As gold nears $5,600, bitcoin dips toward $88,000

After the Federal Reserve decided to keep interest rates unchanged, investors appeared to shift their focus toward traditional safe-haven assets, causing a noticeable reaction in the markets. Bitcoin saw a slight decline, trading around $88,000, down approximately 1% over the past 24 hours. The cryptocurrency’s modest drop reflects investors’ cautious stance amid broader economic uncertainty, as market participants reassess risk and seek stability in more conventional stores of value.

Meanwhile, precious metals experienced significant gains. Spot gold surged to near $5,600 per ounce, reaching new record highs, while silver approached $120 per ounce. This rally highlights the ongoing appeal of metals as reliable hedges against market volatility and inflation concerns. Investors are increasingly favoring these traditional safe havens over riskier assets like cryptocurrencies in the current environment.

What happened today

Risk sentiment softened after the Fed held its policy rate steady, with Chair Jerome Powell signaling a data-dependent path. Crypto assets eased, led by bitcoin, even as precious metals extended gains on geopolitical and macro uncertainty alongside a weaker dollar backdrop.

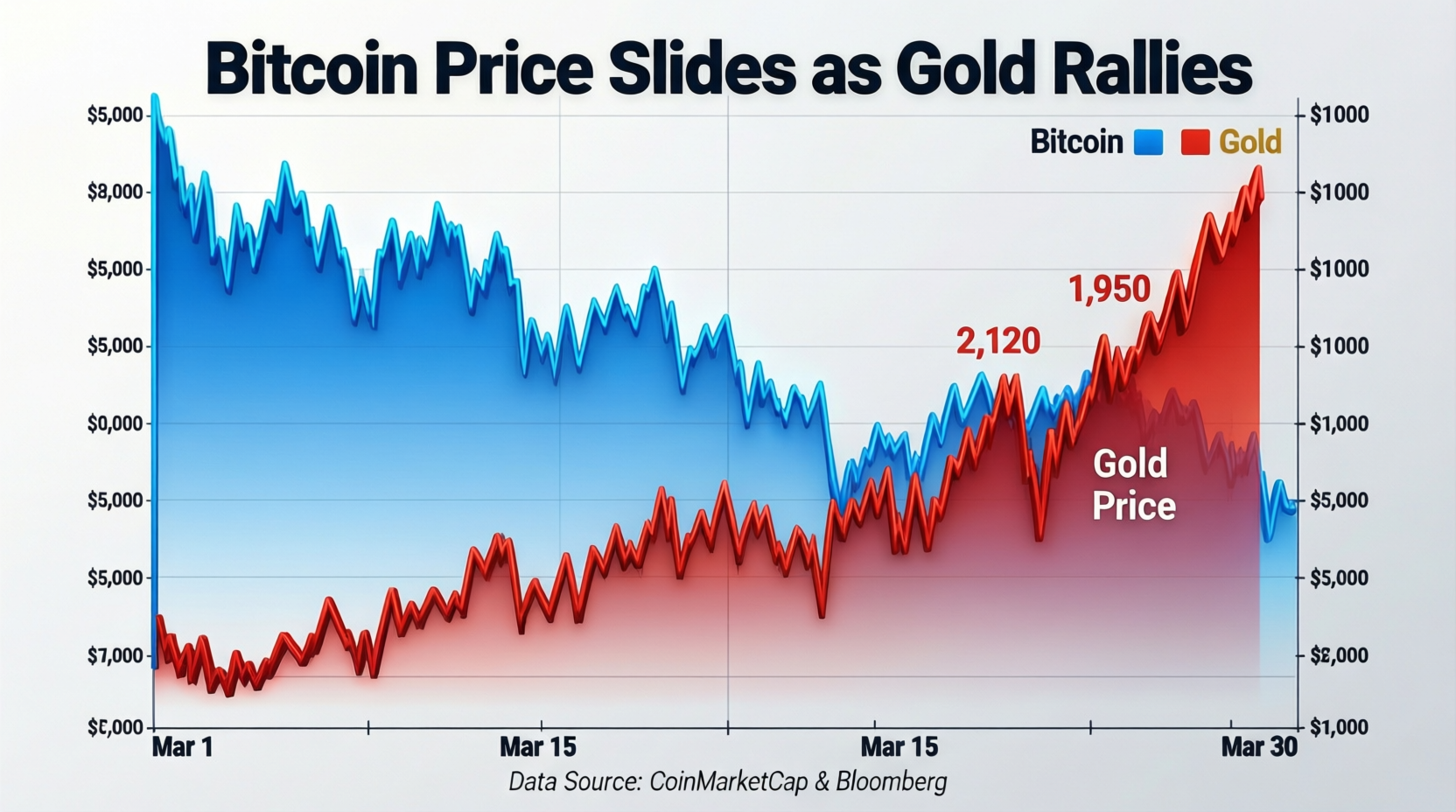

Bitcoin price slides as gold rallies.

Bitcoin’s pullback contrasts with surging metals as asset allocators tilt defensively. BTC traded near $88k intraday, while spot gold printed fresh highs near $5,600 and silver hovered just under $120. The global crypto market cap was roughly $3.06–$3.07T, down about 1–2% over 24 hours.

What “Bitcoin price slides as gold rallies” means for portfolios

The divergence highlights how macro shocks and policy uncertainty can push capital from higher-beta assets (crypto) toward lower-volatility hedges (gold, silver). Heavy central-bank demand has added structural support to gold in recent years.

Drivers behind the metals surge

Safe-haven demand

Heightened geopolitical risks and policy uncertainty boosted bid for bullion.

Dollar dynamics

A softer dollar has supported USD-denominated commodities.

Central-bank buying

Net purchases above 1,000 tonnes annually since 2022 reinforced the trend.

Silver’s squeeze

Silver outperformed on industrial and investor demand, pressing toward $120/oz.

Quotes and commentary

Ubuntu Tribe founder Mamadou Kwidjim Toure told Yahoo Finance: “As the financial landscape evolves, investors are increasingly pivoting from bitcoin (BTC-USD) to gold (GC=F) … Gold has demonstrated exceptional resilience … Gold’s volatility is three to three-and-a-half times lower than bitcoin’s.” (Interview remarks as provided in raw text.)

Context & Analysis

Over the past several weeks, metals have benefited from a steady drumbeat of haven demand, with silver’s industrial angle amplifying upside. In contrast, bitcoin has cooled since a mid-January local high near ~$97k, reflecting rotation and profit-taking. Sustained central-bank accumulation strengthens gold’s floor, while crypto remains more sensitive to liquidity and risk appetite.

Final Words

In the near term, key macroeconomic indicators such as labor market data, inflation figures, and central bank policy guidance are expected to remain the primary drivers of market behavior. These factors will likely continue to highlight the ongoing divergence between cryptocurrencies and precious metals, keeping investors closely focused on how each asset class reacts to economic signals.

Any significant move in the U.S. dollar or interest rates could prompt a reallocation of capital between bitcoin and traditional safe-haven metals. A decisive shift may rebalance flows, with investors adjusting positions to manage risk and optimize returns amid evolving macro conditions.

FAQs

Q : Why did bitcoin fall while gold rallied today?

A : Macro caution post-FOMC steered flows into safe havens, pressuring higher-beta assets like bitcoin.

Q : Did gold really hit a record near $5,600/oz?

A : Yes. Multiple outlets reported spot gold near $5,600/oz on Jan. 29, 2026.

Q : Where is silver trading?

A : Silver approached ~$118–$120/oz alongside gold’s surge.

Q : How big is the crypto market now?

A : About $3.06–$3.07 trillion in total market capitalization as of today.

Q : Is central-bank buying supporting gold?

A : Yes net purchases exceeded 1,000 tonnes annually in recent years.

Q : What does “Bitcoin price slides as gold rallies” imply for diversification?

A : It signals rotation toward lower-volatility hedges; portfolios may benefit from diversified exposure depending on risk tolerance.

Q : Will a weaker dollar always lift gold?

A : Often, but not always other drivers like rates and risk sentiment matter.

Facts

Event

Bitcoin eases as gold and silver hit records following Fed holdDate/Time

2026-01-29T15:23:04+05:00Entities:

Bitcoin (BTC-USD); U.S. Federal Reserve; World Gold Council; Gold (spot); Silver (spot)Figures

BTC ≈ $87,788 (-~1% 24h); Gold ≈ $5,500–$5,600/oz; Silver ≈ $118–$120/oz; Crypto market cap ≈ $3.06–$3.07TQuotes

“Gold’s volatility is three to three-and-a-half times lower than bitcoin’s.” Mamadou Kwidjim Toure (Ubuntu Tribe)Sources

Reuters (FOMC & metals), FT (metals rally), CoinGecko (market cap), Fed (statement)