Middle East Crypto Hub: Regulation, Capital and Opportunity

The middle east crypto hub is a cluster of Gulf financial centres led by Dubai, Abu Dhabi and Bahrain offering dedicated digital-asset regimes, licensing and banking access for global traders, startups and institutions. For US, UK and EU firms, it increasingly works as a complementary base to New York, London, Frankfurt or Singapore, adding regional capital, time-zone coverage and clearer rules when used alongside strong home-country compliance, not as a replacement for it.

Introduction

In 2025, the phrase “middle east crypto hub” now sits in the same board decks as Singapore, Hong Kong and major European centres. US exchanges, UK fintech founders, BaFin-supervised German entities and Gulf family offices are all experimenting with how a MENA digital-asset hub fits into their strategy.

At the same time, governments across the United Arab Emirates, Saudi Arabia and Bahrain are pitching themselves as the next stop for Web3 innovation in the Middle East, with virtual-asset regulation, sovereign capital and lifestyle all part of the sales pitch. For decision-makers in New York, London, Frankfurt or Berlin, the question is no longer “Is there a crypto scene in the Gulf?” but “Is this a hub we should plug into and how do we do it safely?”

Nothing in this guide is legal, tax or investment advice. Treat it as a practical map of the landscape and always work with qualified legal, compliance and tax advisors before acting.

In the rest of this guide, we’ll unpack what the middle east cryptocurrency hub actually is, why it’s booming, how its regulation compares to the US, UK and EU, which institutions are moving in, the risks you can’t ignore, and practical entry routes for traders, funds and startups. Along the way, we’ll flag where a partner such as Mak It Solutions can support with compliant platforms, cloud infrastructure and data tooling rather than pure legal or tax advice.

What Is the Middle East Crypto Hub Today?

Direct answer.

Today’s middle east crypto hub is a cluster of Gulf financial centres especially Dubai, Abu Dhabi and Manama that offer dedicated virtual-asset regimes, licensing pathways and banking access designed for global exchanges, funds and fintechs, rather than a vague “crypto-friendly” label.

Defining a “Middle East Crypto Hub” (and What It Isn’t)

A true Middle East crypto hub is not the entire region and it’s not just a low-tax marketing slogan. It describes specific financial centres with regulators, rulebooks and infrastructure tailored to virtual-asset service providers (VASPs) mainly in the UAE, Bahrain and a few emerging locations.

Dubai’s Virtual Assets Regulatory Authority (VARA), for example, is a standalone regulator responsible for supervising virtual-asset activities across most of the emirate, with its own regulations and licensing framework for exchanges, custodians and brokers. That is very different from a jurisdiction that simply says “crypto is allowed” but offers no licensing path or prudential standards.

So when we talk about a middle east cryptocurrency hub, we’re really talking about a regulated digital-asset ecosystem: supervisors, court systems, compliant banking, cloud data centres, professional services and a growing pool of experienced talent.

Key Hubs to Watch: Dubai, Abu Dhabi, Bahrain and Beyond

Dubai has branded itself as a “capital of crypto”, with city-wide VARA regulation on top of long-standing free zones like the Dubai International Financial Centre (DIFC) and specialist ecosystems in DMCC’s Crypto Centre. The pitch: regulatory clarity, lifestyle and a dense Web3 founder and investor scene.

Abu Dhabi, via Abu Dhabi Global Market (ADGM), leans more institutional with English-law courts, an FSRA rulebook and a growing roster of licensed exchanges, custodians and tokenisation platforms.

Manama, the capital of Bahrain, was one of the first regional hubs to license crypto exchanges, with the Central Bank of Bahrain’s early framework drawing in platforms serving both retail and professional clients.

Around this core, other countries like Jordan, Qatar, Turkey and Egypt are experimenting with pilot projects, sandboxes or tokenisation schemes that may feed into a wider MENA digital-asset hub narrative over the next few years.

Middle East vs US, UK and Europe as Crypto Hubs

Compared with the US, UK and EU, the Gulf hubs often score well on.

Regulatory clarity and speed: purpose-built VA frameworks and sandboxes rather than years of ambiguity.

Tax treatment: generally low or zero personal income tax for residents, though home-country rules still apply for US, UK and EU persons.

Banking and time zone: access to regional banks plus a trading day that bridges Asia and Europe, which many New York or London desks use to extend coverage.

By contrast, the US remains heavily enforcement-led through the U.S. Securities and Exchange Commission (SEC), the Financial Conduct Authority (FCA) focuses on strict marketing rules, and EU regimes under BaFin and MiCA prize consumer protection and prudential safeguards.

What Is Driving the Middle East’s Rise as a Global Crypto Hub?

Direct answer: The middle east crypto hub is booming because Gulf states are using digital assets and tokenisation as part of a wider “post-oil” strategy, while MENA crypto adoption, on-chain volumes and institutional interest from the US, UK, Germany and the wider EU continue to grow.

From Oil to Digital Assets.

Gulf governments are explicit: virtual assets, tokenised securities and Web3 are now part of their economic-diversification playbook, alongside tourism, logistics and AI. National strategies in the UAE and Saudi Arabia frame crypto as one pillar in becoming regional leaders in advanced finance and smart cities, attracting exchanges, infrastructure providers and fintechs from New York, London and Frankfurt.

A MENA digital-asset hub also fits with broader “vision” programmes think Riyadh’s giga-projects or Dubai’s smart-city initiatives where blockchain is used for identity, payments, trade finance and capital-markets plumbing. For UK and German founders, that translates into a chance to pilot tokenisation, stablecoins or DeFi-style products in more experimental yet still supervised environments.

Adoption and Capital Flows.

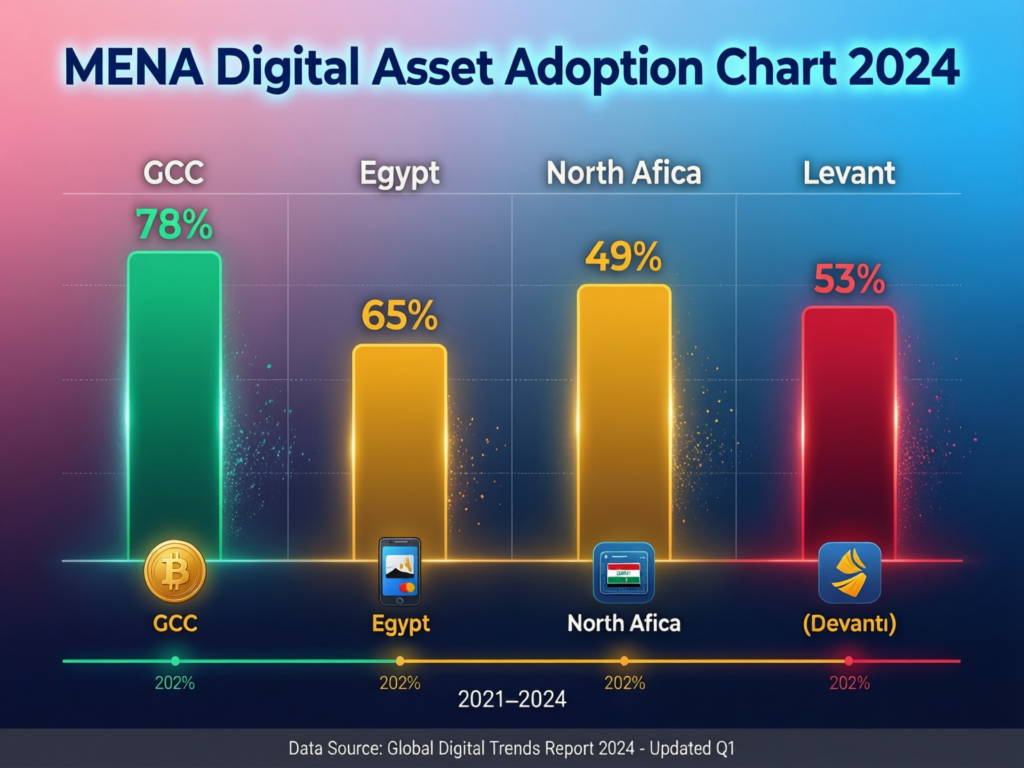

Recent research from Chainalysis estimates that the Middle East & North Africa received around $338.7 billion in on-chain crypto value between July 2023 and June 2024, about 7.5% of global transaction volume.

Crucially, around 93% of that value comes from transactions over $10,000 meaning institutional and professional players dominate, not just retail speculation.

Use cases differ across the region.

Retail users in places like Turkey and Morocco lean on stablecoins for remittances and inflation hedging.

High-net-worth investors in Dubai or Riyadh access offshore funds, structured products and DeFi yield.

Regional and European allocators quietly back local exchanges, market-makers and token funds as part of broader emerging-markets strategies.

As US and EU desks look to diversify counterparties and liquidity pools, this growing Gulf region blockchain ecosystem becomes hard to ignore.

Geopolitics, Time Zones and Connectivity for Global Traders

Geography is a big part of the story. From a trading perspective, a desk in Dubai or Abu Dhabi can cover late Asia, the full European session and early US hours in a single shift, making the middle east crypto hub a practical bridge between Singapore, London and New York.

Operationally, the region leans on world-class airlines, subsea cables and local data centres — including major cloud regions from AWS, Azure and Google Cloud that support low-latency trading, custody and analytics stacks.(Mak it Solutions) Many US/UK firms now run small leadership teams on the ground, while most engineers and quant staff remain distributed across Europe and North America.

Why the Region’s Crypto Regulation Looks Friendlier Than Many Western Markets

Direct answer: Middle East hubs feel “friendlier” because they built tailored virtual-asset regulators and licensing regimes like VARA and ADGM while the US and parts of the EU still rely heavily on enforcement or patchy legacy laws. The result: clearer expectations, sandboxing and faster approvals, albeit with strict AML/KYC and substance rules.

Crypto Regulation in the Middle East.

Zooming out, “crypto regulation middle east” is a patchwork.

Clear frameworks: UAE (federal, ADGM, DIFC plus VARA), Bahrain, and increasingly Saudi Arabia for pilots.

Cautious or restrictive: certain jurisdictions in North Africa and the Levant that limit trading, mining or exchange licensing.

Pilot mode: Qatar, Jordan and others exploring tokenisation, stablecoins or sandboxed activity.

Most genuine hubs use concepts familiar to US, UK and EU lawyers: virtual-asset service provider (VASP), virtual-asset licence, client-asset segregation and regulatory sandboxes. For searchers who type “virtual asset license middle east”, these are the regimes they are really looking for.

Dubai and the UAE Crypto Hub Model (VARA, ADGM, DMCC)

Dubai’s model rests on a city-wide VARA framework layered over free zones such as DMCC and DIFC. VARA’s 2023 Virtual Assets and Related Activities Regulations create a comprehensive VA framework with categories for exchanges, brokers, custodians and lending platforms, bringing them closer to capital-markets-style oversight.

Meanwhile, ADGM in Abu Dhabi runs its own virtual-asset regime and courts, particularly attractive to institutional players, while DMCC has grown a dense cluster of Web3 and mining-adjacent businesses in a trade-free-zone environment.

For US exchanges facing SEC lawsuits, UK-regulated firms navigating strict FCA financial-promotion rules and Germany-based startups watching BaFin’s stance under MiCA, a UAE licence can provide a clearer on-ramp into MENA so long as home-country rules are still fully honoured.

Comparing Middle East Regimes with SEC, FCA, BaFin and MiCA

At a high level

US: enforcement-led, overlapping federal and state regimes, frequent headline actions against exchanges and token issuers.(SEC)

UK: the FCA treats many crypto promotions as high-risk investments, with strict rules on how products can be marketed to UK consumers — including from overseas firms.(FCA)

EU/Germany.

MiCA and BaFin treat many activities as fully regulated financial services, with licensing, capital and conduct obligations that will bite from late 2024 onwards.

By contrast, Middle East hubs tend to be.

More flexible / attractive for some firms because:

There is a single point of contact for VA activity (e.g. VARA or ADGM FSRA)

Sandboxes and phased licences allow controlled innovation.

Approval timelines can be faster for well-prepared applicants.

Stricter in other ways because.

They demand meaningful on-the-ground presence and senior management.

AML/KYC and travel-rule expectations closely follow Financial Action Task Force (FATF) recommendations.

Why some firms prefer a Middle East licence plus strong home-country compliance

Clearer classification of activities and tokens.

A more collaborative regulator, at least at present.

Ability to serve regional clients without abandoning SEC/FCA/BaFin alignment.

Why Exchanges, Funds and Founders Are Basing Operations in Middle Eastern Hubs

Direct answer.

Global exchanges, hedge funds and founders are increasingly basing operations in Gulf hubs for regulatory clarity, access to sovereign and private capital, lifestyle and tax benefits often as a “second hub” alongside London or New York rather than a total relocation.

Global Exchanges and Custodians Choosing a Middle Eastern Base

Major exchanges and custodians have pursued local licences in Dubai, Abu Dhabi and Bahrain, setting up regional headquarters or key operational entities to serve MENA and, in some cases, parts of Africa and South Asia. Many see the region as a hedge against single jurisdiction risk, especially after years of enforcement tension in the US.

US, UK and EU platforms are typically drawn to.

Access to institutional clients in Riyadh, Dubai and Doha.

The ability to run trading, brokerage, staking or custody under a clearer rulebook.

Easier on-the-ground engagement with regulators than in Washington or Brussels.

Hedge Funds, Family Offices and Prop Desks Moving In

For hedge funds and family offices, the Gulf often becomes a second base after London or New York. Riyadh and Dubai are key nodes for meeting sovereign wealth funds and local banks, while Abu Dhabi’s ADGM caters to more traditional asset-management structures.

These allocators are interested in.

Exposure to regional tokens, exchanges and venture deals.

Access to sovereign and private capital for larger funds.

Structuring Shariah-sensitive or screened products for local investors.

Searches like “hedge funds relocating to gulf region” or “family offices crypto strategy middle east” reflect this quiet second-hub trend more than mass migration.

Talent, Lifestyle and Tax.

Founders often move for a mix of personal and business reasons.

Tax: many hubs offer low or zero personal income tax, though US citizens, UK residents and many German founders remain fully exposed to home-country tax and CFC rules.

Lifestyle and safety: Dubai, Abu Dhabi and Riyadh offer modern infrastructure, international schools, strong expat communities and generally low violent-crime rates.

Operational focus: leadership, investor relations and licensing can be based in the Gulf while engineering teams remain in Berlin, Munich, Manchester or Austin.

Remote-first teams particularly like using a MENA digital-asset hub for leadership, capital access and regulatory alignment, without uprooting entire staff from the US, UK or EU.

Risks, Patchwork Regulation and FATF Grey-List Issues to Understand

Direct answer.

The middle east crypto hub is powerful but not risk-free; investors must navigate very different country rules, FATF grey-list exposure, banking and de-risking risk, energy and mining constraints, and the specifics of Shariah-compliant products.

Country-by-Country Risk Map.

It’s vital not to treat the region as a single jurisdiction. On one end of the spectrum sit crypto-friendly hubs like the UAE and Bahrain; on the other are countries that heavily restrict or effectively ban trading, mining or exchange activity.

Some North African and Levant states are still debating how to classify crypto legally, so what’s permitted in Dubai or Manama may be illegal or simply impossible in practice elsewhere. For risk teams in US, UK and German institutions, a simple rule holds: treat each state as its own market, mapped carefully against your group policies.

FATF Grey Lists, AML/KYC and Correspondent Banking Risk

FATF’s “jurisdictions under increased monitoring” the so-called grey list has included Middle Eastern countries such as Lebanon and Yemen in recent updates, with additions and removals over time.

The consequences are real: IMF analysis suggests that being on the grey list can reduce foreign capital inflows by around 7.6% of GDP, underlining why banks and payment providers become more cautious with affected countries.

Even if your chosen hub (for example the UAE, now removed from the FATF grey list and the EU’s high-risk register) is in good standing, your counterparties, investors or underlying users may be in jurisdictions facing heavier scrutiny. That drives up expectations on AML/KYC, source-of-funds evidence and continuous transaction monitoring.

Energy, Mining Crackdowns and Shariah-Compliant Products

Energy use and local politics also shape the Gulf region blockchain ecosystem:

Some countries have cracked down on energy-intensive mining due to power-grid stress.

Others only allow mining in specific free zones or industrial areas.

For product design, Shariah compliance matters. Many local banks and family offices will only consider structures that avoid interest-like returns, excessive uncertainty (gharar) or exposure to prohibited sectors. That has spurred Shariah-screened crypto funds and token baskets that exclude certain assets or strategies.

Red-flag checklist for US, UK and German risk teams

Assuming rules are homogeneous across the “Middle East”.

Using exchanges or custodians without clear licensing from VARA, ADGM or a central bank.

Ignoring FATF grey-list impacts on correspondent banking.

Treating mining or staking yields as “risk-free carry” without energy and legal analysis.

Overlooking Shariah or local-law constraints when designing structured products.

How US, UK and EU Investors Can Use a Middle East Crypto Hub Safely

Direct answer.

International traders, startups and funds should treat a middle east crypto hub as a complementary base, combining clear local licences with strict adherence to home-country rules on securities, AML, data protection and tax. You’re not escaping SEC, FCA, BaFin or MiCA oversight you’re adding a second, region-specific layer.

Practical Entry Routes for US, UK and EU Investors

Typical entry paths include.

Using licensed regional exchanges and custodians in Dubai, Abu Dhabi or Bahrain, while keeping your own entity structure at home.

Setting up a regional entity (often in a free zone) to hold licences and regional client relationships.

Partnering or white-labelling infrastructure from local players for example, a UK broker using a Dubai exchange for order routing.

For many US crypto companies opening offices in the Middle East, the sweet spot is a lean local presence doing regulated front-office work, with back-office and tech in the US, UK or EU. UK expats often ask which hub is “best” Dubai tends to win on lifestyle and liquidity, while Bahrain or ADGM may appeal to more conservative German startups looking for a slightly quieter but still regulated base.

If you’re already building GCC workloads or smart-city platforms, resources like Mak It Solutions’ guide to Middle East cloud providers can help you think about region-specific hosting and compliance alongside your crypto strategy.(Mak it Solutions)

Compliance Checklist with Home Regulators (SEC, FCA, BaFin, MiCA, GDPR/DSGVO)

A simple cross-border checklist for your legal and compliance teams.

Securities and derivatives: confirm how your tokens and products are classified under US securities law, UK rules and MiCA. When in doubt, assume conservative treatment.

Marketing rules: align with FCA financial-promotion rules for any UK-resident exposure, and equivalent standards for EU investors think “clear, fair, not misleading”, suitability checks and risk warnings.

Data protection: benchmark your data handling against GDPR/DSGVO and UK-GDPR — using NHS-level standards for security and retention is a helpful mental model for UK readers.

Tax and CFC: get advice on how Gulf income and asset holdings are taxed in your home jurisdiction, including controlled foreign company rules and reporting obligations.

Operational resilience: align your controls with frameworks like PCI DSS and SOC 2, especially if you issue cards, process payments or hold customer fiat.(Mak it Solutions)

Mak It Solutions’ work on multi-cloud, AI agents and governance for US, UK and EU enterprises for example in their enterprise AI agents guide shows the same principles apply to crypto stacks: design for regulators first, features second.(Mak it Solutions)

None of this replaces tailored legal or tax advice; use it as a framework for conversations with your own advisors.

Choosing the Right Middle East Crypto Hub for Your Strategy

When comparing Dubai, Abu Dhabi, Bahrain and emerging hubs, use a structured lens:

Regulation depth vs cost and speed: VARA and ADGM offer sophisticated frameworks but can be costlier and more demanding; smaller hubs may be faster but less recognised.

Target client base: retail-heavy strategies may look at Dubai and Bahrain, while institutional-first plays often gravitate to ADGM or DIFC.

Banking and payments: assess which local banks, EMI providers and card schemes are comfortable with your model and that they follow PCI DSS and SOC 2-style controls.

A simple expansion playbook

Define the role of the hub trading only, client-facing licences, or full-stack operations.

Shortlist jurisdictions map Dubai, Abu Dhabi, Bahrain (and any others) against your regulatory, tax and client priorities.

Design the operating model where leadership sits, where engineers sit, and how data flows across borders.

Engage advisors and local counsel early before term sheets or relocation decisions.

Build compliant platforms and analytics using partners like Mak It Solutions’ services team to implement secure, audit-ready web, mobile and data infrastructure.(Mak it Solutions)

Key Takeaways

The middle east crypto hub is a set of specific, regulator-backed financial centres (mainly in the UAE and Bahrain), not a generic “crypto-friendly” region.

Economic diversification, rising MENA adoption and institutional-level flows are turning the Gulf into a meaningful counterpart to hubs like London, New York and Singapore.

Dedicated regulators such as VARA and ADGM make the region feel more predictable than some Western markets, but AML, KYC and substance expectations are high.

Exchanges, funds and founders use these hubs as “second bases” to reach regional capital and liquidity, not as a way to avoid SEC, FCA or BaFin oversight.

Major risks include jurisdictional patchwork, FATF grey-list exposure, energy and mining constraints, and Shariah-specific product requirements.

US, UK and EU investors should view the hub as a complementary platform combining local licences with rigorous home-country compliance, modern cloud architectures and strong governance.

If you’re weighing a move into the middle east crypto hub whether as an exchange, fund, fintech or enterprise building tokenised products you don’t have to untangle regulation, cloud and data risks alone.

Mak It Solutions can help your teams design compliant architectures, connect regional cloud and edge environments, and build the analytics and reporting layers your regulators expect across the US, UK, Germany and the wider EU. Share a few details about your plans via our contact page, and we’ll propose a focused workshop to map options, risks and next steps.(Mak it Solutions)

FAQs

Q : Is crypto legal across the whole Middle East or only in a few hubs?

A : Crypto is not uniformly legal or regulated across the Middle East. Some jurisdictions notably the UAE and Bahrain have clear licensing frameworks for exchanges, custodians and brokers, while others heavily restrict trading, mining or exchange operations or simply lack any dedicated rules.When evaluating the region, treat each country as its own market and check up-to-date guidance from local regulators and international bodies such as FATF.

Q : Do I need a local company to trade or invest via a Middle East crypto hub?

A : Retail traders from the US, UK or EU can normally use licensed regional exchanges without forming a local company, provided the platform accepts foreign clients and you comply with home-country tax and reporting rules. Institutional desks, funds and fintechs, however, usually do set up a local entity in a free zone or financial centre (e.g., ADGM, DIFC, DMCC or Bahrain) to hold licences, open bank accounts and hire staff. Local counsel should confirm the right structure for your business and regulator set.

Q : How are profits from Middle East exchanges taxed if I live in the US, UK or EU?

A : In most cases, trading profits realised via a middle east cryptocurrency hub remain taxable in your country of residence, regardless of where the exchange is located. US citizens face worldwide taxation; UK and German residents are generally taxed on worldwide income and gains, with relief through double-taxation treaties where applicable. Specific outcomes vary by entity structure, holding period and whether activity is classified as trading or investment, so tailored tax advice is essential — especially around CFC regimes and reporting obligations.

Q : What kind of bank accounts can crypto businesses open in Dubai, Abu Dhabi or Bahrain?

A : Licensed crypto businesses can in principle open operational and client-money accounts with regional banks or fintech payment institutions, though onboarding standards are strict. Expect enhanced KYC/KYB checks, detailed business-model explanations, transaction-monitoring requirements and ongoing reviews of your FATF risk exposure.Many firms also maintain relationships with correspondent or partner banks in the US, UK or EU to smooth cross-border flows and reduce single-bank risk.

Q : How risky are FATF grey-list and de-risking issues for using Middle East–based exchanges and custodians?

A : FATF grey-listing signals weaknesses in a country’s AML/CFT regime and can make international banks more cautious about dealing with institutions there. IMF estimates suggest grey-listing can cut foreign capital inflows by around 7.6% of GDP, which is why banks may “de-risk” higher-risk relationships. When choosing a hub, check whether the country is currently on the FATF or EU high-risk list, understand your own bank’s risk appetite and build contingency plans for payment and banking disruption.