Blockchain in Oil and Gas: ADNOC and Aramco Lessons

Blockchain in oil and gas uses distributed ledgers and smart contracts to connect operators, service companies, traders and regulators on a shared, tamper-evident record of production, contracts and certificates. When it’s implemented well, it reduces reconciliation work, fraud and emissions-reporting gaps, while enabling new low-CO₂ products and faster cash cycles for everyone involved.

Introduction

Volatile prices, tighter margins and aggressive net-zero timelines mean most oil and gas leaders are reopening their digital roadmaps. US shale operators, North Sea joint ventures and Middle Eastern NOCs are all wrestling with the same issues: fragmented data, slow settlements and rising ESG scrutiny.

In this context, blockchain in oil and gas is re-emerging not as a speculative crypto bet, but as part of a wider “crypto tech” toolbox that includes distributed ledger technology (DLT), smart contracts and tokenization. These tools are finally moving from pilots to production in supply chains, trading and carbon accounting.

We’ll focus on what’s already working in the Middle East especially ADNOC, Saudi Aramco and Oman and what US, UK, German and wider European operators can realistically copy, partner with or plug into over the next 2–3 years.

What Is Blockchain in Oil and Gas?

Blockchain in oil and gas is a shared, tamper-evident database that connects operators, service companies, traders and regulators so that production, contracts and certificates are updated once and trusted by everyone, instead of being re-keyed into separate systems. Practically, that means multi-company workflows haulage, field services, cargoes, low-CO₂ certificates run on a common ledger enforced by smart contracts rather than spreadsheets and email.

This isn’t about ripping out your ERP or trading stack. It’s about adding distributed ledger technology in oil and gas as a coordination layer where many parties need the same truth at the same time.

From Traditional Databases to Distributed Ledgers

Classic oil and gas IT is built around siloed systems ERP, ETRM, SCADA, data historians and specialist trading tools. Each company in a value chain keeps its own records and reconciles differences via manual checks, batch files and audits.

A permissioned blockchain or DLT network changes that model.

Shared source of truth one ledger of volumes, events and commercial terms, replicated across participants.

Immutability once blocks are confirmed, tampering is extremely difficult, which helps with audit and dispute resolution.

Smart contracts code that automatically triggers approvals, invoices or payments when conditions are met (for example, water hauled, cargo delivered).

Granular permissions parties see only the data they’re entitled to, while still relying on the same underlying ledger.

Think of blockchain as a complement to your existing data lake and operational systems: SCADA and IoT feed events into the ledger; your ERP and trading systems consume trusted, reconciled data from it.

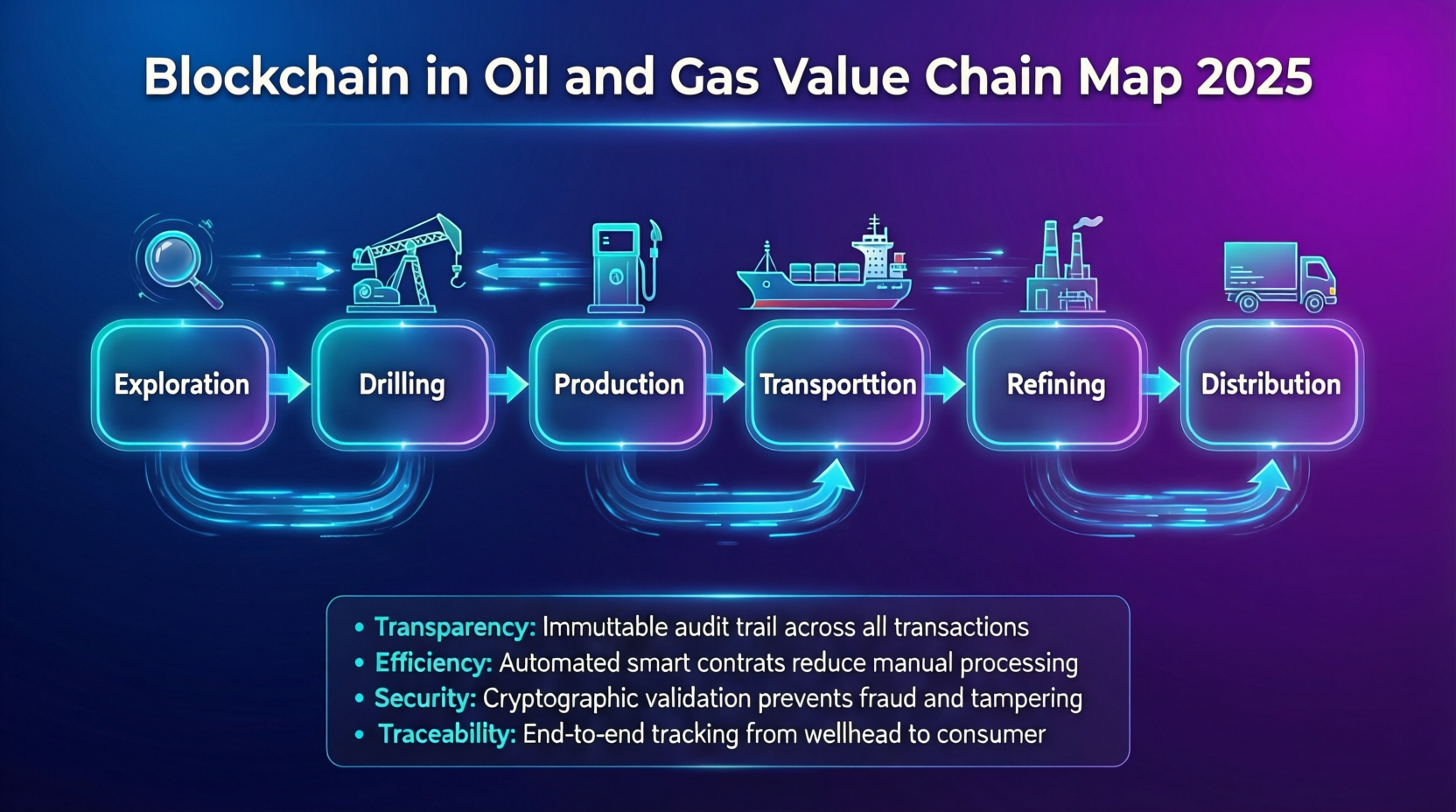

Where Blockchain Fits Across Upstream, Midstream and Downstream

Across the value chain, the sweet spot is hydrocarbon supply chain transparency whenever multiple companies and contracts are involved:

Upstream oilfield services, drilling and completion, produced-water haulage, chemicals, rental tools.

Midstream pipeline nominations, storage, shipping, LNG scheduling.

Downstream crude and products trading, refinery feedstock, retail supply, bunkering.

The OOC (Offshore Operators Committee) Oil & Gas Blockchain Consortium showed this clearly with its produced-water haulage pilot in the US Bakken: field readings, haulage tickets and invoices were synchronized on Data Gumbo’s blockchain network, cutting workflow from 90–120 days down to 1–7 days and eliminating multiple reconciliation steps.

These are exactly the kinds of workflows Gulf producers and Oman’s national oil entities are now targeting in their logistics modernization programs.

Market Size and Adoption in US/UK/Germany/Europe

The blockchain in oil and gas market is no longer a rounding error. Recent research estimates it at around US$1.0–1.1 billion in 2024, with forecasts of roughly US$7–8 billion by 2030 a near-40% compound annual growth rate.

In parallel, the broader blockchain in energy segment is expected to grow from roughly US$1.7–2.3 billion in 2024 to more than US$25 billion by the early 2030s, driven by renewable certificates and grid-level trading.

Current hotspots.

US shale logistics, midstream contracts and pilot projects around how US oil and gas companies use blockchain for supply chain transparency.

UK London as a hub for consortia such as Vakt, plus North Sea JVs experimenting with joint-venture accounting.

Germany/EU energy-trading platforms and utilities exploring blockchain for guarantees of origin, P2P trading and flexibility markets.

Against that backdrop, Middle Eastern NOCs like ADNOC and Aramco are among the most advanced production-grade adopters, making their projects a useful blueprint rather than a distant science experiment.

Core Blockchain Use Cases in the Oil and Gas Value Chain

The main blockchain use cases in oil and gas are multi-party supply chain tracking, energy and commodities trading/post-trade processing, carbon and ESG reporting, and using “crypto tech” to monetize or reduce flared gas. For most operators, the early ROI comes from fewer disputes, shorter cash cycles and cheaper compliance rather than speculative token gains.

Quick reality check

none of this is financial or legal advice. It’s about process efficiency, risk reduction and better data; always do your own research and speak with qualified advisors before committing capital.

Supply Chain and Logistics Transparency

Supply chain is where smart contracts for oilfield services are already paying off.

Materials and inventory valves, OCTG, spares and chemicals tracked from vendor to rig to warehouse.

Field services wireline, cementing, coil tubing and well services captured as work orders on-chain.

Produced-water and waste haulage meter or sensor data triggers automatic tickets and invoices.

In the OOC produced-water pilot, tying truck readings directly into a blockchain-based smart contract automated the entire chain from field reading to invoice payment, with multiple US operators reporting dramatic cycle-time reductions.

Middle East and Oman pilots follow a similar pattern for logistics and port operations: one shared ledger for nominations, movements and approvals instead of phone calls and spreadsheets.

For US, UK and European operators, this translates into:

Fewer billing disputes and manual reconciliations.

Lower days-sales-outstanding for service providers.

Better audit trails when regulators or tax authorities come calling.

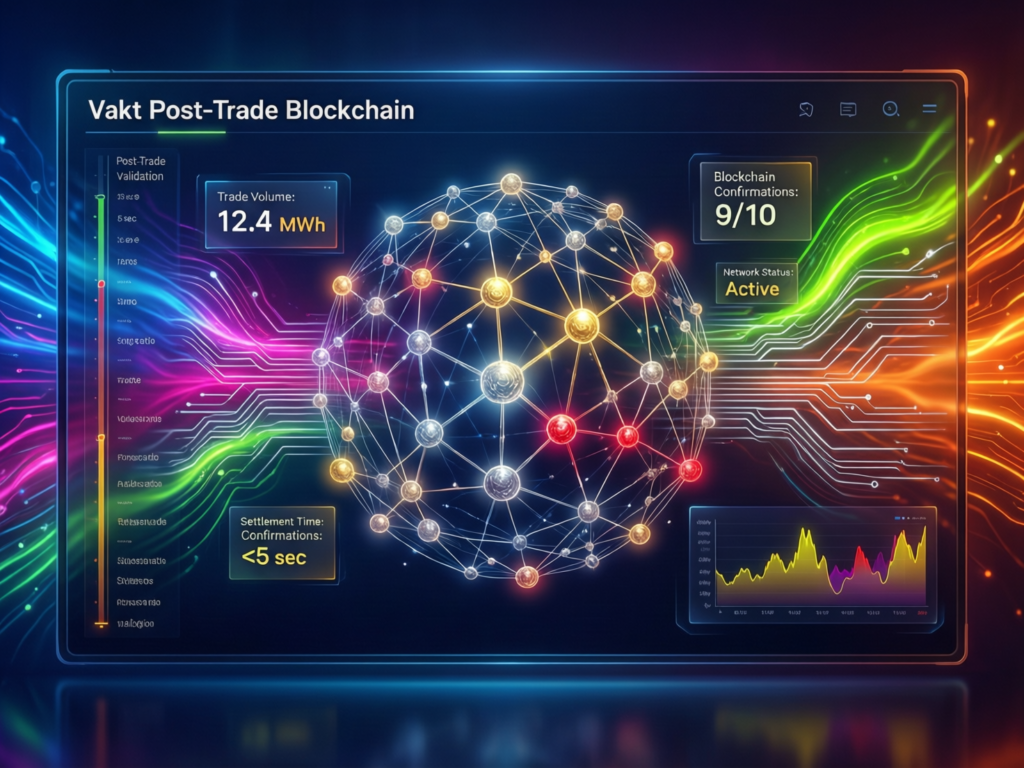

Energy Trading and Post-Trade Platforms (Vakt & Beyond)

Energy trading is another natural fit. Platforms like Vakt provide a blockchain crude oil trading platform for post-trade processing of Brent crude and refined products.

Instead of each trader, broker, inspection company and terminal operator maintaining separate records, Vakt creates a single source of truth for:

Trade confirmations and matching

Cargo and pipeline scheduling

Title transfers and demurrage

Final settlement data

For teams in London, Houston, Amsterdam and Frankfurt, the benefits are pragmatic:

Fewer breaks between ETRM, back office and counterparties

Faster reconciliation and reduced operational risk

Stronger controls to satisfy internal audit and regulators in the US, UK and EU

This is the most mature category of energy commodities trading platform blockchain solutions, and increasingly relevant if you trade with NOCs and majors that already operate on these rails.

Crypto Tech at the Wellhead.

A more controversial but very real use case is using flared or stranded gas to power mobile data centers that mine Bitcoin or other cryptocurrencies:

Containers with ASIC miners are parked near well pads.

They consume gas that would otherwise be flared or shut-in.

Revenue from mining offsets infrastructure or emissions-reduction costs.

From a business perspective, this is a way to monetize waste gas especially in US shale plays and parts of the Middle East where gathering infrastructure is constrained. But optics and regulatory risk are significant.

ESG investors may question whether powering crypto aligns with decarbonization narratives.

Regulation in the US, SEC climate disclosures and state-level rules are increasing scrutiny of emissions data and mitigation claims.

Compliance when crypto is involved, you must think about sanctions, KYC/AML and potential tax complexity.

For US, UK and European operators, the lesson is to treat wellhead crypto projects as emissions-reduction infrastructure with strong governance, not as a speculative side hustle.

Middle Eastern Energy Giants as a Blockchain Blueprint

Middle Eastern NOCs like ADNOC and Saudi Aramco are using blockchain to digitize their value chains, automate trading and logistics, and issue low-CO₂ energy certificates. For international partners in the US, UK, Germany and the wider EU, these projects are templates you can plug into or replicate at home.

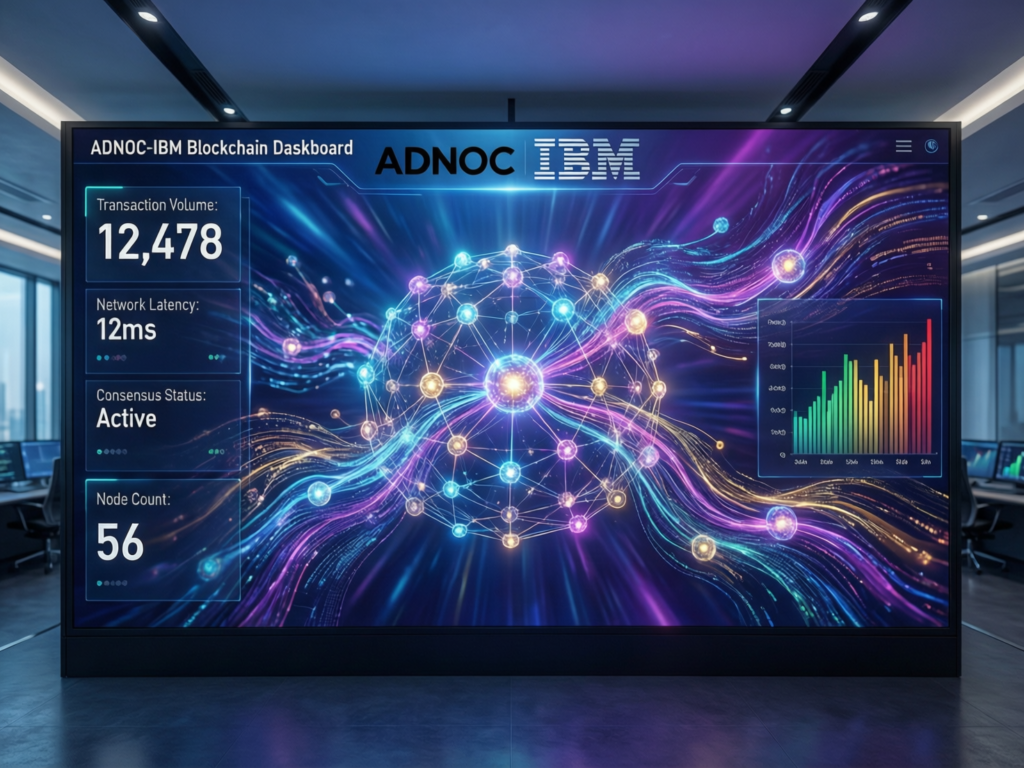

ADNOC–IBM Full Value-Chain Pilot

ADNOC and IBM piloted a blockchain system to track oil and gas “from well to customer” across ADNOC’s full value chain. The permissioned network integrated production, transport and sales data, automating accounting between operating companies and creating real-time visibility of inventory and value.

Key outcomes

Reduced reconciliation between upstream and downstream entities

Faster, more reliable KPIs in ADNOC’s Panorama Digital Command Center

A foundation to connect external partners (traders, refiners, regulators) over time

For US refiners, European traders or LNG buyers interfacing with ADNOC, this means you’ll increasingly be expected to integrate with blockchain-enabled platforms for nominations, certificates and carbon data.

ADNOC–Siemens Blockchain-Based Low-CO₂ Energy Certificates

ADNOC and Siemens Energy are co-developing blockchain-based low-CO₂ energy certificates covering Murban crude, ammonia and aviation fuels. Sensor data from across ADNOC’s operations feeds into a system that calculates carbon intensity per product and writes it to a decentralized ledger.

Why this matters for EU and UK buyers.

Certificates could help meet EU ETS obligations and future border-adjustment mechanisms.

On-chain data provides auditable evidence for investors and regulators evaluating net-zero plans.

It sets a pattern European refiners and utilities can mirror for blockchain-basierte CO₂- und ESG-Berichterstattung für europäische Ölkonzerne.

Expect pressure for interoperability between Middle East certificate schemes and European registries for low-carbon fuels and offsets.

Saudi Aramco, Oman and Regional Consortia

Saudi Aramco has repeatedly invested in and partnered with Data Gumbo, a blockchain-as-a-service platform for industrial smart contracts, including a three-year collaboration agreement announced in 2023.

Across the region.

Oman has trialed blockchain for logistics and port-related supply chains.

QatarEnergy and Bapco Energies are exploring blockchain within broader digitalization and Vision 2030-style initiatives.

Regional consortia mirror the OOC model, focusing on supply chain resilience and trading advantages.

The common driver: Vision 2030 strategies in Saudi Arabia and the UAE, plus logistics modernization agendas in Oman and other GCC states, all see blockchain as a way to build trusted, data-driven trade corridors with Europe and Asia.

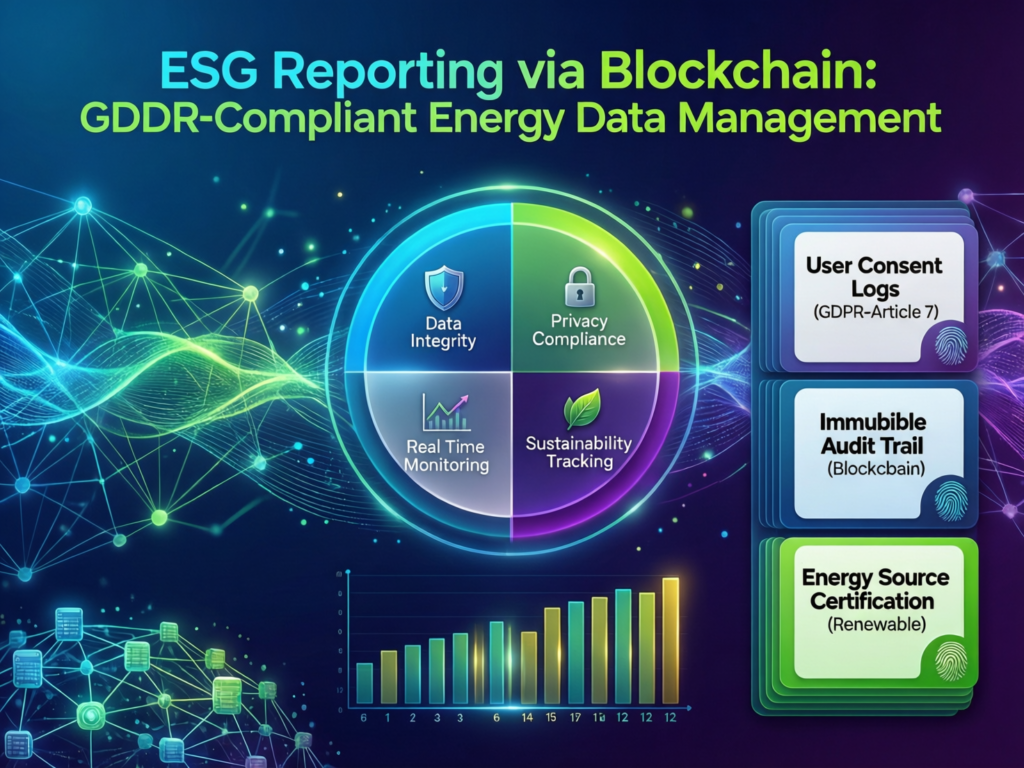

Sustainability, Certification and ESG Reporting on Blockchain

Blockchain is a strong fit for carbon tracking and ESG reporting because it creates a tamper-evident audit trail of emissions and certificates that multiple stakeholders operators, auditors, regulators and investors can verify independently. For boards in New York, London and Frankfurt, this is increasingly a compliance issue, not just a technology choice.

Carbon Tracking and Low-CO₂ Certificates On-Chain

In practical terms, you can.

Tokenize energy attributes (for example, origin, fuel type, CO₂ per barrel or MWh).

Link those tokens to specific cargos, pipeline batches or retail volumes.

Retire or transfer them as products move through the chain.

This underpins

Compliance schemes like EU ETS and emerging national carbon markets.

Voluntary carbon markets and renewable energy certificates.

Corporate net-zero commitments that demand verifiable, auditable emissions-reduction claims.

ADNOC–Siemens is one example; Shell’s blockchain-based “book and claim” platform for sustainable aviation fuel (SAF), Avelia, shows how similar approaches are scaling in European aviation, with tens of millions of gallons tracked across airports by 2025.

ESG and Regulatory Alignment.

Any blockchain-basierte CO₂- und ESG-Berichterstattung must align with data privacy and financial-market regulation.

Privacy and data residency design permissioned networks with GDPR, UK-GDPR and German DSGVO in mind, including controls on personal data, data minimization and regional storage.

Climate disclosures – US-listed companies face evolving SEC climate-related disclosure rules (even amid legal challenges and stays), plus California and EU reporting requirements.

Security frameworks align blockchain deployments with ISO 27001 and SOC 2 controls, including node security, key management and segregation of duties.

Good architecture combines on-chain hashes for integrity, off-chain storage for sensitive data and region-appropriate hosting (for example, EU-only nodes for European certificate data, GCC sovereign cloud for Middle East operations).

Bridging Hydrocarbons and Renewables on a Single Ledger

Many oil and gas companies now manage mixed portfolios: upstream barrels, LNG, solar, wind and increasingly hydrogen. Maintaining separate tracking systems for molecules and megawatt-hours is inefficient.

A shared, permissioned ledger can.

Track hydrocarbons and renewable outputs with consistent emissions accounting.

Support P2P or community energy schemes in Germany, the Netherlands and wider EU.

Provide unified ESG reporting across the group critical for BaFin-regulated entities and London-listed majors.

For German utilities and industrials, this is the link between Blockchain-Anwendungen in der Energiewirtschaft and the oil and gas supply chains feeding refineries, power plants and hydrogen hubs.

What This Means for US, UK, German and European Operators

Middle Eastern blockchain projects aren’t just interesting case studies; they’re showing US, UK and European operators where the bar is heading for transparency, settlement speed and ESG assurance.

US Shale and Gulf of Mexico.

For US shale and Gulf of Mexico operators.

Start with supply chain transparency field services, produced-water haulage and midstream contracts are proven use cases.

Borrow patterns from OOC and Data Gumbo pilots to cut cycle times and disputes.

If exploring US oilfield crypto mining, build strong ESG governance and reporting so wellhead projects don’t undercut climate narratives.

This fits well with broader cloud and data modernization many US operators already have underway Mak It Solutions often sees clients connecting blockchain pilots to real-time analytics and multi-cloud strategies across Houston and Austin. (Mak it Solutions)

Trading, Decommissioning and GDPR-Compliant Data Sharing

In the North Sea and UKCS

Look at decommissioning supply chains, where many contractors and regulators must share schedules, certificates and waste movements.

Use London’s position and platforms like Vakt to pilot blockchain-enabled post-trade processes for crude and product flows. (Ledger Insights)

Ensure UK-GDPR-compliant energy data handling when sharing information between UKCS JVs and Middle Eastern NOCs, especially around personnel or vessel tracking.

Done right, this is an extension of your existing cloud, web and analytics initiatives not a separate technology island.

Germany and Continental Europe.

For Germany and continental Europe.

Operators already active on energy exchanges can explore DSGVO-konforme Blockchain-Lösungen for certificates and flexibility markets. (EU Blockchain Observatory and Forum)

Opportunities lie in midstream logistics, storage and cross-border gas trading with the Netherlands and Central Europe.

BaFin-regulated entities should treat blockchain networks as part of regulated IT infrastructure subject to the same risk, resilience and outsourcing rules applied to trading and clearing platforms.

This is where digitalization in upstream and midstream operations meets European decarbonization policy.

Building Your Blockchain Roadmap in Oil and Gas

You don’t need a five-year moonshot program to start. A practical blockchain roadmap for oil and gas focuses on a few high-value workflows, ties into your existing cloud/data strategy and builds governance from day one.

Business Case and ROI.

Prioritize use cases by

Fast wins produced-water haulage, field-service tickets, simple post-trade confirmation where disputes are frequent.

Strategic plays low-CO₂ certificates, cross-border logistics, trading platforms that affect your market access.

ROI drivers usually include.

Fewer disputes and write-offs

Faster cash cycles for both operators and service companies

Lower compliance and audit costs

Stronger ESG scores and access to green finance

A good pattern is to model your first pilot on an ADNOC, Aramco or OOC-style project that already has reference designs then localize for US, UK or EU regulation.

Architecture Choices.

On the architecture side, you’ll be choosing between.

Enterprise DLT platforms for example, Hyperledger-based or managed blockchain services from AWS, Azure or Google Cloud, often already in your stack. (Mak it Solutions)

Consortium platforms like Vakt or Data Gumbo, where you join an existing network with defined rules.

NOC-run networks where Middle Eastern partners operate the core infrastructure and you integrate from the edge.

You’ll also need to

Respect data-residency rules (EU-only nodes, GCC sovereign clouds, UK data centers). (Mak it Solutions)

Integrate with SAP, ETRM, data lakes and BI tools so blockchain events feed your analytics and reporting. (Mak it Solutions)

Governance, Risk and Change Management

Finally, governance:

Consortium governance who runs nodes, who admits new members, how you update smart contracts or handle disputes.

Risk and compliance KYC/AML if tokens or payments are involved; clear roles for node security and key management.

Change management training schedulers, traders, accounts payable and ESG teams so they trust and use the new workflows.

The transition from pilot to scale usually involves:

Proving value on a narrow scope with a few friendly partners.

Formalizing governance and SLAs.

Onboarding additional participants (vendors, logistics providers, banks).

Expanding into adjacent workflows and regions.

This is exactly the kind of roadmap Mak It Solutions supports tying blockchain to cloud cost optimization, real-time analytics and broader digital transformation, rather than treating it as an isolated experiment. (Mak it Solutions)

Key Takeaways

Blockchain in oil and gas is now a real market, approaching or exceeding US$1 billion in 2024 with fast growth through 2030, especially in supply chain, trading and ESG use cases.

Middle Eastern NOCs are setting the bar, with ADNOC and Aramco deploying blockchain for full value-chain tracking and low-CO₂ certificates that impact global buyers.

US, UK and European operators can start small, using DLT for produced-water haulage, field-service contracts and post-trade reconciliation, then expanding into carbon and certificate tracking.

ESG and regulation are catalysts, not blockers, as long as projects are designed with GDPR/UK-GDPR, EU ETS and SEC climate-disclosure requirements in mind.

Architecture and governance matter as much as code choosing the right platform, cloud regions and consortium rules determines whether you scale beyond pilots.

If you’re looking at ADNOC or Aramco’s blockchain projects and wondering “what’s our version of this?”, Mak It Solutions can help you map it out. Our team combines oil and gas domain expertise with cloud, data and DLT engineering to design realistic pilots that fit US, UK, German and Middle Eastern regulatory realities.

Whether you need a quick ROI case for supply chain transparency or a multi-year roadmap for low-CO₂ certificates and energy trading, we can help you scope, architect and deliver it starting with a focused discovery workshop tailored to your assets and partners.( Click Here’s )

FAQs

Q : Is blockchain in oil and gas only realistic for supermajors and national oil companies, or can mid-sized operators benefit too?

A : Mid-sized operators can benefit by targeting specific workflows like produced-water haulage, field-service approvals and JV reporting rather than full-stack reinvention. Joining existing platforms or NOC-run networks avoids the cost of building and operating your own infrastructure. The payoff comes from fewer disputes, faster settlements and better ESG evidence, not from running a blockchain business yourself.

Q : How much does a typical blockchain pilot for an oil and gas supply chain workflow cost, and how long does it take to implement?

A : Most serious pilots land in the low- to mid-six-figure range and run 12–20 weeks from design to go-live. Costs cluster around platform subscription, integration with ERP/ETRM systems, smart-contract development and onboarding partners. Re-using proven templates and cloud-native integration patterns can shrink costs and timelines, especially when combined with existing analytics or integration programs.

Q : Can we use blockchain in oil and gas without exposing sensitive operational or commercial data to competitors?

A : Yes by using permissioned networks, fine-grained access control and off-chain storage. Only essential hashes and high-level data need to live on the shared ledger, while detailed operational data is kept in secure, regional clouds or on-prem systems. With good design, you gain shared auditability and trust without disclosing proprietary pricing, strategies or person-identifiable information.

Q : How should an oil and gas company choose between joining an existing blockchain consortium (like Vakt or OOC) and building its own platform?

A : Companies should start by mapping their trading and supply-chain ecosystems. If key partners already participate in consortia like Vakt or OOC, joining those networks offers immediate scale and standardization. Building a bespoke platform is justified only if you have regulatory drivers, unique workflows or the market power of a NOC or supermajor. For most firms, a hybrid approach joining some networks while piloting niche use cases on dedicated ledgers works best.

Q : What are the biggest reasons blockchain projects fail in oil and gas, and how can we de-risk our first pilot?

A : Projects usually fail due to fuzzy scope, weak business sponsorship, lack of integration planning and underestimating change management. To de-risk, start with a narrow, high-value use case and clear ROI metrics; involve finance, legal, IT and operations from the outset; align with privacy and ESG regulations early; and treat governance design as a first-class workstream. Partnering with an experienced implementation team reduces the risk of “pilot purgatory” and increases the odds of scaling.