Binance sets 2026 target for GoFi restitution as it eyes South Korea’s top spot

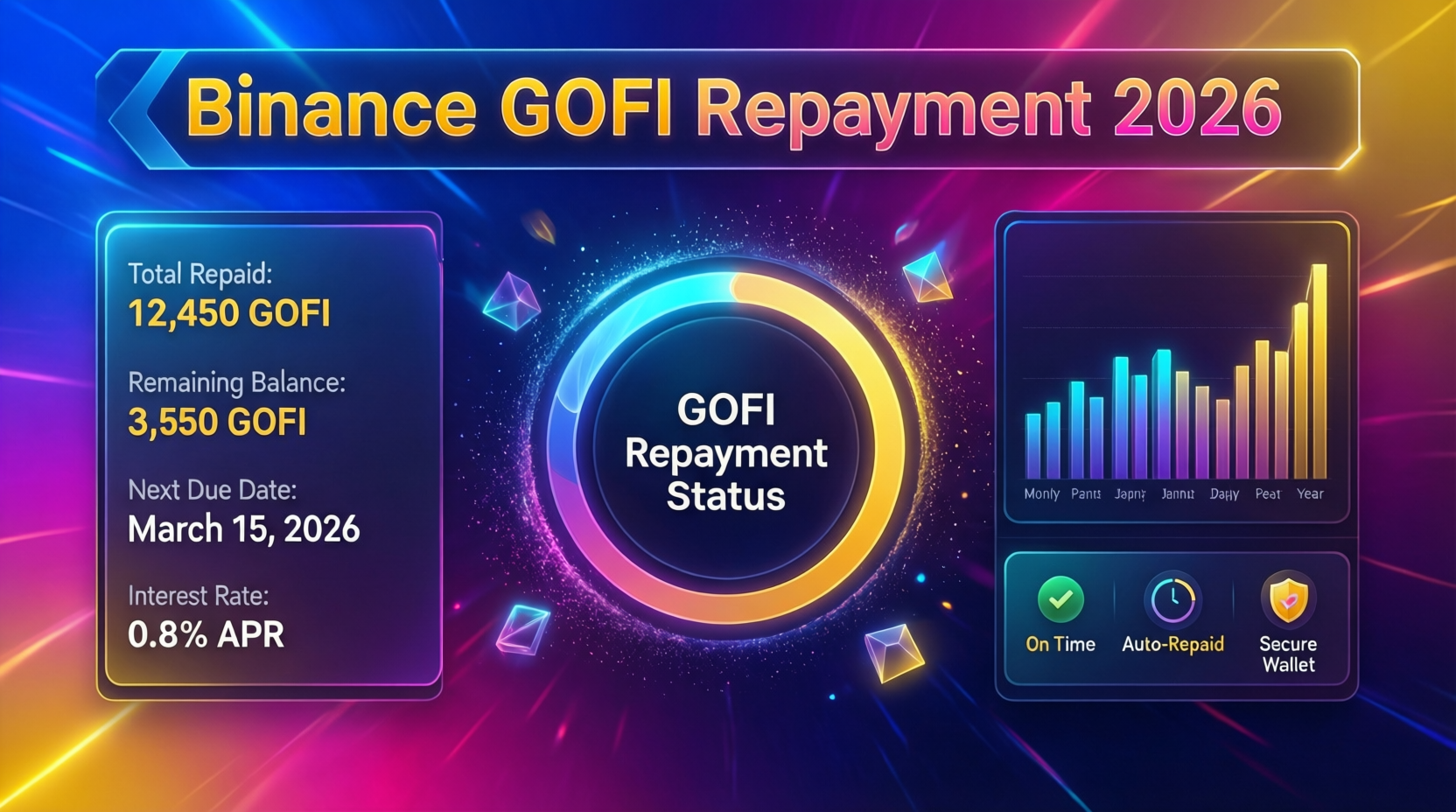

South Korea’s digital-asset market may undergo a significant shift in 2026 as Binance moves to resolve a long-running issue tied to its local affiliate, Gopax. Speaking to The Block, Binance Asia-Pacific lead SB Seker said the exchange is targeting completion of restitution for users of Gopax’s suspended lending product, GoFi, within the year. If achieved, the plan would mark the end of a multi-year liquidity crunch that has weighed on Gopax and limited Binance’s ambitions in the country.

Meeting the 2026 GoFi repayment timeline could prove pivotal for Binance’s domestic strategy. Closing this chapter would help restore user trust, stabilize operations, and potentially clear regulatory and reputational hurdles. With restitution complete, Binance would be better positioned to compete head-on with South Korea’s dominant local exchanges, intensifying competition in one of Asia’s most active crypto markets.

Gopax’s GoFi freeze and the path to repayment

In 2023, Gopax’s GoFi halted withdrawals following turmoil at lending partner Genesis Global Capital, which later filed for Chapter 11 in January 2023. A U.S. court subsequently approved Genesis’s wind-down plan in 2024, shaping broader creditor recoveries and context for GoFi-linked claims. Binance stepped in and acquired a majority stake in Gopax in February 2023, with its formal South Korean regulatory approval arriving in October 2025, paving the way for a structured restitution plan.

What the repayment could cover (assets vs. fiat)

According to reporting citing a recent Gopax notice, the restitution wallet holds the same quantities of assets lost (e.g., ~775.11 BTC, ~5,766.62 ETH, ~706,184.46 USDC across 11 tokens), rather than their fiat value at the time of the freeze—capturing price appreciation since 2023. Binance has indicated it will disclose the wallet address and is working through final government approvals and distribution mechanics to minimize costs for users.

Strategy: competing for the top spot in Korea

After resolving repayments, Seker said Binance will stabilize and upgrade Gopax using Binance’s technical and security standards and roll out a non-controversial product suite already present in the market. With approval in hand, Binance can re-enter a competitive field dominated by large local platforms, and the company says it intends to challenge for market leadership.

“Alignment” on closing the chapter

Seker described broad alignment among users, Binance, regulators, and other stakeholders to finish the process: “We’re definitely looking to try and finish this off this year; it’s been hanging over everybody’s heads for some time… everyone wants to close this chapter.” The interview lays out the clearest public timeline to date and ties operational upgrades at Gopax to the end of repayments.

Timeline and approvals for Binance GoFi repayment 2026

2023 (Jan)

Genesis Global Capital files Chapter 11; GoFi freezes withdrawals.

2023 (Feb)

Binance agrees to acquire majority stake in Gopax.

2024 (May)

Court signs off on Genesis wind-down plan, reinforcing creditor-first recoveries.

2025 (Oct)

KoFIU approves Binance’s Gopax acquisition; Binance re-enters South Korea.

2026

Binance targets completion of GoFi restitution and a product upgrade push.

What could accelerate Binance GoFi repayment 2026

Swift inter-agency approvals for distribution mechanics.

Transparent on-chain disclosure of the restitution wallet.

Coordination between Gopax, custodians, and regulators to minimize user costs.

Context & Analysis

South Korea’s KoFIU approval in 2025 allowed Binance to re-enter a tightly regulated market after a prolonged review. The choice to mirror asset quantities (not fiat) aligns with creditor-friendly outcomes seen in Genesis’s wind-down, where courts affirmed current-value considerations for repayments. If Binance meets its 2026 target and deploys a competitively priced, compliant product set via Gopax, it could pressure incumbent market share particularly in spot markets where Korean retail flow is active.