Dash (DASH) Weekly Update Price Analysis This Week as Privacy Coins Face New Rules (Jan 31, 2026)

DASH is trading around $46, up roughly 30% over the past 7 days, but still well below this week’s spike near $65.5. CoinGecko’s data puts the 7-day range around $46.4–$65.5, with 24h volatility still elevated.

This week’s Dash (DASH) weekly update is dominated by new Russian rules targeting anonymous assets, renewed attention on privacy coins, and growing anticipation around the upcoming Dash Evolution upgrade.In the very short term, the key levels to watch are support near $46 and resistance around $52, followed by the $60–$66 band if momentum returns.

Key Data Snapshot

Data as of: 31 January 2026, 14:14 UTC

Current price: ≈ $45.99 per DASH

24h change: +10.6% (approx.)

7d change: +29.8% (approx.)

7d high / low: $65.52 / $46.36

Market cap: ≈ $582M

24h volume: ≈ $176M

Main sources

CoinGecko, CoinMarketCap, Dash.org, CoinMarketCap AI, BeInCrypto, CoinDesk, Decrypt, Barron’s.

Values are rounded and may vary slightly across data providers. They represent a real-time snapshot around the time of writing.

This Week in Dash (DASH) Quick Summary

Over the last seven days, Dash (DASH) has delivered a volatile but net-positive move, with price up close to 30% despite a sharp pullback from mid-week highs. CoinGecko shows DASH trading around $46, after hitting roughly $65.5 at the top of the move and dipping to about $46.4 at the low end of the weekly range.

The big stories in this Dash weekly update are.

Fresh regulatory pressure on privacy coins in Russia

Ongoing anticipation around the Dash Evolution upgrade

Elevated derivatives and whale positioning

A broader crypto market that has shifted from euphoria to a more cautious, risk-off mood in late January

Dash (DASH) Price Action & Key Levels

Weekly performance

From a price-action angle, this week looks like a classic round-trip spike followed by a retrace:

Current price: ≈ $46

7-day performance: about +29.8%

7-day high: ≈ $65.52

7-day low: ≈ $46.36

DASH is still well above where it was a week ago, but has surrendered a large chunk of the mid-week rally. Earlier in January, Dash had already been flagged as one of the stronger altcoins in privacy-coin-led moves, with intraday rallies of up to 60% as short positions were forced to cover. (CoinDesk)

Short-term technical view

Looking at current structure.

Immediate support

$46 lines up with this week’s low and the bottom of the current 7-day band.

If this level breaks with conviction, the next psychological zone to watch is around $42–$43.

Near-term resistance

$52 roughly the top of the recent 24h range and the first clear resistance area.

Above that, $60 and then the recent spike zone near $65–$66 form a thicker resistance band.

Volatility

A 7-day range of roughly $19 on a sub-$50 coin points to high realized volatility, in line with the broader January swings across crypto.

For now, Dash is in a range-with-downside-retest setup: price has pulled back to the lower end of its weekly band while the wider market digests macro headlines and ETF flow data.

News & Narratives That Moved Dash (DASH) This Week

Russia bans anonymous coins from legal purchases

CoinMarketCap’s Dash updates highlight a new Russian rule that bans “anonymous coins” from legal transactions, explicitly naming DASH among the affected assets.This doesn’t kill usage globally, but it adds to the regulatory overhang that already hangs over privacy-oriented tokens.

Dash Evolution upgrade approaching

The same update notes that the long-discussed Evolution upgrade is getting closer. It’s billed as a major overhaul aiming to bring more user-friendly accounts and dApp-like functionality to the Dash network.That creates a tech-driven bullish narrative, even as regulation keeps some traders cautious.

Whale short position and derivatives activity

CoinGecko’s “Recently Happened to Dash” feed points to a “strategy whale” running a $7.8M short position, reportedly opened near $71 and showing significant unrealised profit when price was around $57 two days ago.Concentrated bets like this can heavily influence intraday volatility and sentiment.

Hidden risks flagged by analysts

A BeInCrypto piece this month warns that dormant DASH coins are being reactivated, whales control a large share of supply, and open interest is elevated all of which may increase the risk of sharp liquidations and distribution near potential cycle tops.

Put together, these forces create a tug-of-war between upgrade optimism and regulation/whale-risk pessimism.

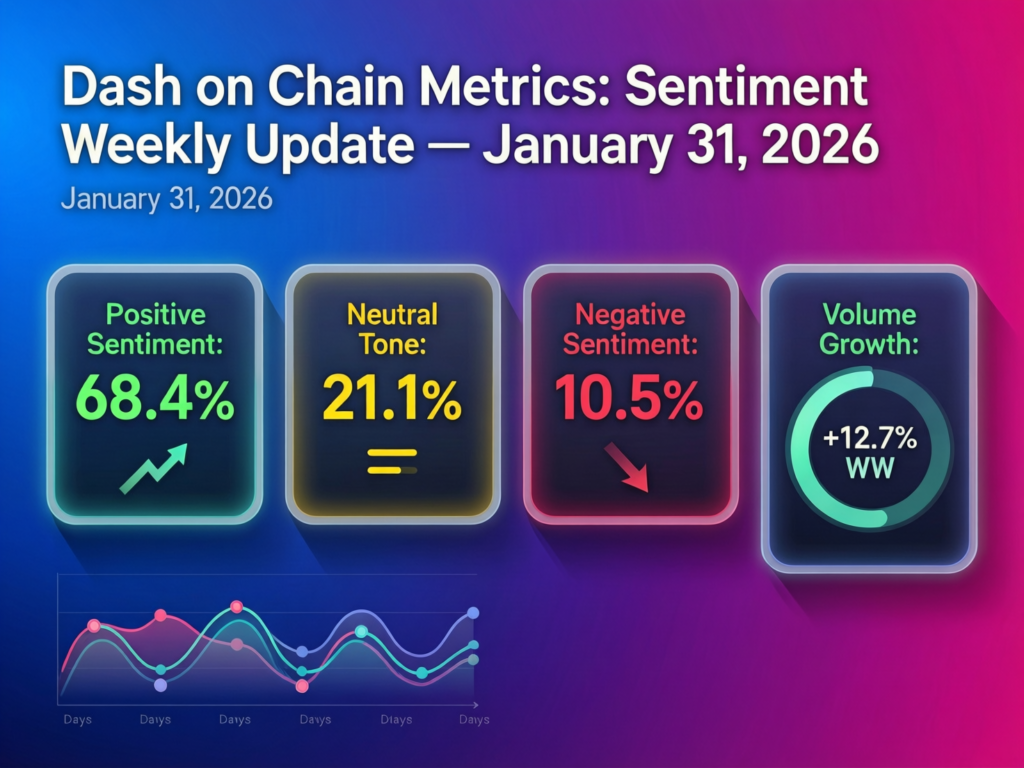

On-Chain, Derivatives & Sentiment

On-chain activity

Dash.org’s metrics hub and third-party dashboards show ongoing network usage. Active addresses are fluctuating but not collapsing, suggesting the core user base is still there.

Whales & distribution

Analysts point out that top whales control a sizeable portion of supply, and some dormant coins have started moving historically a sign that long-term holders may be taking profits into strength. )

Derivatives & open interest

The same report notes record or near-record open interest, which tends to amplify both rallies and crashes when liquidation cascades kick in.

Sentiment

CoinGecko’s sentiment gauge still shows the community mostly bullish on DASH, even after the recent drawdown.

Dash (DASH) vs Bitcoin & the Wider Crypto Market

On a weekly basis, Dash has outperformed Bitcoin (BTC):

DASH: about +29.8% over 7 days

BTC: roughly flat to slightly negative over the same period, after a push above $82k followed by a correction.

Bitcoin remains the main macro driver, but January has been marked by rotations into high-beta altcoins and privacy coins like Dash during risk-on bursts, followed by sharp pullbacks whenever macro concerns (Fed policy, ETF outflows, tech-stock weakness) reappear.

In simple terms, Dash is trading like a high-beta, narrative-driven altcoin, amplifying whatever the broader market is doing.

What This Means for Traders & Long-Term Holders

This section is for information and education only. It is not financial advice.

For short-term traders

Factors many traders are watching right now (again, not advice):

Expect high intraday volatility while derivatives positioning and whale shorts remain elevated.

$46 is an important local support; a sustained break below could open the door to a deeper pullback zone.

On the upside, attention is likely on $52, then $60–$65, which capped this week’s rally.

Regulatory headlines especially around privacy coins can flip order-book dynamics very quickly.

For long-term holders

For longer-horizon investors and Dash users.

The Evolution upgrade is a key fundamental milestone, potentially improving usability and developer interest.

Regulatory risk around privacy features is real and not limited to any one jurisdiction.

Concentrated whale holdings and reactivated dormant supply are structural risks worth tracking over months, not hours.

Comparing Dash’s performance to BTC and the broader market can help clarify whether DASH is adding useful diversification or simply adding volatility.

Risks, Scenarios

Bullish scenario

If markets absorb the Russian privacy-coin rules without major follow-through from other regulators, and Evolution ships smoothly with a positive community response, DASH could reasonably grind back toward recent highs and potentially re-test the $60–$70 area over time, assuming a supportive, risk-on crypto backdrop.

Neutral scenario

Price continues to trade in a wide $45–$65 range, with traders fading extremes while long-term holders wait for clearer signals on regulation, adoption and macro conditions.

Bearish scenario

Tougher rules on privacy coins in other key regions, combined with whale distribution and a sharp risk-off shift across crypto, could trigger a deeper correction below current support zones, particularly if elevated open interest unwinds through forced liquidations.

Bottom Lines

This Dash (DASH) weekly update shows a market caught between strong narratives and equally strong risks. Price has bounced hard from last week’s levels but is still digesting a sharp spike, heavy derivatives positioning and fresh headlines on privacy-coin regulation. For now, DASH is trading like a high-beta bet on sentiment.

Looking ahead, traders may focus on how price behaves around the $46 support zone and the $52–$65 resistance band, while long-term holders watch the Evolution upgrade and regulatory momentum.As always, position sizing, time horizon and independent research matter far more than any single volatile week in the charts.

FAQs

Q : Why did Dash (DASH) move so much this week?

A : Dash rallied earlier in the week on continued interest in privacy coins and speculation around the upcoming Evolution upgrade. It then retraced sharply as the broader market turned cautious and headlines about Russian restrictions on anonymous coins hit the news cycle.

Q : What are the key Dash price levels to watch right now?

A : In the short term, support is clustered around $46, which lines up with the lower end of this week’s range. On the upside, resistance sits near $52, then $60–$65, the area of the recent spike. A decisive break and daily close beyond either boundary would suggest a new phase in the current structure.

Q : How risky is Dash given the latest regulatory news?

A : The Russian move to restrict anonymous coins highlights ongoing regulatory risk for privacy-focused assets, and similar policies in other regions would likely be a clear negative. For now, these rules remain jurisdiction-specific, and Dash continues to trade globally, so the main impact is around headline risk and market perception rather than an immediate shutdown.

Q : Is Dash outperforming or underperforming Bitcoin this week?

A : On a 7-day view, Dash has outperformed Bitcoin, with roughly 30% weekly gains versus low-single-digit or slightly negative returns for BTC over the same period. That gap reflects Dash’s higher beta to shifts in overall market sentiment.

Q : Is Dash too volatile for conservative investors?

A : With a 7-day range from about $46 to $65.5 and double-digit 24h moves, DASH clearly sits at the higher-volatility end of the spectrum compared to large caps like BTC or ETH. That doesn’t make it “bad”, but it does mean position sizing, time horizon and risk tolerance are especially important considerations.