Bitcoin Usage Trends in Arab Countries for US & EU Investors

Bitcoin adoption in Arab countries describes how individuals, businesses and institutions across the Middle East and North Africa use Bitcoin for trading, savings, remittances and payments, and how this shows up in on-chain data, exchange volumes and regulation. In 2025, countries like Turkey, the United Arab Emirates, Egypt and Morocco stand out for rapid growth, while US, UK and EU rules on sanctions, AML and data protection increasingly shape how investors and fintechs can safely tap MENA Bitcoin markets.

Bitcoin Adoption in Arab Countries.

Bitcoin adoption in Arab countries is no longer a niche side-story in global crypto. It has become a visible macro trend, driven by currency instability, young digital populations and a growing web of regulated exchanges from Dubai to Casablanca. For US, UK, German and wider European investors, understanding Bitcoin adoption in Arab countries is now a real due-diligence task, not just a curiosity.

Between July 2023 and June 2024, the wider MENA region received roughly $338.7 billion in on-chain crypto value, around 7.5% of global transaction volume, making it one of the world’s most active crypto regions.Over the same period, Central, Northern and Western Europe took in around $987 billion (about 21.7% of global volume), highlighting how tightly MENA flows are now linked to European capital and regulation.

This guide speaks to US, UK, EU and MENA readers who need a data-driven, compliance-aware view of Bitcoin usage across Arab markets – from retail traders hedging inflation in Cairo to institutional flows routed through Dubai and Abu Dhabi.

We lean on work from analytics providers like Chainalysis, Statista, the World Bank and the International Monetary Fund, plus regional central-bank and regulator reports, and then connect those trends back to the regulatory realities in the United States, the United Kingdom, Germany and the wider European Union.

Quick disclaimer.

Nothing in this article is financial, tax or legal advice. Always verify the latest data and speak to qualified advisors before making decisions.

Introduction.

From niche asset to MENA macro trend

From 2017–2020, Bitcoin activity in most Arab countries looked like a niche, often semi-underground market. That shifted sharply around 2021–2022, when soaring inflation, currency devaluations and COVID-era digitisation pushed more users in Turkey, Egypt, Morocco and Lebanon into crypto.

Chainalysis data showed the MENA region receiving around $566 billion in crypto between mid-2021 and mid-2022, one of the fastest growth rates globally and flows have stayed high, even as prices cycled up and down.

Who this 2025 overview is for (US, UK, EU, MENA readers)

This 2025 outlook is written for.

US asset managers and fintechs in places like New York or Austin exploring MENA exposure

UK-based neobanks and London-centric fintechs planning links with Dubai or Riyadh

German and broader EU banks, CASPs and VASPs in Berlin or Frankfurt looking at GCC corridors

MENA founders, compliance teams and policymakers who want to understand how Western rules constrain or enable cross-border Bitcoin flows

Mak It Solutions already works with clients across the Middle East and Europe on data analytics, cloud and compliance-aware architectures, so we’ll also flag where better data pipelines and dashboards can make these markets less opaque.

How this guide uses data from Chainalysis, Statista and regional reports

Wherever we cite volumes, ranks or growth rates, we rely on.

Global adoption indices and regional reports from Chainalysis

Country-level metrics from Statista and other data providers

Central-bank statements and regional regulatory announcements

Because Bitcoin and crypto data moves quickly, all numbers should be checked against the latest 2024–2025 reports before being used in investment memos or regulatory filings.

Snapshot of Bitcoin Adoption in Arab Countries.

What “Bitcoin adoption in Arab countries” actually means

When we talk about Bitcoin adoption in Arab countries in 2025, we mean:

The share of the population using or holding Bitcoin (penetration)

The on-chain transaction volume and exchange flows involving Arab users

The mix of retail vs institutional activity

How clear or restrictive local regulation is

In practice, Bitcoin is only one part of a broader crypto stack that includes stablecoins and altcoins. But because BTC is still the best-known asset for US, UK and EU investors, we use it as the anchor for this overview.

Fast facts: user penetration, trading volume and rankings by country

Recent analyses suggest that.

MENA as a whole now accounts for around 7–8% of global crypto transaction volume, with Turkey, the UAE, Saudi Arabia, Egypt and Morocco leading flows.

Turkey alone has been estimated at close to $200 billion in annual crypto transactions, with the UAE at roughly $50–60 billion and Egypt around $50 billion; Jordan, Saudi Arabia and Morocco follow.

Saudi Arabia and Qatar have shown triple-digit year-on-year growth in crypto activity, with one Chainalysis report citing around 154% growth for Saudi Arabia.

These are regional crypto figures, not Bitcoin-only – but in most MENA markets, BTC and dollar-pegged stablecoins still account for much of the value.

How Arab markets compare with global crypto adoption indices

On global grassroots adoption indices, MENA does not dominate like Central & Southern Asia, but individual countries such as Turkey and Morocco often appear in the global top-30. By raw volume, MENA is mid-table: below Central/Northern/Western Europe and North America, but ahead of smaller regional blocs.

For US or EU investors, this means Arab Bitcoin markets are meaningful but still “emerging”: significant enough to matter, small enough that shifts in regulation and data quality can materially change the picture.

Fastest-Growing Arab Countries for Bitcoin Adoption Since 2022

UAE, Saudi Arabia, Bahrain, Qatar and Dubai/Abu Dhabi’s role

The fastest-growing Arab markets for Bitcoin and broader crypto since 2022 are the Gulf hubs – especially the UAE, Saudi Arabia, Bahrain and Qatar.

The UAE, via Dubai and Abu Dhabi, positions itself as a regulated digital-asset hub with entities like VARA and the Central Bank of the United Arab Emirates coordinating with global institutions and locally licensed exchanges.Saudi Arabia’s growth has been fuelled by policy attention from the Saudi Central Bank and national digital strategies tied to Vision 2030, including interest in CBDCs.

Bahrain and Qatar use sandbox regimes and specialist financial centres to attract regional and EU-regulated VASPs, providing on-ramps for institutional flows from London, Frankfurt and Luxembourg.

Rising retail adoption in Turkey, Morocco, Egypt, Jordan and North Africa

Below the Gulf hubs, the most intense grassroots usage is in Turkey, Morocco, Egypt, Jordan and parts of North Africa:

In Turkey, double-digit inflation and lira depreciation have pushed both retail savers and professional traders into BTC and stablecoins as hedges.

In Egypt and Morocco, high youth unemployment plus heavy remittance inflows make Bitcoin and stablecoins attractive for cross-border transfers and savings.

Jordan and Lebanon show strong P2P trading and OTC activity, even where formal regulation lags.

For US or UK investors, these markets look more like “emerging-market FX + remittances” plays than pure speculative trading stories.

Bitcoin/crypto adoption statistics in the Middle East and Arab world

Approximate, illustrative rankings always verify with the latest Chainalysis / Statista data before citing.

| Country / Hub | Relative MENA Rank (2025) | Key Driver | Latest Data Year* |

|---|---|---|---|

| Turkey | 1 | Inflation hedge, institutional flows | 2024–2025 |

| United Arab Emirates | 2 | Regulated hub (Dubai/Abu Dhabi), DeFi | 2024–2025 |

| Egypt | 3 | Remittances, retail trading | 2024–2025 |

| Saudi Arabia | 4 | High growth, CBDC/fintech initiatives | 2023–2024 |

| Jordan | 5 | P2P and OTC activity | 2023–2024 |

| Morocco | 6 | Grassroots retail adoption | 2023–2024 |

| Qatar | 7 | Financial-centre licensing & sandboxes | 2024–2025 |

| Bahrain | 8 | Regional VASP hub | 2023–2024 |

* “Data year” refers to the most recent period covered in regional reports rather than the calendar year.

How People in Arab Countries Actually Use Bitcoin

Trading, savings and hedging against inflation in MENA

Across Arab markets, people primarily use Bitcoin for trading, savings and macro hedging.

In high-inflation economies like Turkey and Egypt, BTC and dollar stablecoins often function as a parallel store of value when local currencies slide. Retail users might buy small amounts periodically, while professional traders and family offices trade volatility on offshore and regional exchanges.

In more stable Gulf economies, Bitcoin is used more for speculation and portfolio diversification by high-net-worth individuals and institutions, rather than basic survival.

Remittances between Europe and Arab countries

For flows between Europe and Arab countries, Bitcoin and stablecoins are increasingly used to bridge remittances from:

Workers in London or Manchester sending funds back to Cairo, Amman or Casablanca

Engineers in Berlin or Munich remitting to Riyadh, Jeddah or Doha

Freelancers in New York or Frankfurt invoicing clients in Dubai or Kuwait City

Compared to SWIFT or traditional money transfer services, BTC and stablecoin rails can be cheaper and faster, but they introduce FX and regulatory risk, especially around OFAC sanctions and local licensing.

Small-business payments, e-commerce and informal P2P markets

For small businesses in Dubai, Casablanca or Amman, direct Bitcoin acceptance is still niche compared to card, cash and local instant-payment schemes. But we do see:

Online merchants accepting BTC or USDT for high-risk or cross-border customers

Informal P2P markets where Telegram/WhatsApp groups match local buyers and sellers

Remittance-adjacent services that settle in fiat but use Bitcoin or stablecoins under the hood

If you’re designing e-commerce or payment platforms that serve both EU and GCC users, the practical pattern is often “crypto behind the scenes, fiat at the customer edge” with PCI DSS-compliant card rails on one side and on-chain settlement on the other.

Drivers Behind Crypto Adoption in MENA Despite Regulatory Uncertainty

Currency instability, inflation and limited banking access

The simplest answer to “why has MENA crypto adoption surged despite regulatory uncertainty?” is: macro pressure plus limited alternatives.

High inflation and FX controls in countries like Turkey, Egypt and Lebanon weaken trust in local currency.

In parts of North Africa and the Levant, underbanked populations turn to mobile wallets and exchanges as their first “bank account.”

Where traditional banking is fragile, Bitcoin and stablecoins become the “least bad” option for savings or transfers, even if regulators disapprove.

Youth demographics, digital culture and grassroots crypto communities

MENA is young and extremely online. In Saudi Arabia, for example, more than 60% of the population is under 30, and social media penetration is among the highest in the world.

That demographic reality means.

Crypto education and hype spreads via TikTok, YouTube and Telegram faster than official warnings

Grassroots communities in cities like Dubai, Riyadh, Cairo and Casablanca run meetups, OTC desks and dev groups

This looks closer to earlier waves of grassroots crypto usage in Asia and Latin America than to the institution-first adoption seen in parts of North America.

Sanctions, capital controls and the search for alternative rails

Sanctions and capital controls play a complicated role. Some jurisdictions (e.g. Iran) have seen crypto use explicitly tied to sanction evasion and then cracked down hard.

Legitimate businesses, however, mostly want compliant alternative rails.

Payment and treasury flows that are less dependent on US correspondent banking

FX options when local markets are thin

Faster settlement between EU-based fintechs and GCC banks

For these players, the key question is not “crypto yes or no?” but “which structures keep OFAC, EU sanctions and local regulators comfortable?”

Bitcoin Regulations in the Middle East and Arab World

Is Bitcoin legal in Arab countries? A spectrum from bans to sandboxes

Is Bitcoin “legal” in Arab countries? The reality is a spectrum.

Some countries have outright or practical bans on trading and payments, even if holding is not directly criminalised.

Others (UAE, Bahrain, Qatar’s financial centre, Saudi Arabia) allow licensed activity in controlled environments.

Many operate in a grey zone where banks are cautious, but retail trading via offshore exchanges continues.

From an AEO standpoint, the practical answer is: Bitcoin itself is rarely illegal to own, but regulated usage (exchanges, custodians, payment gateways) may require licences, and some jurisdictions restrict or discourage it strongly.

Central bank and regulator stances.

Central banks like the Central Bank of the UAE, Saudi Central Bank, Central Bank of Egypt, Central Bank of Morocco and Central Bank of Jordan generally warn about risks but differ in how far they go.

GCC hubs: experimenting with sandboxes, VASP licences, CBDC pilots and open banking-style APIs

Levant: more cautious, with tighter FX controls and fewer licensed players

North Africa: a mix of formal restrictions (e.g. earlier bans on crypto trading) and de-facto tolerance of P2P usage

For a London- or Berlin-based fintech, that means each corridor (e.g. UK ↔ UAE vs Germany ↔ Egypt) needs separate regulatory mapping, not just “MENA” as a single label.

Sharia-compliant Bitcoin investments, AML rules and cross-border compliance

Another MENA-specific layer is Sharia compliance. Some Islamic scholars view Bitcoin as permissible (mal or property-like), while others are more sceptical. In practice, Sharia-conscious products tend to.

Focus on spot BTC, avoiding interest-bearing or highly leveraged structures

Emphasise transparent custody and profit-sharing models

All of this sits on top of AML, CFT and sanctions obligations that mirror global expectations: KYC, transaction monitoring, travel rule, suspicious activity reporting, and similar measures. For cross-border flows with the US or EU, you also get screening against OFAC lists and alignment with FATF guidance.

How US, UK and EU Rules Shape Bitcoin Use in Arab Markets

SEC, CFTC, OFAC and US sanctions.

US regulators such as the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC) and Office of Foreign Assets Control (OFAC) shape Arab Bitcoin markets even when activity happens offshore.

SEC/CFTC decisions on spot Bitcoin ETFs and derivatives affect liquidity and hedging tools used by MENA institutions.

OFAC sanctions lists influence which exchanges, wallets and counterparties regional banks will touch.

If you’re a US entity moving Bitcoin-related value to Dubai or Riyadh, you need US-grade sanctions screening and travel-rule-compliant tooling, even when local rules are still evolving.

FCA, UK-GDPR and London fintech links to Dubai and Riyadh

For UK-based firms, the Financial Conduct Authority (FCA) plus UK-GDPR and Open Banking rules define how you can onboard, monitor and serve MENA users.

Common patterns include.

London-licensed fintechs opening regulated entities in Dubai or Abu Dhabi to serve GCC clients

Data architecture that keeps personally identifiable information (PII) in UK/EU clouds while exposing tokenised or minimised data to MENA systems much like handling sensitive NHS-grade health data, but for financial profiles

The aim is to reuse existing KYC, AML, fraud and data-protection controls instead of reinventing the stack per corridor.

BaFin, EU sanctions, GDPR/DSGVO and expectations for German/EU investors

In Germany and the wider EU, MiCA and GDPR/DSGVO define expectations for crypto-asset service providers. The Federal Financial Supervisory Authority (BaFin) now supervises CASPs, requiring clear authorisations and risk controls.

For a Berlin-based fintech offering BTC exposure linked to MENA markets, that means:

MiCA-compliant licensing in the EU first

Careful mapping of counterparties in Dubai, Riyadh or Cairo

Demonstrable GDPR compliance for any MENA user data processed in EU clouds

Comparing Bitcoin Adoption in Arab Countries to Global Trends

Retail vs institutional patterns vs North America, Europe and Asia

So, how is Bitcoin adoption in Arab countries different from global trends?

Compared with North America and Western Europe, Arab markets skew more towards macro hedging, remittances and institutional cross-border flows, and less towards pure DeFi experimentation. Retail participation is strong in Turkey, Egypt and Morocco, but Gulf hubs like Dubai and Riyadh increasingly resemble Singapore or Zurich institution-heavy, regulation-driven and focused on compliant growth.

Relative to Asia, MENA volumes are smaller, but the share of large-ticket transfers (>$10k) is higher, indicating a tilt towards professional and institutional usage.

Role of regional exchanges, P2P platforms and stablecoins

Regional exchanges in Dubai, Abu Dhabi and Bahrain now compete with global players for high-value flows, while P2P platforms and Telegram/WhatsApp groups serve underbanked populations in North Africa and the Levant.

Stablecoins (especially USD-pegged) are critical: they act as the bridge asset between BTC exposure and local-currency needs, mirroring trends seen in Central & Western Europe.

What global investors often misunderstand about MENA crypto data

Three common misconceptions.

“MENA is all retail speculation.”

In reality, a large share of volume is institutional or professional transfers.

“Regulation is chaos.”

There is variance, but GCC hubs are converging towards frameworks recognisable to EU or UK compliance teams.

“Data is unusable.”

With the right combination of Chainalysis-style on-chain data, Statista country metrics and central-bank releases, you can build reasonably robust dashboards the gap is more architecture than data.

Risk Assessment: How Investors and Businesses Can Navigate Arab Bitcoin Markets Safely

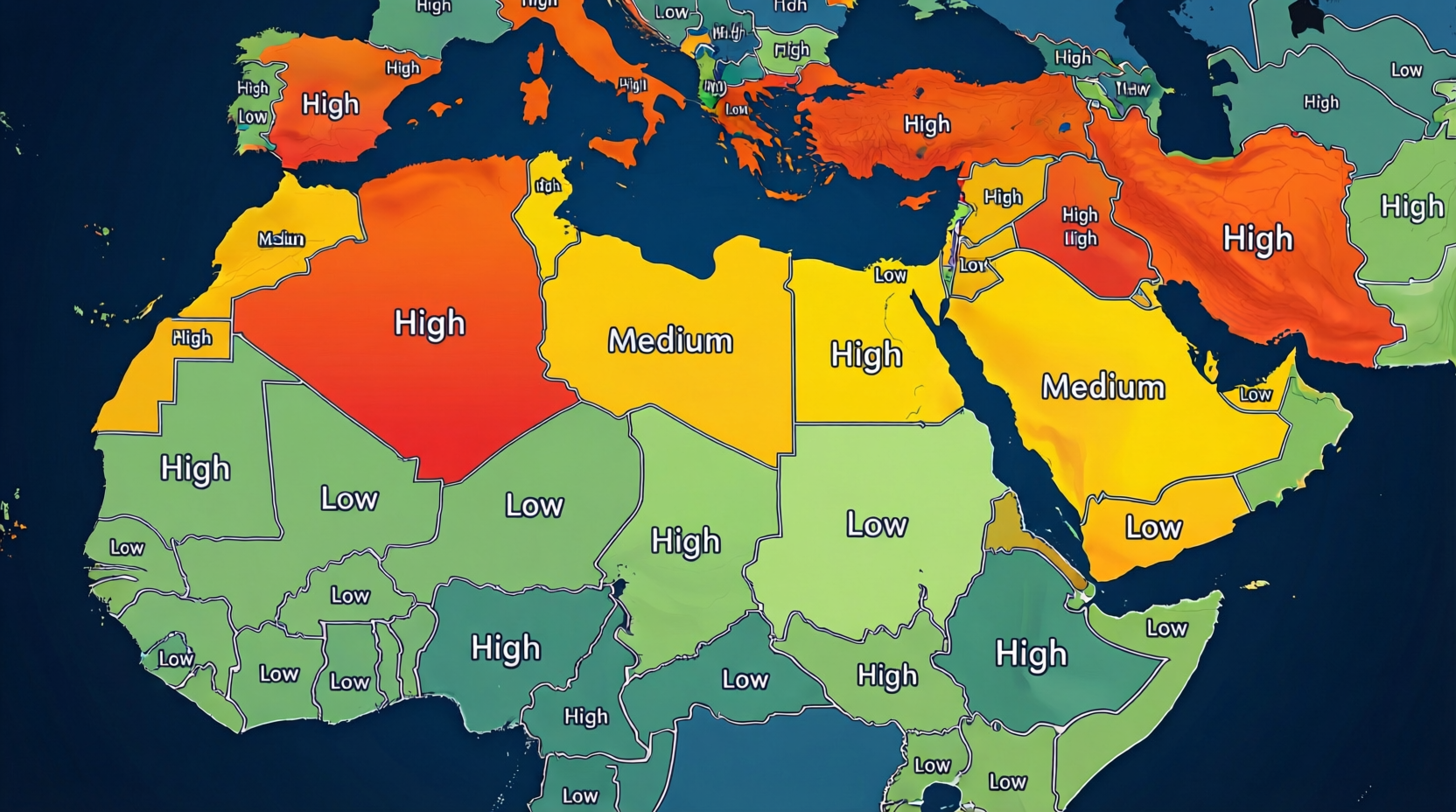

Mapping regulatory risk.

To safely assess regulatory risk when dealing with Bitcoin in Arab markets, investors and businesses should start by mapping:

Whether the target jurisdiction requires licences for crypto trading, custody or payments

Which central bank or financial authority publishes guidance (e.g. circulars from central banks in UAE, Saudi Arabia, Egypt, Morocco, Jordan)

Whether there are explicit bans or only “warnings”

From there, you can classify countries into green (licensable), amber (grey-zone) and red (restricted/blocked) for your specific use case.

Compliance checklists for US, UK and EU entities (KYC, AML, sanctions, data protection)

Here’s a simple, reusable “how to assess regulatory risk” checklist for US, UK and EU entities:

Jurisdiction scan

Identify where your users, servers, counterparties and legal entities sit (US, UK, EU, GCC, Levant, North Africa)

Licensing & registration

Confirm whether you need registration as an MSB/Money Service Business, VASP, e-money or investment firm in each jurisdiction.

KYC/AML & sanctions

Align your KYC, transaction-monitoring and sanctions screening to US (OFAC), EU and UK expectations; confirm travel-rule implementation.

Data protection & security

Map where personal data lives and ensure GDPR/UK-GDPR compliance plus appropriate certifications (e.g. SOC 2, PCI DSS) for payment and identity data.

This is essentially the same level of discipline you’d apply when handling sensitive health data in a highly regulated NHS-style environment just translated to crypto and financial risk instead of medical outcomes.

Choosing data sources.

Finally, data quality matters as much as licences. For ongoing monitoring, most serious players combine:

On-chain and service-level analytics (e.g. Chainalysis dashboards)

Macro and demographic data from Statista, the World Bank and IMF

Official releases from central banks, finance ministries and securities regulators

Mak It Solutions’ recent work on data analytics and BI in the Middle East shows how to stitch these feeds into GCC-aware dashboards, so compliance and strategy teams get near-real-time visibility into flows and risk indicators.

Where Bitcoin Adoption in Arab Countries Is Heading Next

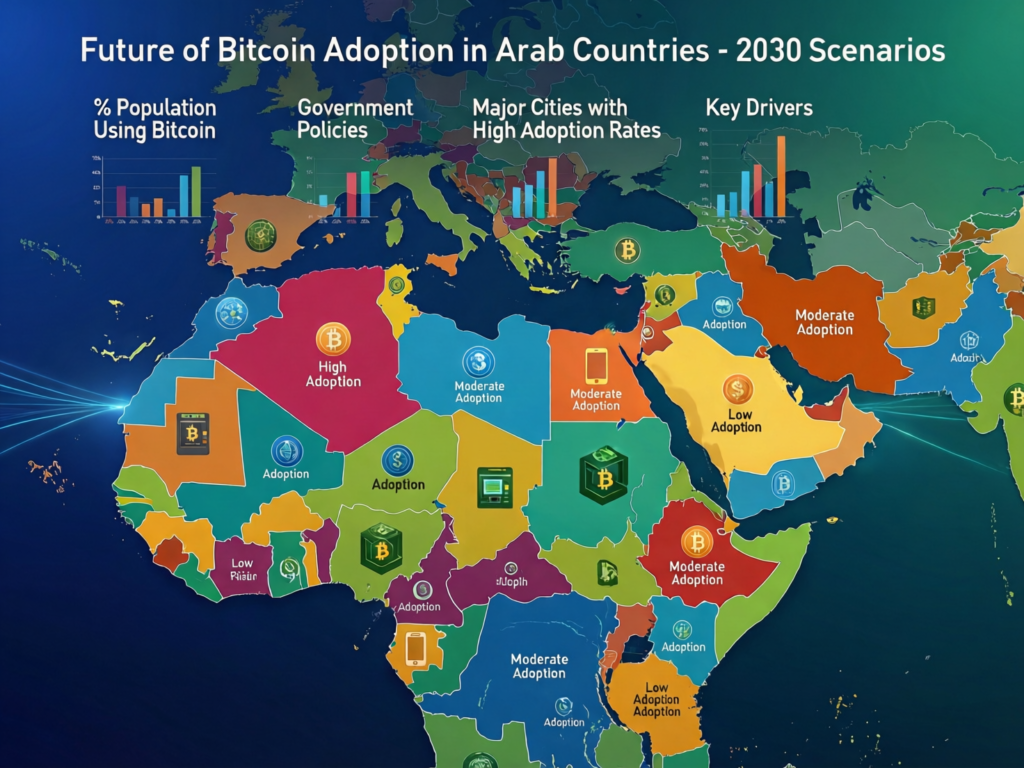

Scenarios to 2030.

Looking towards 2030, a few scenarios stand out.

Regulated hub model

UAE, Saudi Arabia, Qatar and Bahrain become fully regulated hubs interfacing with US, UK and EU markets under MiCA-style rules.

CBDC + Bitcoin coexistence

Central banks roll out CBDCs for domestic payments while allowing licensed BTC and stablecoin activity for investment and cross-border flows.

Data-driven supervision

Regulators increasingly rely on blockchain analytics to monitor risk, making transparent, well-instrumented platforms more competitive than opaque ones.

Opportunities for US, UK, German and wider European companies

For Western firms, the opportunities are less about speculative trading and more about:

Regulated exchanges and brokerages connecting EU/UK clients to GCC markets

Cross-border payment and treasury platforms using BTC/stablecoins under strict compliance

Data and analytics products that help MENA banks and regulators interpret crypto flows

Mak It Solutions already supports cloud, analytics and web platforms tailored to GCC rules; Bitcoin-adjacent architectures are a natural extension of that work.

How to stay updated on MENA crypto adoption (reports, alerts, data subscriptions)

To keep your understanding current.

Subscribe to annual geography reports from Chainalysis and similar providers

Track updates from regulators (e.g. BaFin’s MiCA guidance, FCA consultation papers, GCC central-bank circulars)

Build internal alerts and dashboards so big swings in Turkey, the UAE or Egypt show up in your MI within hours, not months

Key Takeaways

MENA now accounts for a mid-single-digit share of global crypto volume, with Turkey, the UAE and Egypt leading.

Gulf hubs (Dubai, Abu Dhabi, Riyadh, Doha, Manama) are becoming regulated institutional gateways, while North African and Levant markets remain heavily retail and P2P.

The core drivers are inflation, currency risk, remittances and youthful, digital populations, not just speculation.

US, UK and EU rules on sanctions, AML and data protection effectively set the upper bound on what’s possible for compliant MENA Bitcoin products.

Serious investors and fintechs need good data pipelines, not just headlines, to assess country-by-country risk and opportunity.

When to seek specialist legal and compliance advice

You should bring in specialist legal and compliance counsel when.

You plan to onboard users in higher-risk jurisdictions or sanctioned-adjacent markets

You want to passport EU/UK licences into GCC structures or vice versa

You are handling sensitive identity or payment data that must satisfy GDPR/UK-GDPR, PCI DSS and SOC 2-style expectations simultaneously

Think of this like launching a regulated medical-data platform for the NHS: you wouldn’t ship without serious regulatory design the same logic applies here.

Again, this article is for education and strategy only. It is not financial, investment or legal advice, and should be paired with your own research and professional counsel.

If your team needs a deeper cut corridor-level flows, exchange breakdowns, or dashboards tailored to your specific regulators treat this article as the executive summary and back it with a dedicated data room or report. Mak It Solutions can help you design the underlying data architecture, ingestion pipelines and BI layer so new Chainalysis/Statista or central-bank releases appear in your dashboards automatically.

If you’re exploring Bitcoin or broader crypto exposure to Arab markets and want to stay on the right side of US, UK, EU and regional regulators, you don’t have to build the stack alone. Share your current architecture, target corridors and key regulators with Mak It Solutions, and request a focused “MENA Crypto Adoption & Regulatory Risk” workshop. Together we can sketch an end-to-end roadmap from data sources and cloud regions to KYC/AML workflows and dashboards that matches your risk appetite and growth ambitions.( Click Here’s )

FAQs

Q : Which data sources are most reliable for tracking Bitcoin adoption in Arab countries?

A : The most reliable view comes from combining several sources: blockchain analytics platforms like Chainalysis for on-chain flows, Statista and World Bank or IMF data for macro and demographic context, and official statements from regional central banks and regulators. No single dataset is perfect, but a blended approach gives a much clearer picture than exchange volumes alone, especially in markets where P2P and OTC activity is significant.

Q : How do Bitcoin remittance costs to Arab countries compare with SWIFT and traditional money transfer services?

A : In many corridors, BTC and stablecoin rails can be cheaper and faster than SWIFT or bureau-style remittance services, especially for mid-sized tickets where bank fees and FX margins bite hardest. However, you must factor in network fees, spreads on/off-ramps, FX slippage and compliance overhead (KYC/AML, sanctions checks). For low-value remittances, regulated fintechs using local instant-payment systems can still beat Bitcoin on cost and UX, particularly in GCC countries with modern domestic rails.

Q : Can US and UK residents legally use Dubai-based crypto exchanges to trade Bitcoin related to MENA markets?

A : In principle, many Dubai- or UAE-based exchanges are accessible to US and UK residents, but users must respect their home-country rules (SEC/CFTC/FCA guidance, tax obligations) and any platform-specific restrictions. Exchanges may limit US persons due to regulatory risk, and some products (like derivatives or high-yield schemes) could trigger additional licensing issues. Always check the exchange’s terms of service and, for institutional flows, obtain formal legal advice.

Q : What should German and EU fintechs consider before offering Bitcoin products targeted at MENA users?

A : German and EU fintechs need to ensure MiCA-compliant authorisation, robust AML/sanctions controls, and GDPR/DSGVO-compliant data handling before marketing Bitcoin products into MENA.They should also map whether local regulators in target countries treat their offerings as securities, payment instruments or something else. Finally, they must design cloud and data architectures that respect both EU data-residency expectations and any local rules in GCC, Levant or North Africa.

Q : How often do Bitcoin regulations change in the Middle East, and how can investors keep track?

A : Regulation in the Middle East is evolving quickly: some GCC hubs have introduced or updated digital-asset frameworks every 12–24 months, while guidance in North Africa and the Levant often appears via central-bank circulars or ad-hoc statements. Investors should monitor official regulator websites, subscribe to regional law-firm briefings, and use compliance vendors that track sanctions and licence changes. For larger exposures, building a small internal “reg intel” function, supported by dashboards and alerts, is increasingly a necessity rather than a luxury.