Real Estate Tokenization Middle East: Investor Guide

Real estate tokenization in the Middle East turns income-generating property in hubs like Dubai, Abu Dhabi, Riyadh and Doha into blockchain-based tokens, so foreign investors can buy fractional exposure instead of a whole unit. In 2026, the most credible deals sit on regulated rails (DLD, VARA, FSRA, REGA/RER, MiCA-aligned EU platforms), with smart contracts automating rent flows while traditional laws still govern title, tax and investor rights.

Introduction

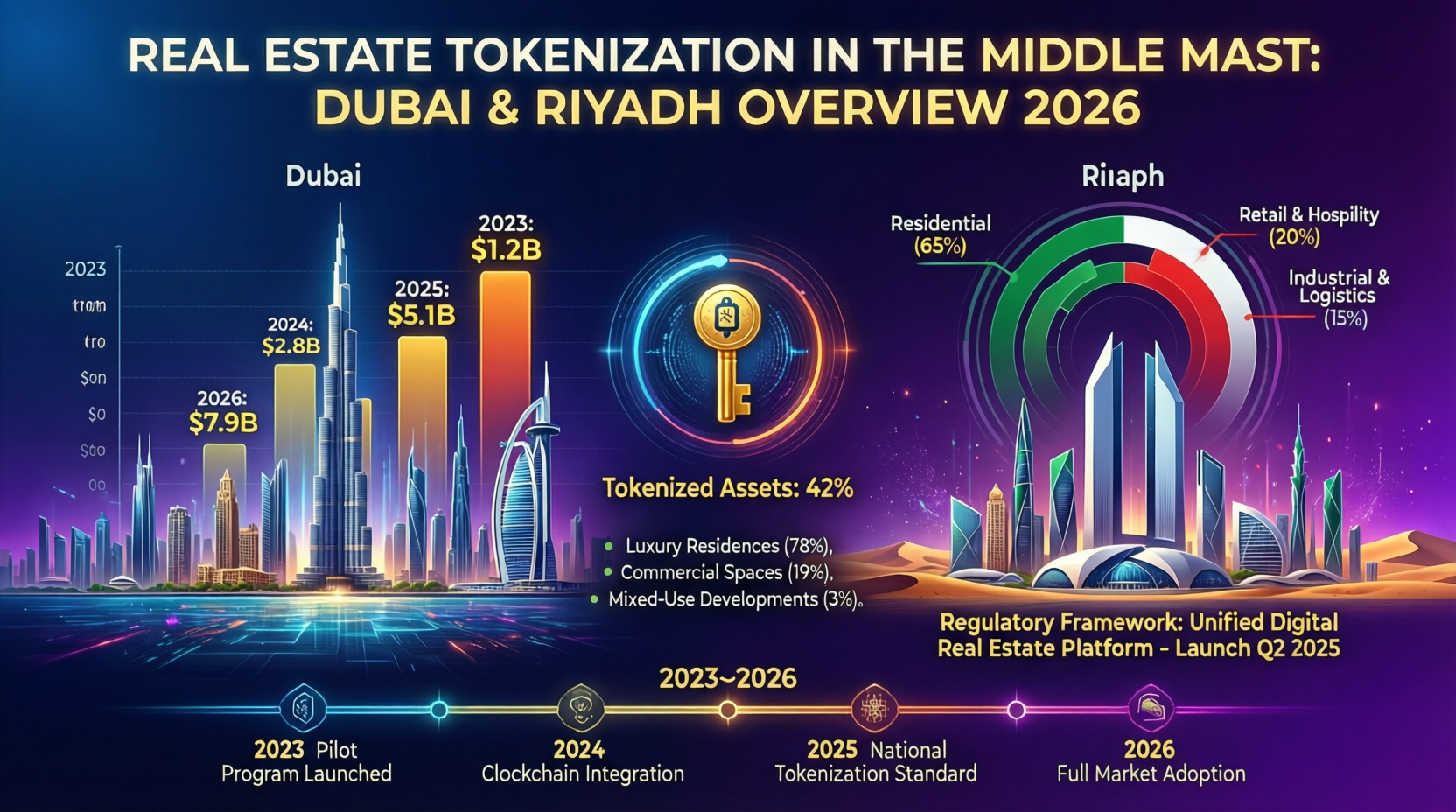

In 2026, real estate tokenization Middle East means you can buy a small slice of a Dubai apartment, Riyadh logistics hub or Doha hospitality asset through regulated digital tokens, instead of wiring hundreds of thousands for a whole unit. Dubai’s Land Department (DLD) has already launched a Real Estate Tokenisation Project, positioning itself as the first land registry in the region to adopt blockchain-based fractional ownership, while Saudi Arabia is rolling out a national tokenization infrastructure with its Real Estate General Authority (REGA) and Real Estate Registry (RER).

In this playbook we’ll unpack.

What real estate tokenization actually is for Middle East assets

Why hubs like Dubai, Abu Dhabi, Riyadh and Doha are sprinting ahead

How rules like MiCA in the EU and VARA in Dubai shape risk and returns

A practical pathway for US, UK and German investors to make a first allocation without blowing up their compliance

Why the Middle East Is Leading Real Estate Tokenization

The Middle East is ahead because regulators and land registries like Dubai Land Department and Saudi Arabia’s RER/REGA are building tokenization infrastructure directly into national real estate systems, aligned with long-term visions such as Saudi Vision 2030 and Dubai’s digital-asset strategy.

Vision 2030, Diversification & Foreign Capital

GCC governments are using tokenized real-world assets (RWAs) to accelerate the shift from oil-based revenues to diversified digital economies. Vision 2030 in Saudi Arabia and long-term growth plans in the UAE explicitly call for attracting foreign capital into infrastructure, tourism and real estate.

Real estate is a flagship RWA category.

Assets are tangible, easy to understand and already a favourite among global investors seeking inflation-hedging, income-producing exposure.

Tokenization simply slices these assets into programmable, fractional ownership real estate blockchain positions, lowering the minimum ticket from “one apartment” to a few hundred or thousand dollars.

Global tokenization isn’t a sideshow. Some market studies estimate the wider tokenized-asset market could reach well into the multi-trillion-dollar range by 2030, with real estate one of the largest segments.

From Pilots to National Infrastructure in UAE & Saudi Arabia

Dubai has moved fastest at registry level. Under its Real Estate Evolution Space (REES) initiative, DLD’s Real Estate Tokenisation Project now lets authorised platforms tokenise property titles, making it the first real estate registration entity in the Middle East to integrate blockchain-based fractional ownership into the official registry.

Key moves in the UAE and Saudi Arabia include.

Dubai Land Department (DLD) live pilot with licensed tokenization platforms, with all transactions settled in AED during the first phase and recorded in the official registry.

Dubai’s Virtual Assets Regulatory Authority (VARA) rulebooks for asset-referenced virtual assets (ARVAs), including tokenised real estate, with strict reserve, disclosure and capital rules.

Saudi Arabia’s national tokenization infrastructure a “global first” national system using SettleMint’s platform as the core engine to merge blockchain-based title, automated valuation, escrow and fractional ownership into RER’s registry.

Banking partners, custodians and infrastructure providers (SettleMint, Ctrl Alt and others) plug into this stack, so deals can be offered compliantly to foreign investors in the USA, UK, Germany and wider EU.

Who This Market Suits: US, UK, German & EU Investors

So who is real estate tokenization in the Middle East really for?

HNWIs and family offices in New York, London or Frankfurt looking for yield plus diversification into GCC growth cities

Sophisticated retail investors comfortable with digital assets but wanting more regulated, income-focused exposure

Institutions and pension schemes piloting small RWA tokenization allocations alongside US REITs and European property funds

US and UK investors often like AED and SAR-linked rental cash flows because AED is pegged to the USD, and leases are typically dollar-anchored even when priced locally. German and wider EU investors, guided by MiCA and local regulators like BaFin, increasingly seek MiCA-aligned RWA products that can be held via EU structures in Luxembourg or Frankfurt while allocating into Dubai or Riyadh projects.

How Real Estate Tokenization Works for Middle East Property

Real estate tokenization in the Middle East usually means putting a property (or portfolio) into a legal wrapper such as an SPV or trust, issuing blockchain tokens that represent fractional ownership or economic rights, and using smart contracts to manage rent distribution, governance and where allowed secondary trading for investors abroad.

From Property Title to Digital Tokens: The Basic Structure

The workflow usually looks like this

Underlying asset a freehold apartment in Dubai Marina, a villa in Abu Dhabi, a logistics warehouse near Riyadh, or a hospitality asset in Doha.

Legal wrapper an SPV, fund, trust or other regulated vehicle holds the title; investors don’t own the building directly, they own claims on the SPV.

Token issuance the SPV’s shares or units are mirrored as digital tokens on a blockchain. In Dubai, many structures fit VARA’s definition of asset-referenced virtual assets (ARVAs), which must meet specific reserve, disclosure and governance requirements.

Custody and wallets investors hold tokens in custodial or self-hosted wallets, but the legal “golden record” of their rights sits in contractual terms linked back to the SPV and land registry.

Platform UX often feels similar to a modern fintech or wealth app. The same kind of cloud architecture and data pipelines we discuss in our guide to data analytics and business intelligence in the Middle East sits behind many of these platforms.

Fractional Ownership, RWAs & Smart Contracts for Rental Income

Tokenization turns rent and capital appreciation into programmable cash flow classic RWA tokenization. Smart contracts can.

Collect rent in AED, USD, USDT/USDC or EUR/GBP and distribute it pro-rata to token holders on a monthly or quarterly schedule

Net off service charges, maintenance and property management fees before distribution

Route funds through regulated payment rails while keeping an on-chain record of entitlements

In a typical setup, a New York-based investor might buy USD-denominated tokens referencing a Dubai rental asset, while a London or Frankfurt investor buys euro-exposed tokens in the same SPV through an EU-regulated feeder.

Benefits and Risks vs Buying a Whole Apartment in Dubai or Riyadh

Compared with buying a whole apartment in Dubai or Riyadh.

Benefits

Lower ticket sizes (often a few thousand dollars) and easier diversification across Dubai, Abu Dhabi, Riyadh, Jeddah and Doha

Potentially improved liquidity via secondary markets, compared with waiting months to sell a single unit

Programmatic, transparent income tracking, especially for cross-border portfolios

Risks

Platform risk if the platform fails, investors need the legal wrapper and registry integration to protect their rights

Smart-contract and operational risk bugs, poor key management or flawed upgrade processes can impact distributions

Market depth secondary liquidity is still thinner than on major stock exchanges or large listed REITs

For platforms building these rails, the same concerns about resilience, cost and governance we cover in our multi-cloud strategy in the Middle East guide quickly become relevant.

Key Hubs Dubai, Abu Dhabi, Riyadh & Doha Opportunities

Today, most live tokenized real estate deals are clustered around Dubai and Abu Dhabi in the UAE, plus emerging Saudi hubs like Riyadh, with Doha and Ras Al Khaimah piloting RWA projects and digital-asset zones.

Dubai & Abu Dhabi Sandbox Projects, Rentals & Yields

Dubai is the visible frontrunner. DLD’s tokenization project, combined with VARA’s rulebooks and ADGM’s FSRA framework in Abu Dhabi, gives issuers and distributors a clearer path to launch tokenized rentals, hospitality and mixed-use assets.

Typical features.

Asset types prime apartments, serviced residences, hotel inventory and selected commercial units

Yields research from Savills and Knight Frank shows Dubai’s prime residential rental yields often in the 5–8% range, the highest among many global cities, with rents rising sharply through 2024.

Currency incomes are AED-denominated but effectively USD-pegged, which many US and GCC investors like, while UK and EU investors accept FX risk in exchange for higher nominal yields.

Abu Dhabi’s FSRA-regulated environment is attractive for institutional-grade structures, especially for Luxembourg and Frankfurt managers testing GCC RWAs alongside EU-domiciled tokenized funds.

For teams building investor dashboards, the design challenges overlap with what we see in MENA mobile app trends and future super apps in the Middle East: instant performance data, Arabic/English UX, and transparent fee presentation.

Saudi Arabia National Tokenization Infrastructure & Vision 2030 Pipeline

Saudi Arabia’s national real estate tokenization infrastructure may end up being the “anchor rail” for the region. RER and REGA are deploying a national system where title management, valuation, escrow and fractional ownership all sit on a unified backbone powered by SettleMint and local marketplace partners.

That matters for foreign investors because.

Counterparty risk is tied to the national registry and regulated infrastructure, not a single startup.

Tokenization can gradually extend from residential to logistics, warehousing and mixed-use developments, many tied to Vision 2030 megaprojects.

Saudi regulators are actively considering how foreigners can access onshore real estate via regulated channels, including tokenized structures.

Qatar, Ras Al Khaimah & Other Gulf Hubs to Watch

Beyond the “big two,” watch.

Doha institutional-grade hospitality and office projects, often wrapped in conservative, long-lease structures attractive to EU insurers and UK pension funds.

Ras Al Khaimah (RAK) a fast-rising hub promoting tourism, green projects and digital sectors, including island developments like Al Marjan which may align naturally with tokenized hospitality and residential models.

Bahrain, Oman, Kuwait, Jordan, Egypt early-stage ecosystems with strong interest from banks and sovereign funds exploring RWAs and data-driven real estate analytics, much like the projects we describe in our industrial IoT in oil & gas and IoT in desert agriculture articles.

Regulation, Investor Protection & Data Compliance

For tokenized real estate, your biggest risk isn’t only price; it’s whether your token, platform and data flows are covered by frameworks such as VARA, MiCA, BaFin, FCA, SEC and local AML/data-protection laws. That determines what happens if something breaks.

Middle East Rulebook VARA, DLD, FSRA & Saudi REGA/RER

In the UAE and Saudi Arabia.

VARA (Dubai) regulates virtual assets in most of Dubai and sets detailed rules for asset-referenced virtual assets (ARVAs), including tokenized real estate. Issuers must demonstrate a legally recognised link between tokens and underlying assets, maintain reserves and meet disclosure standards.

Dubai Land Department (DLD) still the ultimate source of truth for title; tokenization pilots are layered on top of existing land law, not a replacement.

Abu Dhabi’s FSRA supervises digital-asset activities in ADGM, providing another regulated venue for RWA issuance aimed at professional investors.

Saudi Arabia’s REGA/RER gatekeepers for title and tokenization infrastructure, integrating blockchain into the national registry and shaping foreign investor access rules.

Dubai’s broader VARA issuance regime (Category 1 ARVAs, Category 2 other tokens, and exempt assets) sets a high bar for any real estate token that is meant to behave like a financial instrument, which is good for serious investors but raises implementation costs.

How MiCA, BaFin, FCA & SEC View Real Estate Tokens

In Europe and the US, tokenized real estate usually sits at the intersection of.

MiCA the EU’s Markets in Crypto-Assets Regulation, now fully applicable, setting harmonised rules for asset-referenced tokens and crypto-asset service providers.

MiFID II and local securities laws if the token is really a security, MiCA sits alongside (not instead of) traditional capital-markets rules.

BaFin (Germany) treats many RWA tokens as securities or investment products, requiring prospectuses, custody rules and licensed distributors.

FCA (UK) and SEC (US) focus on whether a token is an investment contract or security; cross-border distribution into New York or London from a Dubai or Riyadh platform must respect their guidance and any exemptions used.

For German investors in particular, Legal Nodes points to hubs like Luxembourg and Germany itself as strong homes for RWA vehicles that can hold tokenized Middle East assets within EU-supervised structures. ([Legal Nodes][8])

KYC/AML, GDPR/UK-GDPR/DSGVO & Tax Reporting for Foreign Investors

Any serious Middle East platform inviting US, UK or EU investors will require:

Robust KYC/AML identity verification, source-of-funds checks, open-banking links, sanctions screening and Travel Rule-compliant transaction monitoring.

Data protection handling EU/UK personal data means aligning with GDPR, UK-GDPR and Germany’s DSGVO, including clear data maps, DPO roles and secure cloud regions very similar to the data-governance patterns we explore in unstructured data analytics for US, UK and EU enterprises.

Tax reporting you remain on the hook at home.

US: foreign rental income and gains reportable to the IRS; FBAR/FATCA may apply if foreign accounts are involved.

UK: HMRC treats Middle East tokens as overseas property income and capital gains, with FX implications.

Germany/EU: you must declare income and gains to your local Finanzamt; classification (security vs crypto-asset) affects how.

Cloud and infrastructure spending for these compliance stacks can climb quickly; the cost-control ideas from our cloud cost optimization guide apply just as well to RWA platforms.

How to Invest in Real Estate Tokenization Middle East from Abroad

For a foreign investor, the basic journey is: choose a regulated platform, pass KYC, fund in USD/GBP/EUR, pick a tokenised property in Dubai, Abu Dhabi or Riyadh, monitor rent distributions and handle tax and reporting back home.

Step-by-Step Flow From Platform Research to First Token

Define your profile

Clarify risk tolerance, ticket size and target markets (e.g. higher-yield Dubai vs more policy-driven Riyadh vs Doha hospitality)

Shortlist platforms

Check.

Licensing (VARA/FSRA/CBUAE in UAE; REGA/RER in KSA; MiCA-aligned partners in EU)

Audit history, security posture, on-chain transparency

Local partners such as DLD or REGA formally linked to the tokenization project

Onboarding & KYC/AML

Expect to provide ID, proof of address, source-of-funds documents and possibly enhanced due diligence for larger tickets or US investors.

Funding options

Bank transfer, open-banking connections or sometimes stablecoins converted to fiat on arrival. Factor in FX spreads if you’re sending GBP or EUR.

Selecting deals

Compare yield, occupancy, lease length, leverage (if any), token structure (equity vs revenue-sharing), governance rights and exit routes.

Ongoing monitoring

Track rental distributions, quarterly statements and token-holder votes via dashboards or apps. The UX often looks similar to high-quality fintech or analytics tools like those we build under our business intelligence services.

Pathway for US Investors Accreditation, SEC Rules & IRS Reporting

If you’re investing “from the USA”.

Many platforms restrict US access to accredited investors or route US capital through specific exemptions to stay onside SEC rules.

The SEC and other bodies have warned about tokenization risks, particularly mis-selling and inadequate disclosures; MiCA-style visibility is still some way off in the US, despite moves like the GENIUS Act on stablecoins.

From an IRS perspective, tokenized rent is still foreign rental income; tokens held with non-US custodians or platforms may trigger additional reporting.

US investors often favour USD-denominated tokens to neutralise FX, treating them as an alternative to offshore REITs or direct buy-to-let.

Pathway for UK, German & Wider EU Investors

For investors in London, Manchester, Berlin, Frankfurt or Luxembourg:

UK

Look for FCA-regulated intermediaries or advisors, and pay attention to UK-GDPR, sanctions and overseas property income rules.

Germany

BaFin-regulated distributors and MiCA-aligned EU CASPs are key for German investors; expect detailed documentation for the Finanzamt on underlying assets and cash flows.

Wider EU

MiCA introduces passporting for crypto-asset services; EU hubs like Luxembourg and Frankfurt will likely act as bridges between EU investors and Middle East tokenization platforms.

This is also where broader architecture questions (edge vs cloud, data residency, latency) from our edge vs cloud computing for AI workloads guide quietly show up in RWA platforms, especially when handling near-real-time pricing and compliance checks across time zones.

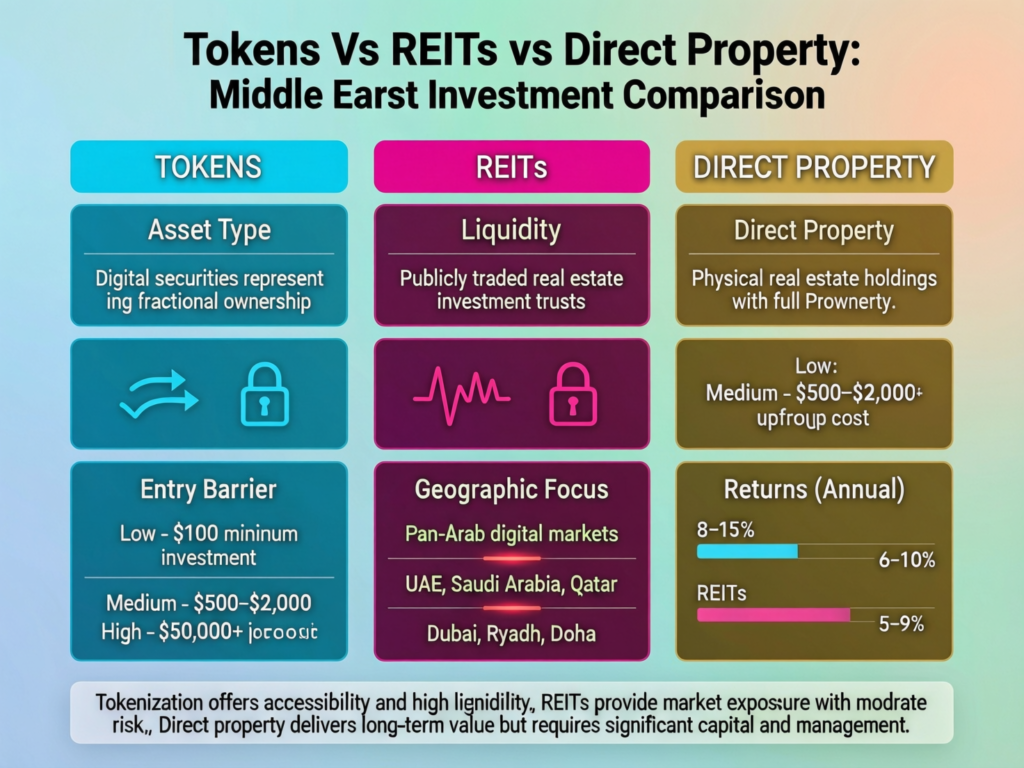

Tokenized Real Estate vs REITs & Traditional Property

Compared with REITs and direct ownership, Middle East real estate tokens try to blend institutional-grade assets with lower minimum tickets and programmable income but they add platform, regulatory and liquidity risk you don’t fully see with listed products.

Returns, Liquidity & Diversification Tokens vs REITs vs Direct Property

Returns

Dubai and Saudi income-producing assets can deliver higher gross yields than many US and European REITs, especially in fast-growing neighbourhoods, but investors must adjust for fees, FX and vacancy risk.

Liquidity

Tokens may trade on secondary venues with daily or weekly liquidity, but order books are thin compared with listed REITs on major exchanges; direct property is slowest of all.

Diversification

Tokens make it easier to build a cross-border, multi-sector Middle East portfolio (residential, hospitality, logistics) with smaller tickets.

Deloitte forecasts that tokenized private real estate funds alone could reach around US$1 trillion by 2035, a strong signal that institutions expect tokenization to sit alongside REITs and funds rather than replacing them.

Key Risks Platform Risk, Legal Uncertainty, Liquidity & FX

Core risks to stress-test before committing:

Platform & smart-contract risk bugs or operational failures can delay distributions even if the underlying property performs.

Regulatory change MiCA implementation, VARA updates or new cross-border rules can change what’s allowed, or where the token can legally trade.

FX & macro risk AED is pegged to USD, but pegs can come under pressure over long horizons; SAR, QAR and others introduce additional FX considerations for EUR and GBP investors.

Bankruptcy / licence loss if a platform collapses or loses its licence, investors need strong legal separation between token issuer, operator and asset-holding SPV topics explored in depth in specialist commentary on VARA issuance licences.

How to Run Due Diligence & Size Your Allocation

A practical due-diligence checklist:

Licensing and regulatory status in Dubai, Abu Dhabi, Saudi Arabia and any EU/UK on-ramps

Custody (who holds private keys?), audits, incident history

Property manager track record and local partners (developers, agents, legal counsel)

Token documentation: rights, ranking in the capital stack, governance and exit mechanics

Sizing ideas (illustrative only, not advice):

HNWIs 3–10% of real estate allocation in tokenized Middle East assets, laddered across platforms and cities

Family offices pilot programmes with small tickets across several regulated platforms to build internal conviction

Institutions treat tokenized Middle East real estate as part of an innovation sleeve inside broader alternatives

None of this is investment, legal or tax advice. Always do your own research and take professional advice in your home jurisdiction before committing capital.

At this point, many organisations decide to engage specialist analytics and engineering partners teams like Mak It Solutions who already support GCC-focused projects in areas like multi-cloud strategy and data analytics in the region.

Concluding Remarks

Real estate tokenization in the Middle East is likely to appeal most to investors who:

Already hold traditional property or REITs and want higher-yielding, GCC-exposed positions

Are comfortable with digital assets but want stronger regulatory clarity (MiCA, VARA, FSRA, REGA) and real-world collateral

Have access to cross-border tax and legal advice in the US, UK and EU

You might choose to wait if you have low risk tolerance, dislike emerging-market FX exposure, or prefer only listed, deep-liquidity instruments. But for many US, UK and German investors, starting with a small, well-researched allocation via a regulated platform, with conservative assumptions and full tax advice offers a pragmatic way to learn by doing.

Key Takeaways

Real estate tokenization in the Middle East turns income-producing assets in Dubai, Abu Dhabi, Riyadh and Doha into fractional digital property tokens, typically wrapped in SPVs or funds.

UAE and Saudi Arabia are embedding tokenization into land registries and national infrastructure, while MiCA, BaFin, FCA and SEC views shape how EU, UK and US investors can participate.

Yields can be attractive versus many global REITs, but investors must price in platform, legal, liquidity and FX risk on top of normal real-estate risk.

The most resilient structures combine regulated onshore infrastructure (DLD, VARA, FSRA, REGA/RER) with EU or UK wrappers to align with MiCA, GDPR/UK-GDPR and local tax obligations.

A practical entry path is to start small, diversify across cities and platforms, and treat tokenized Middle East real estate as a complement not a replacement to existing REITs and property holdings.

If you’re exploring real estate tokenization in the Middle East and need help turning regulation, data and infrastructure into a concrete roadmap, Mak It Solutions can help. Our teams already support GCC-focused projects across cloud, analytics and compliant digital platforms, from Riyadh to Dubai and Doha.

Reach out via our contact page to outline your use case whether you’re an asset manager in Frankfurt, a family office in London or a fintech founder in New York and we’ll help you scope a practical prototype or production-grade platform.

FAQs

Q : Can investing in tokenized Dubai real estate help with UAE residency or the Golden Visa?

A : Owning tokenized Dubai real estate by itself does not currently qualify you for a UAE Golden Visa. UAE rules look at the value of legally registered property (typically AED 2 million+ under the property route), not the size of your digital token holdings. However, if tokenisation is used as a payment or structuring mechanism to acquire full legal title that meets the threshold and is registered with DLD, that property may support a Golden Visa application subject to evolving rules and full compliance. Always verify with official UAE sources and specialist advisors before acting.

Q : Are Middle East real estate tokens Sharia-compliant and how is that structured in practice?

A : Some Middle East real estate tokens are explicitly marketed as Sharia-compliant, often using sukuk-like or profit-sharing structures rather than interest-bearing loans. In practice, that can mean leasing or partnership models where investors share rental profits and capital gains, with underlying finance structured to avoid riba and excessive gharar. Whether any given token is truly compliant depends on its legal terms, the presence of a recognised Sharia board and ongoing audits, so Muslim investors should request fatwas, legal opinions and regular compliance reports.

Q : What are typical minimum investment amounts and lock-up periods for Dubai and Saudi tokenized properties?

A : Minimum investments for GCC real estate tokens often range from a few hundred to a few thousand US dollars (or AED/SAR equivalents), designed to be accessible for sophisticated retail investors as well as HNWIs. Lock-up periods vary: some deals allow near-immediate secondary trading, while others impose 6–24-month lock-ups, especially for development or value-add projects. Check each offer’s terms for minimum ticket, secondary-market rules and any early-exit penalties before committing capital.

Q : What happens to my tokens if a Middle East real estate platform goes bankrupt or loses its licence?

A : If a tokenization platform fails, your outcome depends on how well the legal structure separates platform operations from the asset-holding SPV or fund. In robust setups, tokens represent claims on an SPV that is bankruptcy-remote from the platform, with registry-backed title and independent trustees or administrators who can step in. In weaker models, investors may find their rights tied up in insolvency proceedings. This is why checking VARA, FSRA and national-law alignment and reading legal opinions, custody terms and contingency plans is critical before investing.

Q : How do tokenized Middle East properties fit alongside US REITs and European property funds in a diversified portfolio?

A : Tokenized Middle East real estate can act as a higher-yield, higher-risk satellite allocation next to core US REITs and European property funds. The appeal is exposure to fast-growing GCC cities plus programmable, fractional ownership, while the trade-offs are added platform, regulatory and liquidity risk. Many investors start with a low single-digit percentage of their overall real-estate allocation in tokenized Middle East assets, rebalancing over time as the regulatory landscape and market depth mature.