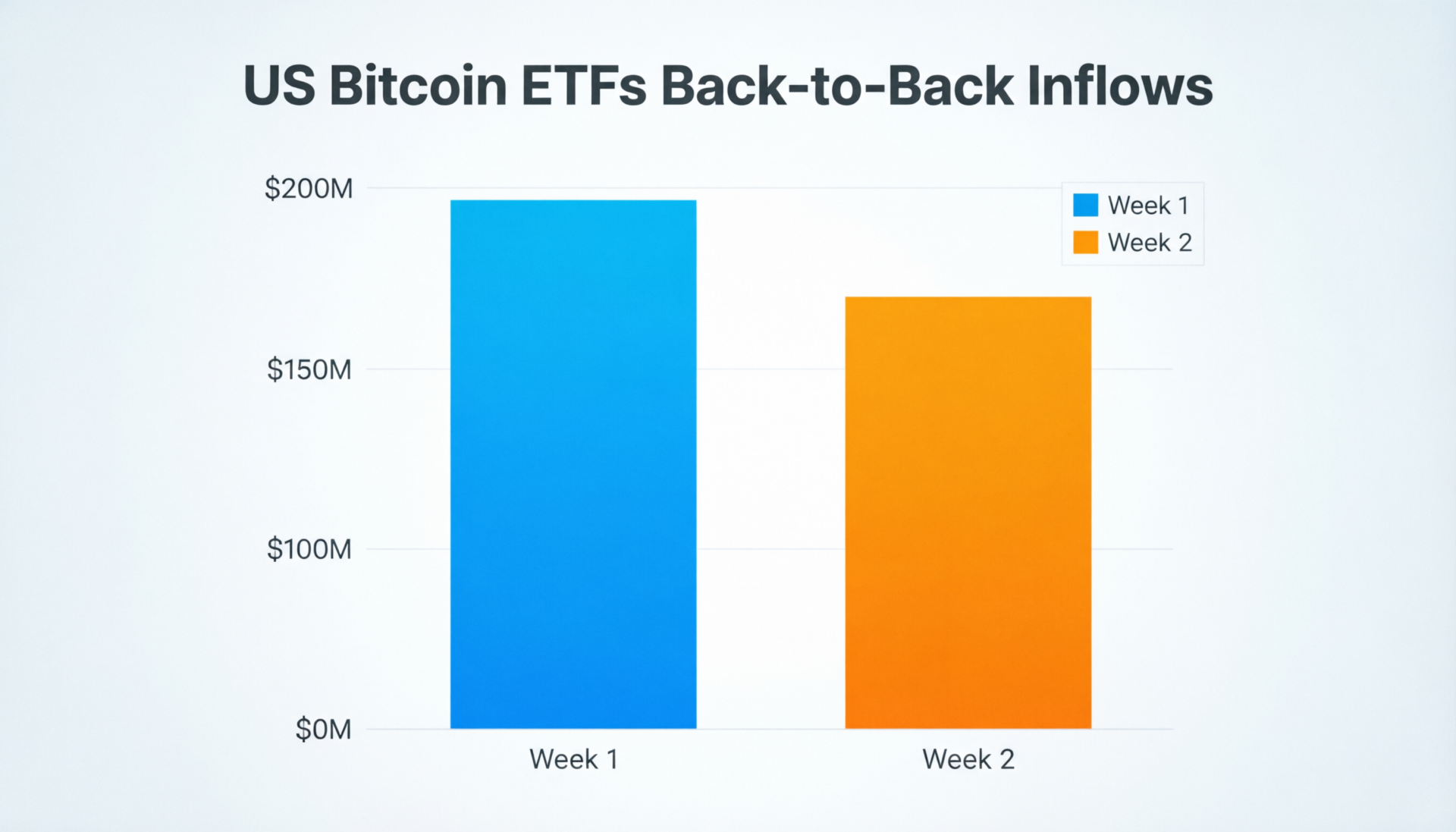

U.S. spot bitcoin ETFs see first two-day streak of inflows in a month

For the first time in nearly a month, U.S. spot bitcoin exchange-traded funds have recorded back-to-back daily inflows, snapping a prolonged period of persistent redemptions. This shift marks a tentative sign of stabilization in institutional demand, following weeks of steady outflows that weighed on market sentiment. Data from ETF trackers shows that investors added a combined total of roughly $616 million across the two sessions, suggesting renewed interest after a challenging stretch for crypto-linked investment products.

The inflows come despite bitcoin continuing to trade well below its October peak, highlighting a cautious but improving outlook among market participants. While prices remain under pressure, the return of net inflows indicates that some investors may be positioning for a longer-term recovery rather than reacting to short-term price weakness.

ETF flows snap the streak

Fresh capital returned on Friday and Monday, marking a two-day net +$616M across U.S.-listed spot bitcoin ETFs—the first such streak in weeks. Flow tables compiled by Farside Investors show $371.1M on Friday (Feb. 6) and $144.9M on Monday (Feb. 9). A separate market recap by CoinDesk also flagged the back-to-back positive days.

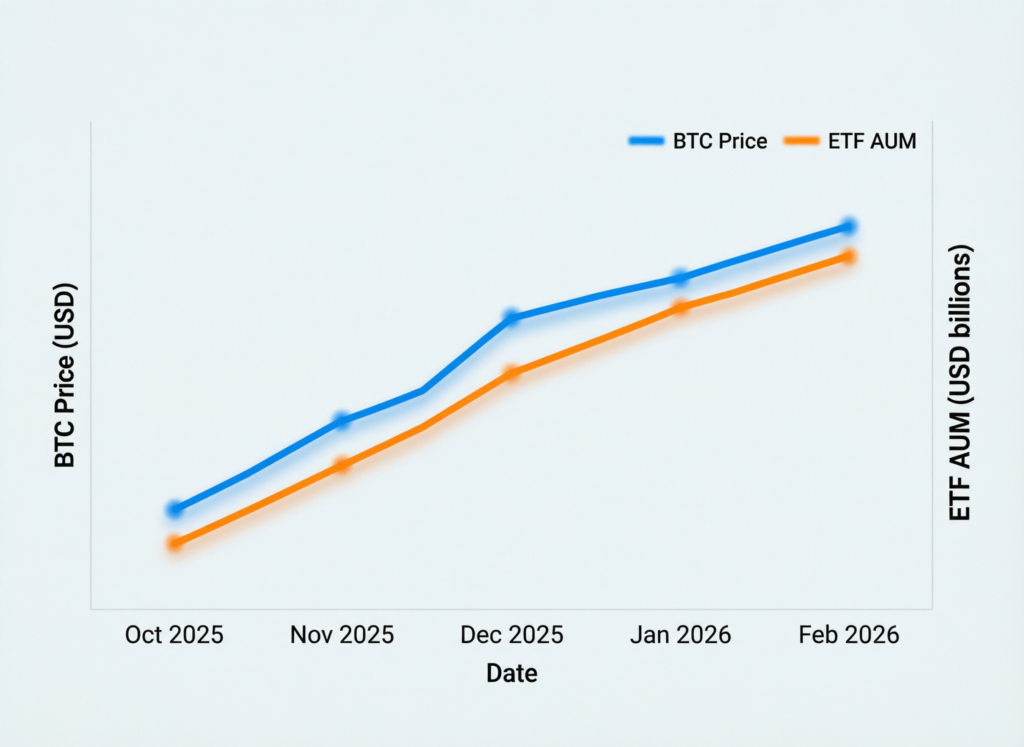

Price context and divergence

BTC slid to roughly $60K late last week before rebounding toward ~$70K, but remains far below its October 2025 peak (~$125K–$126K). Yet aggregate ETF holdings have contracted only modestly since then about 6–7% underscoring “stickier” investor behavior. Coverage from Barron’s and analysis citing SoSoValue/Bloomberg data highlight this divergence.

What the inflows imply for AUM and positioning

While price drove AUM down from the October peak, holdings have not mirrored the drawdown one-for-one. Commentary summarizing SoSoValue and analyst takes indicates U.S. spot ETF BTC held is down ~7% versus a ~40–50% price retreat, suggesting longer-horizon, low-turnover holders dominate ETF demand.

Which products led?

Daily tables attribute the bulk of the Friday inflow to the largest funds, with IBIT and peers turning positive after prior redemptions. Farside’s ledger details fund-level contributions across the complex.

U.S. bitcoin ETFs back-to-back inflows: drivers and risks

Macro tone: recent equity/AI volatility and a flight to safety have weighed on crypto; rebounds can be fragile.

Fund dynamics: prior redemptions eased as price stabilized; renewed inflows don’t guarantee trend continuation.

Liquidity watch: monitor spreads/discounts and volumes as indicators of sustained interest.

Context & Analysis

The return of U.S. bitcoin ETFs back-to-back inflows after a bruising sell-off hints at base-building rather than a definitive trend reversal. Flows can lag price, and sticky ETF ownership may temper volatility, but sustained demand will likely depend on macro risk appetite and clarity on rates.

Concluding Remarks

The two-day inflow of approximately $616 million into U.S. spot bitcoin ETFs offers a welcome, though still cautious, signal that investor demand may be stabilizing after an extended period of outflows. While the rebound is modest, it suggests that selling pressure could be easing as some investors reassess positioning amid recent market weakness.

Attention now turns to whether these positive inflows can be sustained through the remainder of the week. Of particular interest is whether ETF holdings continue to rise even as bitcoin’s spot price remains under pressure, a divergence that would indicate growing confidence in longer-term prospects rather than short-term price movements.

FAQs

Q : What caused the recent inflows?

A : Stabilizing prices and value-buyers likely drove allocations after a sharp drawdown.

Q : How big were the inflows?

A : About $616M across Friday and Monday combined, per aggregated flow tables.

Q : Are holdings shrinking as fast as price?

A : No. ETF holdings/AUM are down ~6–7% since October, versus a ~40–50% price drop.

Q : Which funds led the rebound?

A : The largest U.S. spot BTC ETFs (including IBIT and peers) contributed most of Friday’s inflow.

Q : Does back-to-back inflows mean the bottom is in?

A : Not necessarily; watch whether positive prints persist and if flows broaden across funds.

Q : Where can I verify daily U.S. bitcoin ETF flows?

A : Use Farside’s flow table and corroborate with coverage from CoinDesk or similar outlets.

Q : Do U.S. bitcoin ETFs back-to-back inflows predict performance?

A : They can reflect improving sentiment, but flows alone are not a timing signal.

Facts

Event

First back-to-back net inflows into U.S. spot BTC ETFs in nearly a monthDate/Time

2026-02-10T09:00:00+05:00Entities

Farside Investors; CoinDesk; SoSoValueFigures

Friday +$371.1M; Monday +$144.9M; cumulative ~$616M; ETF holdings down ~6–7% since Oct; BTC off ~40–50% from Oct ATH (~$125K–$126K)Quotes

“ETF holdings have fallen far less than price since October,” per roundups citing SoSoValue and analysts.Sources

Farside flow table; CoinDesk market update; Barron’s price context.