Bitcoin (BTC) Weekly Update: Price Analysis After the Flush to $60K 6 Feb 2026

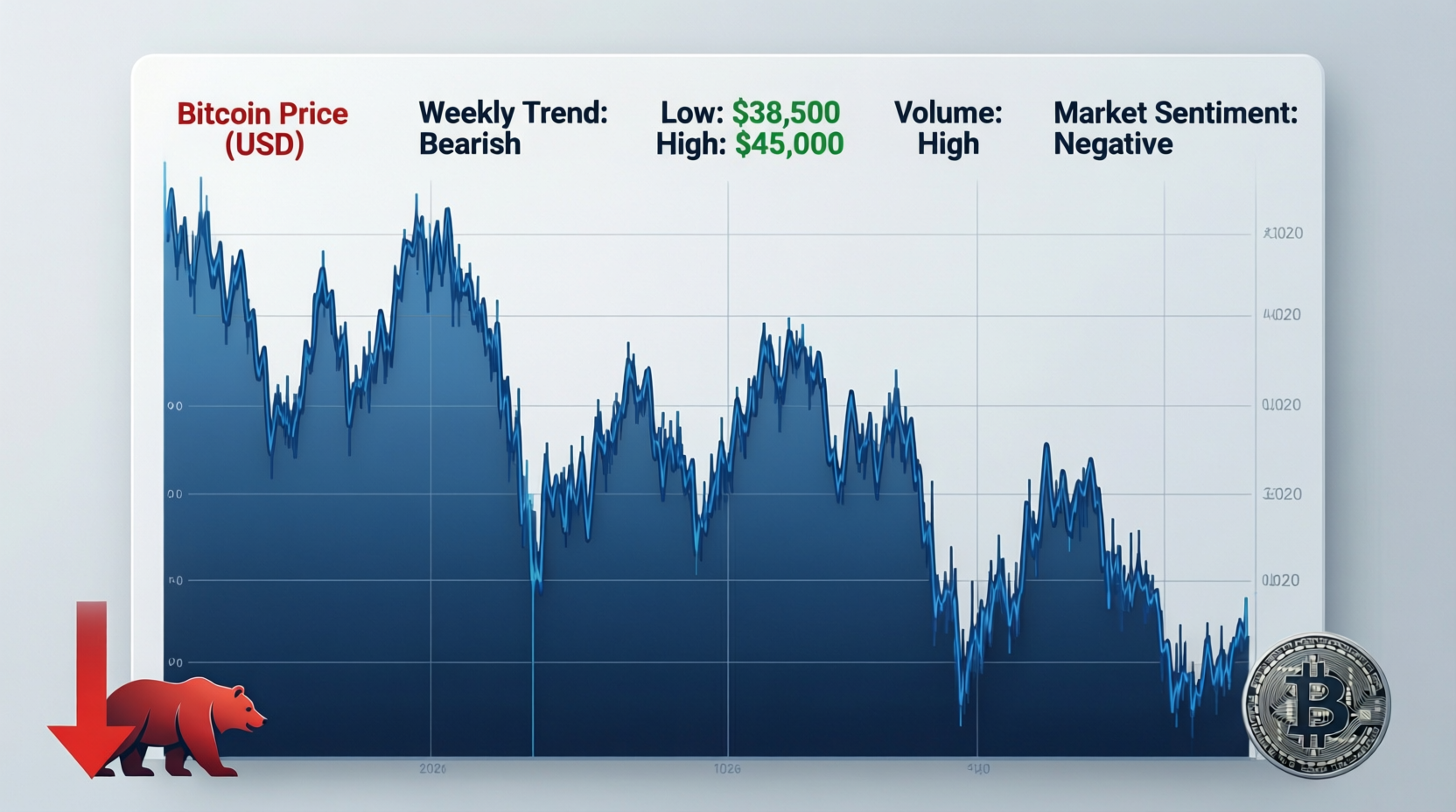

This Bitcoin weekly update covers a highly volatile week where BTC traded roughly between $60K and $84K, with an estimated 7-day performance near -20%. A sharp macro-driven sell-off in tech stocks, worries over spot ETF outflows and a cascade of futures liquidations pushed price down to about $60,000 on some exchanges before a partial rebound. For now, key support sits in the $60K–$62K zone, with resistance around $72K–$76K and a bigger cap near $84K, as traders watch whether deleveraging, extreme fear and stabilising funding can support a short-term base.

Key Data Snapshot

Data as of: 6 Feb 2026, 10:24 UTC

Current price: ≈ $65,900

From blended data (OpenAI finance feed, CoinGecko and CoinMarketCap).

24h change: ≈ -7.7%

7d change: ≈ -20.2% (vs PKR, similar magnitude in USD)

7d high / low.

Official CoinGecko 7d range: $62,822 – $84,177

With an intraday wick this morning near $60,008 on some venues.

Market cap: ≈ $1.31T

24h volume: ≈ $150–170B traded across exchanges

Dominance: BTC share of total crypto market cap around 56–57%.

Main data sources: CoinGecko, CoinMarketCap, Tapbit market report, CoinDesk, MacroMicro.

Numbers above are approximate but reflect live tick data at the time of writing.

This Week in BTC Bitcoin Weekly Update Summary

This Bitcoin (BTC) weekly update comes after one of the sharpest pullbacks of 2026 so far. After trading above $80K last week and even touching the mid-$80Ks, BTC slid aggressively, flushing down toward $60K before bouncing back into the mid-$60Ks.

The drawdown looks driven by a mix of macro risk-off in U.S. tech stocks, concern over continued spot BTC ETF outflows, and a cascade of futures liquidations as key support levels failed.

For traders in Pakistan watching BTC/PKR pairs, the percentage moves have been similar, even if the local price is filtered through PKR exchange rate swings.

BTC Price Action & Key Levels

Weekly performance

From last Friday to today, BTC is down roughly 20% in fiat terms, as reflected in PKR-based pricing on CoinGecko.

Over the last 7 days, BTC traded in an official range of roughly $62.8K–$84.2K, with at least one major venue printing a low just above $60K during the worst of the sell-off.

That mix of big intraday wicks and heavy volume is typical of a deleveraging phase rather than a calm trend market.

Short-term technical view

Non-signal, neutral snapshot.

Immediate support: the zone between $60K–$62K, where the latest flush found buyers and forced liquidations slowed.

First resistance: the $72K–$76K band, lining up with prior high-volume trading, intraday rebound caps and psychological round levels.

Major resistance: the former breakdown area around $84K–$85K, where losing that cluster previously triggered algorithmic selling and stop cascades.

Volatility is elevated: BTC moved more than 20% peak-to-trough this week, and intraday swings north of 10% have been common.

News & Narratives That Moved BTC This Week

Tech stock sell-off & macro jitters: A sharp drop in the Nasdaq and renewed worry about “higher for longer” central bank policy hit risk assets broadly, spilling over into BTC.

ETF outflow concerns

A recent Barron’s piece highlighted that while spot BTC ETFs helped drive the January rally, persistent outflows during a drawdown can amplify selling pressure. (Barron’s)

Liquidation cascade

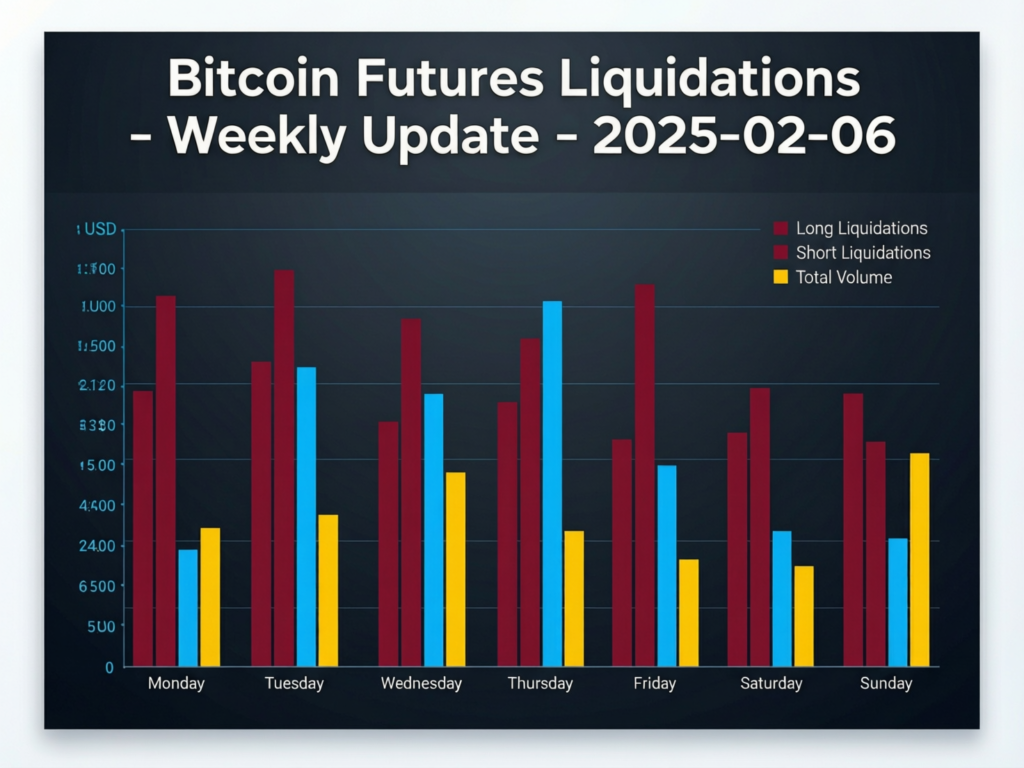

Tapbit’s market breakdown reported BTC crashing to about $60,008 with more than $659M in crypto futures liquidations in 24 hours, roughly a third from BTC longs alone. (Tapbit Exchange)

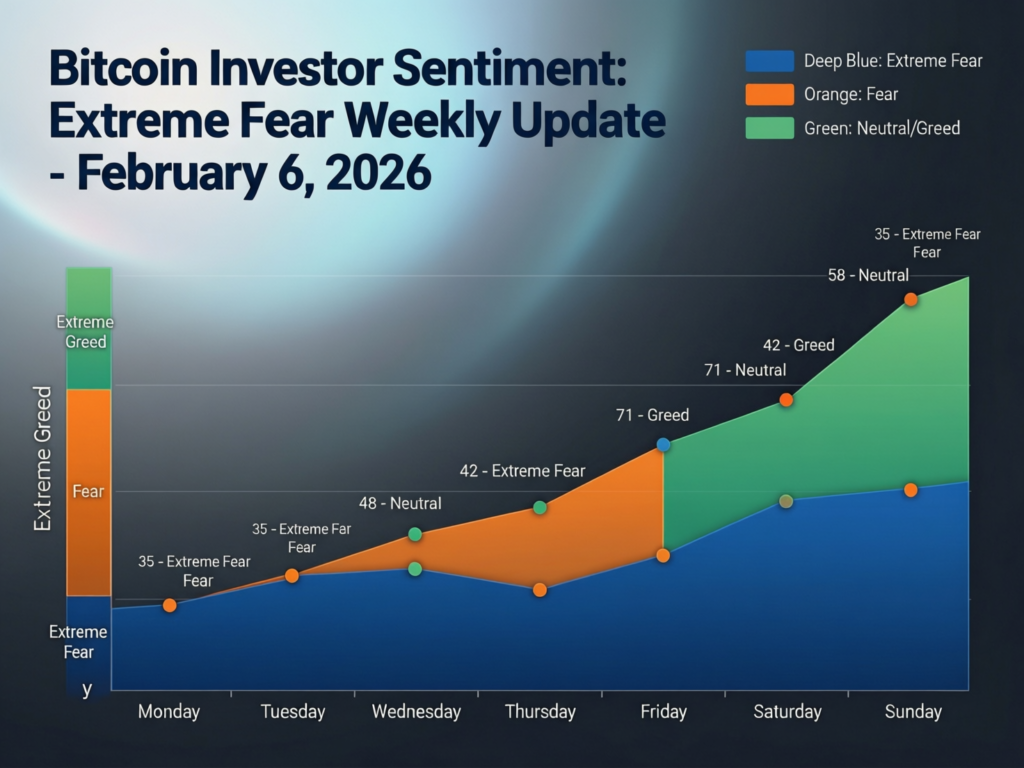

Extreme fear readings

CoinGecko’s news stream notes the Fear & Greed Index dropping into extreme fear territory and on-chain sentiment turning decisively bearish, consistent with this week’s price action.

Overall narrative: a classic deleveraging event layered on top of macro stress, not a single protocol-specific failure.

On-Chain, Derivatives & Sentiment

Open interest & liquidations

A recent CoinDesk piece highlighted BTC futures open interest dropping to about $105.9B, with around $679M of liquidations in 24 hours during the worst of the move clear evidence of a leverage flush.

Funding rates

MacroMicro data shows BTC perpetual funding around 0.007% on 5 Feb essentially neutral after briefly flipping negative, suggesting a reset from overly long positioning.

Market sentiment

Community sentiment on CoinGecko is currently skewed bearish, with polls showing more than half of respondents expecting further downside and text commentary emphasising “crash” risk.

In short, derivatives positioning now looks cleaner than a week ago, but spot sentiment is still fragile.

BTC vs the Wider Crypto Market

On a monthly view, BTC is down roughly 28% versus about 27–28% for the broader crypto market in PKR terms, meaning it’s underperforming slightly but still behaving like a bellwether risk asset.

Many major altcoins (for example, Solana and others) have seen similar or larger percentage drawdowns, while BTC dominance around 56–57% implies some rotation back into BTC relative to alts typical “flight to quality” behaviour within crypto.

What This Means for Traders & Long-Term Holders

For traders (non-advice, just context)

Expect high intraday volatility, with 5–10% moves still very possible while the market digests recent liquidations.

The $60K–$62K zone is the key downside area many are watching; a clean break with strong volume could open deeper tests toward prior high-volume regions below.

On the upside, reclaiming and holding $72K–$76K would be an early sign that the worst of the panic is fading.

Leverage remains a double-edged sword here given recent liquidation data—risk management is critical.

If you’re trading from Pakistan or similar emerging markets, remember that using high leverage on offshore derivatives platforms plus PKR volatility can compound risk very quickly.

For long-term holders

The long-term thesis (fixed 21M supply, ETF adoption, corporate and sovereign interest) remains driven by structural factors rather than a single volatile week.

Macro is still the wild card: a deeper S&P 500 drawdown could pressure BTC regardless of on-chain health.

ETF flows, regulation progress and macro data (jobs, inflation, central bank guidance) are the key external levers to watch over the coming weeks.

Risks, Scenarios.

Bullish scenario:

BTC holds above $60K–$62K, funding stays neutral to mildly positive, ETF outflows slow or reverse, and macro data comes in benign opening the door for a grind back toward $76K and eventually $84K.

Neutral scenario

Choppy range between roughly $60K–$76K, with alternating squeezes and fades as the market continues digesting prior leverage and waits for clearer macro or ETF signals.

Bearish scenario

A clear break below $60K with renewed macro stress (for example, a deep stock-market sell-off) could extend the drawdown, with analysts warning that a major equity correction might override crypto-specific positives in 2026.

Wrapping It Up

This Bitcoin weekly update captures a market digesting a sharp flush. After a run into the mid-$80Ks and a spike toward $60K, price, leverage and sentiment are all resetting. Macro headwinds, ETF flows and derivatives positioning still drive the short-term story, but the broader case for Bitcoin scarce supply, deeper liquidity and expanding institutional access remains intact.

For traders, that means respecting volatility, sizing risk conservatively and being careful with leverage. For long-term holders, it’s a reminder that big drawdowns can appear even inside larger uptrends. Ground decisions in your own research, time horizon and risk tolerance; no single week, bullish or bearish, should define your Bitcoin strategy.

FAQs

Q : Why did BTC drop so sharply toward $60,000 this week?

A : The main drivers were a sharp risk-off move in tech stocks, persistent worries about spot BTC ETF outflows, and a cascade of futures liquidations after key support near $84K gave way. Together, these pressures pushed BTC down to about $60K on some exchanges before a partial recovery.

Q : What are the most important BTC price levels to watch right now?

A : On the downside, the $60K–$62K band is the key support that absorbed this week’s panic selling. On the upside, $72K–$76K is the first meaningful resistance zone, with a more significant cap around $84K–$85K where the recent breakdown began.

Q : Is leverage still a big risk in the Bitcoin market after this week’s flush?

A : Open interest and funding data suggest a significant deleveraging has already occurred, with hundreds of millions of dollars in positions liquidated over 24 hours. While that reduces some systemic risk, the market is still volatile, so new leverage can quickly become dangerous if price whipsaws again.

Q : How does BTC’s performance this week compare to the rest of the crypto market?

A : BTC is down roughly 20% over 7 days, with many large altcoins seeing similar or even larger drops. Dominance in the mid-50% range suggests that, despite the sell-off, BTC is still acting as a relative “safer” asset inside crypto, attracting some rotation from smaller coins.

Q : Is Bitcoin still considered “safe” for long-term holders after such volatility?

A : BTC remains highly volatile and is not “safe” in the sense of a stable asset; sharp drawdowns are part of its historical behaviour. However, the long-term investment case limited supply, growing institutional adoption and deepening market infrastructure has not fundamentally changed due to one volatile week, though macroeconomic risks remain significant.