Bitcoin rebound stalls at $71,000 amid extreme fear, thin liquidity

Bitcoin’s sharp rebound from last week’s drop into the low-$60,000s lost momentum near a key resistance level, as the “rebound stalls at $71,000” narrative gained traction among traders. While the recovery initially lifted short-term sentiment, fragile market confidence and thinning liquidity limited follow-through. Buyers struggled to sustain momentum above resistance, keeping optimism cautious rather than decisive.

As of Tuesday, BTC was trading roughly between $69.7k and $70.1k, easing back from intraday highs after rebounding from the Feb. 6 sell-off. The price action suggests hesitation among market participants, with investors closely watching macro signals, liquidity conditions, and broader risk appetite for direction. Until stronger conviction returns, bitcoin may remain range-bound, with traders wary that rallies could fade quickly near overhead resistance rather than evolve into a sustained breakout.

Why the bitcoin rebound stalls at $71,000

After dipping to roughly $60k on Feb. 6, BTC snapped back toward $70k–$71k but met heavy supply from sellers using strength to reduce risk. The widely watched Crypto Fear & Greed Index plunged into single digits (6–7) over the weekend its weakest since the 2022 FTX-era trough before improving to ~14 on Monday, still “extreme fear.”

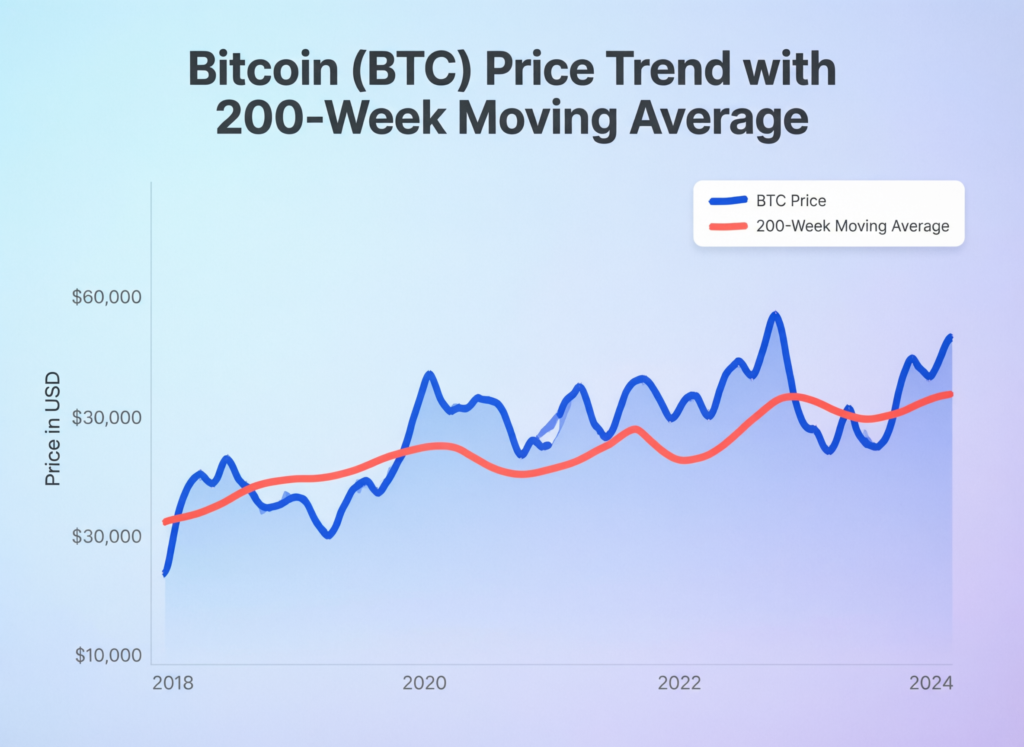

In an email note, Alex Kuptsikevich at FxPro cautioned that “there is still a huge supply in the markets from those who want to exit … on the rebound,” adding that a new test of the 200-week moving average is possible soon. That long-term gauge sits just below ~$58k.

Liquidity and flows: why the bitcoin rebound stalls at $71,000

Market structure has weakened. Kaiko’s latest read describes a broad risk-off unwind: aggregate spot volumes across major centralized exchanges have fallen ~30% since Oct–Nov 2025, with monthly spot turnover slipping from around $1T toward the $700B area. Thinner order books mean modest sell pressure can trigger outsized intraday swings.

Technical lines to watch

BTC’s late-2025/early-2026 cycle peak near ~$126k implies a ~50% drawdown into the $60k–$70k band, a typical post-peak retracement in prior halving cycles. The 200-week moving average (~$58k) remains the longer-term support to monitor; sustained closes below could accelerate liquidations, while continued defense of ~$60k favors a choppy base-building phase.

Context & Analysis

Recent reports from Barron’s and Business Insider show BTC slipping back toward $70k after a sharp Feb. 6 shock, consistent with a classic bear-market relief rally. Near-term direction likely hinges on whether broader risk assets stabilize and whether liquidity returns to spot markets.

Concluding Remarks

For now, the $60,000 level remains the key signal for bitcoin’s near-term direction. Holding above this support would suggest a period of consolidation rather than renewed weakness. However, a clear break below $60k especially in an environment of thin order books and risk-off positioning could quickly trigger another wave of forced selling across the market.

Until overall sentiment stabilizes and trading participation improves, upside momentum appears limited. Liquidity remains fragile, making rallies vulnerable to selling pressure. In this environment, the area around $71,000 continues to act as a ceiling, with the path of least resistance capped unless stronger conviction and sustained demand return to the market.

FAQs

Q : Why did Bitcoin stall near $71,000?

A : Overhead supply met the rebound, and thin liquidity amplified downside moves. Trading volumes remain roughly 30% below late-2025 levels, so sellers faced less depth, making pullbacks sharper.

Q : Is this just a relief rally?

A : Many analysts frame the move as a bear-market bounce until breadth, volume, and sentiment improve materially. Without those confirmations, upside follow-through tends to fade.

Q : What are sentiment gauges saying right now?

A : The Crypto Fear & Greed Index plunged to 6–7 (extreme fear) during the selloff and has only recovered to around ~14, signaling sentiment remains fragile.

Q : What key technical levels matter now?

A:

Resistance: ~$71,000

Support: ~$60,000

Long-term anchor: 200-week MA near ~$58,000

Q : Could BTC revisit $60,000?

A : Yes. Analysts warn that thin order books and weak sentiment can easily produce another test of long-term support zones.

Q : How does low retail participation affect price moves?

A : It reduces market depth, so relatively modest orders can trigger outsized swings, cascaded stop-outs, and faster momentum shifts.

Q : Does the halving cycle still fit this drawdown?

A : Yes. A roughly ~50% drawdown from a ~$126k peak aligns with prior halving-cycle behavior, even though timing varies between cycles.

Q : Where is the exact keyword used for discoverability?

A : This FAQ explicitly includes the phrase bitcoin rebound stalls at $71,000 for SEO and discoverability.

Facts

Event

BTC rebound fades at resistance; sentiment in extreme fearDate/Time

2026-02-10T00:00:00+05:00Entities

Kaiko, FxPro, CoinDeskFigures

~$69.7k–$70.1k spot; Fear & Greed ~6→14; spot volumes ~–30% since Oct–Nov 2025; 200-week MA ≈ $58k (USD)Quotes

“There is still a huge supply … be prepared for a new test of the 200-week moving average soon.” Alex Kuptsikevich, FxPro.Sources

CoinDesk analysis (fear gauge/71k), Barron’s (price/peak context)