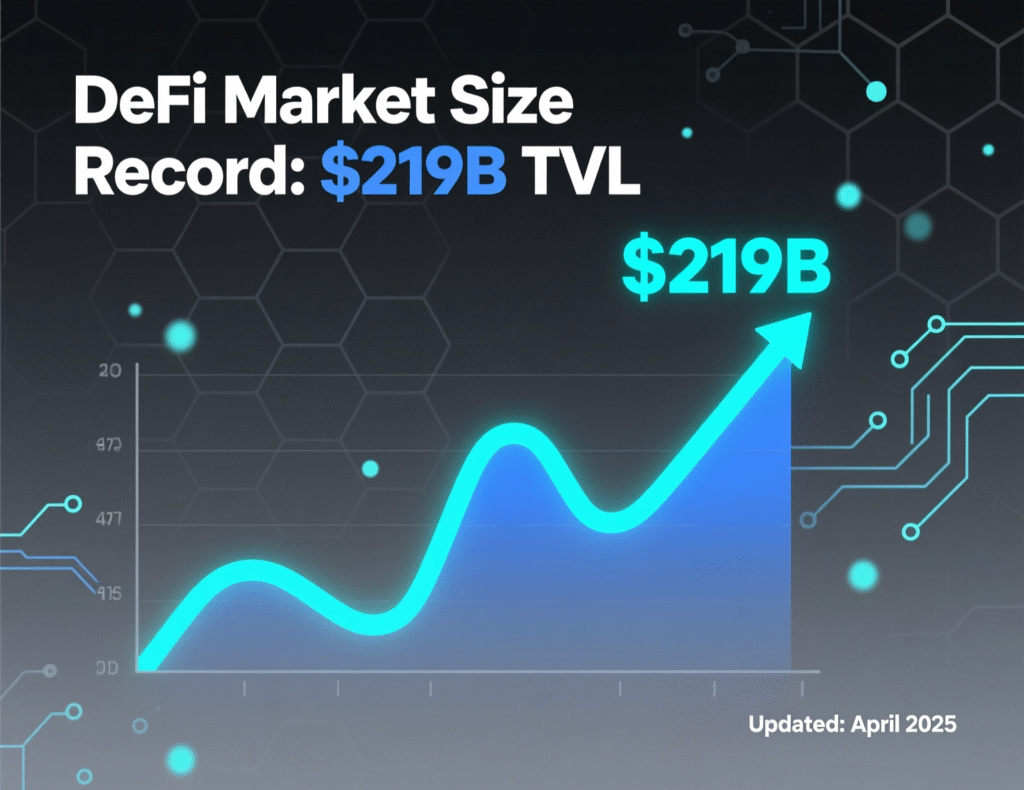

Aave (AAVE) surged past the $290 resistance level as the decentralized finance (DeFi) sector reached a new milestone of $219 billion in total value locked (TVL). The lending protocol’s token has gained around 2% in the last 24 hours and nearly 6% over the past week, signaling renewed investor interest. This move underscores the growing confidence in DeFi projects, with Aave continuing to stand out as one of the leading platforms in decentralized lending and borrowing.

The rally in AAVE aligns with broader strength across the cryptocurrency market, driven primarily by bitcoin’s push above $120,000. The flagship asset’s rise has lifted overall risk appetite, spilling into altcoins and DeFi tokens. As capital flows back into decentralized markets, Aave’s breakout suggests traders are positioning for sustained growth in the sector.

Market snapshot and drivers

CoinDesk, citing DeFiLlama, reported “assets across protocols” in DeFi at a record ~$219B. Aave’s deposits climbed to about $74B, keeping it atop DeFi lenders. Fresh inflows followed Aave’s new Plasma market, which surpassed ~$6B within a week of launch.

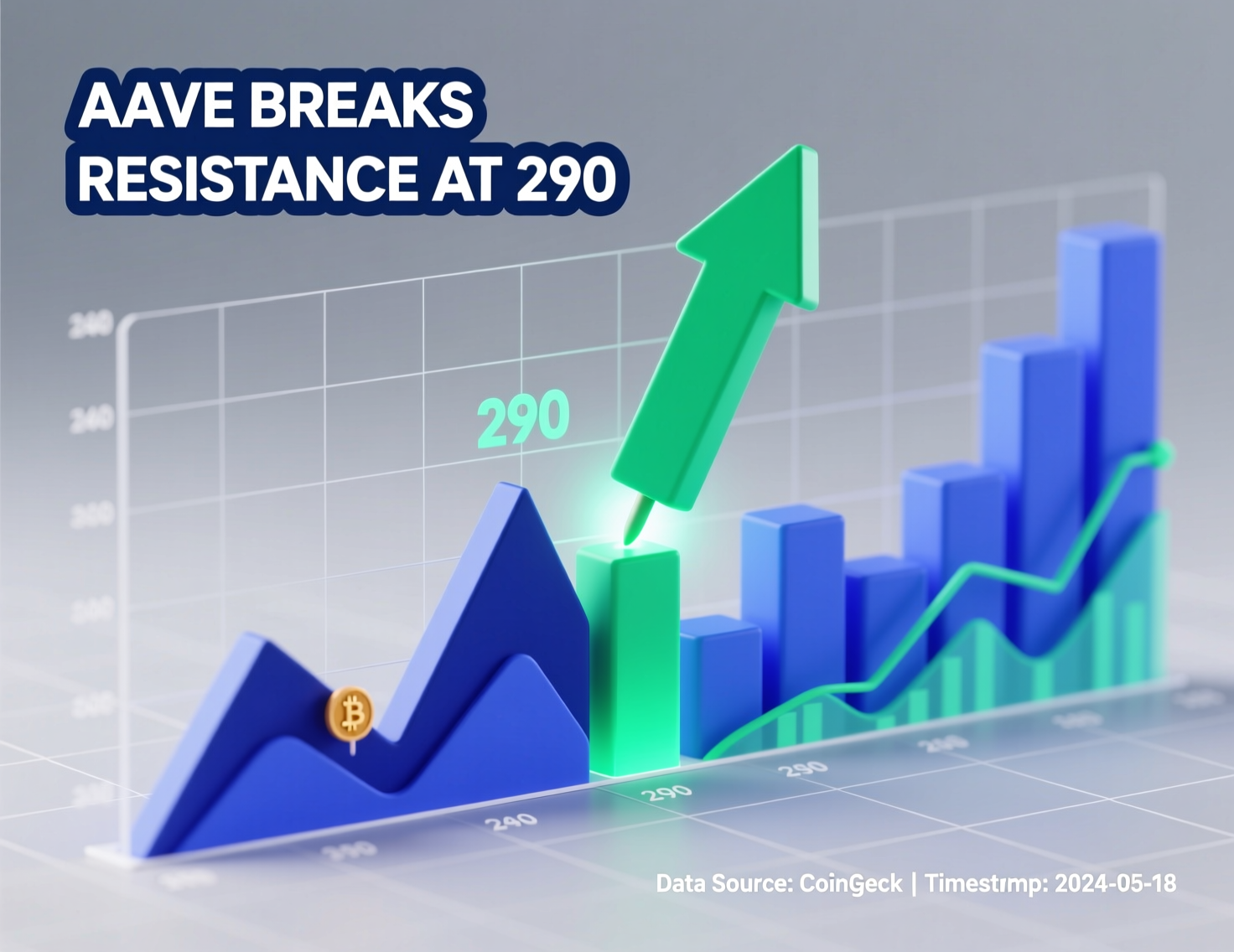

AAVE breaks resistance at $290

AAVE advanced through $290 before encountering supply at $290–$294 the zone that rejected price multiple times intraday. Support has firmed around $284–$285 after a rebound from last week’s lows. The session range spanned roughly $279–$294, with a brief high near $290.4 before a pullback.

Intraday context as BTC lifts risk

Bitcoin traded above $120,000 and briefly over $122,000 on Friday, keeping crypto beta elevated into the U.S. session, according to multiple market updates and live price feeds. Barron’s

Liquidity and participation

Volume expanded materially versus recent averages, a sign of institutional participation during the breakout and subsequent consolidation. DeFi stablecoin capitalization also pushed past $300B this week, amplifying on-chain liquidity conditions.

What’s next for Aave fundamentals

Beyond price, Aave’s deposit milestone (~$73–$74B) reflects sustained growth relative to mid-September levels, when third-party trackers first flagged a new high. Plasma’s early traction paired with Chainlink oracle integration adds a new venue for stablecoin-centric lending.

How to track AAVE’s setup without overtrading

<section id=”howto”> <h3>How to monitor AAVE resistance and support levels</h3> <ol> <li id=”step1″><strong>Step 1:</strong> Mark $284–$285 (support) and $290–$294 (resistance) on your chart.</li> <li id=”step2″><strong>Step 2:</strong> Watch 1h/4h closes above $294 for confirmation; below $284 for invalidation.</li> <li id=”step3″><strong>Step 3:</strong> Track BTC’s trend above $120K as a risk proxy for DeFi beta.</li> <li id=”step4″><strong>Step 4:</strong> Monitor Aave deposits/flows via DeFiLlama and Aave’s app analytics.</li> <li id=”step5″><strong>Step 5:</strong> Size positions conservatively; use stop-losses outside key zones.</li> </ol> <p><em>Note: Process may vary by platform and jurisdiction. Confirm requirements before acting.</em></p> </section>

Risks to the outlook

A reversal back below support could turn the $284–$285 area into resistance. Failure to clear $294 on sustained volume risks extended range-bound trade, especially if BTC loses the $120K handle. Macro-driven volatility (rates, liquidity, regulation) remains an overhang.

Context & Analysis

AAVE’s breakout aligns with cyclical liquidity returning to DeFi (stablecoins >$300B; BTC >$120K). Structural flows Aave’s deposit growth and the Plasma market support the bull case, but technicals still demand a clean daily close above $294 to unlock higher targets.

Conclusion

Aave’s (AAVE) move through the $290 level is encouraging for bulls, but the key test lies just above. The $294 zone now acts as the immediate barrier, and only a firm break and consolidation above it would confirm stronger upside momentum.

Such a move would be more convincing if supported by broader crypto tailwinds. Continued bitcoin strength above key thresholds, along with consistent capital inflows into Aave’s lending protocol, could provide the fuel needed. If these conditions align, the breakout would likely signal the beginning of AAVE’s next leg higher in the ongoing DeFi rally.

FAQs

Q : Why did AAVE rally today?

A : Broader crypto strength (BTC >$120K) and improving DeFi liquidity coincided with Aave deposit growth and new market activity on Plasma.Key Levels

Q : Where are the key levels?

A : Support sits around $284–$285, while resistance is near $290–$294, based on repeated intraday rejections.DeFi Market Record

Q : Did the DeFi market really hit a record?

A : Yes“assets across protocols” reached about $219B, according to DeFiLlama data cited by CoinDesk.Aave Deposits

Q : How much is deposited on Aave now?

A : Roughly $74B in deposits, per DeFiLlama data referenced by CoinDesk, following earlier highs reported mid-September.Plasma Market

Q : What’s the Plasma angle?

A : Aave’s new Plasma market saw over $6B in deposits within a week; the chain integrated Chainlink oracles at launch.

Q : Does macro matter for AAVE?

A : Yes BTC trend and liquidity factors such as stablecoin supply and ETF flows heavily influence DeFi tokens’ risk premium.

Q: Is this a confirmed breakout if AAVE breaks resistance at $290?

A : Not until price holds above ~$294 on strong volume; otherwise, the range may persist.